فرهنگ لغات تخصصی بازار ارز حرف L

Labor Cash Earnings – Japan: The average amount of pre-tax earnings per regular employee, including overtime pay and bonuses. Though the report does not take into account all sources of household income (accumulated wealth and capital gains from financial assets are omitted), Labor Cash Earnings accurately reflects the spending ability of domestic consumers, one […]

Labor Cash Earnings - Japan: The average amount of pre-tax earnings per regular employee, including overtime pay and bonuses. Though the report does not take into account all sources of household income (accumulated wealth and capital gains from financial assets are omitted), Labor Cash Earnings accurately reflects the spending ability of domestic consumers, one of the driving forces behind economic growth. Because growth in wages fuels higher consumption, rising Labor Cash Earnings generally lead to higher inflation.

Labour Productivity - Canada: average productivity level of Canadian workers. Labour Productivity is calculated by dividing the gross domestic product (GDP) by the number of hours worked, yielding output per hour, which is the key measure of productivity growth. The availability of better technology and higher levels of education among the workforce are factors commonly attributed to increased productivity.

Growth in labour productivity is usually seen as a sign of a healthy economy because higher productivity allows higher output for a fixed population. Rising Labour Productivity can also offset inflationary pressures associated with economic growth and spending. Economic expansion attributed to increased Labour Productivity will not result in inflation, meaning that central banks will not need to increase interest rates during times of high growth.

Large Company: In the manufacturing sector, all companies with total employment of 50 or more were included in the large company partition. In the nonmanufacturing sector, all companies with total employment of 15 or more were included in the large company partition.

Large Retailers' Sales: The total value of goods sold in large department stores, chain convenience stores, and supermarkets in a particular month. The report serves as a direct gauge of consumption and consumer confidence. Consumer spending is one of the most important leading indicators for the Japanese economy. An increasing number of sales can signal consumer confidence and economic growth, but higher consumption can also leads to inflationary pressures.

Last Trading Day: The day on which trading ceases for an expiring contract.

Layoff: The elimination of jobs, often without regard to employee performance, usually when a company is experiencing financial difficulties.

lb: Abbreviation for pound:(in English-speaking countries) an avoirdupois unit of weight equal to 7000 grains, divided into 16 ounces (0.453 kg), used for ordinary commerce. Abbreviation: lb., lb. av.

LDC: Less developed countries, often used with respect to secondary debt market.

Lead: Payment of a financial obligation earlier than is expected or required.

Leading Indicator Index: Leading indicator index brings together a number of economic indicators that tend to precede the rest of the economy.

Leading Indicators: Statistics that are considered to predict future economic activity.

Leads and Lags: The effect on foreign trade payments of an anticipated move in the exchange rate, normally a devaluation. The importers speeden up the payment for the imports and exporters delay recieving payment for the exports.

Left-hand Side: Taking the left hand side of a two way quote i.e. selling the quoted currency

Letter of Credit: A letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. In the event that the buyer is unable to make payment on the purchase the bank will be required to cover the full or remaining amount of the purchase.

Often used in international transactions to ensure that payment will be received. Due to the nature of internation dealings such as distance, differing laws in each country, and difficulty in knowing each party personally the use of letters of credit has become a very important aspect of international trade. The bank also acts on behalf of the buyer (holder of letter of credit) where the supplier will not be paid until the supplier confirms to the bank that the goods have been shipped.

Leverage: The degree to which an investor or business is utilizing borrowed money. Companies that are highly leveraged may be at risk of bankruptcy if they are unable to make payments on their debt; they may also be unable to find new lenders in the future. Leverage is not always bad, however; it can increase the shareholders' return on their investment and often there are tax advantages associated with borrowing. also called financial leverage

For example, suppose a trader puts down $1,000 as a margin in order to control $100,000. In this case, the trader's leverage would be 100:1 because the trader controls one-hundred times what he put down. Likewise, his level of margin would be 1% because only 1% was required to open the larger position

Liability: A company's legal debts or obligations that arise during the course of business operations. These are settled over time through the transfer of economic benefits including money, goods or services.

Recorded on the balance sheet (right side), liabilities include loans, accounts payable, mortgages, deferred revenues and accrued expenses. Liabilities are a vital aspect of a company's operations because they are used to finance operations and pay for large expansions. They can also make transactions between businesses more efficient. For example, the outstanding money that a company owes to its suppliers would be considered a liability.

Outside of accounting and finance this term simply refers to any money or service that is currently owed to another party. One form of liability, for example, would be the property taxes that a homeowner owes to the municipal government.

Current liabilities are debts payable within one year, while long-term liabilities are debts payable over a longer period.

LIBOR: London Interbank Offered Rate a.An interest rate at which banks can borrow funds, in marketable size, from other banks in the London interbank market. The LIBOR is fixed on a daily basis by the British Bankers' Association. The LIBOR is derived from a filtered average of the world's most creditworthy banks' interbank deposit rates for larger

loans with maturities between overnight and one full year. b.The LIBOR is the world's most widely used benchmark for short-term interest rates. It's important because it is the rate at which the world's most preferred borrowers are able to borrow money. It is also the rate upon which rates for less preferred borrowers are based. For example, a multinational corporation with a very good credit rating may be able to borrow money for one year at LIBOR plus 4 or 5 points.

The LIBOR is the world's most widely used benchmark for short-term interest rates. It's important because it is the rate at which the world's most preferred borrowers are able to borrow money. It is also the rate upon which rates for less preferred borrowers are based. For example, a multinational corporation with a very good credit rating may be able to borrow money for one year at LIBOR plus 4 or 5 points. Countries that rely on the LIBOR for a reference rate include the United States, Canada, Switzerland and, of course, England.

LIBOR - London Inter Bank Offer Rate: British Bankers' Association average of interbank offered rates for dollar deposits in the London market based on quotations at 16 major banks. Effective rate for contracts entered into two days from date appearing.

Life of Contract: The period between the beginning of trading in a particular future and the expiration of trading.

LIFFE: London International Financial Futures Exchange.

Limit: A maximum or minimum amount

Limit Down: Maximum price drop allowed on a futures contract in a single trading day.

Limit Move: The largest price change allowed for a given futures contract in a single day, as determined by the exchange. also called maximum price fluctuation.

Limit Order: To avoid buying or selling a stock at a price higher or lower than you wanted, you need to place a limit order rather than a market order. A limit order is an order to buy or sell a security at a specific price.

A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher. When you place a market order, you can't control the price at which your order will be filled.

For example, if you want to buy the stock of a "hot" IPO that was initially offered at $9, but don't want to end up paying more than $20 for the stock, you can place a limit order to buy the stock at any price up to $20. By entering a limit order rather than a market order, you will not be caught buying the stock at $90 and then suffering immediate losses if the stock drops later in the day or the weeks ahead.

Remember that your limit order may never be executed because the market price may quickly surpass your limit before your order can be filled. But by using a limit order you also protect yourself from buying the stock at too high a price. Some firms may charge you more for executing a limit order than a market order.

Limit Up: Maximum price increase allowed on a futures contract in a single trading day.

Limited Convertibility: When residents of a country are prohibited from buying other currencies even though non-residents may be completely free to buy or sell the national currency and the foreign institutional investors also have the liberty to buy and sell shares on the stock exchange of that country.

line of credit: An arrangement in which a bank or vendor extends a specified amount of unsecured credit to a specified borrower for a specified time period. also called credit line.

Liquid and Illiquid Markets: The ability of a market to buy and sell at ease with no impact on price stability. A market is described as liquid if the spread between the bid and the offer is small. Another measure of liquidity is the presence of buyers and sellers, with more players creating tighter spreads. Illiquid markets have fewer participants; thus, the spreads are wider and the risk to the short-term trader are greater.

Liquidity: 1 Liquid Market - the degree to which market participants are willing to buy and sell at every price level.

Liquid markets are characterized a high level of trading actively preformed by a diverse group of traders (hedgers, corporations, governments, speculators).

Liquid markets are usually described as safer, since investors are more certain that they are able to get into or out of a trade in any market condition.

2 Liquid Asset - the degree to which an asset is able to be converted into quickly into cash. The classic examples of liquid assets are Money Market Accounts and Certificate of Deposits or in equities, Blue Chip stocks.

Liquidity Risk: The risk stemming from the lack of marketability of an investment that cannot be bought or sold quickly enough to prevent or minimize a loss.

Local: A futures trader who normally trades on an exchange on his/her own account.

Locked Market: A market is locked when the bid price equals the asked price.

London Inter Bank Offer Rate (LIBOR): British Bankers' Association average of interbank offered rates for dollar deposits in the London market based on quotations at 16 major banks. Effective rate for contracts entered into two days from date appearing.

Long: In foreign exchange, when a currency pair is bought, it is understood that the primary currency in the pair is 'long', and the secondary currency is 'short'.

Long - Position: A position that was obtained by buying in anticipation of an increase in price.

Long Hedge: The purchase of futures contracts for price protection purposes, as a defensive position against an increase in cash prices, or falling interest rates. The purchase of a futures contract or call option to protect a short position against possible increases in the prices of commodities, currencies, indexes, or securities. For example, an investor might purchase a futures contract on fixed-income securities to protect against a decline in interest rates. Also called buying hedge.

Long/Short: A trader is in a LONG POSITION when she buys a currency pair. Shorting is the opposite of going long. The trader is in a SHORT POSITION when she sells a currency pair.

For example, when a trader buys EUR/USD, she is "longing" the Euro while at the same time "shorting the US dollar. If she were to decide to sell EUR/USD, she is "shorting" Euros and "Longing" the US dollar.

Lot: A unit to measure the amount of the deal. The value of the deal always corresponds to an integer number of lots.

LSE: London Stock Exchange

برچسبها :

مقالات مرتبط

فرهنگ لغات تخصصی بازار ارز حرف D

Daily Trading Limit: The highest and lowest prices that a commodity or option is permitted to reach in a given trading session. Once reached, no trading occurs on that commodity or option until the following session. also called fluctuation limit or price limit. Day Order: A buy or sell order that will expire automatically […]

فرهنگ لغات تخصصی بازار ارز حرف I

IBD/TIPP Economic Optimism Index:The IBD/TIPP Economic Optimism Index is the earliest and most authoritative take on consumer confidence each month and predicts with 90% reliability monthly changes in sentiment in well-known polls by The Conference Board and the University of Michigan. The IBD/TIPP Economic Optimism Index is based on a survey of 1,000-plus adults […]

فرهنگ لغات تخصصی بازار ارز حرف K

Key currency: One of the national currencies (dollar, euro, yen, etc.) or IMF’s special drawing rights (SDR) used by a country to hold its foreign currency reserves and gold for settling international trade transactions and other obligations. Also called reserve currency. Kiwi: Slang for the New Zealand dollar.

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

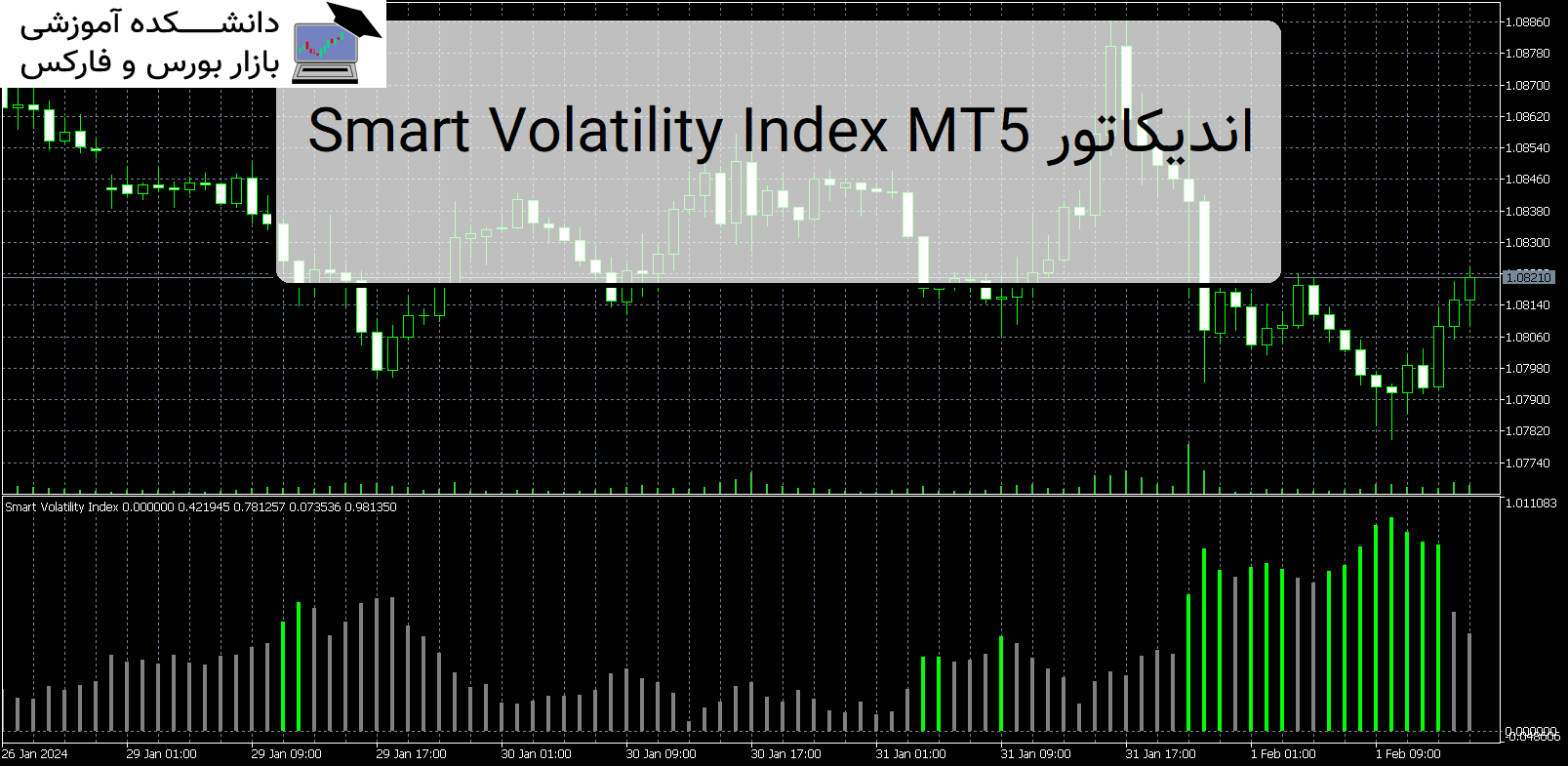

Smart Volatility Index MT5 اندیکاتور

معرفی و دانلود اندیکاتور کاربردی Smart Volatility Index MT5 Smart Volatility Index MT5 از محبوب ترین و با رتبه بندی بالای شاخص نوسانات (VIX) در بازار است. این خوانش همان چیزی است که VIX برای شاخص های سهام انجام می دهد. معرفی اندیکاتور کاربردی Smart Volatility Index MT5 با این حال، این شاخص در تمام […]

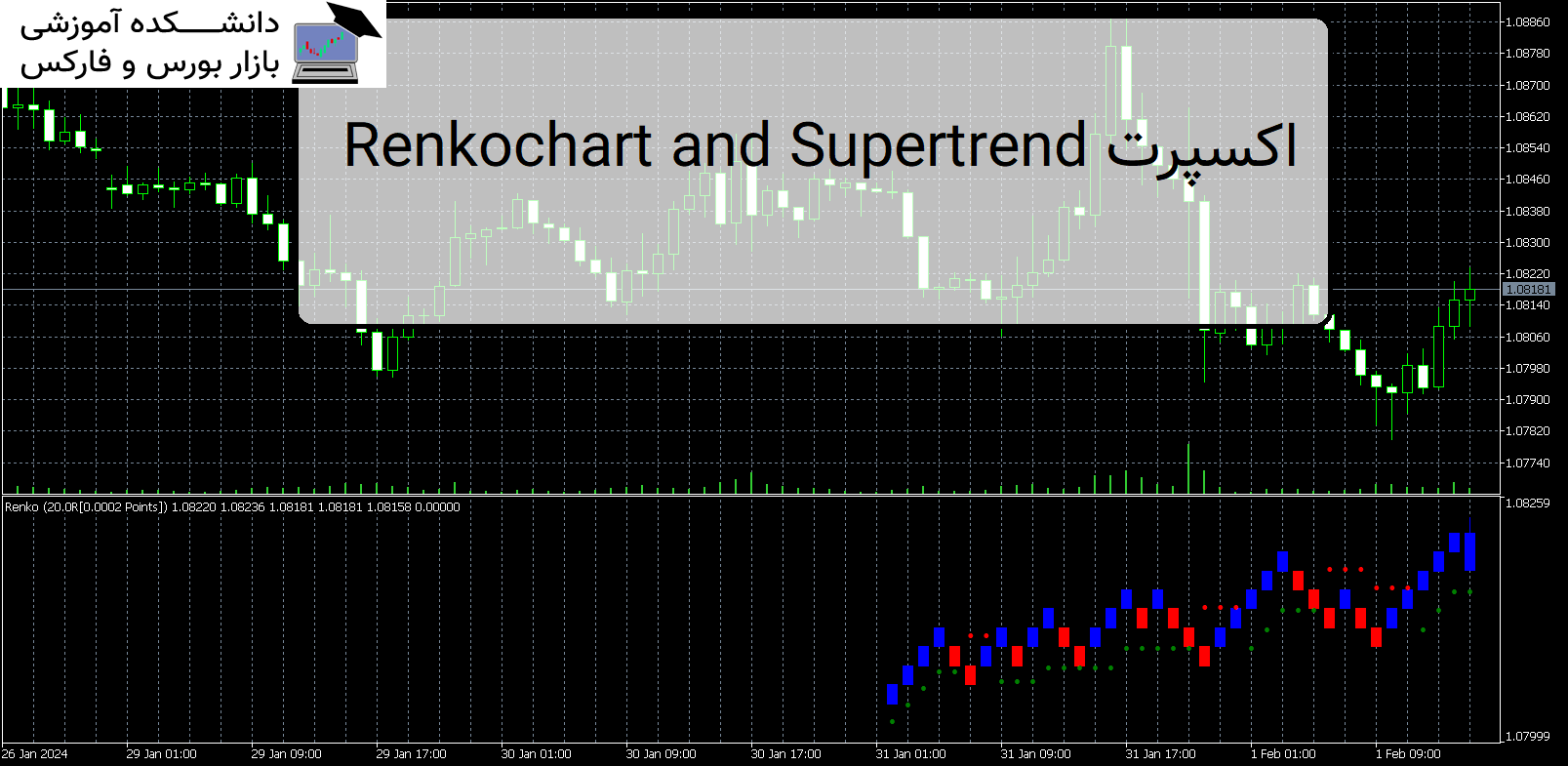

Renkochart and Supertrend اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی Renkochart and Supertrend Renkochart and Supertrend شاخص فوق روند را در زمان واقعی نمایش می دهد. پس از نصب اندیکاتور، پنجره نمودار Renko و نشانگر supertrend را در همان پنجره نمایش می دهد. معرفی اندیکاتور کاربردی Renkochart and Supertrend این به شما این امکان را میدهد که نقاط ورودی و […]