History of the U.S. Economy in the 20th Century

INTRODUCTION When Professor Timothy Taylor, managing editor of the prestigious Journal of Economic Perspectives, tells you that the stock market crash of 1929 was not a substantial cause of the Great Depression and that F.D.R.’s New Deal may have actually slowed economic recovery, he speaks with authority and credibility. Those are only two insights that […]

This fast-paced course introduces you to vital economic lessons learned in the last century to provide invaluable guidance for understanding the current economy.

Each of 10 lectures focuses exclusively on one decade to achieve a clear understanding of economic developments and outside influences on the U.S. economy.

In some cases, you examine well-defined events like the creation of the Federal Reserve or the war in Vietnam. In other lectures, you explore larger societal shifts, such as the evolving role of women in the economy and changing consumption patterns.

"Of course, knowing what happened in economic history does not offer easy answers to today's problems," states Professor Taylor. "Times change; the past rarely offers a perfect template for the present.

"But knowing the history does help discussions about the present to get off on the right foot, free of at least some of the myths and ignorance that can so easily lead us astray. As always in the study of history, knowing where you came from helps us to learn who you are and where you are."

Professor Taylor takes care to ensure that you can follow this course clearly regardless of your knowledge of economics.

He uses historical examples and quotes from economists and other notables, and his use of economic reasoning often brings surprising insight.

He is the editor-in-chief of the Journal of Economic Perspectives. At Stanford University he won the award for excellent teaching in a large class given by the Associated Students of Stanford University.

At the University of Minnesota, he was named a Distinguished Lecturer by the Department of Economics.

Explore the U.S. Economy Decade by Decade

"An economy operates on many levels, and so must these lectures," states Professor Taylor. "The discussion must touch on the lives of ordinary people: their patterns of consumption, work, and education. It must describe the rise and fall of industrial conditions and unions.

"At the national level, the discussion moves to government budget and monetary policies and the conditions of growth, employment, and inflation. Finally, at the international level, there are issues of how people, capital, and goods flow across borders."

A decade-by-decade course structure includes memorable milestones.

For example:

* In adjusted numbers, the per capita GDP of 1900 would equal $5,000. This GDP per capita of $5,000 was a fifth of what it was in 2000. This was still a high standard of living. * During World War I, the U.S. ran a trade surplus due to an increase in exports, using the earnings to pay off debts and make loans to European countries.

* In the 1920s automobiles became the country's largest industry and led the way to other inventions. * Mismanagement of monetary policy was the main cause of the Great Depression. * The Employment Act of 1946 gave the federal government the responsibility to maintain high employment, growth, and stable prices.

* The broader public policy agenda of the 1950s was quiet. Other than the Korean War, the government enacted few major policies. It is unknown if this economic stability was healthy or stagnant. * Productivity slowed down dramatically during the late 1960s and early 1970s and had terrible effects on the U.S. economy. * The strangling inflation of the 1970s spilled over into the early 1980s. Federal Reserve Chairman Paul Volcker used a recession to break the inflation.

* In the 1990s perception of job insecurity differed from reality. Job insecurity led to economic insecurity.

Lecture 1, the 1900s. You discuss the status of both the country and the economy at the turn of the century as well as the role of the federal government regarding mergers, social legislation, and inflation. "Overall," notes Professor Taylor, "this decade is marked by financial chaos."

Lecture 2, the 1910s. You discuss the government's creation of various federal institutions and the consequences that World War I had on both the government and the economy as a whole. You also examine Frederick Taylor's concept of scientific management and conclude with a discussion of the gentle changes in living standards.

Lecture 3, the 1920s. Although titled "The Roaring 1920s," you begin with a discussion of the Recession of 1920-1921. This recession was followed by the consumption boom marked by the transforming technologies of electricity and the automobile as well as developments in macroeconomic policy. It is this boom which then gave the decade its nickname.

Lecture 4, the 1930s. The fourth lecture highlights the Great Depression, which you learn was most likely caused by a mismanaged monetary policy. You also examine the merits of the New Deal and its role in U.S. economic recovery.

Lecture 5, the 1940s. World War II and its aftermath dominated the 1940s. You survey the economic effects of the war and examine how they actually contributed to the country's economic recovery. More specifically, you look at the war's effects on the federal budget and the reshaping of the U.S. economy. You conclude with an examination of the global institutions built by the U.S. to restore trust in the world.

Lecture 6, the 1950s. "Our task in Lecture 6 is to determine whether or not the quiet boom of the 1950s was beneficial for the U.S. economy," says Professor Taylor. You learn that while this decade revealed many healthy signs of prosperity, it remained plagued by controversies and, thus, future economic uncertainty.

Lecture 7, the 1960s. You pick up with the uncertainty as you investigate the 1960s. You look at the various ways that macroeconomic issues influence the way our country is run. You also discuss the building of the Great Society and antitrust and immigration issues.

Lecture 8, the 1970s. This uncertainty takes you to the confusion of stagflation which lingered throughout the 1970s: two recessions and the creation of price controls, floating exchange rates, and expanding global trade. You also closely examine the productivity slowdown of the 1970s.

Lecture 9, the 1980s. You examine the effects of 1970s inflation on 1980s economic stability. This leads into a discussion of the causes and consequences of the budget and trade deficits. You also look at changing market structure and its effects on deregulation.

Lecture 10, the 1990s. To conclude, you focus on misperceptions of the inequality and insecurities of the 1990s and discuss an economic and social agenda for the 21st century

110GB=11000MB

ONLY TORRENT DOWNLOAD

برچسبها :

مقالات مرتبط

Martin J Pring Candlesticks Explained

INTRODUCTION Candlestick Charting is one of today’s most versatile and popular technical trader’s tools. First used successfully by rice traders in eighteenth-century Japan, candlesticks have gained newfound popularity among today’s fast-action breed of trader. “Candlesticks Explained” – a powerful, four-hour multimedia CD-ROM tutorial and workbook – offers a comprehensive tahlil of the unique graphic traits […]

How To Trade Major First -Hour Reversals For Rapid Gains

INTRODUCTION The Most Comprehensive Work On Trading The Opening That’s Been Published In Years! Now You Can Be Coached By Kevin Haggerty As He Teaches And Trains You How To Trade His Explosive First-Hour Reversal Strategies. Learn Kevin’s Best Strategies Plus Learn His Never Before Revealed Opening Gap Pullback Strategy!

Super MAX FOREX Manual Trading System

INTRODUCTION How many years have you been forex trading and looking for that trading system that’s worth a million bucks? As a trader of stock options and forex for the last 13 years, I’ve written my share of forex trading systems, and while they have their place and value, I’ve recently been introduced to Dr. […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

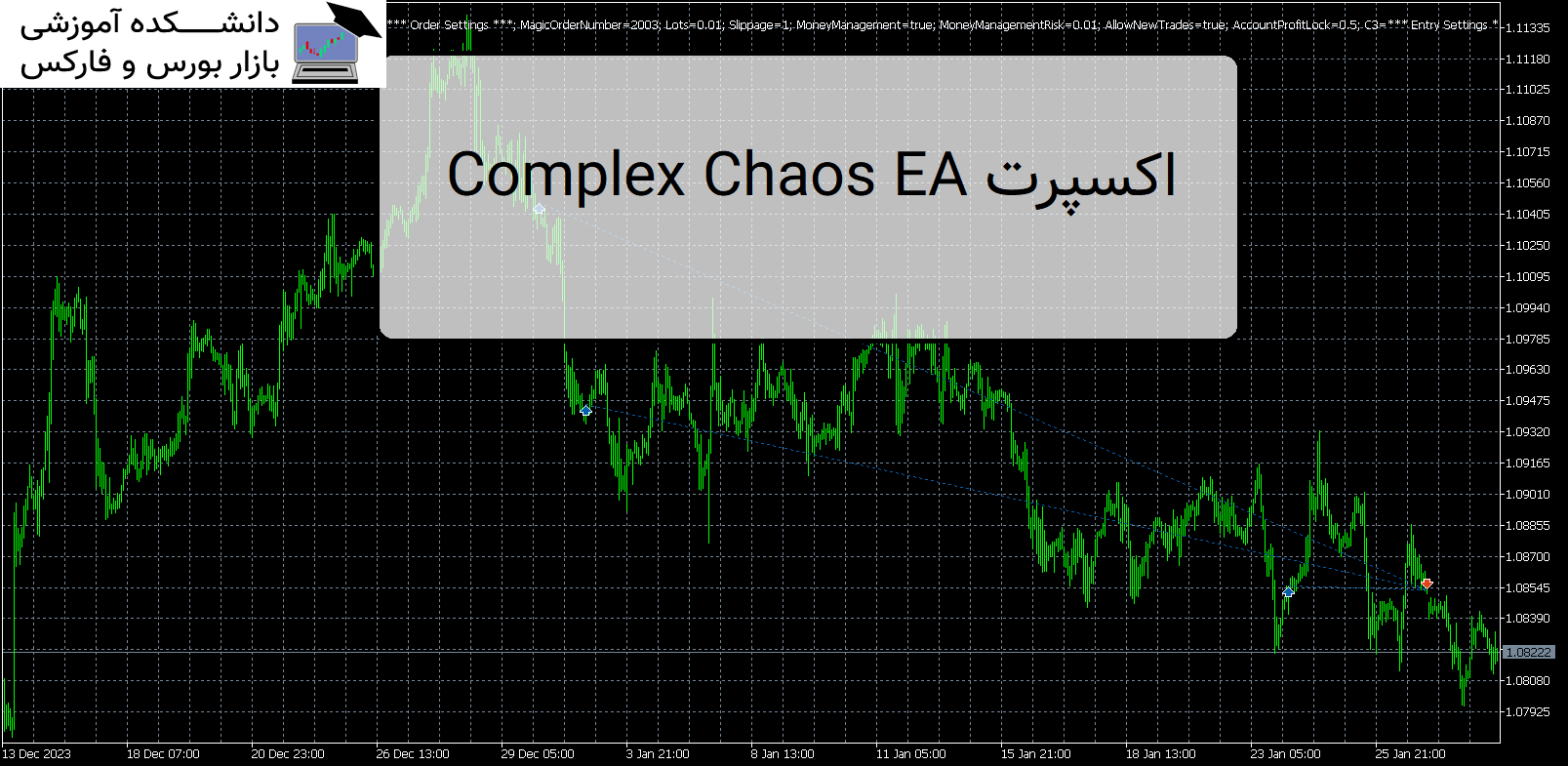

Complex Chaos EA اکسپرت MT5

معرفی و دانلود اکسپرت کاربردی Complex Chaos EA Complex Chaos EA یک سیستم خودکار است که از یک جفت میانگین متحرک نمایی برای تشخیص جهت بازار استفاده می کند و معاملات را در حالت شمع باز باز می کند. معرفی اکسپرت کاربردی Complex Chaos EA اگر بازار بر خلاف یک معامله حرکت کند، در یک […]

Terraforming 1 اکسپرت MT5

معرفی و دانلود اکسپرت کاربردی Terraforming اولین نسخه من از اکسپرت کاربردی Terraforming 1 . EA از آربیتراژ آماری برای کسب سود از جفت ارز USD EUR و GBP استفاده می کند. معرفی اکسپرت Terraforming 1 موقعیت ها زمانی باز می شوند که یک فرصت آربیتراژ شناسایی شود. پوزیشن ها پس از 3 ساعت یا […]