Asset Pricing with Speculative Trading

Speculative trading stems from disagreements among traders. Besides the approaches based on the existence of private information (and noise traders) or the di erences of opinions, Harrison and Kreps(1978) and Morris(1996) relied on the presence of diverse beliefs to explain speculative phenomena. This paper proposes a new model of speculative trading by introducing rational beliefs of […]

Speculative trading stems from disagreements among traders.

Besides the approaches based on the existence of private information (and noise traders) or the di erences of opinions, Harrison and Kreps(1978) and Morris(1996) relied on the presence of diverse beliefs to explain speculative phenomena.

This paper proposes a new model of speculative trading by introducing rational beliefs of Kurz(1994) and Kurz and Wu(1996). Agents hold diverse beliefs which are

\rational" in the sense of being compatible with observed data.

In a non-stationary environment the agents may learn only

about the stationary measure of observed data.

Agents' beliefs can be non-stationary and diverse even when their stationary measures become the same as that of the data with complete learning.In a Markovian framework of dividends and beliefs, we obtainanalytical results on how the speculative premium depends on the extent of heterogeneity of beliefs. In addition, we demonstrate the possible emergence of endogenous uncertainty (as de ned by Kurz and Wu(1996)) and the persistent presence of diverse beliefs and positive speculative premiums.

برچسبها :

مقالات مرتبط

Engle And Lange-Predicting Vnet – A Model Of The Dynamics Of Market Depth

The paper proposes a new intraday measure of market liquidity, VNET, which directly measures the depth of the market corresponding to a particular price deterioration. VNET is constructed from the excess volume of buys or sells associated with a price movement. As this measure varies over time, it can be forecast and explained. Using NYSE […]

The Mathematics Of Financial Modeling And Investment Management

the mathematics of financial modeling & investment management The Mathematics of Financial Modeling & Investment Management covers a wide range of technical topics in mathematics and finance-enabling the investment management practitioner, researcher, or student to fully understand the process of financial decision-making and its economic foundations.This comprehensive resource will introduce you to key mathematical techniques-matrix […]

All About Stocks-ESME FAERBER

Book Description How to buy, what to hold, and when to sell- the guide to getting started in stocks and managing your portfolio! Want to become a more accomplished investor? All About Stocks is packed with the practical, hands-on guidance you need to choose your investments wisely minimize your risk, and enter today’s market with confidence-no […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

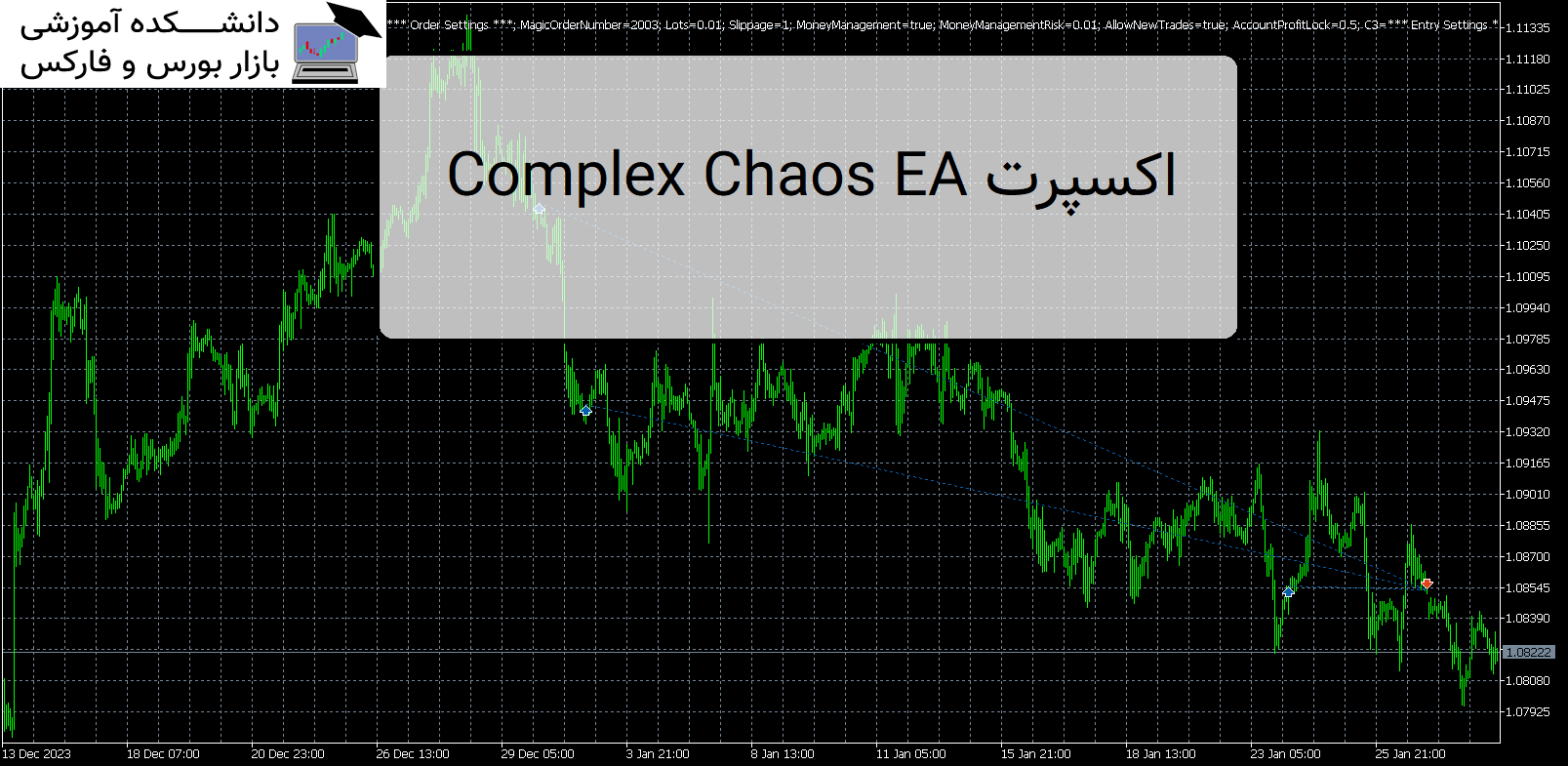

Complex Chaos EA اکسپرت MT5

معرفی و دانلود اکسپرت کاربردی Complex Chaos EA Complex Chaos EA یک سیستم خودکار است که از یک جفت میانگین متحرک نمایی برای تشخیص جهت بازار استفاده می کند و معاملات را در حالت شمع باز باز می کند. معرفی اکسپرت کاربردی Complex Chaos EA اگر بازار بر خلاف یک معامله حرکت کند، در یک […]

Terraforming 1 اکسپرت MT5

معرفی و دانلود اکسپرت کاربردی Terraforming اولین نسخه من از اکسپرت کاربردی Terraforming 1 . EA از آربیتراژ آماری برای کسب سود از جفت ارز USD EUR و GBP استفاده می کند. معرفی اکسپرت Terraforming 1 موقعیت ها زمانی باز می شوند که یک فرصت آربیتراژ شناسایی شود. پوزیشن ها پس از 3 ساعت یا […]

-

فایل های که پسوند آنها rar یا zip یا 7z هست را چگونه باز کنم؟

توسط نرم افزار Winrar فایل را از حالت فشرده خارج کنید و بعد برای اجرا و یا نصب اقدام کنید. دانلود WINRAR

فایل های با فرمت mq4 و mq5 را چگونه اجرا کنم ؟جهت اجرای این نوع فایل ها برای نسخه mq4 باید متاتریدر 4 را روی سیستم خود و برای نسخه mq5 متاتریدر 5 را روی سیستم عامل خود نصب داشته باشید . جهت راهنمایی کلیک کنید

-

رمز تمامی فایل ها :

- عنوان مقاله : Asset Pricing with Speculative Trading

- نوع فایل : PDF

- حجم فایل : 422 کیلوبایت