فرهنگ لغات تخصصی بازار ارز حرف C

Cable: The common name for the GBP/USD currency pair. Cable Transfer: Telegraphic transfer of funds from one centre to another. Now synonymous with inter bank electronic fund transfer. Cable/Sterling: A term used in the foreign exchange market for the US Dollar/British Pound rate. Calendar Spread: An option strategy involving the simultaneous purchase and sale of […]

Cable: The common name for the GBP/USD currency pair.

Cable Transfer: Telegraphic transfer of funds from one centre to another. Now synonymous with inter bank electronic fund transfer. Cable/Sterling: A term used in the foreign exchange market for the US Dollar/British Pound rate. Calendar Spread: An option strategy involving the simultaneous purchase and sale of options of the same class and strike price but different expiration dates. Call: An option that gives the holder the right to buy the underlying instrument at a specified price during a fixed period. Call Option: A call option confers the right but not the obligation to buy stock, shares or futures at a specified price. Call Rate: The overnight interbank interest rate. Cambist: An expert on exchange rates, or a foreign currency trader. Candlestick Chart: The candlestick encapsulates the open, high, low and close of the trading period in a single candle. A type of chart which shows the price movements of a market asset over a certain period of time. Cap: The highest interest rate that can be paid on a floating-rate bond, or the highest rate that an adjustable rate mortgage can rise to in a specified period of time. Cap-An abbreviation for capitalization: The market price of an entire company, calculated by multiplying the number of shares outstanding by the price per share. here also called market cap or market capitalization Capacity utilization: Capacity utilization is a concept in Economics which refers to the extent to which an enterprise or a nation actually uses its installed productive capacity. Thus, it refers to the relationship between actual output produced and potential output that could be produced with installed equipment, if capacity was fully used. Capacity Utilization Rate - Canada: Measures the extent to which Canadian manufacturing companies make use of their productive capacity (factories and machinery). Capacity Utilization Rates act as an indicator of overall demand in the economy. High Capacity Utilization Rates reflect that resources are in high demand, and this exerts inflationary pressures. High Capacity Utilization Rates may also lead to new capital investments, such as new plants and equipment that promote growth in the future. The headline figure is reported as the ratio of actual production to potential production. Capex-Capital Expenditure: Amount spent to acquire or upgrade productive assets (such as buildings, machinery and equipment, vehicles) to increase the capacity or efficiency of a firm for more than one accounting period. Also called capital spending. Capital Investment-Germany: Measures the total value of German investments in equipment including machinery and construction equipment. Equipment Investment is a part of GDP and released at the same time, therefore changes in the figure directly change overall GDP. But Equipment Investment is also an early indicator for production since companies generally make capital expenditures in a healthy economy when the need to expand operational productivity exists. Because such capital expenditures are sensitive to business conditions, the report can also forecast economic growth or recession. The headline number is the percentage change in Equipment Investment in the reporting quarter. Capital Account: Juxtaposition of the long and short term capital imports and exports of a country. (economics) that part of the balance of payments recording a nation's outflow and inflow of financial securities capital expenditure -CAPEX: Amount spent to acquire or upgrade productive assets (such as buildings, machinery and equipment, vehicles) to increase the capacity or efficiency of a firm for more than one accounting period. Also called capital spending. Capital Flow: International capital flows have the potential to bring a wide range of benefits to both the host nation and the country of origin, increasing global output, employment, and wealth. Whether international capital flows bring a net gain depends on the policies pursued by both the recipient and the host country, and whether there are well-designed inernational rules and institutions governing the interaction Capital Gain: The profit made from the sale of a capital asset, such as real estate, a house, jewelry or stocks and bonds. Capital Loss: In finance, a capital gain is profit that results from the sale or exchange of a capital asset over its purchase price. If the price of the capital asset has declined instead of appreciated, this is called a capital loss. Capital gains occur in both real assets, such as property, as well as financial assets, such as stocks or bonds. For equities, according to each national or state legislation, a large array of fiscal obligations must be respected regarding capital gains, and taxes are charged by the state over the transactions, dividends and capital gains on the stock market. However, these fiscal obligations may vary from jurisdiction to jurisdiction because, among other reasons, it could be assumed that taxation is already incorporated into the stock price through the different taxes companies pay to the state, or that tax free stock market operations are useful to boost economic growth. Capital Markets: Markets in which capital (stocks, bonds, etc.) is traded; Usually for medium or long term investing. Capital Risk: 1. The risk an investor faces that he or she may lose all or part of the principal amount invested. For example, when someone invests $10,000 into the stock market, he or she faces a capital risk on the $10,000 invested 2. The risk a company faces that it may lose value on its capital. The capital of a company can include equipment, factories and liquid securities. If a company does not insure the value of some of its assets, it will face capital risk from such things as fire, flood and theft. Capital Spending: Money spent to acquire or upgrade physical assets such as buildings and machinery. Capping: The practice of selling large amounts of a commodity or security close to the options expiry date in order to prevent a rise in market price. The investor who might practice capping is a call option writer. If practicing capping, he or she is trying to avoid having to transfer the underlying security or commodity to the option holder. The goal is to have the option expire worthless so that the premium initially received by the writer is protected. This is a violation of NASD rules. Carry: The income or cost associated with keeping a foreign exchange position overnight. This is derived when the currency pairs in the position have different interest rates for the same period of time. Carry Trade: In a carry trade, the investor makes money by borrowing in a country with low interest rates, converting the money to a currency where interest rates are higher and lending the money at that higher rate. The profit comes from the spread between the borrowing and lending rates Carry-Over Charge: A finance charge associated with the storing of commodities (or foreign exchange contracts) from one delivery date to another. Cash: Currency and coins that can be used in exchange for goods or debt. Cash and Carry: The buying of an asset today and selling a future contract on the asset. A reverse cash and carry is possible by selling an asset and buying a future. Cash Market: A market in which commodities, such as grain, gold, crude oil, or RAM chips, are bought and sold for cash and delivered immediately. also called spot market. Cash Settlement: A procedure for settling futures contract where the cash difference between the future and the market price is paid instead of physical delivery CBI: Confederation of British Industry CBI Industrial Trends Survey - UK: A survey of senior manufacturing executives on trends in output, prices, exports, and costs. The CBI Industrial Trends Survey collects data on topics like current business confidence, capacity utilization, and investment intentions. The survey differs from most other economic surveys in that it focuses on the opinions of executives rather than quantitative data. CBOE: Chicago Board Options Exchange. CBOT or CBT: Chicago Board of Trade The Chicago Board of Trade (CBOT) NYSE: CME, established in 1848, is the world's oldest futures and options exchange. More than 50 different options and futures contracts are traded by over 3,600 CBOT members through open outcry and eTrading. Volumes at the exchange in 2003 were a record breaking 454 million contracts. On 12 July 2007, the CBOT merged with the CME and ceased to exist as an independent entity. Central Bank: A bank, administered by a national government, which regulates the behavior of financial institutions within its borders and carries out monetary policy. CEO=Chief Executive Officer: The highest-ranking executive in a company or organization, responsible for carrying out the policies of the board of directors on a day-to-day basis. the corporate executive responsible for the operations of the firm; reports to a board of directors; may appoint other managers (including a president) [syn: chief executive officer] Certificate of Deposit: CD. Short- or medium-term, interest-bearing, FDIC-insured debt instrument offered by banks and savings and loans. CDs offer higher rates of return than most comparable investments, in exchange for tying up invested money for the duration of the certificate's maturity. Money removed before maturity is subject to a penalty. CDs are low risk, low return investments, and are also known as "time deposits", because the account holder has agreed to keep the money in the account for a specified amount of time, anywhere from three months to six years. CET: Central European Time CFD=Contract For Difference: A contract for difference (or CFD) is a contract between two parties, buyer and seller, stipulating that the seller will pay to the buyer the difference between the current value of an asset and its value at contract time. (If the difference is negative, then the buyer pays instead to the seller.) CFTC: The Commodity Futures Trading Commission, the US Federal regulatory agency ,created in 1975, that supervises the trading of futures on commodity exchanges. CGPI: Corporate Goods Price Index CGPI -Capital Goods Price Index: An economic index computed by the New Zealand government that measures the change in fixed capital-asset prices in the New Zealand economy from one period to another. The index helps indicate the change in costs for capital assets, which are used by companies and the New Zealand government to produce other goods. The CGPI is produced every quarter. The index monitors changes in six types of physical capital assets: residential and nonresidential buildings, transportation equipment, land-improvement costs, plant machinery and other types of construction. CHAPS: Clearing House Automated Payment System. Chartist: A person who attempts to predict prices by analyzing past price movements as recorded on a chart. CHIPS: The New York clearing house clearing system. (Clearing House Interbank Payment System). Most Euro transactions are cleared and settled through this system. CIBOR: Copenhagen Interbank Rate, the rate at which the banks lend the Danish Krone on an unsecured basis. The rate is calculated daily by the Danmarks Nationalbank (the Danish Central Bank), based on rules set out by the Danish Banker's Association. Civic Federation: The Civic Federation is a non-partisan government research organization working to maximize the quality and cost-effectiveness of government services in the Chicago region. The Federation’s membership includes business and professional leaders from a wide range of Chicago-area companies and institutions. The Federation maintains a growing archive of publications concerning local tax policies, government services, and public expenditures. Claimant Count Rate: Claimant count rates: Regional Trends 38 This table shows seasonally adjusted annual averages. National and regional claimant count rates are calculated by expressing the number of claimants as a percentage of the estimated total workforce (the sum of claimants, employee jobs, self-employment... Clean float: An exchange rate that is not materially effected by official intervention. Clearing: The process of settling a trade. clearing house: A corporation established by an exchange in order to facilitate the execution of trades by transferring funds, assigning deliveries, and guaranteeing the performance of all obligations Closing a Position: The process of selling or buying a foreign exchange position resulting in the liquidation (squaring up) of the position. Closing Market Rate: The rate at which a position can be closed based on the market price at end of the day. Closing Price: The price (or price range) recorded during trading that takes place in the final moments of a day's activity that is officially designated as the "close." Closing Purchase Transaction: The purchase of an option identical to one already sold to liquidate a position. CME: Chicago Mercantile Exchange CML: Council of Mortgage Lenders (UK) Coincidence Indicator Index: The business cycle of economic conditions have four phases: peak, contraction, recession, and recovery. Were leading indicators strive to forecast future economic conditions and lagging indicators are delayed - Coincident Indicator attempt to track the current health of the economy, measuring changes as they are taking place. Example of Coincident Indicators are manufacturing sales or personal income. Coincident Index - Japan: Measures the current economic activity based on a composite of indicators that track current business conditions in Japan . Coincident Indicator: An economic indicator which varies directly with, and at the same time as, the related economic trend, thereby providing information about the current state of the economy. Some examples include nonagricultural employment, personal income, and industrial production. Collateral: Properties or assets that are offered to secure a loan or other credit. Collateral becomes subject to seizure on default. Properties or assets that are offered to secure a loan or other credit. Collateral becomes subject to seizure on default. For example, if you get a mortgage, your collateral would be your house. In margin trading, the securities in your account act as collateral in the case of a margin call. Comex: Commodity Exchange of New York. Commercial Paper: Promissory note (issued by financial institutions or large firms) with very-short to short maturity period (usually, 2 to 30 days, and not more than 270 days), and secured only by the reputation of the issuer. Rated, bought, sold, and traded like other negotiable instruments, commercial paper is a popular means of raising cash, and is offered generally at a discount instead of on interest bearing basis. Also called paper. See also government paper. Commission: The fee levied by an institution to undertake a trade on behalf of a customer. Commodity: Reasonably homogenous good or material, bought and sold freely as an article of commerce. Commodities include agricultural products, fuels, metals, etc., and are traded in bulk on a commodity exchange or on spot market. Commodity Futures Trading Comission: The Commodity Futures Trading Commission (CFTC)is an independent agency of the United States Government. The Commodity Exchange Act (CEA), 7 U.S.C. § 1 et seq., prohibits fraudulent conduct in the trading of futures contracts. In 1974, Congress amended the Act to create a more comprehensive regulatory framework for the trading of futures contracts and created the Commodity Futures Trading Commission. The CFTC is an independent agency of the United States Government. It replaced the Commodity Exchange Authority. The stated 'mission' of the CFTC is to protect market users and the public from fraud, manipulation, and abusive practices related to the sale of commodity and financial futures and options, and to foster open, competitive, and financially sound futures and option markets. Company Operating Profit-Australia: The profits of Australian companies after all expenses have been accounted for. Company Operating Profits is an important indicator of economic health as positive profits allow firms to re-invest to increase efficiency and expand output. Higher profits also suggest stronger demand and productivity and therefore a better overall economic outlook. Company Operating Profits - Australia: The profits of Australian companies after all expenses have been accounted for. Company Operating Profits is an important indicator of economic health as positive profits allow firms to re-invest to increase efficiency and expand output. Higher profits also suggest stronger demand and productivity and therefore a better overall economic outlook. Composite Index of Leading Indicators: An index published monthly by the Conference Board used to predict the direction of the economy's movements in the months to come. The index is made up of 10 economic components, whose changes tend to precede changes in the overall economy. These 10 components include: 1. the average weekly hours worked by manufacturing workers 2. the average number of initial applications for unemployment insurance 3. the amount of manufacturers' new orders for consumer goods and materials 4. the speed of delivery of new merchandise to vendors from suppliers 5. the amount of new orders for capital goods unrelated to defense 6. the amount of new building permits for residential buildings 7. the S&P 500 stock index 8. the inflation-adjusted monetary supply (M2) 9. the spread between long and short interest rates 10. consumer sentiment The Composite Index of Leading Indicators is a number that is used by many economic participants to judge what is going to happen in the near future. By looking at the Composite Index of Leading Indicators in the light of business cycles and general economic conditions, investors and businesses can form expectations about what's ahead, and make better-informed decisions. Compound Option: An option on an option. Examples include a call on a call, a put on a put, a call on a put, and a put on a call. This type of option usually exists for currency or fixed income markets where an uncertainty exists regarding the option's risk protection capabilities. Concerted Intervention: Concerted intervention refers to action by a number of central banks to control exchange rates. conference board: The Conference Board is a non-profit global business organization composed of business executives that hosts conferences, conducts business management research, and produces a number of economic statistics, including the Consumer Confidence Index, CEO Confidence index, the Help Wanted index, and indexes of leading indicators, coincident indicators, and lagging indicators. A similar but separate organization exists in Canada, Conference Board of Canada. The Conference Board also publishes a magazine of ideas and opinion, called Across the Board from 1976 to 2006 and The Conference Board Review henceforth. Confirmation: Written acknowledgment of a trade, listing important details such as the date, the size of the transaction, the price, the commission, and the amount of money involved. Construction output: Construction output includes construction work done by enterprises with prevailing construction activity. Included are enterprises with 20 or more employees the data of which are collected by reports, while construction work for enterprises up to 19 employees is estimated. The value of construction output is calculated in constant prices (1994=100%). Increase (or decrease) of construction output indicates by how many % the construction output increased (or decreased) in surveyed month in comparison with the same month of the previous year. Construction Work Done - Australia: Measures the value of all construction completed in Australia during the previous month. Officially referred to as Building Activity, this figure is used to track developments in the construction sector. Because the construction sector is a leading indicator of economic output and the rest of the housing market, a consistent decline in this number (particularly in conjunction with a decline in new building permits or housing financing) predicts a contraction in the economy as a whole. The headline number the percentage change in the value from the previous month. Consumer Confidence Index: A measure of consumer optimism toward current economic conditions. The consumer confidence index was arbitrarily set at 100 in 1985 and is adjusted monthly on the basis of a survey of about 5,000 households. The index considers consumer opinion on both current conditions (40% of the index) and future expectations (the other 60%). The Consumer Confidence Index is closely watched because many economists consider consumer optimism an important indicator of the future health of the economy. Consumer Credit: Debt incurred for the purpose of buying a good. This good may consist of either products or services. The debt must be non mortgage-related, and incurred by the ultimate user of the good as opposed to a manufacturer intending to use it in production or resale. Types of consumer credit include installment credit (not including real estate related loans) and open-end credit such as credit cards. Either unsecured or secured by an assignment of title, consumer debt is monitored by the Federal Reserve Board, and is a leading economic indicator. Consumer Price Index: Monthly measure of the change in the prices of a defined basket of consumer goods including food, clothing, and transport. Countries vary in their approach to rents and mortgages. Consumer sentiment: Economical indicator, A survey of consumer attitudes concerning both the present situation as well as expectations regarding economic conditions conducted by the University of Michigan. Five hundred consumers are surveyed each month. The level of consumer sentiment is directly related to the strength of consumer spending. consumer spending: Consumer demand or consumption is also known as personal consumption expenditure. It is the largest part of aggregate demand or effective demand at the macroeconomic level. Contagion: The tendency of an economic crisis to spread from one market to another. In 1997, political instability in Indonesia caused high volatility in their domestic currency, the Rupiah. From there, the contagion spread to other Asian emerging currencies, and then to Latin America, and is now referred to as the 'Asian Contagion'. Contract: The standard unit of trading. Contract Expiration Date: The date on which a currency must be delivered to fulfill the terms of the contract. For options, the last day on which the option holder can exercise his right to buy or sell the underlying instrument or currency. Contract Month: The month in which a futures contract matures or becomes deliverable if not liquidated or traded out before the date specified. convenience store: A convenience store is a small store or shop. They are often located alongside busy roads, or at gas/petrol stations. This can take the form of gas stations supplementing their income with retail outlets, or convenience stores adding gas to the list of goods that they offer. Railway stations also often have convenience stores. They are also frequently located in densely-populated urban neighborhoods Convenience Store Sales: The value of items sold at small convenience stores, based on a monthly industry survey. Japanese consumers spend a significant portion of their income at the more than forty thousand convenience stores in the country. In fact Japan has one of the highest convenience store per capita rates in the industrialized world. Even though a significant portion of Japan 's economy depends on global demand for exports, domestic consumption is still very important. Convenience Store Sales give good insight into developments in overall Japanese consumer spending because of the Japanese consumer's reliance on convenience stores to supply everyday necessities. As with most indicators of consumer spending, rapid growth in Convenience Store Sales signals mounting inflationary pressures. The headline value is the percentage change in store sales from the previous year's sales. Convergence: The tendency for prices of physical commodities and futures to approach one another, usually during the delivery month. Conversion: The process of converting a convertible security, such as a bond or preferred stock, into common stock. Convertible currency: Currencies that can be exchanged for other currencies or gold. Copey: Slang for the Danish krone. Corporation: The most common form of business organization, and one which is chartered by a state and given many legal rights as an entity separate from its owners. This form of business is characterized by the limited liability of its owners, the issuance of shares of easily transferable stock, and existence as a going concern. The process of becoming a corporation, call incorporation, gives the company separate legal standing from its owners and protects those owners from being personally liable in the event that the company is sued (a condition known as limited liability). Incorporation also provides companies with a more flexible way to manage their ownership structure. In addition, there are different tax implications for corporations, although these can be both advantageous and disadvantageous. In these respects, corporations differ from sole proprietorships and limited partnerships. Correction: A move in price against the current established trend. The term is commonly used to describe a temporary reversal of trend after a period of sustained movement. If prices have risen too quickly a correction will bring the market to more reasonable levels and contribute to a more stable trend. A correction (as opposed to a full reversal or crash) is usually considered beneficial for the long term health of the market. Correlation: A relationship between two variables. A statistical measure referring to the relationship between two or more variables (events, occurrences etc.). A correlation between two variables suggests some causal relationship between these variables. Typically the Swiss Franc is closely correlated with the German Mark. correspondent: A bank, brokerage or other financial institution that performs services for other banks, brokerages or other financial institutions, where the latter does not have direct access. Correspondent Bank: The foreign banks representative who regularly performs services for a bank which has no branch in the relevant centre, e.g. to facilitate the transfer of funds. In the US this often occurs domestically due to inter state banking restrictions. Cost of Carry: Out-of-pocket costs incurred while an investor has an investment position. Examples include interest on long positions in margin account, dividend lost on short margin positions, and incidental expenses. Cost of Living Index: Broadly equivalent to Retail Price Index or Consumer price. Counter Currency: The second listed Currency in a Currency Pair. Counterpart: A participant in a financial transaction. Counterparty: One of the participants in a financial transaction. Counterparty Risks: Counterparty risk refers to the danger either side of an agreement will not live up to their contractual obligations. Countervalue: Where a person buys a currency against the dollar, it is the dollar value of the transaction. Country Risk: When speaking of international investments, this refers to the added risk associated with a particular country. Analysts would consider economic, political, legal, social, foreign exchange volatility or geographic factors to determine a particular investment's Country Risk. Coupon Value: The annual rate of interest of a bond. Cover: To repurchase a previously sold contract. CPI: Consumer Price Index. Monthly measure of the change in the prices of a defined basket of consumer goods including food, clothing, and transport. Countries vary in their approach to rents and mortgages. Crawling peg: A method of exchange rate adjustment; the rate is fixed/ pegged, but adjusted at certain intervals in line with certain economic or market indicators. Credit Card: Any card that may be used repeatedly to borrow money or buy products and services on credit. Issued by banks, savings and loans, retail stores, and other businesses. Credit Checking: Before making a large financial transaction, it imperative to check whether the counterparty has enough available credit to carryout/honor the transaction. Credit checking refers to the process of verifying that counterparty has enough credit. The check is initiated after the price has been determined. credit line: An arrangement in which a bank or vendor extends a specified amount of unsecured credit to a specified borrower for a specified time period. also called credit line. Credit Risk: The risk that a debtor will not repay; more specifically the risk that the counterparty does not have the currency promised to be delivered. Cross Currency Pairs: A pair of currencies that does not include the U.S. dollar. For example: EUR/JPY or GBP/CHF. Cross Deal: A foreign exchange deal in which neither currency is the US Dollar. Cross Rate: An exchange rate between two currencies, usually constructed from the individual exchange rates of the two currencies, as most currencies are quoted against the dollar. Cross rates: Rates between two currencies, neither of which is the US Dollar. Cross-Rate: The exchange rate between 2 currencies where neither of the currencies are USD. Cross-Trade: A cross-trade transaction is a transaction where either the buy broker and the sell broker are the same, or the buy broker and the sell broker belong to the same firm. Crossover: The point on a stock chart when a security and an indicator intersect. Crossovers are used by technical analysts to aid in forecasting the future movements in the price of a stock. In most technical tahlil models, a crossover is a signal to either buy or sell. Cup with Handle: A pattern on a bar chart that is in the shape of the letter "U" over a period of between 7 and 65 weeks. Once the stock price reaches the second peak of the "U", some technical analysts believe that the price will fall as investors who bought at the previous peak start to sell their shares. Currency: Money issued by a government. Currency Basket: Various weightings of other currencies grouped together in relation to a basket currency(e.g. ECU or SDR). Sometimes used by currencies to fix their rate often on a trade weighted basket. A selected group of currencies whose weighted average is used as a measure of the value or the amount of an obligation. A currency basket is commonly used in contracts as a way of avoiding (or minimizing) the risk of currency fluctuations Currency Option: A contract that grants the holder the right, but not the obligation, to buy or sell currency at a specified price during a specified period of time. Currency Pair: The two currencies that make up a foreign exchange rate. IE: USD/YEN. Currency Risk: The possibility of an unfavorable change in exchange rates. Currency symbols: AUD - Australian Dollar CAD - Canadian Dollar EUR - Euro JPY - Japanese Yen GBP - British Pound CHF - Swiss Franc Current Account: The net balance of a country's international payment arising from exports and imports together with unilateral transfers such as aid and migrant remittances. It excludes capital flows. Current Balance: The value of all exports (goods plus services) less all imports of a country over a specific period of time, equal to the sum of trade and invisible balances plus net receipt of interest, profits and dividends from abroad. Cycle: The set of expiration dates applicable to different classes of option.برچسبها :

مقالات مرتبط

فرهنگ لغات تخصصی بازار ارز حرف J

Jawbone: Announcements and statements by politicians or monetary authorities to influence decisions by business, consumer, or trade union sectors, often associated with forecasts and policy implications. Job-to-applicant ratio: The job-to-applicant ratio shows how many positions are available to a job seeker Jobber: A trader who trades for small, short-term profits during the course of […]

فرهنگ لغات تخصصی بازار ارز حرف X

XAG: Silver Exchange Rate (ISO) XAU: Gold Exchange Rate (ISO)

فرهنگ لغات تخصصی بازار ارز حرف P

Package Deal: An order that contains a number of exchange or deposit items that must be completed simultaneously, or not at all. Package deals allow traders to ensure specific prices or times to maturity for multiple assets. A trader may want to participate in a package deal to properly execute an investment strategy. […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

MIDAS Super VWAP اندیکاتور MT5

معرفی و دانلود اندیکاتور MIDAS Super VWAP اندیکاتور MIDAS Super VWAP می تواند حرکت بازیکنان بزرگ را به روش های مختلف ردیابی کند و ارزیابی کند که آیا اجرای خوب یا اجرای ضعیف در دستورات دارند. معرفی اندیکاتور کاربردی MIDAS Super VWAP VWAP، MVWAP و MIDAS را در یک مکان تصور کنید… خوب، شما آن […]

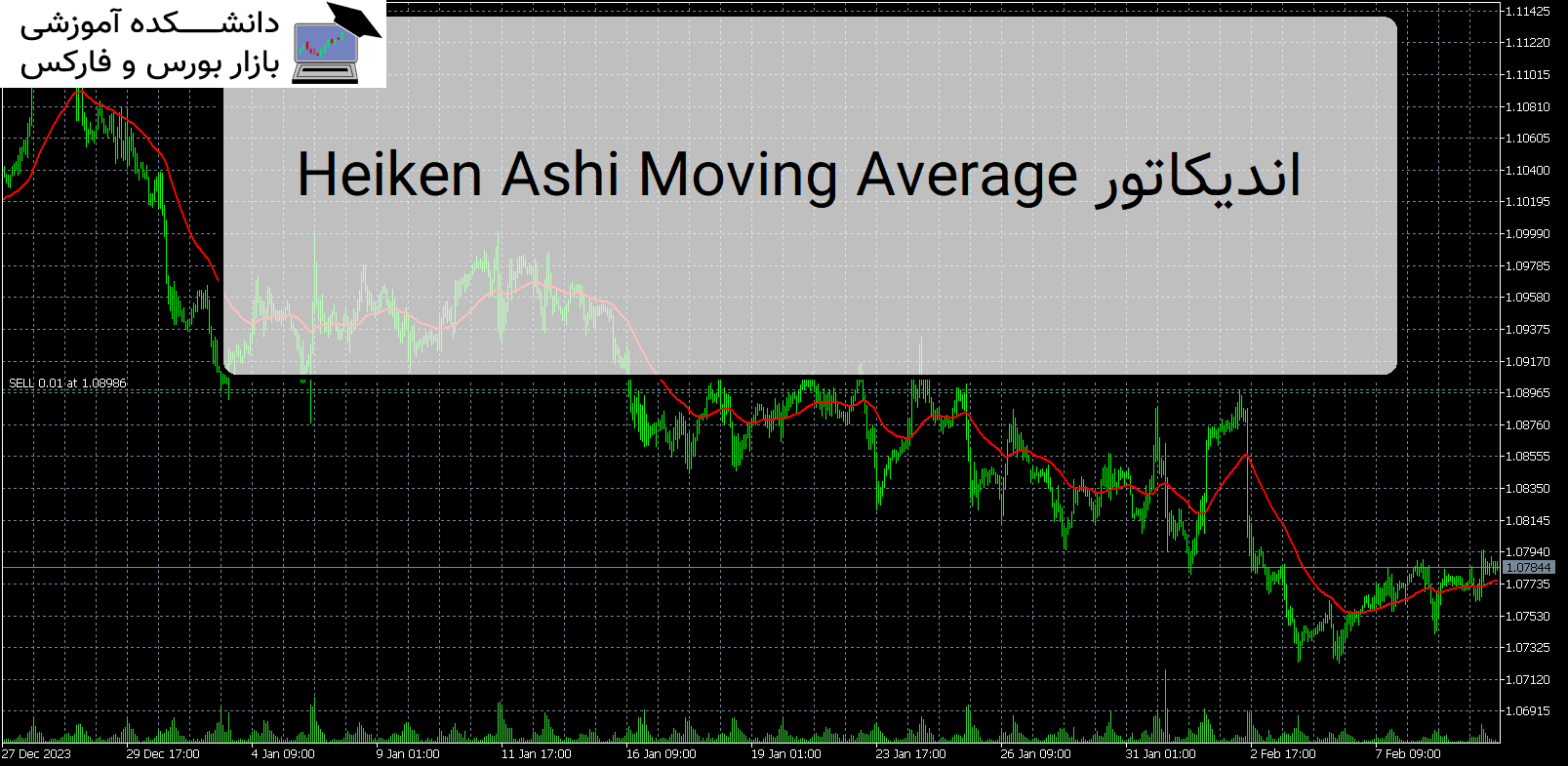

Heiken Ashi Moving Average اندیکاتور MT5

معرفی و دانلود اندیکاتور Heiken Ashi Moving Average اندیکاتور محبوب و کاربردی Heiken Ashi Moving Average با روش های مختلف محاسبه شده بر روی شمع های صاف Heiken Ashi موجود در پوشه نمونه ها . معرفی اندیکاتور Heiken Ashi Moving Average اندیکاتور کاربردی برای کار باز نویز کاهش یافته. شما یک نشانگر میانگین متحرک با […]