فرهنگ لغات تخصصی بازار ارز حرف G

G10: Eleven industrialized nations that meet on an annual basis to consult each other, debate and cooperate on international financial matters. The member countries are: France, Germany, Belgium, Italy, Japan, the Netherlands, Sweden, the United Kingdom, the United States and Canada, with Switzerland playing a minor role. G5: The Group of Five. The […]

G10: Eleven industrialized nations that meet on an annual basis to consult each other, debate and cooperate on international financial matters. The member countries are: France, Germany, Belgium, Italy, Japan, the Netherlands, Sweden, the United Kingdom, the United States and Canada, with Switzerland playing a minor role.

G5: The Group of Five. The five leading industrial countries, being US, Germany, Japan, France, UK.

G7: The seven leading industrial countries, being US , Germany, Japan, France, UK, Canada, Italy.

Gamma: The rate at which a delta changes over time or for one unit change in the price of the underlying asset.

Gap: A mismatch between maturities and cash flows in a bank or individual dealers position book. Gap exposure is effectively interest rate exposure.

GCC=Gulf Cooperation Council: GCC is an association of Persian Gulf nations formed for the purpose of collective defense against aggression.

The Gulf Cooperation Council, or GCC, is made up of Saudi Arabia, United Arab Emirates, Kuwait, Qatar, Oman and Bahrain.

GDP=Gross Domestic Product: Measures the value of goods and services produced with in a country . GDP is the most comprehensive overall measure of economic output and provides key insight as to the driving forces of the economy.

German ZEW Indicator of Economic Sentiment: Experts are asked for a qualitative assessment of the direction of inflation, interest rates, exchange rates and the stock market in the next six months. Thus the indicator provides a medium-term forecast for the German economy.

Gilt-edged Securities: Stocks and shares issued and guaranteed by the British government to raise funds and traded on the Stock Exchange. A relatively risk-free investment, gilts bear fixed interest and are usually redeemable on a specified date. The term is now used generally to describe securities of the highest value. According to the redemption date, gilts are described as short (up to five years), medium, or long (15 years or more).

Gilts: Risk-free bonds issued by the British government. They are the equivalent of U.S. Treasury securities.

Globex: A system for global after hours electronic trading in futures and options developed by Reuters for CME and CBOT for use in conjunction with various exchanges around the world.

GNP Deflator: Removes inflation from the GNP figure. Usually expressed as a percentage and based on an index figure.

GNP Gap: The difference between the actual real GNP and the potential real GNP. If the gap is negative an economy is overheated.

Going Long: The purchase of a stock, commodity, or currency for investment or speculation.

Going Short: The selling of a currency or instrument not owned by the seller.

Gold Standard: The original system for supporting the value of currency issued. This system was in vogue before 1973 when the fixed exchange rates were prevalent.

Gold Tranche: Part of the country quota for IMF members that had to be paid in gold. This was normally 25% of the quota, the remainder being in domestic currency. The Gold Tranche was automatically available to members without condition. Amount of gold that each member country of the International Monetary fund (IMF) contributes as part of its membership obligations to the fund, and can readily borrow when facing economic difficulties.

Golden Cross: An intersection of two consecutive moving averages which move in the same direction and suggest that the currency will move in the same direction.

Good Till Cancelled Order - GTC: A buy or sell order which remains open until it is filled or canceled.

Government Expenditures - Euro-zone: The value of spending by Euro-zone governments. Euro-zone Government Expenditures is a major component of Euro-zone GDP. However, its release has relatively little market impact since the fiscal policy of Euro-zone governments is usually well-anticipated in advance. Nevertheless, any unexpected change in government expenditures due to unforeseen events can affect to markets

Government Spending: Represents public expenditure by the German government. The government budget on spending is determined by fiscal policy. Thus, it is very predictable and rarely, if ever, moves the market upon release.

grantor: The seller of an option contract

Greenery Day: Greenery Day (April 29): day for commemorating the Emperor Showa's love for nature and many trees he planted on tours throughout the country. (Up to 1988, this day was celebrated as the birthday of the Emperor Showa.)

Gross Domestic Product: Measures the value of goods and services produced with in a country . GDP is the most comprehensive overall measure of economic output and provides key insight as to the driving forces of the economy.

Gross Fixed Capital Formation (GFCF) - Euro-zone: A measure of European investment in capital goods. Fixed capital investments typically increase productivity and GDP growth. When businesses are investing in the big fixed capital items, such as machinery, vehicles, and buildings, it typically reflects optimism for future growth; otherwise, those businesses would other uses for that money.

Higher capital investments also tend to increase productivity and contribute to GDP growth. This makes GFCF a measure of business sentiment as well as a leading indicator for economic growth.

The headline figure of GFCF is expressed in annualized percentage change for the quarter. Note: GFCF makes up about 20% of the Euro-zone GDP, with Machinery, equipment, vehicles, land-improvements, and buildings being the biggest contributors. Software and artwork are sometimes considered as the intangible fixed assets.

Gross National Product: Gross domestic product plus income earned from investment or work abroad.

GTC - Good 'Til Cancelled Order: An order to buy or sell at a specified price. This order remains open until filled or until the client cancels.

برچسبها :

مقالات مرتبط

فرهنگ لغات تخصصی بازار ارز حرف Z

Z-Certificate: Certificate issued by the Bank of England to “discount houses” in lieu of stock certificates to facilitate their dealing in the short dated gilt edge securities. Zero Coupon Bond: A bond that pays no interest. The bond is initially offered at a discount to its redemption value. ZEW: Zentrum für Europäische Wirtschaftsforschung (German: […]

فرهنگ لغات تخصصی بازار ارز حرف X

XAG: Silver Exchange Rate (ISO) XAU: Gold Exchange Rate (ISO)

فرهنگ لغات تخصصی بازار ارز حرف B

Back: Term referring to the amount that the spot price exceeds the forward price Back Office: The office location, or department, where the processing of financial transactions takes place. Back Testing: The process of designing a trading strategy based on historical data. It is then applied to fresh data to see if and how well […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

Tillson TMA T3 اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی Tillson TMA T3 اندیکاتور کاربردی Tillson TMA T3 این یک میانگین متحرک است که از EMA و DEMA در فرمول خود استفاده می کند و با بسط Binomial درجه 3 محاسبه می شود. معرفی اندیکاتور کاربردی Tillson TMA T3 1- سیگنال های اشتباهی که در سایر میانگین های متحرک (زیگ […]

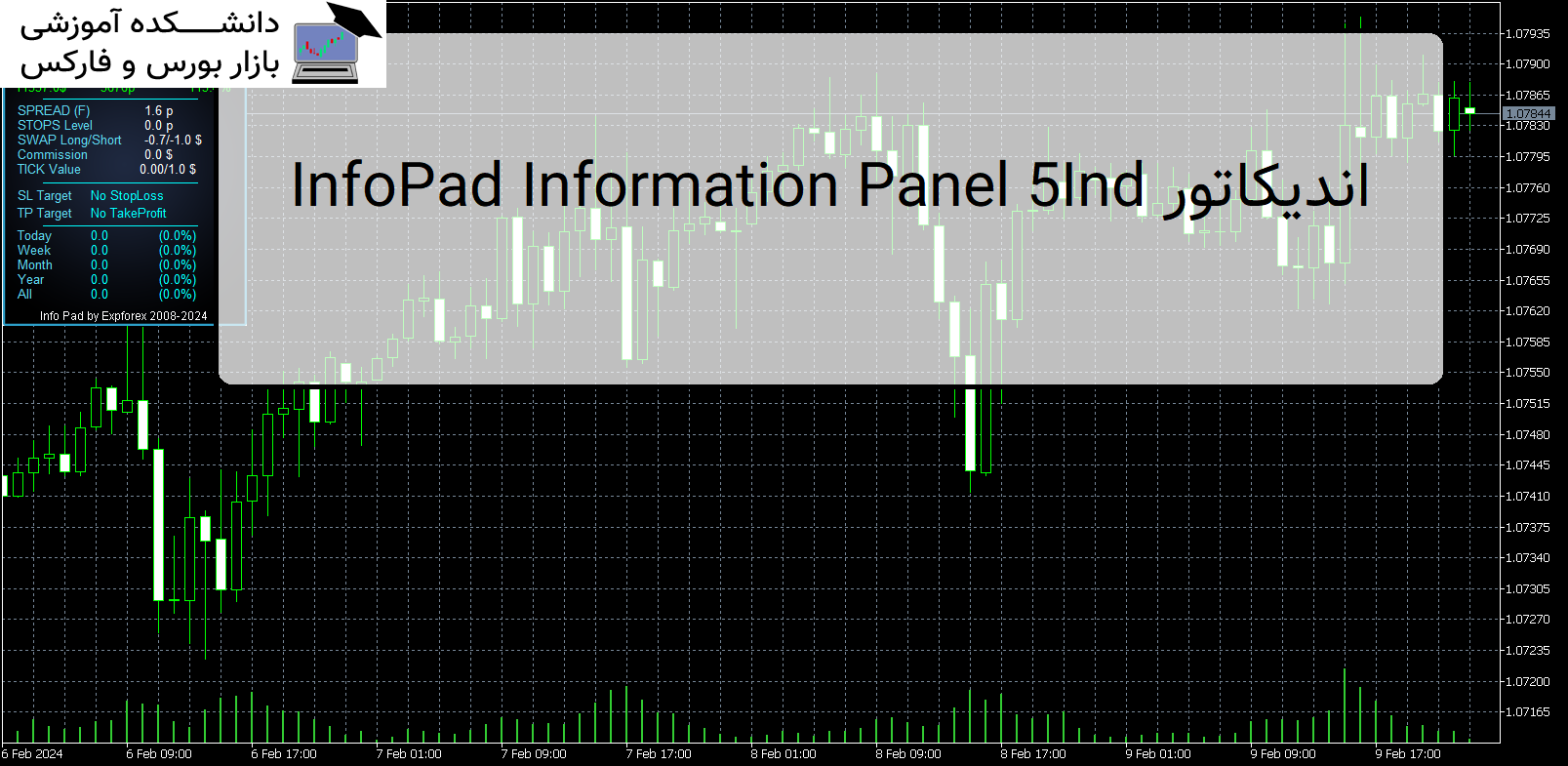

Ind5 InfoPad Information Panel اندیکاتور

معرفی و دانلود اندیکاتور Ind5 InfoPad Information Panel اندیکاتور Ind5 InfoPad Information Panel یک پنل اطلاعاتی است که اطلاعات مربوط به جفت ارز انتخاب شده را در ترمینال MetaTrader 5 ایجاد می کند. معرفی اندیکاتور Ind5 InfoPad Information Panel این نشانگر 5 عملکرد دارد: اطلاعات اصلی و اصلی را در نماد انتخاب شده نشان می […]