Bass – The Basics of Financial Mathematics

In this course we will study mathematical finance. Mathematical finance is not about predicting the price of a stock. What it is about is figuring out the price of options and derivatives.The most familiar type of option is the option to buy a stock at a given price at a given time. For example, suppose […]

In this course we will study mathematical finance. Mathematical finance is not about predicting the price of a stock. What it is about is figuring out the price of options and derivatives.The most familiar type of option is the option to buy a stock at a given price at a given time. For example, suppose Microsoft is currently selling today at $40 per share. A European call option is something I can buy that gives me the right to buy a share of Microsoft at some future date. To make up an example, suppose I have an option that allows me to buy a share of Microsoft for $50 in three months time, but does not compel me to do so. If Microsoft happens to be selling at $45 in three months time, the option is worthless. I would be silly to buy a share for $50 when I could call my broker and buy it for $45. So I would choose not to exercise the option. On the other hand, if Microsoft is selling for $60 three months from now, the option would be quite valuable.

برچسبها :

مقالات مرتبط

ICWR

Download ICWR: Learn how to trade EUR/USD, USD/CAD, GBP/USD or any other major currency pair by mastering a system that combines top level mathematics with the fundamental principles of human behavior – simplified in such a way that even a high school dropout can quickly start profiting from it . . . ICWR

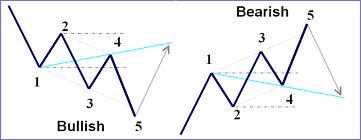

Wolfe Waves

Wolfe Waves This particular methodology is perhaps the most unique, effective trading technique I’ve (Linda) ever come across! It was developed and shared by a good friend, Bill Wolfe, who for the last 10 years has made a living trading the S&P His son, Brian, also trades it. Brian was the first teenager I’ve ever […]

BELLA SYSTEM

Download BELLA SYSTEM : 1. Open a 30 min chart EUR/USD. Insert RSI (14), Stochastic Oscillator (14,3,3) and EMAS 5 and 13. 2. We have to watch for a divergence between the price and the RSI or the Stochastic.This is very important, because sometimes we don´t see a divergence between the price and the RSI, […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

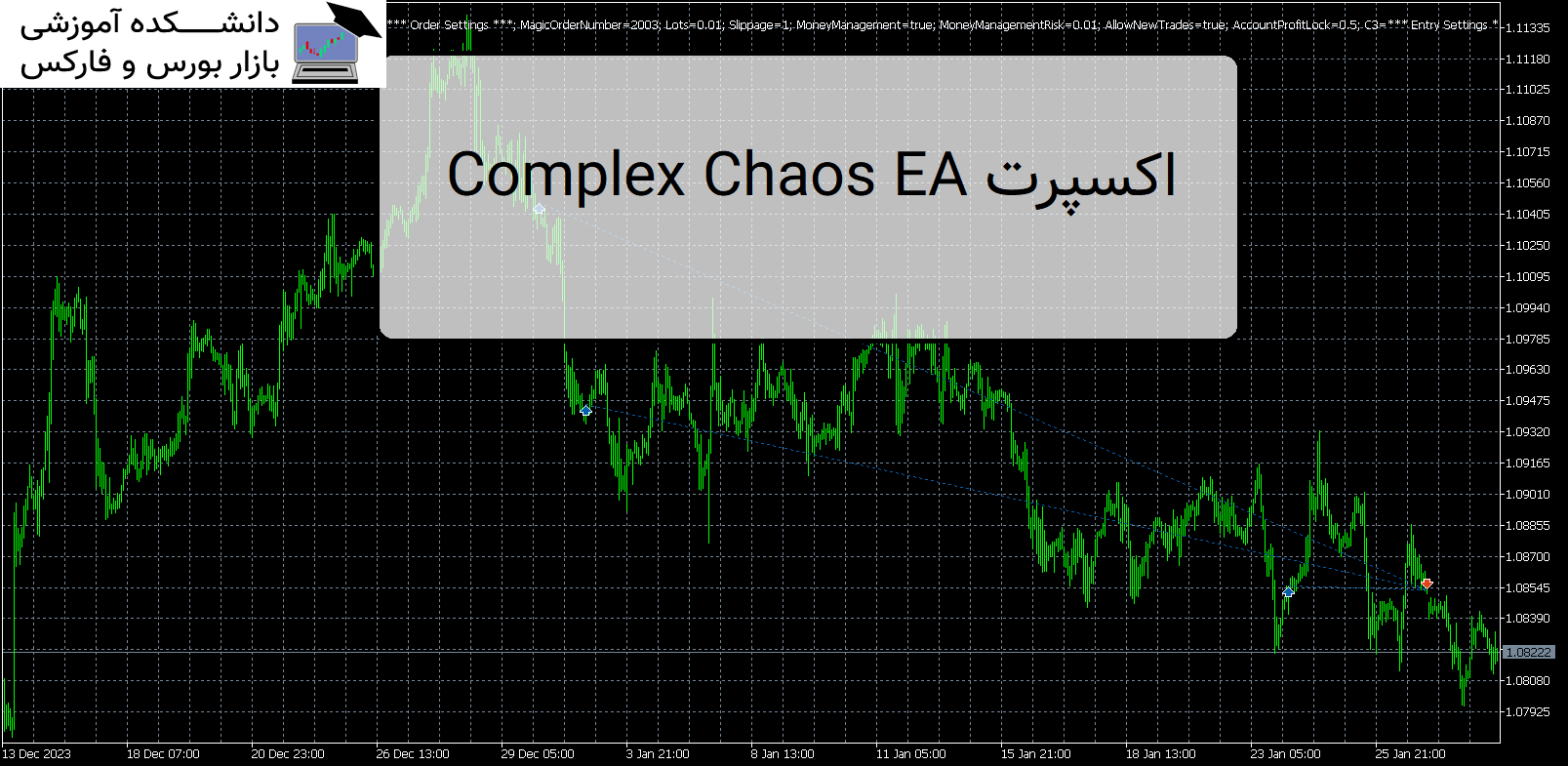

Complex Chaos EA اکسپرت MT5

معرفی و دانلود اکسپرت کاربردی Complex Chaos EA Complex Chaos EA یک سیستم خودکار است که از یک جفت میانگین متحرک نمایی برای تشخیص جهت بازار استفاده می کند و معاملات را در حالت شمع باز باز می کند. معرفی اکسپرت کاربردی Complex Chaos EA اگر بازار بر خلاف یک معامله حرکت کند، در یک […]

Terraforming 1 اکسپرت MT5

معرفی و دانلود اکسپرت کاربردی Terraforming اولین نسخه من از اکسپرت کاربردی Terraforming 1 . EA از آربیتراژ آماری برای کسب سود از جفت ارز USD EUR و GBP استفاده می کند. معرفی اکسپرت Terraforming 1 موقعیت ها زمانی باز می شوند که یک فرصت آربیتراژ شناسایی شود. پوزیشن ها پس از 3 ساعت یا […]

-

فایل های که پسوند آنها rar یا zip یا 7z هست را چگونه باز کنم؟

توسط نرم افزار Winrar فایل را از حالت فشرده خارج کنید و بعد برای اجرا و یا نصب اقدام کنید. دانلود WINRAR

فایل های با فرمت mq4 و mq5 را چگونه اجرا کنم ؟جهت اجرای این نوع فایل ها برای نسخه mq4 باید متاتریدر 4 را روی سیستم خود و برای نسخه mq5 متاتریدر 5 را روی سیستم عامل خود نصب داشته باشید . جهت راهنمایی کلیک کنید

-

رمز تمامی فایل ها :

- عنوان مقاله : Bass - The Basics of Financial Mathematics

- نوع فایل : PDF

- حجم فایل : 460 کیلوبایت