Engle And Lange-Predicting Vnet – A Model Of The Dynamics Of Market Depth

The paper proposes a new intraday measure of market liquidity, VNET, which directly measures the depth of the market corresponding to a particular price deterioration. VNET is constructed from the excess volume of buys or sells associated with a price movement. As this measure varies over time, it can be forecast and explained. Using NYSE […]

The paper proposes a new intraday measure of market liquidity, VNET, which directly measures the depth of the market corresponding to a particular price deterioration. VNET is constructed from the excess volume of buys or sells associated with a price movement. As this measure varies over time, it can be forecast and explained. Using NYSE TORQ data, it is found that market depth varies with volume, transactions, andvolatility. These movements are interpreted in terms of the varying proportion ofinformed traders in an asymmetric information model. When an unbalanced order #ow is transacted in a surprisingly short time relative to that expected using the Engle and Russell (Econometrica 66 (1998) 1127) ACD model, the depth is further reduced providing an estimate of the value of patience. The tahlil is repeated for 1997 TAQ datarevealing that the parameters of the relationships changed only modestly, despite shifts in market volume, volatility, and minimum tick size. A dynamic market reaction curve is estimated with the new data. ( 2001 Elsevier Science B.V. All rights reserved.

برچسبها :

مقالات مرتبط

Performance Asx Resources

Performance Asx Investment in resources is often seen as a poor cousin to the more highly promoted industrial companies of the Australian stock market. This paper analyses the performance of resources as an ASX Sector, finding there is good investment potential if you know where to look. The crux of the comparison is that averages […]

MTPredictor Trading Course – Part 2

MTPredictor Trading/Training Course Part 2 MTPredictor Trading/Training Course © 2003/2004 ALL RIGHTS RESERVED. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopier, a recording or otherwise without the prior written permission of the publisher and the author. This […]

Vanessa FX Advanced System

Vanessa FX Advanced Systems A full guide to the Vanessa FX Systems package By Vanessa FX & Nick B Forex trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the Forex market. Do not trade with […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

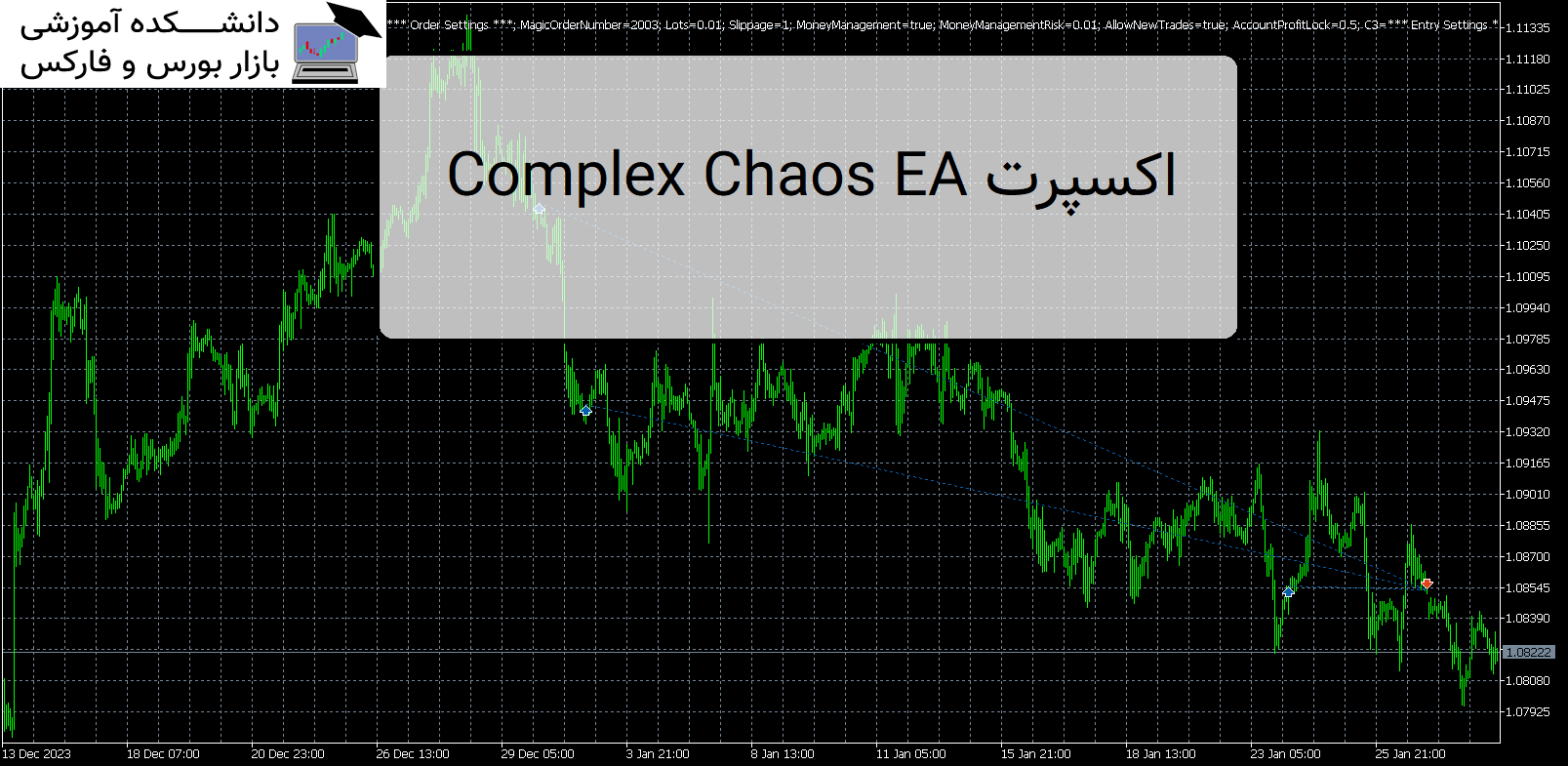

Complex Chaos EA اکسپرت MT5

معرفی و دانلود اکسپرت کاربردی Complex Chaos EA Complex Chaos EA یک سیستم خودکار است که از یک جفت میانگین متحرک نمایی برای تشخیص جهت بازار استفاده می کند و معاملات را در حالت شمع باز باز می کند. معرفی اکسپرت کاربردی Complex Chaos EA اگر بازار بر خلاف یک معامله حرکت کند، در یک […]

Terraforming 1 اکسپرت MT5

معرفی و دانلود اکسپرت کاربردی Terraforming اولین نسخه من از اکسپرت کاربردی Terraforming 1 . EA از آربیتراژ آماری برای کسب سود از جفت ارز USD EUR و GBP استفاده می کند. معرفی اکسپرت Terraforming 1 موقعیت ها زمانی باز می شوند که یک فرصت آربیتراژ شناسایی شود. پوزیشن ها پس از 3 ساعت یا […]

-

فایل های که پسوند آنها rar یا zip یا 7z هست را چگونه باز کنم؟

توسط نرم افزار Winrar فایل را از حالت فشرده خارج کنید و بعد برای اجرا و یا نصب اقدام کنید. دانلود WINRAR

فایل های با فرمت mq4 و mq5 را چگونه اجرا کنم ؟جهت اجرای این نوع فایل ها برای نسخه mq4 باید متاتریدر 4 را روی سیستم خود و برای نسخه mq5 متاتریدر 5 را روی سیستم عامل خود نصب داشته باشید . جهت راهنمایی کلیک کنید

-

رمز تمامی فایل ها :

- عنوان مقاله : ...Engle And Lange-Predicting Vnet - A Model Of

- نوع فایل : PDF

- حجم فایل : 400 کیلوبایت