Bessembinder And Venkataraman-Does An Electronic Stock Exchange Need An Upstairs Market

We examine block trades on the Paris Bourse to test several theoretical predictions regarding upstairs trading, and exploit cross-sectional variation in “crossing rules” on the Paris Bourse to provide evidence on their relevance. Paris provides an excellent setting to test the implications of upstairs intermediation models, because its electronic limit order market closely resembles […]

We examine block trades on the Paris Bourse to test several theoretical predictions regarding upstairs trading, and exploit cross-sectional variation in “crossing rules” on the Paris Bourse to provide evidence on their relevance. Paris provides an excellent setting to test the implications of upstairs intermediation models, because its electronic limit order market closely resembles the downstairs markets envisioned by theorists. We present direct evidence in support of Grossman’s (1992) prediction that upstairs brokers lower execution costs by tapping into pools of unexpressed liquidity, as actual execution costs upstairs are less than one third as large as would be anticipated if block trades were executed against displayed liquidity in the downstairs market. Consistent with prior analyses, the Paris data also supports the Seppi (1990) hypothesis... that upstairs brokers certify trades as uninformed. We find that participants in stocks with less restrictive crossing rules agree to outside-the-quote executions for more difficult trades and at times when downstairs liquidity is lacking. These likely represent trades that could not have been otherwise completed, suggesting that market quality can be enhanced by allowing participants more flexibility to execute blocks at prices outside the quotes, a consideration particularly relevant to U.S. markets in the wake of decimalization.

برچسبها :

مقالات مرتبط

Nicktrader On Divergences

part1 – part2 part1:This discussion was held late one night in Woodies CCI Club. It helped me understand divers without prices and how to trade them with CCI. The text started out approximately twice the size it is now. It was edited to make it more readable and easier to understand. It is important to […]

Jan L Arps – Surfing The Market Waves – The Swing Trader’s

The objective of this course is to give you a thorough understanding of the TRADERS’ TOOLBOX Swing Trader’s tools, to teach you how get a “feel” for the rhythm of the market swings and to trade the swings like a pro – that is, to buy the bottom s and sell the tops. After all, […]

Tom Peters – 100Ways

100 WAYS …FOUR days a week (if humanly possible), 25 weeks running. That’s my promise. (Or, at least, my Goal.) One hundred short but (hopefully) sweet Blogs, collectively titled: 100 Ways to Help You Succeed/Make Money.It was all triggered by a “trivial” experience this past Saturday.. pressing services. I get paid (very) well for […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

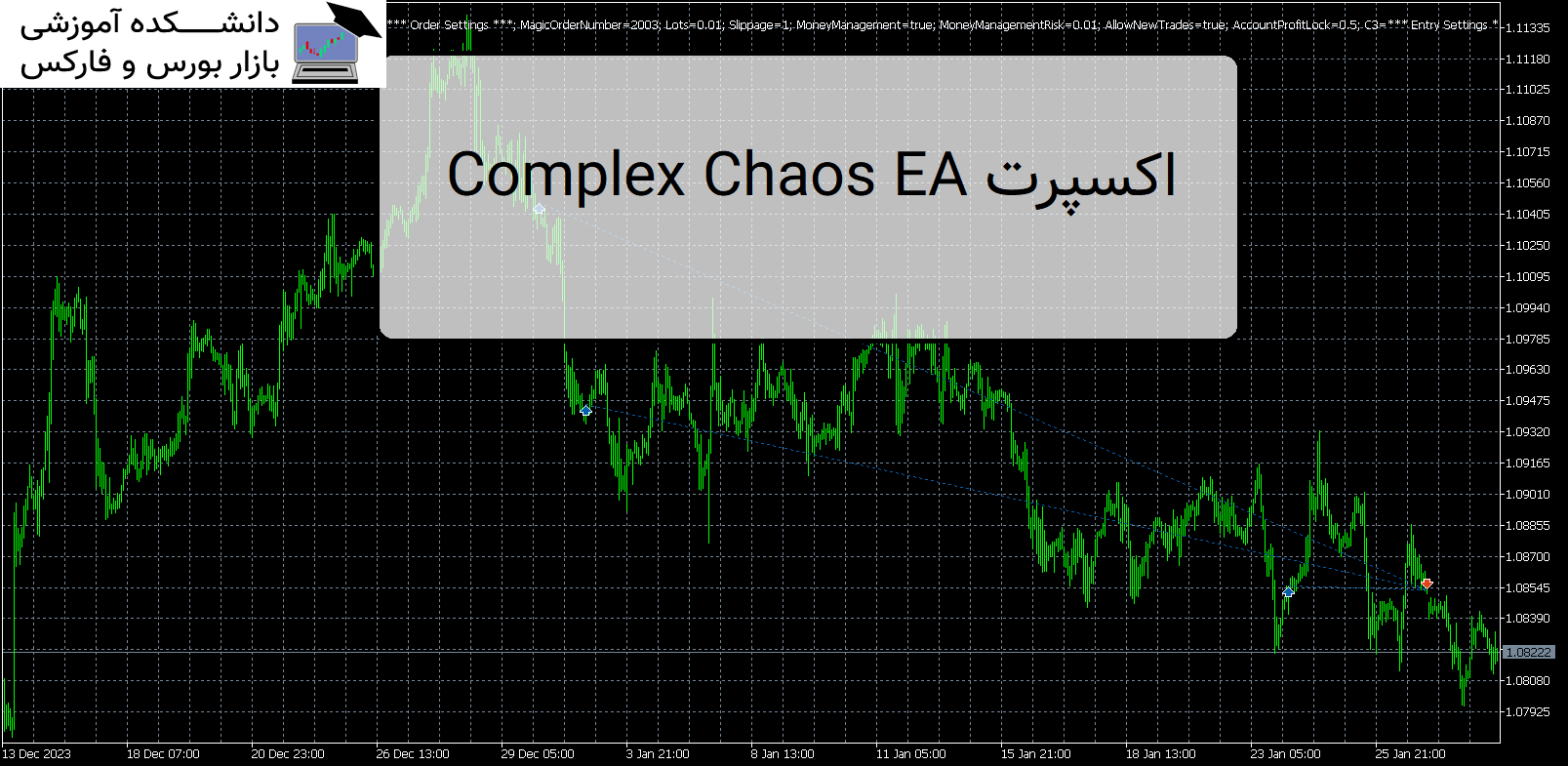

Complex Chaos EA اکسپرت MT5

معرفی و دانلود اکسپرت کاربردی Complex Chaos EA Complex Chaos EA یک سیستم خودکار است که از یک جفت میانگین متحرک نمایی برای تشخیص جهت بازار استفاده می کند و معاملات را در حالت شمع باز باز می کند. معرفی اکسپرت کاربردی Complex Chaos EA اگر بازار بر خلاف یک معامله حرکت کند، در یک […]

Terraforming 1 اکسپرت MT5

معرفی و دانلود اکسپرت کاربردی Terraforming اولین نسخه من از اکسپرت کاربردی Terraforming 1 . EA از آربیتراژ آماری برای کسب سود از جفت ارز USD EUR و GBP استفاده می کند. معرفی اکسپرت Terraforming 1 موقعیت ها زمانی باز می شوند که یک فرصت آربیتراژ شناسایی شود. پوزیشن ها پس از 3 ساعت یا […]

-

فایل های که پسوند آنها rar یا zip یا 7z هست را چگونه باز کنم؟

توسط نرم افزار Winrar فایل را از حالت فشرده خارج کنید و بعد برای اجرا و یا نصب اقدام کنید. دانلود WINRAR

فایل های با فرمت mq4 و mq5 را چگونه اجرا کنم ؟جهت اجرای این نوع فایل ها برای نسخه mq4 باید متاتریدر 4 را روی سیستم خود و برای نسخه mq5 متاتریدر 5 را روی سیستم عامل خود نصب داشته باشید . جهت راهنمایی کلیک کنید

-

رمز تمامی فایل ها :

- عنوان مقاله : ...Bessembinder And Venkataraman-Does An Electronic

- نوع فایل : PDF

- حجم فایل : 340 کیلوبایت