Fallon W – Calculating Value At Risk

Value At Risk The value of a portfolio of financial assets is subject to many risks: credit risks, market risks, etc. \Value at Risk,VaR, is a statistical estimate of the market risk of a portfolio. VaR attempts to answer the following question. Given a certain confidence level and a specified time horizon, what is the […]

Value At Risk

The value of a portfolio of financial assets is subject to many risks: credit risks, market risks, etc. \Value at Risk,VaR,

is a statistical estimate of the market risk of a portfolio.

VaR attempts to answer the following question. Given a certain confidence level and a specified time horizon, what is the maximum potential loss of the portfolio?

Researchers and practitioners haveproposed many methods of measuring market risk.

In 1994 Morgan disclosed its RiskMetrics methodology and made its volatility and correlation data set publicly available. This quickly set the RiskMetrics variance-covariance method of calculating \Value at Risk as an industry standard and it has become a benchmark in the measurement of financial market risks.

Value At Risk

برچسبها :

مقالات مرتبط

day trading forex

Trading Forex You may have read fluff books, tried momentum chat rooms, attended expensive but minimally useful seminars, and found they didn’t help you trade better in actual trading situations. We’re differen….. Trading Forex

Manual Forex In English

Manual Forex Currency exchange is very attractive for both the corporate and individual traders who make money on the Forex – a special financial market assigned for the foreign exchange. The following features make this market different in compare to all other sectors of the world financial… Manual Forex

A Realistic And Effective Strategy For Using Candlestic

Tsutae Kamada Pick up any stock or futures chart book in Japan and more than 90% of the time you’ll find candlestick charts. It’s rare to see bar charts like those used in U.S. When I ask friends who work at stock brokerages in Japan why they use andlesticks rather than bars, interestingly, nobody says […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

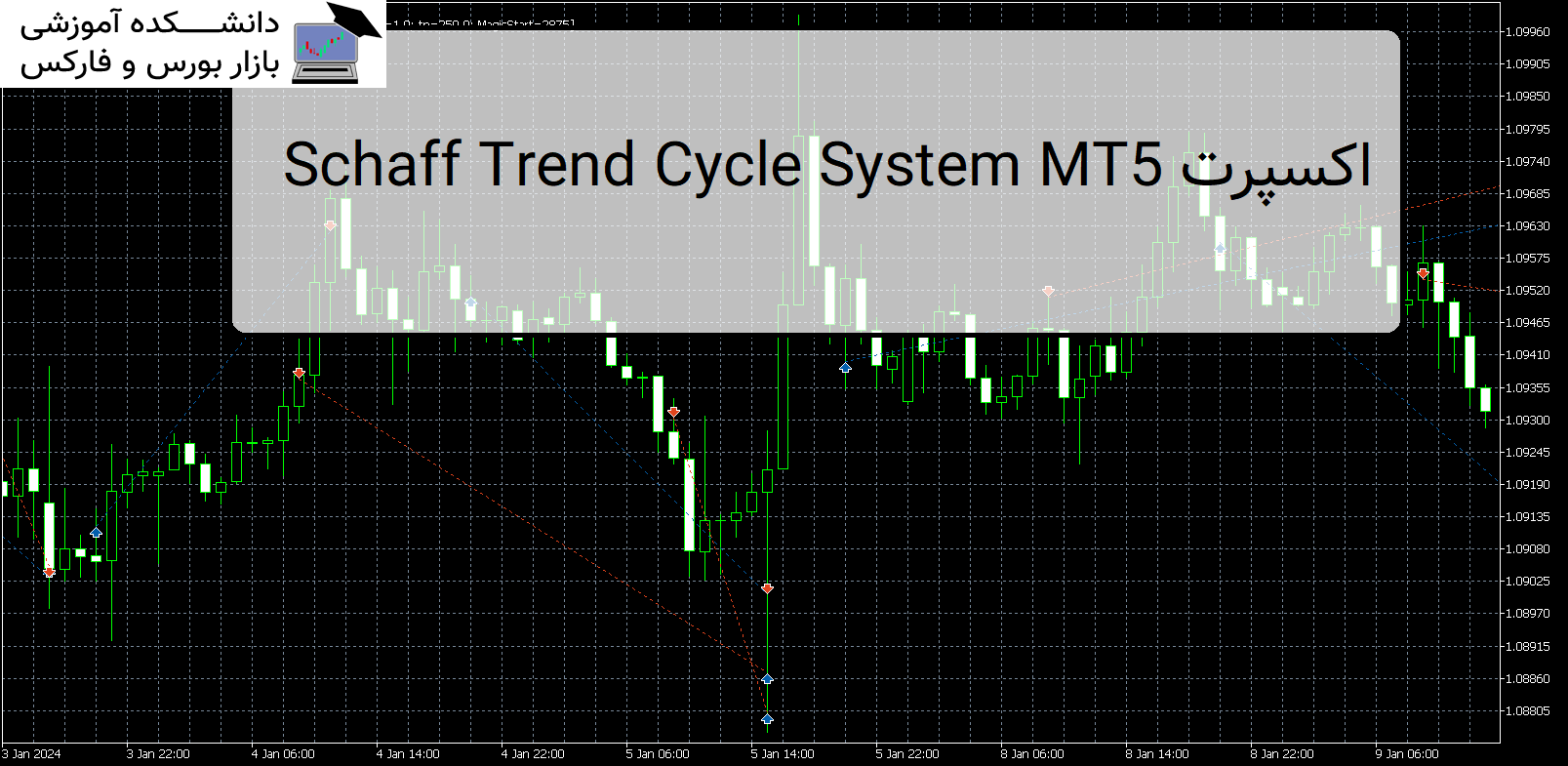

Schaff Trend Cycle System MT5 اکسپرت

معرفی و دانلود اکسپرت کاربردی Schaff Trend Cycle System MT5 اکسپرت کاربردی Schaff Trend Cycle System MT5 که توسط Profectus.AI توسعه یافته است، یک ربات تجاری پیشرفته است که از قدرت سیستم شاف بهره می برد. معرفی اکسپرت کاربردی Schaff Trend Cycle System MT5 این محصول حرفه ای تخصص ما را به نمایش می گذارد […]

TaolishenEN اکسپرت MT5

معرفی و دانلود اکسپرت کاربردی TaolishenEN TaolishenEN تراکنشهای بدون مشارکت EA خطرات زیادی را به همراه دارند. به دلیل ترس یا طمع، بهترین موقعیت معاملاتی را از دست خواهیم داد. معرفی اکسپرت کاربردی TaolishenEN نسخه ی نمایشی تجارت EA: VPS IP: 117.50.106.17 حساب ورود: Taolishen رمز عبور:qq2356692354 با این حال، اگر EA توانایی قضاوت نداشته […]

-

فایل های که پسوند آنها rar یا zip یا 7z هست را چگونه باز کنم؟

توسط نرم افزار Winrar فایل را از حالت فشرده خارج کنید و بعد برای اجرا و یا نصب اقدام کنید. دانلود WINRAR

فایل های با فرمت mq4 و mq5 را چگونه اجرا کنم ؟جهت اجرای این نوع فایل ها برای نسخه mq4 باید متاتریدر 4 را روی سیستم خود و برای نسخه mq5 متاتریدر 5 را روی سیستم عامل خود نصب داشته باشید . جهت راهنمایی کلیک کنید

-

رمز تمامی فایل ها :

- عنوان مقاله : Fallon W - Calculating Value At Risk

- نوع فایل : PDF

- حجم فایل : 960 کیلوبایت