Most Market Moving

Non-farm payrolls use to be the most market moving economic indicator for the US dollar, but this is no longer true. Back in April of 2005, we published a report using 2004 data that ranked non-farm payrolls as the single piece of economic data that caused the biggest average daily movement for the US dollar […]

Non-farm payrolls use to be the most market moving economic indicator for the US dollar, but this is no longer true. Back in April of 2005, we published a report using 2004 data that ranked non-farm payrolls as the single piece of economic data that caused the biggest average daily movement for the US dollar during that year. We have now updated the tahlil by looking at the impact of economic data on currency prices between June 2005 and June 2006. The latest report indicates that the ISM or Institute of Supply Management’s index of manufacturing sentiment actually surpassed the non-farm payrolls as the market moving indicator for the US dollar over the past 12 months. The changes that we have seen in the rankings are primarily due to the shifts in the economic cycle,changes to major market themes and the Federal Reserve’s greater emphasis on inflation. Regardless of whether you are a fundamental or a technical trader, knowing which economic data can cause the biggest shifts in the markets is extremely important.Depending upon your specific trading strategy, it will help you to decide when to be in the markets and when to stay out.

برچسبها :

مقالات مرتبط

Borsellino Lewis 2001 – Trading Es And Nq Futures Course

In this Seven-Part Course, I’ll lead you through the highlights of devising a plan to trade. Our focus is on Stock Index Futures – in particular, S&Ps and NASDAQ – but many of these lessons can be applied to any market. My goal is to help you – whether a novice or an experienced trader […]

You Can Choose To Be Rich Workbook by Robert T. Kiyosaki

Where do Americans get financial advice? Merrill Lynch? CNBC? Or Robert T. Kiyosaki? If you don’t know who Robert T. Kiyosaki is, well, you can find him at the top of many a best-seller list. His, is currently No. 1 on the New York Times paperback “advice” chart—a list that it’s been on for an astonishing 98 weeks. […]

Tom Demark System

Download Tom Demark System Market Timing with DeMark Indicators™ on Bloomberg The technical analysis indicators developed by Tom DeMark enjoy a reputation for reliability amongst its small group of market users that exceeds that of the average price or volume indicator. DeMark remains one of the lesser known market indicators and is seldom covered […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

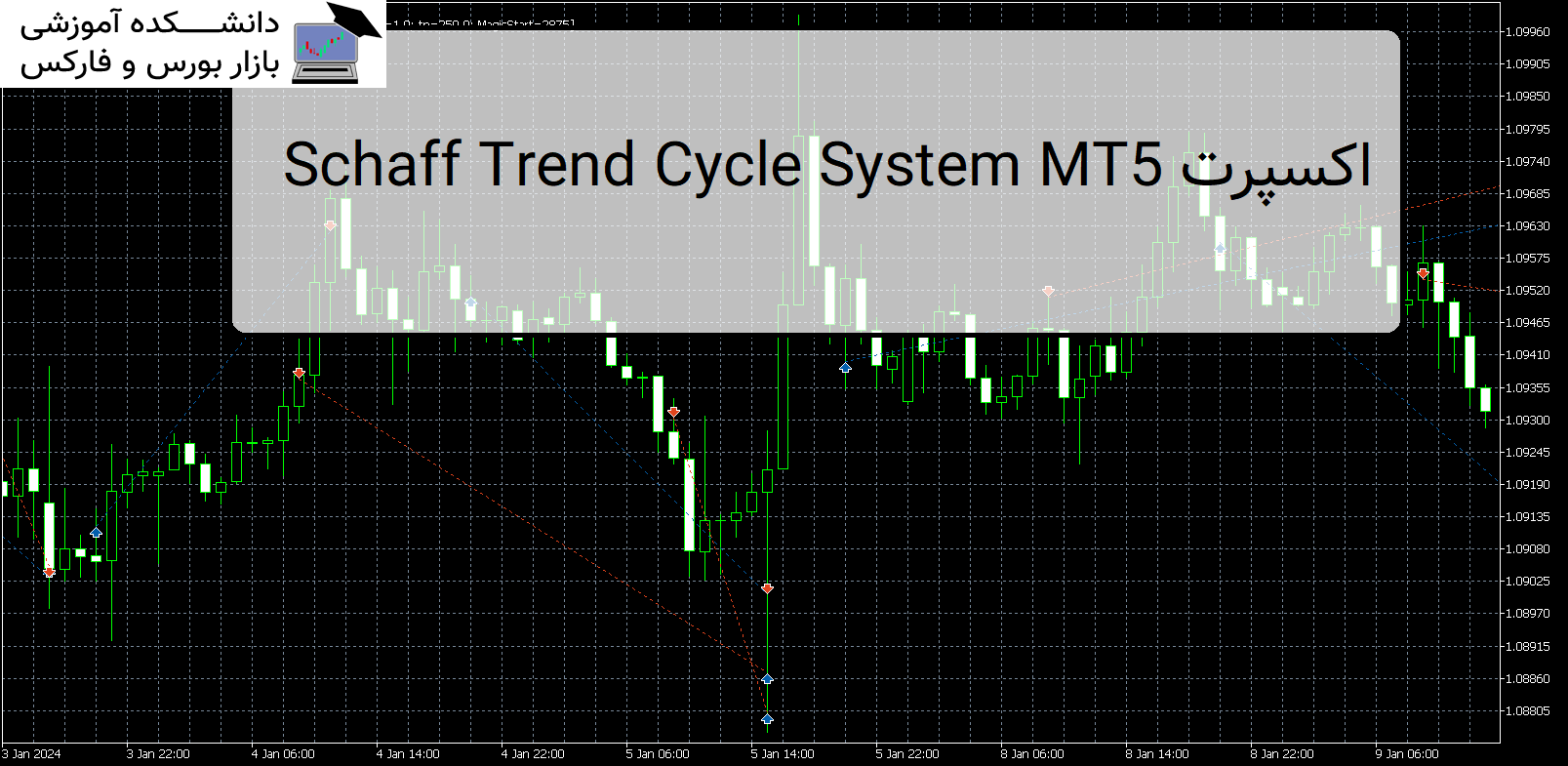

Schaff Trend Cycle System MT5 اکسپرت

معرفی و دانلود اکسپرت کاربردی Schaff Trend Cycle System MT5 اکسپرت کاربردی Schaff Trend Cycle System MT5 که توسط Profectus.AI توسعه یافته است، یک ربات تجاری پیشرفته است که از قدرت سیستم شاف بهره می برد. معرفی اکسپرت کاربردی Schaff Trend Cycle System MT5 این محصول حرفه ای تخصص ما را به نمایش می گذارد […]

TaolishenEN اکسپرت MT5

معرفی و دانلود اکسپرت کاربردی TaolishenEN TaolishenEN تراکنشهای بدون مشارکت EA خطرات زیادی را به همراه دارند. به دلیل ترس یا طمع، بهترین موقعیت معاملاتی را از دست خواهیم داد. معرفی اکسپرت کاربردی TaolishenEN نسخه ی نمایشی تجارت EA: VPS IP: 117.50.106.17 حساب ورود: Taolishen رمز عبور:qq2356692354 با این حال، اگر EA توانایی قضاوت نداشته […]

-

فایل های که پسوند آنها rar یا zip یا 7z هست را چگونه باز کنم؟

توسط نرم افزار Winrar فایل را از حالت فشرده خارج کنید و بعد برای اجرا و یا نصب اقدام کنید. دانلود WINRAR

فایل های با فرمت mq4 و mq5 را چگونه اجرا کنم ؟جهت اجرای این نوع فایل ها برای نسخه mq4 باید متاتریدر 4 را روی سیستم خود و برای نسخه mq5 متاتریدر 5 را روی سیستم عامل خود نصب داشته باشید . جهت راهنمایی کلیک کنید

-

رمز تمامی فایل ها :

- عنوان مقاله : Most Market Moving

- نوع فایل : PDF

- حجم فایل : 100 کیلوبایت