Sarin And Saudagaran-Testing For Micro-Structure Effects Of International Dual Listings Using Int

This paper examines the impact on the liquidity of NYSE/AMEX listed stocks when they were subsequently listed on the London or the Tokyo Stock Exchanges. It can be argued that the increased competition from foreign market makers will reduce the monopoly rents that specialists can earn, thereby improving their quotes. We find, however, that spreads […]

This paper examines the impact on the liquidity of NYSE/AMEX listed stocks when they were subsequently listed on the London or the Tokyo Stock Exchanges. It can be argued that the increased competition from foreign market makers will reduce the monopoly rents that specialists can earn, thereby improving their quotes. We find, however, that spreads do not decrease following a dual listing, though the depth of the quotes increases as predicted. The apparent increase in depth disappears once we account for changes in price,volume and return variance. We also find that the level of informed trading increases,which increases the cost to the specialist of providing liquidity, and explains why spreadsdo not decline in spite of increased competition. Consistent with an increase in informed trading, we also document an increase in trading activity.

برچسبها :

مقالات مرتبط

ADCT Trader

ALL RIGHTS RESERVED: No part of this manual may be reproduced or transmitted in any form by any means, electronic ormechanical, including photocopying, recording or by any information storage or retrieval systems, without the express written permission from the author and publisher. All materials contained herein have been copyrighted. Reproduction will be in violation of […]

Eleswarapu Thompson And Venkataraman-The Impact Of Regulation Fair Disclosure Trading Costs And

In October of 2000, the Securities and Exchange Commission (SEC) passed Regulation Fair Disclosure (FD) in an effort to reduce selective disclosure of material information by firms to analysts and other investment professionals. We find that the information asymmetry reflected in trading costs at earnings announcements has declined after Regulation FD, with the decrease more […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

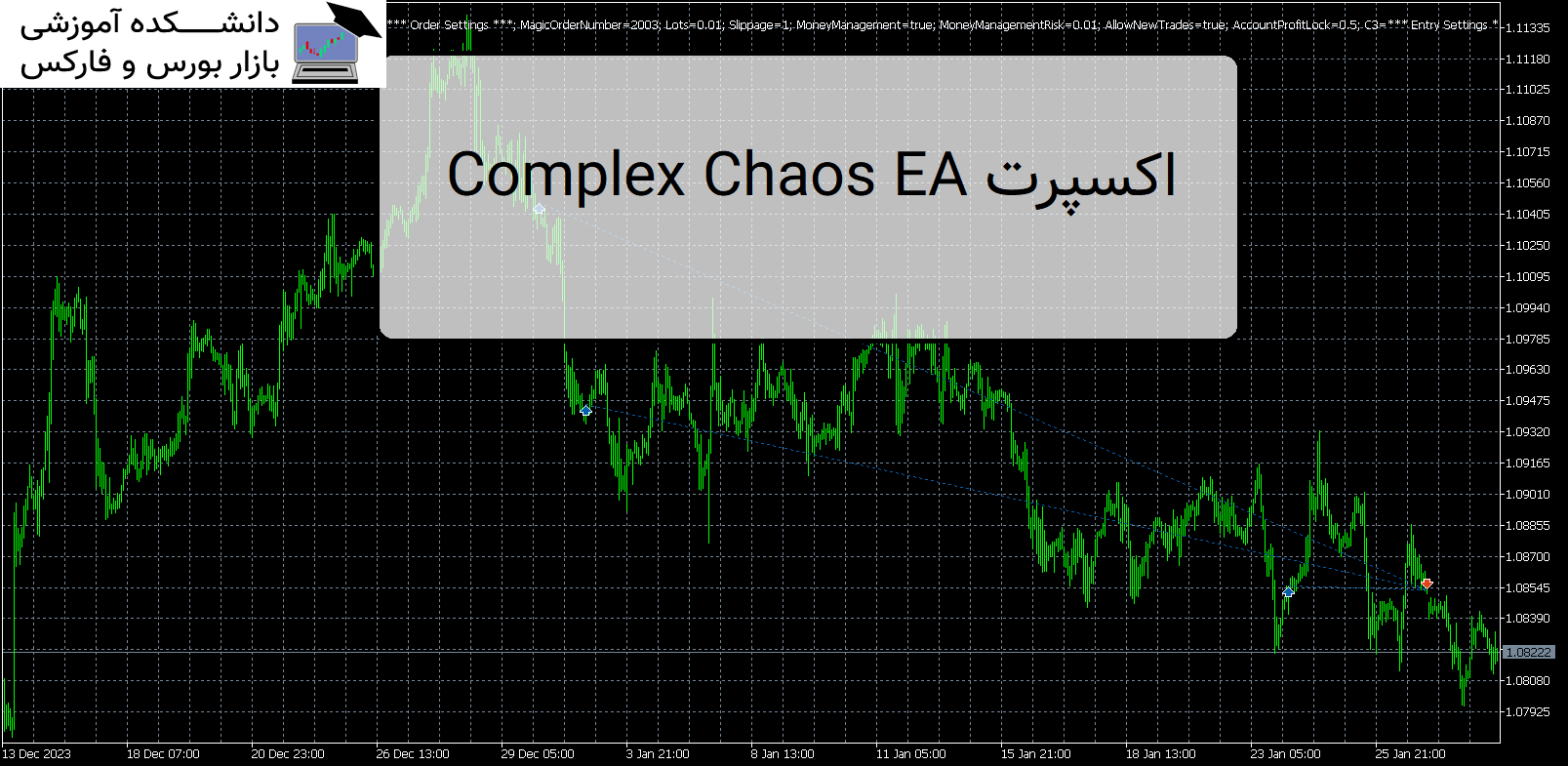

Complex Chaos EA اکسپرت MT5

معرفی و دانلود اکسپرت کاربردی Complex Chaos EA Complex Chaos EA یک سیستم خودکار است که از یک جفت میانگین متحرک نمایی برای تشخیص جهت بازار استفاده می کند و معاملات را در حالت شمع باز باز می کند. معرفی اکسپرت کاربردی Complex Chaos EA اگر بازار بر خلاف یک معامله حرکت کند، در یک […]

Terraforming 1 اکسپرت MT5

معرفی و دانلود اکسپرت کاربردی Terraforming اولین نسخه من از اکسپرت کاربردی Terraforming 1 . EA از آربیتراژ آماری برای کسب سود از جفت ارز USD EUR و GBP استفاده می کند. معرفی اکسپرت Terraforming 1 موقعیت ها زمانی باز می شوند که یک فرصت آربیتراژ شناسایی شود. پوزیشن ها پس از 3 ساعت یا […]

-

فایل های که پسوند آنها rar یا zip یا 7z هست را چگونه باز کنم؟

توسط نرم افزار Winrar فایل را از حالت فشرده خارج کنید و بعد برای اجرا و یا نصب اقدام کنید. دانلود WINRAR

فایل های با فرمت mq4 و mq5 را چگونه اجرا کنم ؟جهت اجرای این نوع فایل ها برای نسخه mq4 باید متاتریدر 4 را روی سیستم خود و برای نسخه mq5 متاتریدر 5 را روی سیستم عامل خود نصب داشته باشید . جهت راهنمایی کلیک کنید

-

رمز تمامی فایل ها :

- عنوان مقاله : ...Sarin And Saudagaran-Testing For

- نوع فایل : PDF

- حجم فایل : 1 مگابایت