فرهنگ لغات تخصصی بازار ارز حرف F

Face value: the value printed on the face of a stock, bond, or other financial instrument or document. Factory Orders: An economic indicator which refers to the total orders of durable and nondurable goods. The nondurable goods orders consist of food , clothing , light industrial products and products designed for the maintenance of […]

Face value: the value printed on the face of a stock, bond, or other financial instrument or document.

Factory Orders: An economic indicator which refers to the total orders of durable and nondurable goods. The nondurable goods orders consist of food , clothing , light industrial products and products designed for the maintenance of the durable goods.

Fast Market: A financial market experiencing high trading volume and increased volatility.

FDIC=Federal Deposit Insurance Corporation: The Federal Deposit Insurance Corporation (FDIC) is a United States government corporation created by the Glass-Steagall Act of 1933. The vast number of bank failures in the Great Depression spurred the United States Congress into creating an institution which would guarantee deposits held by commercial banks, inspired by the Commonwealth of Massachusetts and its Depositors Insurance Fund (DIF). The FDIC provides deposit insurance which currently guarantees checking and savings deposits in member banks up to $100,000 per depositor.

Fed - Federal Reserve: The Central Bank of the United States.

Fed Fund Rate: The interest rate on Fed funds. This is a closely watched short term interest rate as it signals the Feds view as to the state of the money supply.

Fed Funds: Reserve balances that are maintained by commercial banks in the Federal Reserve System at amounts above what is required. These excess reserves are available for lending to other banks in need of reserves. Although the loans are usually made on a single-day basis, they may be renewed. The availability of and the rate paid for federal funds are important indicators of Federal Reserve policy; hence, both are watched closely by financial analysts in order to forecast changes in the credit markets. Also called fed funds.

FEDAI: Foreign Exchange Dealers Association of India) is an association of all dealers in foreign exchange which sets the ground rules for fixation of commissions and other charges and also determines the rules and regulation relating to day-to-day transactions in foreign exchange in India. The FEDAI has commonly recognised 38 currencies for dealing.

Federal Deposit Insurance Corporation - FDIC: The Federal Deposit Insurance Corporation (FDIC) is a United States government corporation created by the Glass-Steagall Act of 1933. The vast number of bank failures in the Great Depression spurred the United States Congress into creating an institution which would guarantee deposits held by commercial banks, inspired by the Commonwealth of Massachusetts and its Depositors Insurance Fund (DIF). The FDIC provides deposit insurance which currently guarantees checking and savings deposits in member banks up to $100,000 per depositor.

Federal National Mortgage Association-Fannie Mae: The Federal National Mortgage Association (FNMA) (NYSE: FNM), commonly known as Fannie Mae, is a government sponsored enterprise (GSE) sponsored by the United States government. As a GSE, it is a privately-owned corporation authorized to make loans and loan guarantees. It is not backed or funded by the U.S. government, nor do the securities it issues benefit from any explicit government guarantee or protection. This secondary mortgage market helps to replenish the supply of lendable money for mortgages and ensures that money continues to be available for new home purchases. The name "Fannie Mae" is a creative acronym-portmanteau of the company's full name that has been adopted officially for ease of identification.

Federal Open Market Committee: Abbreviation for Federal Open Market Committee. A 12-member committee which sets credit and interest rate policies for the Federal Reserve System. This committee consists of 7 members of the Board of Governors, and 5 of the 12 Federal Reserve Bank Presidents. This group, headed by the Chairman of the Federal Reserve Board, sets interest rates either directly (by changing the discount rate) or through the use of open market operations (by purchasing and selling government securities which affects the federal funds rate).

Federal Open Market Committee =FOMC: A 12-member committee which sets credit and interest rate policies for the Federal Reserve System. This committee consists of 7 members of the Board of Governors, and 5 of the 12 Federal Reserve Bank Presidents. This group, headed by the Chairman of the Federal Reserve Board, sets interest rates either directly (by changing the discount rate) or through the use of open market operations (by purchasing and selling government securities which affects the federal funds rate).

Federal Reserve - Fed: The Central Bank of the United States.

Federal Reserve Board: The board of the Federal Reserve System, appointed by the US President for 14 year terms, one of whom is appointed for four years as chairman.

Federal Reserve System: The central banking system of the US comprising 12 Federal Reserve Banks controlling 12 districts under the Federal Reserve Board. Membership of the Fed is compulsory for banks chartered by the Comptroller of Currency and optional for state chartered banks.

Fedwire: An automated communications and settlement system linking the Federal Reserve banks with other banks and with depository institutions.

Fill: The process of completing a customer's order to buy or sell a currency pair.

Execute an order or buy or sell a security or commodity.

Fill or Kill: An order given to a broker that must immediately be filled in its entirety or, if this is not possible, totally canceled.

Fill Price: The price at which a buy or sell order was executed.

Final Goods: In economics final goods are goods that are ultimately consumed rather than used in the production of another good. For example, a car sold to a consumer is a final good; the components such as tires sold to the car manufacturer are not; they are intermediate goods used to make the final good.

Finance: To raise money through the issuance and sale of debt and/or equity.

Financial Asset: A non-physical asset, such as a security, certificate, or bank balance

Financial Risk: The possibility that a bond issuer will default, by failing to repay principal and interest in a timely manner. Bonds issued by the federal government, for the most part, are immune from default (if the government needs money it can just print more). Bonds issued by corporations are more likely to be defaulted on, since companies often go bankrupt. Municipalities occasionally default as well, although it is much less common. also called default risk or credit risk.

Finantial Institution: Institution which collects funds from the public and places them in financial assets, such as deposits, loans, and bonds, rather than tangible property.

Finex: A futures and options exchange for the trading of financial contracts on currencies and U.S. Treasury securities. The FINEX, with trading floors in New York City and Dublin, Ireland, is a division of the New York Board of Trade.

Fiscal Policy: Decisions by the President and Congress, usually relating to taxation and government spending, with the goals of full employment, price stability, and economic growth. By changing tax laws, the government can effectively modify the amount of disposable income available to its taxpayers. For example, if taxes were to increase, consumers would have less disposable income and in turn would have less money to spend on goods and services.

This difference in disposable income would go to the government instead of going to consumers, who would pass the money onto companies. Or, the government could choose to increase government spending by directly purchasing goods and services from private companies. This would increase the flow of money through the economy and would eventually increase the disposable income available to consumers. Unfortunately, this process takes time, as the money needs to wind its way through the economy, creating a significant lag between the implementation of fiscal policy and its effect on the economy.

Fisher Effect: The direct relationship between inflation and interest rates. Increasing inflationary expectations result in increasing interest rates.

Fixed Interest Security: A fixed interest security is a debt security. When you buy or subscribe for a fixed interest security, you are in effect lending money to an entity, known as the ‘issuer’. In return for the loan you provide, the issuer will pay you a specified rate of interest (a coupon) during the lifetime of the fixed interest security, and will repay the face value of the fixed interest security (the principal) to you at a predefined time (maturity date).

Fixed Exchange Rate: Official rate set by monetary authorities for one or more currencies. In practice, even fixed exchange rates are allowed to fluctuate between definite upper and lower bands, leading to intervention by the central bank.

Flat/square: Dealer jargon used to describe a position that has been completely reversed, e.g. you bought $500,000 then sold $500,000, thereby creating a neutral (flat) position.

Floating Exchange Rate: When the value of a currency is decided by the market forces dictating the demand and supply of that particular currency.

Floor: The place on an exchange where trading occurs.

FOMC: Abbreviation for Federal Open Market Committee. A 12-member committee which sets credit and interest rate policies for the Federal Reserve System. This committee consists of 7 members of the Board of Governors, and 5 of the 12 Federal Reserve Bank Presidents. This group, headed by the Chairman of the Federal Reserve Board, sets interest rates either directly (by changing the discount rate) or through the use of open market operations (by purchasing and selling government securities which affects the federal funds rate).

FOMC Meeting Announcement: The Federal Open Market Committee consists of the seven Governors of the Federal Reserve Board and five Federal Reserve Bank presidents. The FOMC meets eight times a year in order to determine the near-term direction of monetary policy. Changes in monetary policy are now announced immediately after FOMC meetings.

foreclose: To deprive (a mortgagor) of the right to redeem mortgaged property, as when payments have not been made.

foreclosure: Legal process by which a lender cancels (forecloses) a borrower's right of redemption of the mortgaged property through a court order (called foreclosure order). The court sets a date up to which the borrower can redeem the property by paying off the entire loan balance (including foreclosing expenses).

Thereafter, the lender is free to sell the property and, upon the sale, applies the sale proceeds first to the due amount and pays the remainder (if any) to the borrower. The borrower remains liable for the due amount if the property remains unsold, and for the shortfall if the sale proceeds are insufficient to pay off the entire debt. The lender is generally under an obligation to sell the property at or near its fair market value (FMV).

Foreign Currency Effect: Refers to how changes in the exchange rate affect the return on foreign investment

Foreign direct investment - FDI: Foreign direct investment (FDI) is defined as "investment made to acquire lasting interest in enterprises operating outside of the economy of the investor

Foreign Exchange: (Forex, FX) - the simultaneous buying of one currency and selling of another.

Foreign Exchange Centers: London is the largest centre of foreign exchange trading. New York, Tokyo, Singapore, Zurich and Hong Kong are also important.

Foreign Exchange Market: Market where currencies are traded internationally. About a trillion (million million) dollars-worth of foreign exchange is traded globally every day, making forex larger than all bond markets put together. Currency markets exist in the form of spot, forward, futures and options markets. Foreign exchange transactions are made up of: Trade flows Only 5% to 10% of total forex transactions. Imports usually need to be paid for in the currency of the country from which they originate.

Exports are usually paid for in one's own currency. A trade deficit therefore causes a currency to depreciate. Flow-ons Created when a large trade is split up into several smaller trades. Capital flows Cross-border investment. Speculation Short-term investment based on expected currency movements. This accounts for the lion's share of forex market volume.

Foreign Position: It means a position under which one party hereto agrees to purchase from or sell to the other party hereto an agreed amount of foreign currency.

Forex: An abbreviation of foreign exchange

Forex Club: Groups formed in the major financial centers to encourage educational and social contacts between FX dealers, under the umbrella of Association Cambiste International.

Forex Deal: The purchase or sale of a currency against sale or purchase of another currency. The maximum time for a deal is defined when the deal opens, the deal can be closed at any moment until the expiry date and time. A deal cannot be closed on its first 3 minutes, due to technical reasons.

Forward: A contract obligating one party to buy and another other party to sell a financial instrument, equity, commodity or currency at a specific future date.

Forward Contract: A contract between two counterparties where one person agrees to buy from the other person, who of course agrees to sell, a certain quantity of a financial instrument or commodity at a pre determined price but for delivery at an agreed future date.

Forward Cover Taking: forward contracts to protect against movements in the exchange rate.

Forward Deal: A deal with a value date greater than the spot value date.

A transaction consisting of a purchase or sale (often of foreign currency) with settlement to occur at a specified future date. Such a transaction will state the specific amount of the asset to be delivered at the specific time, as well as the unit price at which it will be delivered.

Forward margins: Discounts or premiums between spot rate and the forward rate for a currency. Normally quoted in points.

Forward Operations: Forex transactions, on which the fulfillment of the mutual delivery obligations is made on a date later than the second business day after the transaction was concluded.

Forward Outright: A commitment to buy or sell a currency for delivery on a specified future date or period. The price is quoted as the Spot rate minus or plus the forward points for the chosen period.

Forward Points: The points that are added to or subtracted from the spot rate to calculate the forward rates for a forward foreign exchange transaction. These points are based on the differential between the interest rates of the two currency pairs.

Forward Price: The net price resulting from calculating the forward points and subtracting them from the existing spot rate. This is the rate at which a currency can be purchased or sold for delivery in the future.

Forward Rate: The rate at which a foreign exchange contract is struck today for settlement at a specified future date which is decided at the time of entering into the contract. The decision to subtract or add points is determined by the differential between the deposit rates for both currencies concerned in the transaction.

The base currency with the higher interest rate is said to be at a discount to the lower interest rate quoted currency in the forward market. Therefor the forward points are subtracted from the spot rate. Similarly, the lower interest rate base currency is said to be at a premium, and the forward points are added to the spot rate to obtain the forward rate.

Forward Rates: The net price resulting from calculating the forward points and subtracting them from the existing spot rate. This is the rate at which a currency can be purchased or sold for delivery in the future.

Free Reserves: Funds available to banks for lending or investment, widely regarded as an indicator of available Bank Credit. Excess reserves are the amount remaining after required reserves are subtracted from reserve balances deposited with a Federal Reserve Bank. The total of free reserves is computed by subtracting from a bank's Excess Reserves (or reserve account balances above its reserve requirements) any borrowings from the Federal Reserve.

Front Office: 1.In Business, front office refers to Sales and Marketing divisions of a company. It may also refer to other divisions in a company that involves interactions with customers.

2.The activities carried out by the dealer , normal trading activities.

Fundamental tahlil: tahlil of economic and political information with the objective of determining future movements in a financial market.

Fundamentals: The macro economic factors that are accepted as forming the foundation for the relative value of a currency, these include inflation, growth, trade balance, government deficit, and interest rates.

Futures: A way of trading financial instruments, currencies or commodities for a specific price on a specific date in the future. Unlike options, futures give the obligation (not the option) to buy or sell instruments at a later date. They can be used to both protect and to speculate against the future value of the underlying product.

A contract to buy or sell a specified amount of a commodity or financial instrument at an agreed price at a set date in the future. If the price for the commodity or financial instrument rises between the contract date and the future date, the investor will make money; if it declines, the investor will lose money. The term also refers to the market for such contracts.

The primary difference between a Future and a Forward is that Futures are typically traded over an exchange (Exchange- Traded Contacts - ETC), versus forwards, which are considered Over The Counter (OTC) contracts. An OTC is any contract NOT traded on an exchange.

Futures Exchange-Traded Contracts: They are firm agreements to deliver (or take delivery of) a standardized amount of something on a certain date at a predetermined price. Futures exist in currencies, money market deposits, bonds, shares and commodities. They are traded on an exchange with the clearing corporation gauranteeing the contract and moreover the trade is done on a mark to market basis.

FX: Foreign Exchange.

FY: Fiscal Year

برچسبها :

مقالات مرتبط

فرهنگ لغات تخصصی بازار ارز حرف Y

Yard: A slang word used in the currency industry meaning ‘billion’. Year To Date – YTD: The period beginning January 1st of the current year up until today’s date. Yield: Annual income earned from an investment, expressed usually as a percentage of the money invested. Yield Curve: In finance, the yield curve is the […]

فرهنگ لغات تخصصی بازار ارز حرف E

Easing: Modest decline in price. ECB–European Central Bank: The Central Bank for the new European Monetary Union. Echo Watchers Survey: The Economy Watchers Survey asks business-cycle sensitive workers their thoughts on existing and future economic conditions, giving a detailed picture of economic trends in Japan . The survey is based on questionnaires from […]

فرهنگ لغات تخصصی بازار ارز حرف M

M0: Cash in circulation . Only used by the UK. M1: Cash in circulation plus demand deposits at commercial banks. There are variations between the precise definitions used by national financial authorities. machin tool: A machine tool is a powered mechanical device, typically used to fabricate metal components of machines by machining, which […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

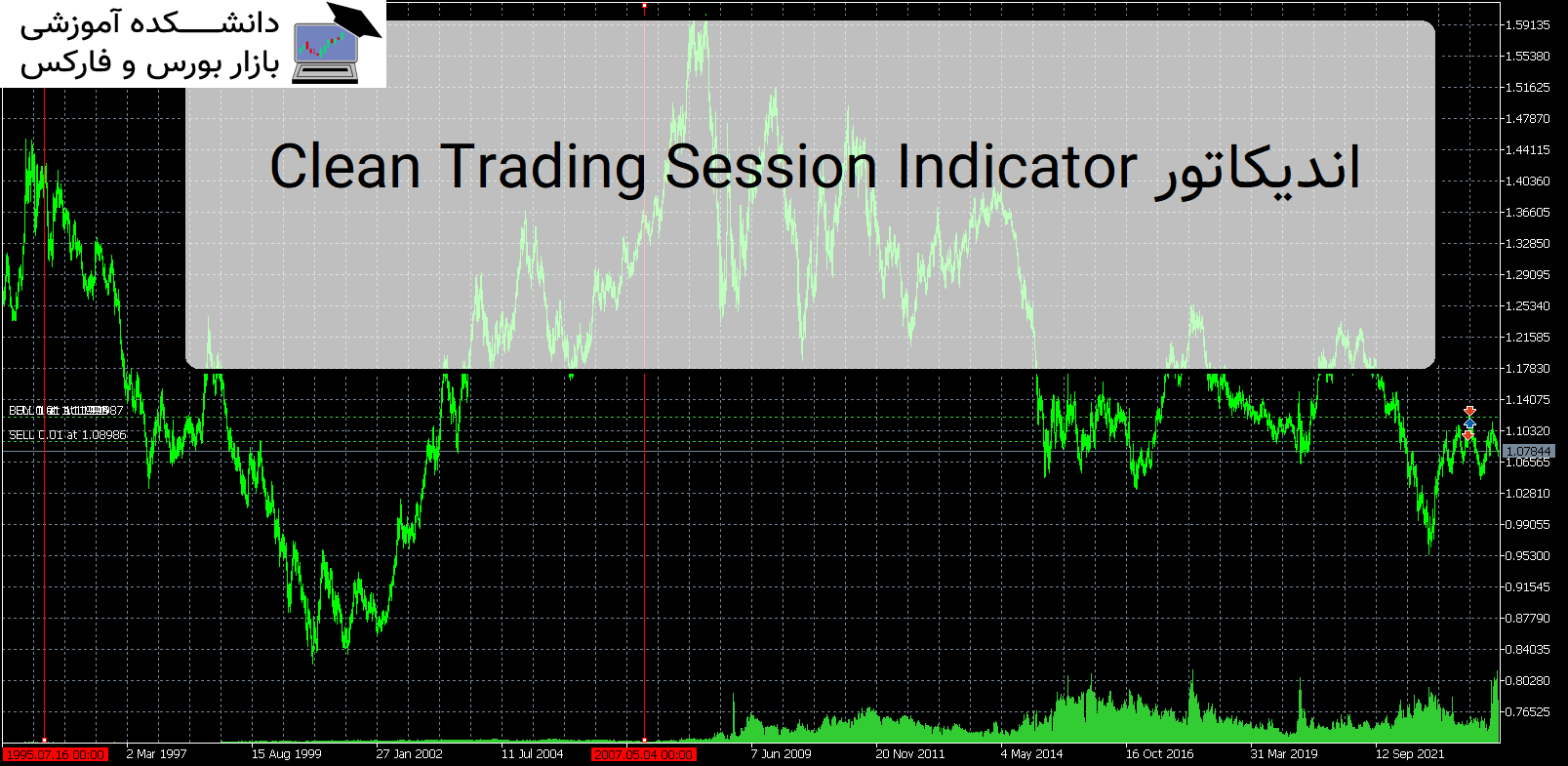

Clean Trading Session Indicator اندیکاتور MT5

معرفیو و دانلود اندیکاتور کاربردی Clean Trading Session Indicator اندیکاتور کاربردی Clean Trading Session Indicator مهم ترین جلسات معاملاتی را برای بازار فارکس مانند لندن، نیویورک، توکیو نشان می دهد. معرفی اندیکاتور کاربردی Clean Trading Session Indicator اندیکاتور Clean Trading Sessions یک شاخص ساده و در عین حال کاملاً کاربردی جلسات فارکس است که برای […]

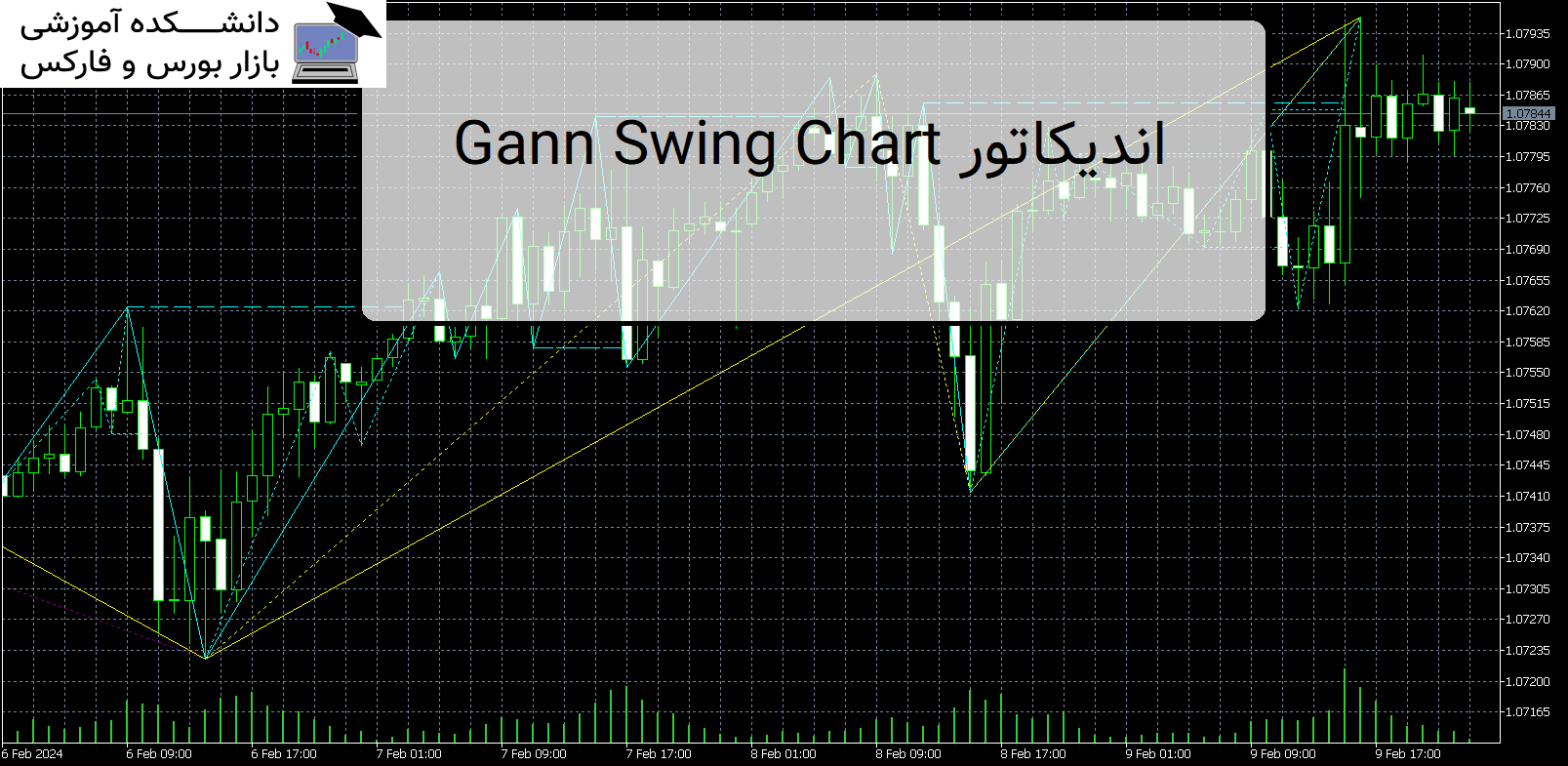

Gann Swing Chart اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی Gann Swing Chart اندیکاتور کاربردی Gann Swing Chart این اندیکاتور محبوب و کاربردی نمودار Swing گان (یک نوار) را با امواج چند لایه به معامله گران نشان می دهد. معرفی اندیکاتور کاربردی Gann Swing Chart 1. لایه موج F1: امواج گان بر اساس شمع ها ترسیم می شوند. موج SGann […]