Kalman Filter For Arbitrage Identification In High Frequency Data

We present a methodology for modelling real world high frequency financial data.The methodology copes with the erratic arrival of data and is robust to additive outliers in the data set. Arbitrage pricing relationships are formulated into a linear state space representation. Arbitrage opportunities violate these pricing relationships and are analogous to multivariate additive outliers. Robust […]

We present a methodology for modelling real world high frequency financial data.The methodology copes with the erratic arrival of data and is robust to additive outliers in the data set. Arbitrage pricing relationships are formulated into a linear state space representation.

Arbitrage opportunities violate these pricing relationships and are analogous to multivariate additive outliers. Robust identification/filtering of arbitrage opportunities in the data is accomplished by Kalman filtering.

The state space model used to describe the pricing relationships is general enough to handle both linear and non-linear models. The recursive Kalman equations are adapted to filter tick data, cope with the erratic arrival of observations and produce estimates of all the arbitrage prices on every time step.

We demonstrate the methodology with a robust neural network filter applied to foreign exchange triangular arbitrage. Tick data from three markets is used: $/DM,£/$, £/DM 1993-1995. The filter produces estimates of the arbitrage price for all exchange rates on every second, increasing both the speed and efficiency of arbitrage identification.

File Size: 188KB File Type: PDF Pages: 20

برچسبها :

مقالات مرتبط

Marketwise Trading School – Options Trading Primer

Trading Primer The follow ing presentation is intended for educational purposes only. Trading strategies and position sizes are not suitable for all investors. References and links to other websites and sources are not recommendations nor have they been judged by Market Wise Trad ing School, LLC. to be accurate or reliable in part or in […]

Batfink Method

Download Batfink Method : Introduction Day trading foreign currency (Forex) is challenging pursuit, emotionally and strategically. This system endeavours to provide a disciplined, mechanical way of Intraday trading the forex market. The BatFink Daily Range Strategy (BF) was originally designed to be currencyspecific to the GBP/USD but was also found to be suitable for other […]

Putting it all together ; orthomolecular

orthomolecular The orthomolecular concept is a simple one, using optimal nutrition to combat, heal and prevent physical and mental illness. \Orthomolecular nutrition is based on diets and food supplements of essential vitamins and minerals specifically selected to solve individual problems and needs. Its overall aim is promoting optimal health and longevity for everyone. In this […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

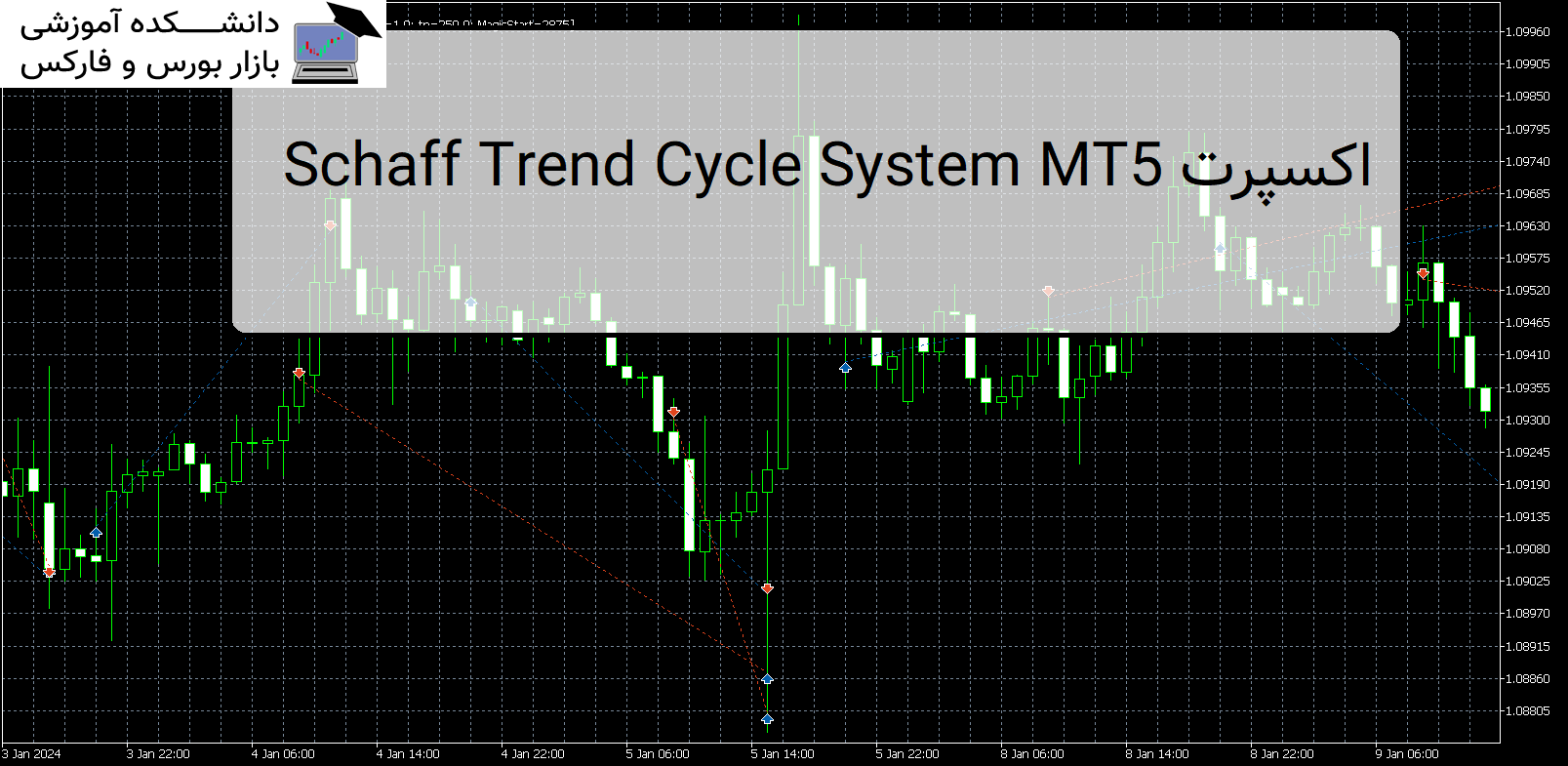

Schaff Trend Cycle System MT5 اکسپرت

معرفی و دانلود اکسپرت کاربردی Schaff Trend Cycle System MT5 اکسپرت کاربردی Schaff Trend Cycle System MT5 که توسط Profectus.AI توسعه یافته است، یک ربات تجاری پیشرفته است که از قدرت سیستم شاف بهره می برد. معرفی اکسپرت کاربردی Schaff Trend Cycle System MT5 این محصول حرفه ای تخصص ما را به نمایش می گذارد […]

TaolishenEN اکسپرت MT5

معرفی و دانلود اکسپرت کاربردی TaolishenEN TaolishenEN تراکنشهای بدون مشارکت EA خطرات زیادی را به همراه دارند. به دلیل ترس یا طمع، بهترین موقعیت معاملاتی را از دست خواهیم داد. معرفی اکسپرت کاربردی TaolishenEN نسخه ی نمایشی تجارت EA: VPS IP: 117.50.106.17 حساب ورود: Taolishen رمز عبور:qq2356692354 با این حال، اگر EA توانایی قضاوت نداشته […]

-

فایل های که پسوند آنها rar یا zip یا 7z هست را چگونه باز کنم؟

توسط نرم افزار Winrar فایل را از حالت فشرده خارج کنید و بعد برای اجرا و یا نصب اقدام کنید. دانلود WINRAR

فایل های با فرمت mq4 و mq5 را چگونه اجرا کنم ؟جهت اجرای این نوع فایل ها برای نسخه mq4 باید متاتریدر 4 را روی سیستم خود و برای نسخه mq5 متاتریدر 5 را روی سیستم عامل خود نصب داشته باشید . جهت راهنمایی کلیک کنید

-

رمز تمامی فایل ها :

- عنوان مقاله : ...Kalman Filter For Arbitrage Identification

- نوع فایل : PDF

- حجم فایل : 187 کیلوبایت