فرهنگ لغات تخصصی بازار ارز حرف R

Rally: A recovery in price after a period of decline. A substantial rise in the price of a security, commodity, or overall market, following a decline. Range: The difference between the highest and lowest price of a future recorded during a given trading session. Rate: Price at which a currency can be […]

Rally: A recovery in price after a period of decline.

A substantial rise in the price of a security, commodity, or overall market, following a decline.Range:

The difference between the highest and lowest price of a future recorded during a given trading session.Rate:

Price at which a currency can be purchased or sold against another currency.Rate of Inflation:

The Consumer Price Index is a measure of the average price level of a fixed basket of goods and services purchased by consumers. Monthly changes in the CPI represent the rate of inflation.RBA:

Reserve Bank of AustraliaRBNZ:

Reserve Bank of New ZealandRBNZ Official Cash Rate:

The Official Cash Rate (OCR) is the interest rate set by the Reserve Bank to meet the inflation target specified in the Policy Targets Agreement. The agreement signed in September 2002, between the Minister of Finance and the Governor of the Reserve Bank, requires the Reserve Bank to keep inflation, on average over the medium term, at between 1 and 3 percent per annum. The OCR was introduced in March 1999 and is reviewed eight times a year by the Bank. Monetary Policy Statements are issued with the OCR on four of those occasions. Unscheduled adjustments to the OCR may occur at other times in response to unexpected or sudden developments, but to date this has occurred only once, following the 11 September 2001 attacks on the World Trade Centre in New York. The OCR influences the price of borrowing money in New Zealand and provides the Reserve Bank with a means of influencing the level of economic activity and inflation. An OCR is a fairly conventional tool by international standards. In the past, the Reserve Bank used a variety of tools to influence inflation, including influencing the supply of money and signalling desired monetary conditions to the financial markets. Such mechanisms were more indirect, more difficult to understand, and less conventional.Reaction:

A decline in prices following an advance.Realized and Unrealized Profit:

Unrealized profit is a gain from an increase in the price of a currency that has not been closed or cashed in. Realized profits are made from the cashing in of the unrealized gain.Recession:

A decline in business activity. Often defined as two consecutive quarters with a real fall in GNP.Recovery:

A period in a business cycle following a recession, during which the GDP rises.Rectangle:

In technical tahlil, a chart pattern in which the price of a security bounces back and forth between two horizontal lines. Because a rectangle is thought to occur when stock is being distributed or accumulated by knowledgeable investors, a major price movement is expected once the stock breaks out of the rectangle formation A rectangle describes a price pattern where supply and demand are in approximate balance for an extended period of time. The shares move in a narrow range, hitting resistance at the rectangle's top and finding support at its bottom. It is a pattern of indecision, one in which the bulls and bears are approximately equally powerful. Ultimately, one side or the other wins the tug of war and the shares break out or break down. Typically, the breakout or breakdown can be measured by the height of the rectangle.Red book:

The Redbook Index measures same-store sales at general-merchandise retailers representing about 9,000 locations. The sales are considered an industry benchmark because they exclude results from new or closed locations. The Johnson Redbook Index is a proprietary indicator of growth in retail sales, and provides advanced estimates of trends in retail sales ahead of official releases and company reports in an easy-to-read four-page report. The weekly indicator is made public every Tuesday morning, with clients receiving notice via conference call, e-mail or fax prior to public release.REINZ=Real Estate Institute of New Zealand:

The Real Estate Institute of New Zealand is the professional body for the real estate industry in New Zealand.Relative Return:

The return that an asset achieves over a period of time compared to a benchmark. The relative return is the difference between the absolute return achieved by the asset and the return achieved by the benchmark. Relative returns are most often used when reviewing the performance of a mutual fund manager. Because holders of mutual funds are charged management fees, they expect a manager to achieve returns higher than the benchmark index. For example, if the fund you are holding achieves an absolute return of 12% over the past year while the benchmark index provides a return of 15%, then the fund has achieved a relative return of -3% for the year.Relative Strength Index - RSI:

The RSI is a price-following oscillator that ranges between 0 and 100. A popular method of analyzing the RSI is to look for a divergence in which the price of the currency is making a new high, but the RSI is failing to surpass its previous high. This divergence is an indication of an impending reversal. When the RSI then turns down and falls below its most recent trough, it is said to have completed a "failure swing." The failure swing is considered a confirmation of the impending reversal in the price of the currency.Repurchase --REPO:

This type of trade involves the sale and later repurchase of an instrument, at a specified time and date. Occurs in the short-term money market.Reserve Currency:

One of the national currencies (dollar, euro, yen, etc.) or IMF's special drawing rights (SDR) used by a country to hold its foreign currency reserves and gold for settling international trade transactions and other obligations. Also called reserve currency.Reserve Requirements:

Requirements regarding the amount of funds that banks must hold in reserve against deposits made by their customers. This money must be in the bank's vaults or at the closest Federal Reserve Bank.Reserves:

Funds held against future contingencies, normally a combination of convertible foreign currency, gold, and SDRs. Official reserves are to ensure that a government can meet near term obligations. They are an asset in the balance of payments.Resistance:

Price level at which technical analysts note persistent selling of a currency.Resistance Point or Level:

A price recognized by technical analysts as a price level which a currency pair has trouble breaking through it to the upside, but which is likely to result in a significant price increase if broken. There are different levels of resistance levels for different time frames.Retail Outlet:

retail outletRetail Price Index:

Measurement of the monthly change in the average level of prices at retail, normally of a defined group of goods.Retail Trade:

The total value of goods and services sold each month at retail outlets. The report serves as a direct gauge of consumption and consumer confidence. Consumer spending is one of the most important leading indicators for the Japanese economy. An increasing number of sales signal consumer confidence and economic growth, but higher consumption also leads to inflationary pressures. The headline figure they release is a year-on-year percentage change in the nominal value of items sold.Retail Trade Monthly - Japan:

The total value of goods and services sold each month at retail outlets. The report serves as a direct gauge of consumption and consumer confidence. Consumer spending is one of the most important leading indicators for the Japanese economy. An increasing number of sales signal consumer confidence and economic growth, but higher consumption also leads to inflationary pressures. The headline figure they release is a year-on-year percentage change in the nominal value of items sold.Retracements:

Synonymous with the term correction; used to denote a temporary reversal in the overall trend of the market to accommodate for excessive acceleration or deceleration of a movement in the price of a currency.Reuter Dealing:

One electronic, screen-based currency trading platform.Revaluation:

to increase the legal exchange value of (a nation's currency) relative to other currencies.Revenue:

1.The total amount of money received by a company for goods or services sold before deducting expenses. 2.government income due to taxationReversal:

Change in the general direction of a market, such as a rally. also called trend reversal.RICS:

Royal Institution of Chartered Surveyors The Royal Institution of Chartered Surveyors (RICS) is the official representative professional body which regulates property professionals and surveyors. The institution was founded in the United Kingdom after a meeting of 20 surveyors at the Westminster Palace Hotel on 23 March 1868. The institution is still based in the United Kingdom, however, as at 2005 the institution is represented or affiliated in excess of 120 countries and boasts a 136,000 strong worldwide membership. The institution was founded in London in 1868 as the "Institution of Surveyors" and has occupied headquarters on the corner of Great George Street and Parliament Square since that date. The institution received its Royal Charter in 1881 and became the "Institution of Chartered Surveyors" in 1930. In 1946 the institution became a royal institution entitled to add "Royal" to its name and, thereby, achieved its present name. The majority of members are based in the United Kingdom, however there is a strong international membership in many Commonwealth countries such as Canada, Hong Kong and Australia, and membership is growing rapidly in the United States and across Europe, Asia and Africa. The RICS has close links with many national surveying institutions and is a member association of the International Federation of Surveyors (FIG). Outside of the UK (and particularly in non-Commonwealth countries), the institution generally avoids the use of the full name including "Royal" and styles itself as "RICS".

RICS House Price Balance:

Gauge for costs of homes in the United Kingdom. The figure is based on surveyors' opinions on the state of the market, calculated as is the percent of surveyors reporting a rise in prices minus those reporting a fall. A rise in house prices indicates a strong housing market, which generally reflects a strong overall economy.Risk:

Exposure to uncertain change, most often used with a negative connotation of adverse change.Risk Capital:

The capital that an investor does not need to maintain his/her living standard.Risk Management:

The employment of financial tahlil and use of trading techniques to reduce and/or control exposure to financial risk.Risk Position:

An asset or liability, which is exposed to fluctuations in value through changes in exchange rates or interest rates.Risk Premium:

Additional sum payable or return to compensate a party for adopting a particular risk.Risk-Adjusted Return:

A measure of how much risk a fund or portfolio takes on to earn its returns, usually expressed as a number or a rating.Risks:

There are risks associated with any market. It means variance of the returns and the possibility that the actual return might not be in line with the expected returns. The risks associated with trading foreign currencies are: market, exchange, Interest rate, yield curve, volatility, liquidity, forced sale, counter party, credit, and country risk.Roll-Over:

The process of extending the settlement value date on an open position forward to the next valid value date.Rolling over:

The substituting of a far option for a near option of the same underlying stock at the same strike/exercise price.Rollover:

A charge that is incurred by Forex investors who roll over their positions to the following delivery date The fee arises from the difference in interest rates between the two currencies underlying a transaction. Sometimes investors can earn a credit if they are purchasing the currency with the higher of the two interest rates. Investors are often required to maintain certain margin positions with their brokers to earn a credit from rolloverRound trip:

Buying and selling of a specified amount of currency.Rounding Top and Bottom:

Similar to a Cup and Handle pattern, a rounding top signifies a rounded resistance line and a bearish overall trend. Alternatively, a rounding bottom is a bullish for which the bottom curve can serve as a support line. Both patterns are best-suited to longer-term analyses.RPI-Retail Price Index:

Retail Price Index measures changes in the prices of goods and services bought for household consumption in the UK. The RPI takes a large sample of retail goods including food, tobacco, household goods and services, transport fares, motoring costs, clothing, and leisure goods and services. An increase in the index means that prices have increased on average (inflation) while a decrease means that prices on the whole have fallen (deflation).RSI - Relative Strength Index:

Relative Strength Index. A technical tahlil indicator which measures the magnitude of gains over a given time period against the magnitude of losses over that period. The equation is RSI = 100 - 100 / (1 + RS) where RS = (total gains / n) / (total losses / n) and n = number of RSI periods. The value can range from 1 to 100. Some technical analysts believe that a value of 30 or below indicates an oversold condition and that a value of 70 or above indicates an overbought condition.برچسبها :

مقالات مرتبط

فرهنگ لغات تخصصی بازار ارز حرف P

Package Deal: An order that contains a number of exchange or deposit items that must be completed simultaneously, or not at all. Package deals allow traders to ensure specific prices or times to maturity for multiple assets. A trader may want to participate in a package deal to properly execute an investment strategy. […]

فرهنگ لغات تخصصی بازار ارز حرف O

OCO – One Cancels the Other Order: A designation for two orders whereby one part of the two orders is executed the other is automatically cancelled.For example, an investor with limited funds may place an order to buy both stocks and bonds and specify that it’s a “one-cancels-the-other-order.” In other words, if the market favors […]

فرهنگ لغات تخصصی بازار ارز حرف Y

Yard: A slang word used in the currency industry meaning ‘billion’. Year To Date – YTD: The period beginning January 1st of the current year up until today’s date. Yield: Annual income earned from an investment, expressed usually as a percentage of the money invested. Yield Curve: In finance, the yield curve is the […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

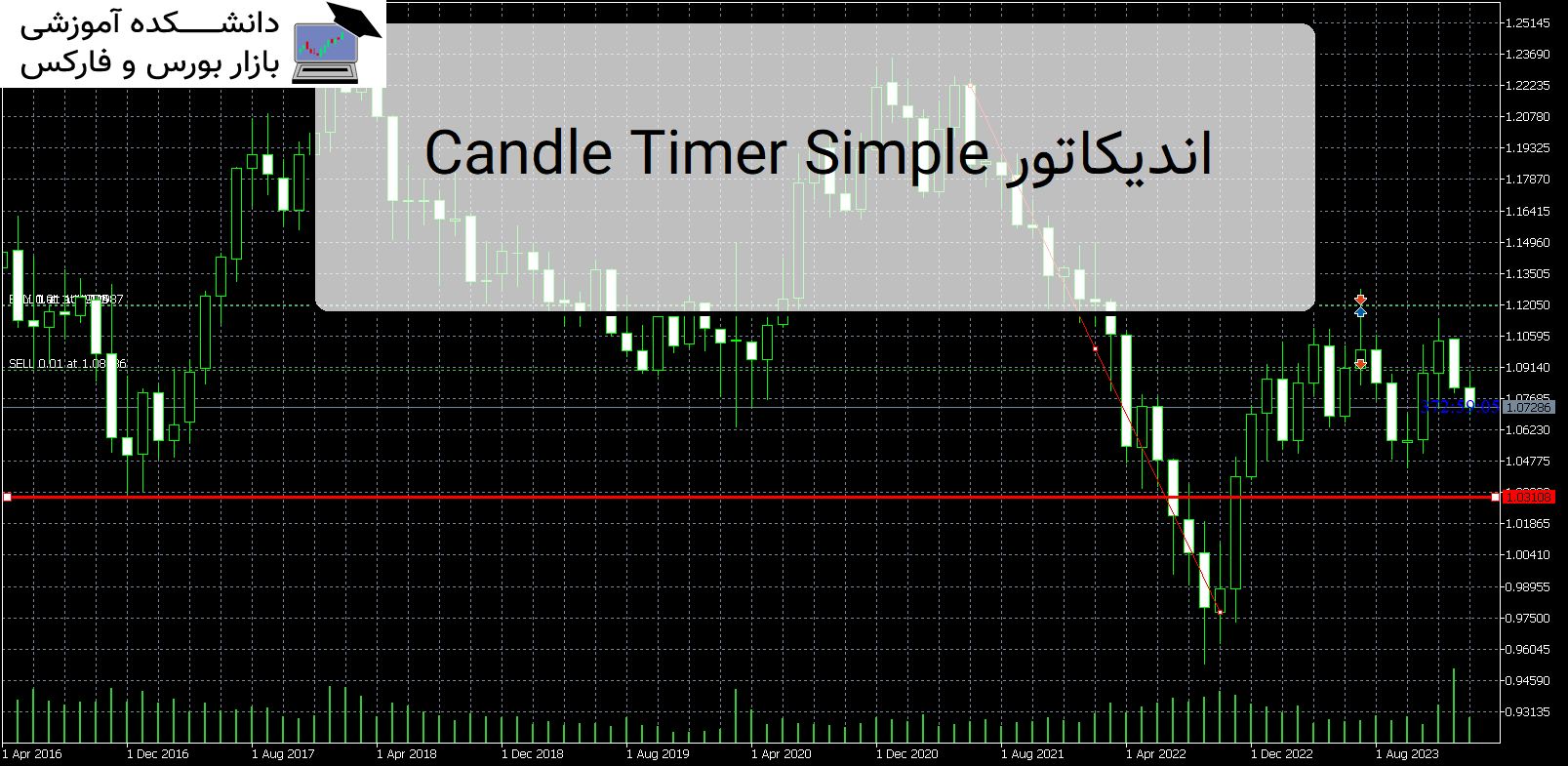

Candle Timer Simple اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی Candle Timer Simple Candle Timer Simple هنگام استفاده از تایمرهای کندل استیک، به یاد داشته باشید که زمان بندی الگوهای کندل استیک می تواند نقش مهمی در استراتژی معاملاتی شما داشته باشد. اندیکاتور Candle Timer Simple تنظیمات حتماً گزینه Chart shift را در نمودار انتخاب کنید. (در نمودار کلیک راست […]

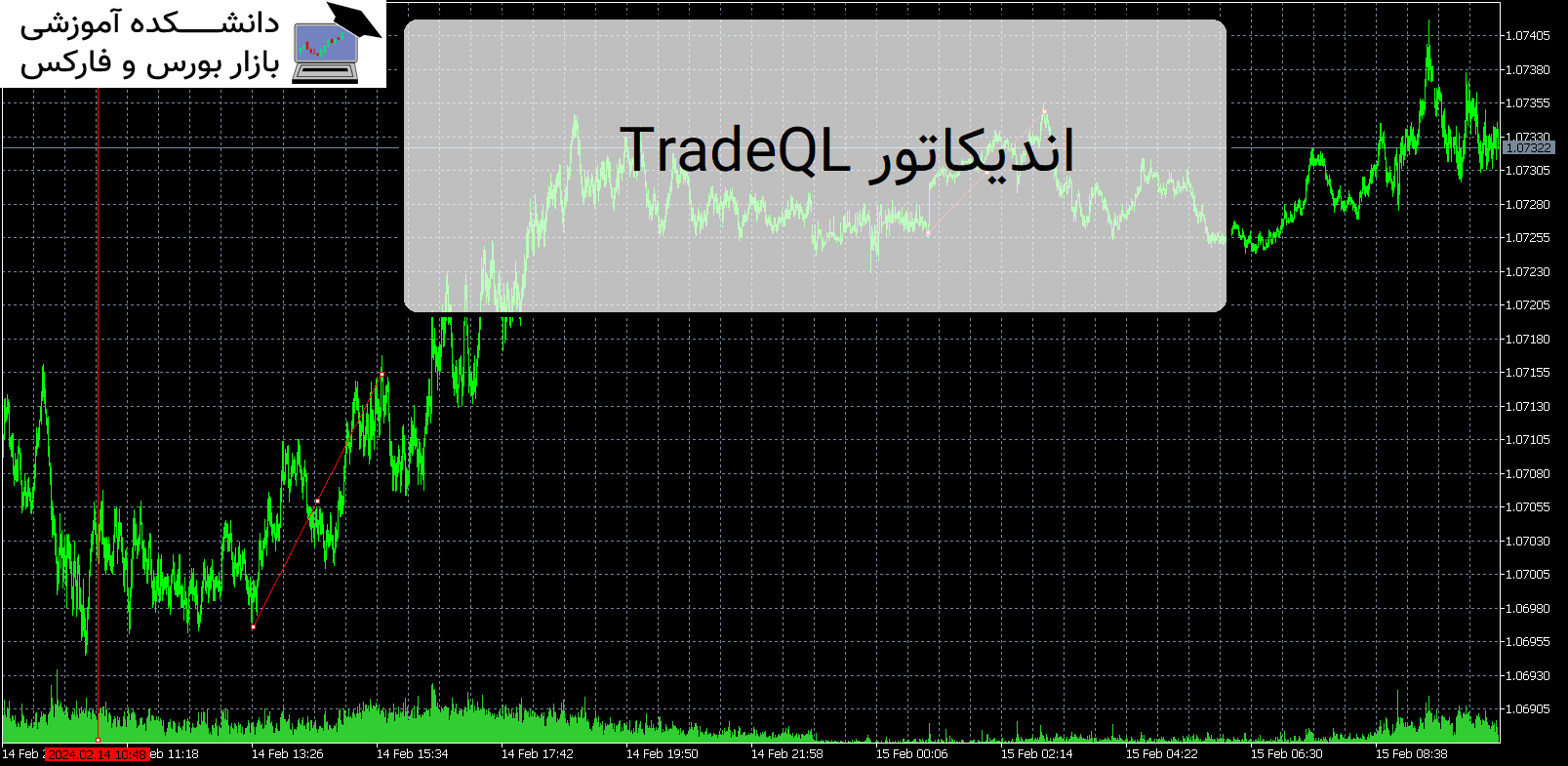

TradeQL اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی TradeQL اندیکاتور کاربردی TradeQL ابزاری محبوب کاربردی و قابل تنظیم است که الگوهای معاملاتی خاصی را در نمودارهای شمعی برجسته می کند مناسب معامله گران تازه کار. اندیکاتور TradeQL کاربران می توانند الگوها را از طریق پرس و جوهای TradeQL تعریف کنند، که این نشانگر سپس روی نمودار اعمال می […]