فرهنگ لغات تخصصی بازار ارز حرف M

M0: Cash in circulation . Only used by the UK. M1: Cash in circulation plus demand deposits at commercial banks. There are variations between the precise definitions used by national financial authorities. machin tool: A machine tool is a powered mechanical device, typically used to fabricate metal components of machines by machining, which […]

M0: Cash in circulation . Only used by the UK.

M1: Cash in circulation plus demand deposits at commercial banks. There are variations between the precise definitions used by national financial authorities.

machin tool: A machine tool is a powered mechanical device, typically used to fabricate metal components of machines by machining, which is the selective removal of metal. The term machine tool is usually reserved for tools that used a power source other than human movement, but they can be powered by people if appropriately set up.

Many historians of technology consider that the true machine tools were born when direct human involvement was removed from the shaping or stamping process of the different kinds of tools.

For instance, they consider that lathe machine tools were invented around 1751 by Jacques de Vaucanson because he was the first to mount the cutting instrument on a mechanically adjustable head, taking it out of the hands of the operator

Maintenance: A set minimum margin that a customer must maintain in his margin account

Majors:

These are the most popular currency pairs available for trading and include EUR/USD, GBP/USD, USD/JPY, USD/CHF, USD/CAD and AUD/USD. Less traded pairs are known as 'Exotics'.

Make a Market: A dealer is said to make a market when he quotes both the bid and offer prices at which he stands ready to buy and sell.

Managed Float: When the monetary authorities intervene regularly in the market to stabilise the rates or to push the exchange rate in a required direction. It is also called the dirty float which we have in India.

Manufacturing I/S Ratio - Canada: The ratio of inventory to shipments at Canadian manufacturing firms. By examining inventories and shipments, the figure is able to gauge to what degree manufacturing firms are satisfying market demand.

Inventories include goods not yet sold by firms. Growing inventories are a sign of declining demand as unsold goods pile up in warehouses. Shipments data, on the other hand, is indicative of market demand.

Accordingly, a Manufacturing I/S Ratio greater than 1 suggests an inventory build-up and decreasing demand for manufactured goods, while a ratio less than 1 suggests an inventory reduction and increasing demand for manufactured goods.

The I/S Ratio can also be interpreted as an estimate of the time (in months) that it would take to exhaust inventories, holding shipments constant.

Manufacturing Shipments: The ratio of inventory to shipments at Canadian manufacturing firms. By examining inventories and shipments, the figure is able to gauge to what degree manufacturing firms are satisfying market demand. Inventories include goods not yet sold by firms.

Growing inventories are a sign of declining demand as unsold goods pile up in warehouses. Shipments data, on the other hand, is indicative of market demand.

Accordingly, a Manufacturing I/S Ratio greater than 1 suggests an inventory build-up and decreasing demand for manufactured goods, while a ratio less than 1 suggests an inventory reduction and increasing demand for manufactured goods.

The I/S Ratio can also be interpreted as an estimate of the time (in months) that it would take to exhaust inventories, holding shipments constant.

The data used to calculate the I/S ratio can be found in the monthly survey of manufacturing released by Statistics Canada each month. The I/S ratio is also a component of the Canadian Leading Indicator Index.

Margin: Margin is a good faith deposit that a trader puts up as collateral to hold a position. The amount of margin that the trader puts up determines his leverage. For example, suppose a trader puts down $1,000 as a margin in order to control $100,000.

In this case, the trader's leverage would be 100:1 because the trader controls one-hundred times what he put down. Likewise, his level of margin would be 1% because only 1% was required to open the larger position.

Margin Call: A call for additional funds in a margin account either because the value of equity in the account has fallen below a required minimum (also termed a maintenance call) or because additional currencies have been purchased (or sold short).

Marginal Risk: The risk that a customer goes bankrupt after entering into a forward contract. In such an event the issuer must close the commitment running the risk of having to pay the marginal movement on the contract.

Mark-to-Market: Recording the price or value of a security, portfolio, or account on a daily basis, to calculate profits and losses or to confirm that margin requirements are being met.

Market Close: This refers to the time of day that a market closes. In the 24 hour-a-day foreign exchange market, there is no official market close. 5:00 PM EST is often referred to and understood as the market close because value dates for spot transactions change to the next new value date at that time.

Market Maker: A dealer who regularly quotes both bid and ask prices and is ready to make a two-sided market for any financial instrument.

Market Order: An order to buy or sell a stock immediately at the best available current price.

Market Rate: The current quote of a currency pair.

Market Risk: The risks that occur when general market pressures cause the value of an investment to fluctuate.

Market Timing: Attempting to predict future market directions, usually by examining recent price and volume data or economic data, and investing based on those predictions.

Market Value: 1.Market value of a forex position at any time is the amount of the domestic currency that could be purchased at the then market rate in exchange for the amount of foreign currency to be delivered under the forex Contract.

2.The last reported sale price of a security, or the current bid and ask price in the context of an over-the-counter security. Also known as market price.

Market-Maker: A person or firm that provides liquidity making two-sided prices (bids and offers) in the market.

Markup: Premium

Maturity: The date on which payment of a financial obligation is due.

Maturity Date: (1) The last trading day of a futures contract. (2) Date on which a bond matures, at which time the face value will be returned to the purchaser. Sometimes the maturity date is not one specified date but a range of dates during which the bond may be repaid.

MBA: Mortgage Bankers Association of America

Merchandise Trade Balance: The Merchandise Trade Balance is a measure of "visible" trade, which is trade in goods like cars and electronics. Specifically it is the difference between Japan 's imports of goods and exports of goods, excluding services.

A positive value indicates a trade surplus (exports exceed imports) while a negative value indicates a trade deficit (imports exceed exports).

Movements in the Merchandise Trade Balance reflect altered demand for Japanese Yen, which can move the value of the currency. Positive growth in the trade balance may lead to a future appreciation of the Yen due to steady demand in exchange for Japanese exports.

The Merchandise Trade report itself gives insight into changing trends regarding Japanese trade.

Such developments are especially important for Japan , which is an export-oriented economy that has historically experienced large trade surpluses, any affect on this could have dramatic affect on the domestic economy.

The headline figure is expressed as a percentage change from the last equivalent period, and a positive percentage change can indicate that export growth has exceeded import growth.

Micro economics: The study of the behavior of small economic units, such as that of individual consumers or households. opposite of macroeconomics.

Microcredit: A.the lending of very small amounts of money at low interest, esp. to a start-up company or self-employed person.

B.An extremely small loan given to impoverished people to help them become self employed. Also known as "microlending."

Mid-price or middle rate: The price half-way between the two prices, or the average of both buying and selling prices offered by the market makers.

Mine and Yours: Terms used by floor traders to signify buying and selling. Mainly used in forex transactions

If a trader wanted to buy something, he/she would type or say "Mine," as in "It's mine." If the trader wanted to sell, he/she would type or say "Yours," as in "It's yours."

Minimum price fluctuation: The smallest increment of market price movement possible in a given futures contract.

Mio: Million

MITI: Japanese ministry of International Trade & Industry.

MM: Money Markets

MOF: Ministry Of Finance

Momentum: The tendency of a currency pair to continue movement in a single direction.

Monetary Base-Japan: Currency supplied by the Bank of Japan. The Monetary Base includes all banknotes and coins in circulation plus all currency held as deposits by the Bank of Japan.

As an official measure of the Japanese money supply, the Monetary Base will show the immediate impacts of monetary policy actions and can give an indication into the future direction of inflation. An expansion in the monetary base is generally inflationary while a decline will likely have the opposite effect.

Money Market: Highly liquid markets for short-term investing in monetary instruments and debts, typically maturing in less than one year. Because of large transaction cost relative to potential interest, transactions occur in large amounts and thus participants are mainly banks and other large financial institutions.

Money market Instuments: Short-term, high grade (low risk) financial instruments such as bankers' acceptance, certificates of deposit (CDs), commercial paper, and treasury bills.

Money Supply: The total supply of money in circulation in a given country's economy at a given time. There are several measures for the money supply, such as M1, M2, and M3. The money supply is considered an important instrument for controlling inflation by those economists who say that growth in money supply will only lead to inflation if money demand is stable.

In order to control the money supply, regulators have to decide which particular measure of the money supply to target. The broader the targeted measure, the more difficult it will be to control that particular target.

However, targeting an unsuitable narrow money supply measure may lead to a situation where the total money supply in the country is not adequately controlled.

mortgage-backed security (MBS): In finance, a mortgage-backed security (MBS) is an asset-backed security whose cash flows are backed by the principal and interest payments of a set of mortgage loans. Payments are typically made monthly over the lifetime of the underlying loans.

Moving Average: A technical tahlil term meaning the average price of a security over a specified time period (the most common being 20, 30, 50, 100 and 200 days), used in order to spot pricing trends by flattening out large fluctuations.

This is perhaps the most commonly used variable in technical tahlil. Moving average data is used to create charts that show whether a stock's price is trending up or down.

They can be used to track daily, weekly, or monthly patterns. Each new day's (or week's or month's) numbers are added to the average and the oldest numbers are dropped; thus, the average "moves" over time.

In general, the shorter the time frame used, the more volatile the prices will appear, so, for example, 20 day moving average lines tend to move up and down more than 200 day moving average lines.

MPC-Marginal Propensity To Consume: A component of Keynesian theory, MPC represents the proportion of an aggregate raise in pay that is spent on the consumption of goods and services, as opposed to being saved.

Let's illustrate this with an example. Suppose you receive a bonus with your paycheck, and it's $500 on top of your normal annual earnings. You suddenly have $500 more in income than you did before.

If you decide to spend $400 of this marginal increase in income on a new business suit, your marginal propensity to consume will be 0.8 ($400 divided by $500).

Mutual fund: An open-ended fund operated by an investment company which raises money from shareholders and invests in a group of assets, in accordance with a stated set of objectives. mutual funds raise money by selling shares of the fund to the public, much like any other type of company can sell stock in itself to the public.

Mutual funds then take the money they receive from the sale of their shares (along with any money made from previous investments) and use it to purchase various investment vehicles, such as stocks, bonds and money market instruments.

In return for the money they give to the fund when purchasing shares, shareholders receive an equity position in the fund and, in effect, in each of its underlying securities.

For most mutual funds, shareholders are free to sell their shares at any time, although the price of a share in a mutual fund will fluctuate daily, depending upon the performance of the securities held by the fund.

Benefits of mutual funds include diversification and professional money management. Mutual funds offer choice, liquidity, and convenience, but charge fees and often require a minimum investment. A closed-end fund is often incorrectly referred to as a mutual fund, but is actually an investment trust.

There are many types of mutual funds, including aggressive growth fund, asset allocation fund, balanced fund, blend fund, bond fund, capital appreciation fund, clone fund, closed fund, crossover fund, equity fund, fund of funds,

global fund, growth fund, growth and income fund, hedge fund, income fund, index fund, international fund, money market fund, municipal bond fund, prime rate fund, regional fund, sector fund, specialty fund, stock fund, and tax-free bond fund.

مقالات مرتبط

فرهنگ لغات تخصصی بازار ارز حرف Z

Z-Certificate: Certificate issued by the Bank of England to “discount houses” in lieu of stock certificates to facilitate their dealing in the short dated gilt edge securities. Zero Coupon Bond: A bond that pays no interest. The bond is initially offered at a discount to its redemption value. ZEW: Zentrum für Europäische Wirtschaftsforschung (German: […]

فرهنگ لغات تخصصی بازار ارز حرف E

Easing: Modest decline in price. ECB–European Central Bank: The Central Bank for the new European Monetary Union. Echo Watchers Survey: The Economy Watchers Survey asks business-cycle sensitive workers their thoughts on existing and future economic conditions, giving a detailed picture of economic trends in Japan . The survey is based on questionnaires from […]

فرهنگ لغات تخصصی بازار ارز حرف T

حرف T T Bill اسناد خزانه Take Profit Order حدسود-دستوری از طرف معامله گر برای پايان دادن به معامله در نرخی معين به منظور کسب سود .برای مثال اگر شمايک معامله خريدجفت ارزی داريد و پيش بينی می کنيد که قيمت تا ميزان مشخصی بالا خواهد رفت ولی مطمئن نيستيد که پس از […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

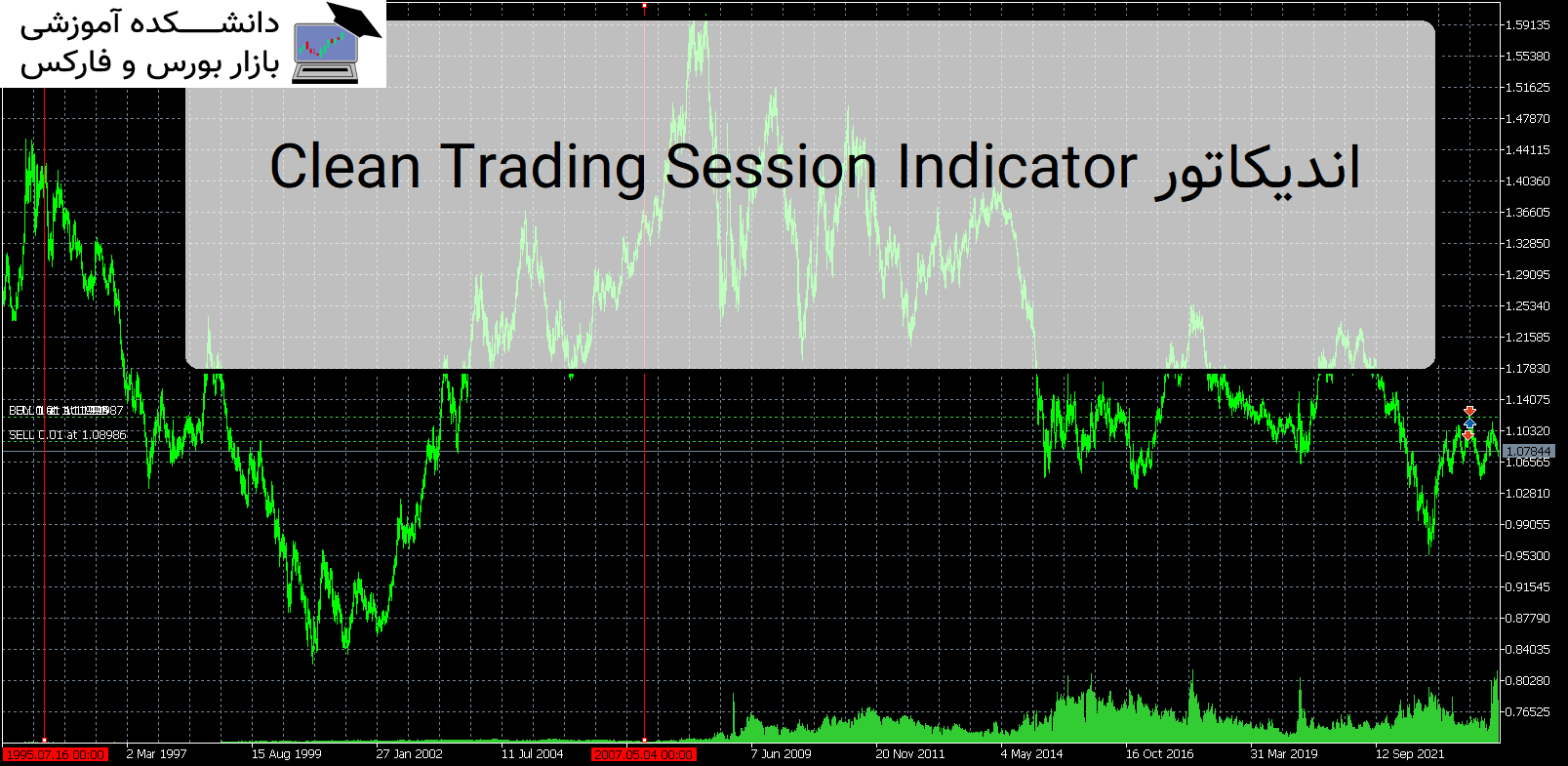

Clean Trading Session Indicator اندیکاتور MT5

معرفیو و دانلود اندیکاتور کاربردی Clean Trading Session Indicator اندیکاتور کاربردی Clean Trading Session Indicator مهم ترین جلسات معاملاتی را برای بازار فارکس مانند لندن، نیویورک، توکیو نشان می دهد. معرفی اندیکاتور کاربردی Clean Trading Session Indicator اندیکاتور Clean Trading Sessions یک شاخص ساده و در عین حال کاملاً کاربردی جلسات فارکس است که برای […]

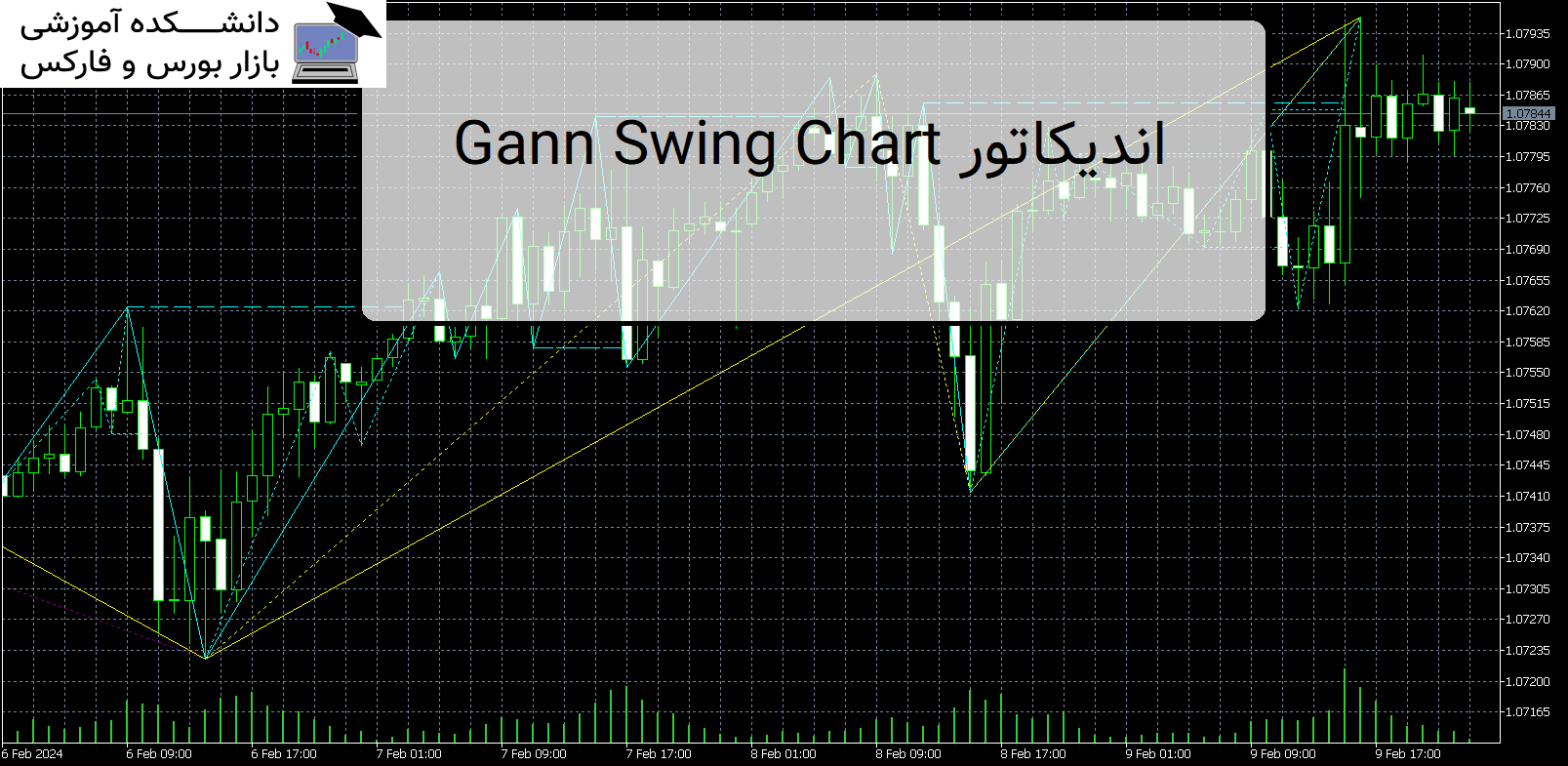

Gann Swing Chart اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی Gann Swing Chart اندیکاتور کاربردی Gann Swing Chart این اندیکاتور محبوب و کاربردی نمودار Swing گان (یک نوار) را با امواج چند لایه به معامله گران نشان می دهد. معرفی اندیکاتور کاربردی Gann Swing Chart 1. لایه موج F1: امواج گان بر اساس شمع ها ترسیم می شوند. موج SGann […]