Asset Pricing with Speculative Trading

Speculative trading stems from disagreements among traders. Besides the approaches based on the existence of private information (and noise traders) or the di erences of opinions, Harrison and Kreps(1978) and Morris(1996) relied on the presence of diverse beliefs to explain speculative phenomena. This paper proposes a new model of speculative trading by introducing rational beliefs of […]

Speculative trading stems from disagreements among traders.

Besides the approaches based on the existence of private information (and noise traders) or the di erences of opinions, Harrison and Kreps(1978) and Morris(1996) relied on the presence of diverse beliefs to explain speculative phenomena.

This paper proposes a new model of speculative trading by introducing rational beliefs of Kurz(1994) and Kurz and Wu(1996). Agents hold diverse beliefs which are

\rational" in the sense of being compatible with observed data.

In a non-stationary environment the agents may learn only

about the stationary measure of observed data.

Agents' beliefs can be non-stationary and diverse even when their stationary measures become the same as that of the data with complete learning.In a Markovian framework of dividends and beliefs, we obtainanalytical results on how the speculative premium depends on the extent of heterogeneity of beliefs. In addition, we demonstrate the possible emergence of endogenous uncertainty (as de ned by Kurz and Wu(1996)) and the persistent presence of diverse beliefs and positive speculative premiums.

برچسبها :

مقالات مرتبط

Jake Bernstein – Market Masters

These are just a few of the dozens of winning tips you ll find in Market Masters. What does it take to succeed? What do winners have in common? How can their experiences help you succeed? According to Jake Bernstein, great traders are created, not born. Those who lack discipline, persistence and self-confidence lose the […]

Joe Ross – Trading Spreads And Seasonals

Trading Spreads Copyright September, 1997 by Ross Trading, Inc. Revised February 2000. Revised August, 2004, Revised May, 2006. Copyright May, 2006 by Ross Trading, Inc.

Finance – The Mathematics Of Financial Derivatives

Finance is one of the fastest growing areas in the modern banking and corporate world. This, together with the sophistication of modern financial products, provides a rapidly growing impetus for new mathematical models and modern mathematical methods. Indeed, the area is an expanding source for novel and relevant “real-world” mathematics. In this book, the authors […]

آخرین مقالات

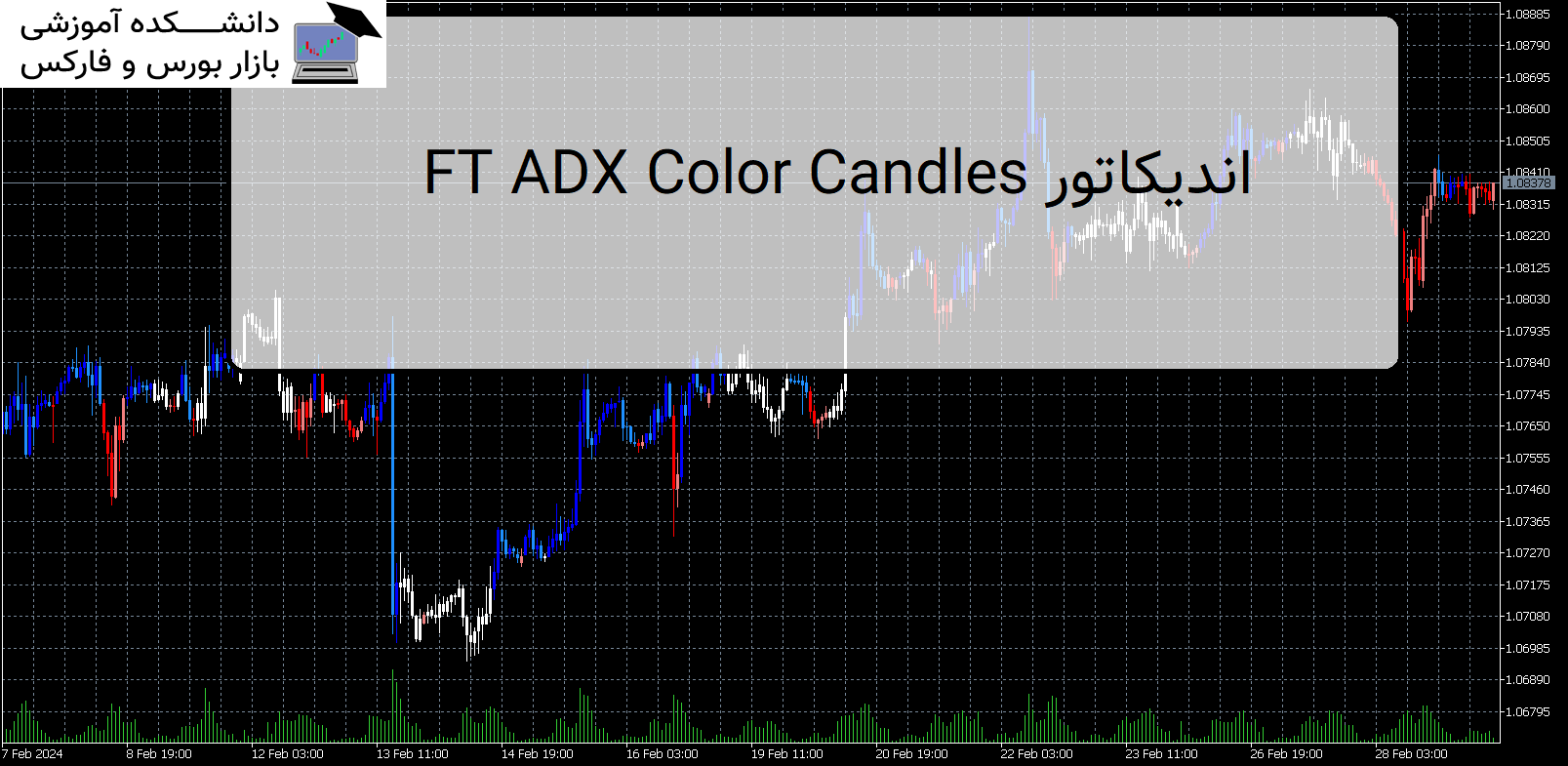

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

The Waiter MT5 Free اکسپرت

معرفی و دانلود اکسپرت کاربردی The Waiter MT5 Free اکسپرت کاربردی The Waiter Free MT5 این یک سیستم خودکار و محبوب است که همیشه برای گرفتن حرکات بزرگ بازار آماده است مناسب برای معامله گران گرامی. معرفی اکسپرت کاربردی The Waiter Free MT5 چگونه کار می کند؟ تنظیم حالت (توقف یا محدود کردن) فاصله سفارشات […]

MAs Trick اکسپرت MT5

معرفی و دانلود اکسپرت کاربردی MAs Trick MAs Trick مشاور متخصص استراتژی شمعی میانگین متحرک سه گانه یک ابزار معاملاتی خودکار پیچیده است که برای بازار فارکس طراحی شده است. معرفی اکسپرت کاربردی MAs Trick این EA از یک رویکرد پویا استفاده میکند و بینشهای سه میانگین متحرک با طولهای مختلف را با شکلهای کندل […]

-

فایل های که پسوند آنها rar یا zip یا 7z هست را چگونه باز کنم؟

توسط نرم افزار Winrar فایل را از حالت فشرده خارج کنید و بعد برای اجرا و یا نصب اقدام کنید. دانلود WINRAR

فایل های با فرمت mq4 و mq5 را چگونه اجرا کنم ؟جهت اجرای این نوع فایل ها برای نسخه mq4 باید متاتریدر 4 را روی سیستم خود و برای نسخه mq5 متاتریدر 5 را روی سیستم عامل خود نصب داشته باشید . جهت راهنمایی کلیک کنید

-

رمز تمامی فایل ها :

- عنوان مقاله : Asset Pricing with Speculative Trading

- نوع فایل : PDF

- حجم فایل : 422 کیلوبایت