What moves the currency market

Trends. More than 80 percent of currency trading volume is speculative innature and, as a result, the market frequently overshoots and then corrects. Also, many of the macroeconomic catalysts and events traders use in the equity or futures markets, including gauging interest-rate changes and economic releases,are also integral to forex trading. In addition, price moves […]

Trends. More than 80 percent of currency trading volume is speculative innature and, as a result, the market frequently overshoots and then corrects. Also, many of the macroeconomic catalysts and events traders use in the equity or futures markets, including gauging interest-rate changes and economic releases,are also integral to forex trading. In addition, price moves in many commodities or indices are highly correlated to currency moves.For example, Australia is the world’s t h i rd, l a rgest gold pro d u c e r, which explains the Australian dollar’s 80-percent positive correlation with gold prices. As a result, many commodity traders can trade forex to spread their risk or leverage certain positions.

برچسبها :

مقالات مرتبط

A Course in Miracles

A Course in Miracles This “combined” edition from the Foundation for Inner Peace is the only complete version that includes all of the writings that Dr. Helen Schucman, the Scribe of A Course in Miracles, authorized to be printed. It consists of a Text, Workbook for Students, Manual for Teachers, and Clarification of Terms. Also […]

50cci-system

Download 50-cci-System : PDF by the link below . . .My good friend Verus has taken an extraordinary amount of time to study and document the essentials of the 50cci trading system that I introduced. I have reviewed and edited this document with Verus and I believe it captures the essentials of the protocol that […]

Prechter Robert – The Major Works Of R N Elliott

Ralph Nelson Elliott (1871-1948) led an adventurous and productive life. He enjoyed a remarkably successful accounting career, including a U.S. State Department appointment, long before he published his first book on the stock market at the age of 67. An inspiration to anyone facing his “declining years, ” Elliott’s evident genius reached full flower in […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

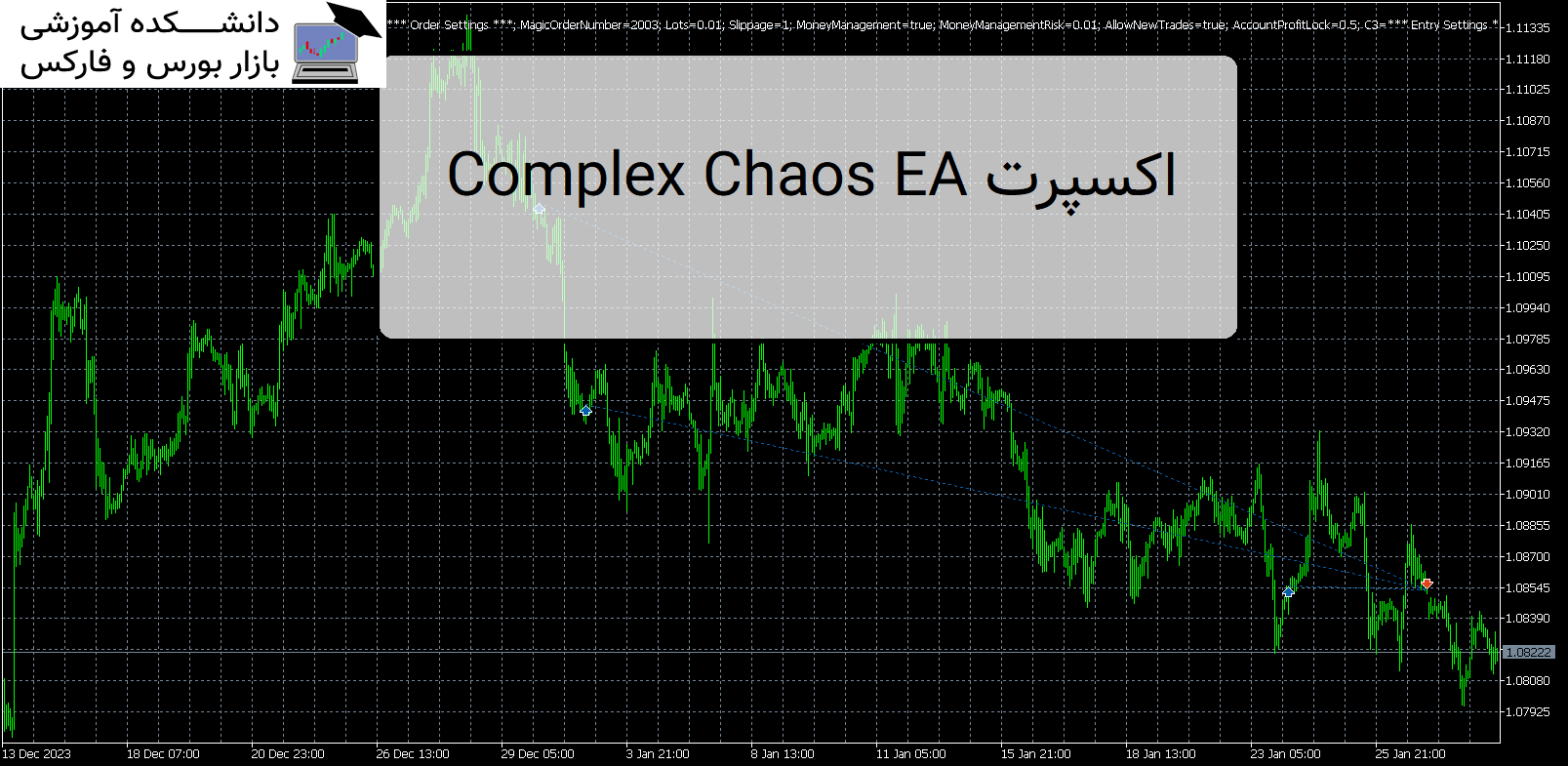

Complex Chaos EA اکسپرت MT5

معرفی و دانلود اکسپرت کاربردی Complex Chaos EA Complex Chaos EA یک سیستم خودکار است که از یک جفت میانگین متحرک نمایی برای تشخیص جهت بازار استفاده می کند و معاملات را در حالت شمع باز باز می کند. معرفی اکسپرت کاربردی Complex Chaos EA اگر بازار بر خلاف یک معامله حرکت کند، در یک […]

Terraforming 1 اکسپرت MT5

معرفی و دانلود اکسپرت کاربردی Terraforming اولین نسخه من از اکسپرت کاربردی Terraforming 1 . EA از آربیتراژ آماری برای کسب سود از جفت ارز USD EUR و GBP استفاده می کند. معرفی اکسپرت Terraforming 1 موقعیت ها زمانی باز می شوند که یک فرصت آربیتراژ شناسایی شود. پوزیشن ها پس از 3 ساعت یا […]

-

فایل های که پسوند آنها rar یا zip یا 7z هست را چگونه باز کنم؟

توسط نرم افزار Winrar فایل را از حالت فشرده خارج کنید و بعد برای اجرا و یا نصب اقدام کنید. دانلود WINRAR

فایل های با فرمت mq4 و mq5 را چگونه اجرا کنم ؟جهت اجرای این نوع فایل ها برای نسخه mq4 باید متاتریدر 4 را روی سیستم خود و برای نسخه mq5 متاتریدر 5 را روی سیستم عامل خود نصب داشته باشید . جهت راهنمایی کلیک کنید

-

رمز تمامی فایل ها :

- عنوان مقاله : What moves the currency market

- نوع فایل : PDF

- حجم فایل : 830 کیلوبایت