فرهنگ لغات تخصصی بازار ارز حرف O

OCO – One Cancels the Other Order: A designation for two orders whereby one part of the two orders is executed the other is automatically cancelled.For example, an investor with limited funds may place an order to buy both stocks and bonds and specify that it’s a “one-cancels-the-other-order.” In other words, if the market favors […]

A designation for two orders whereby one part of the two orders is executed the other is automatically cancelled.For example, an investor with limited funds may place an order to buy both stocks and bonds and specify that it's a "one-cancels-the-other-order." In other words, if the market favors stocks and they are bought, the order to buy bonds will be canceled. Conversely, if the market suggests bonds are the way to go, the order will be to buy bonds and the order to buy stocks will be canceled

OCR-Official Cash Rate:

The Official Cash Rate (OCR) is the interest rate set by the Reserve Bank to meet the inflation target specified in the Policy Targets Agreement. The agreement signed in September 2002, between the Minister of Finance and the Governor of the Reserve Bank, requires the Reserve Bank to keep inflation, on average over the medium term, at between 1 and 3 percent per annum.

Odd Lot:

A non standard amount for a transaction.

ODPM:

Office of the Deputy Prime Minister (UK)

OECD-Organization for Economic Cooperation and Development:

Organization for Economic Cooperation and Development

Off-Balance Sheet:

Financing or the raising of money by a company that does not appear on the company's balance sheet, such as Interest Rate Swaps and Forward Rate Agreements.

Off-Shore:

The operations of a financial institution which although physically located in a country, has little connection with that country's financial systems. In certain countries a bank is not permitted to do business in the domestic market but only with other foreign banks. This is known as an off shore banking unit.

Offer:

The price at which a currency pair or security is for sale; the quoted price at which an investor can buy a currency pair. This is also known as the 'ask', 'ask price', and 'ask rate'.

Offer - ask:

The rate at which a dealer is willing to sell a currency. See Ask (offer) price

Official Reserve Assets - Japan:

The wealth controlled by the Bank of Japan. Japan holds enormous reserves of foreign currencies, currently holding the largest foreign reserve of American Dollars in the world. Central Banks have recently moved to diversify their currency reserves; the shift has been away from the traditionally favored Dollar toward other currencies like the Euro. Because of the size and influence of the Bank of Japan's huge Reserve Assets, adjustments can radically alter the supply of a currency in the market and sway other banks to act. Long term trends in the Bank's reserve asset figures merit close attention.

All these assets help Japan ensure its financial well-being when faced with economic or geo-political issues. In particular, large foreign currency reserves give the BOJ the freedom to exert a measure of control over its exchange rate by manipulating the supply of foreign currencies.

official reserves:

Holdings of gold and foreign currencies by official monetary institutions.

Offset:

The closing-out or liquidation of a futures position.

The elimination or reduction of a current long or short position by making a transaction with the same security in the opposite direction. Also known as close out or even up.

Offsetting transaction:

A trade which serves to cancel or offset some or all of the market risk of an open position.

Offshore:

The operations of a financial institution which although physically located in a country, has little connection with that country's financial systems. In certain countries a bank is not permitted to do business in the domestic market but only with other foreign banks. This is known as an off shore banking unit.

Old Lady:

Old lady of Threadneedle Street, a term for the Bank of England.

One Cancels Other Order:

Where the execution of one order automatically cancels a previous order also referred to as OCO or 'One cancels the other'.

One Cancels the Other Order - OCO:

A designation for two orders whereby one part of the two orders is executed the other is automatically cancelled.

Open Market Operations:

The central bank operations in the markets to influence exchange and interest rates.

Open Order:

Buy or sell order that remains in force until executed or cancelled by the customer.

Option:

A contract conferring the right but not the obligation to buy (call) or to sell (put) a specified amount of an instrument at a specified price within a predetermined time period.

Option Premium:

The option premium is the price the buyer of the options contract pays for the right to buy or sell a security at a specified price in the future.

Option Class:

All options of the same type - calls or puts -listed on the same underlying instrument.

Option Series:

All options of the same class having the same exercise/strike price and expiration date.

Options:

An agreement that allows the holder to have the option to buy/sell a specific currency at a certain price within a certain time. Two types of options – call and put. A call is the right to buy while a put is the right to sell. One can write or buy call and put options. Options do not have as much liquidity as the underlying (spot) currency.

Order:

A customer's instructions to buy or sell currencies.

OTC - Over the Counter:

Used to describe any transaction that is not conducted over an exchange.

A security that is not traded on an exchange, due to an inability to meet listing requirements. For such securities, brokers and dealers negotiate directly with one another over computer networks and by phone, and their activities are monitored by the NASD. Also known as unlisted.

Out-of-the-Money:

A put option is out-of-the-money if the exercise/strike price is below the price of the underlying instrument. A call option is out-of-the money if the exercise/strike price is higher than the price of the underlying instrument.

Outperform:

In general, this means to do better than some particular benchmark. Mutual Fund XYZ is said to outperformthe S&P500 if its return exceeds the S&P500 return. However, this language does not take risk into account. That is, one might have a higher return than the benchmark in a particular year because of higher risk exposure. Outperform is also a term used by analysts to describe the prospects of a particular company. Usually, this means that the company will do better than its industry average. Related: underperform.

Output:

1.Manufacturing: Amount of energy, work, goods or services, etc. produced by a machine, factory, firm, or an individual in a period.

2.Contracting: Desired result from a project or contractor.

Over the Counter - OTC:

A decentralized market (as opposed to an exchange market) where geographically dispersed dealers are linked by telephones and computer screens.

Overall Household Spending:

A survey of both wage-earning and non-working households, such as those classified as single-member, unemployed, or retired. The headline figure is the percentage change in average spending per household from the previous year. Increases in household spending are favorable for the Japanese economy because high consumer spending generally leads to higher levels of economic growth. Higher spending is also a sign of consumer optimism, as households confident in their future outlook will spend more. At the same time accelerated growth exerts inflationary pressure, which can lead to interest rate increases in the future.

Overbought:

A term used to characterize a market in which currency prices have risen at a pace that is above typical market acceleration, and hence is due for a retracement.

Overheated /Economy:

Is an economy on a high growth rate trajectory placing pressure on the production capacity resulting in increased inflationary pressures and higher interest rates.

Overnight Limit:

The maximum amount of a net long or short position that a dealer can carry over into the next dealing day.

Overnight Position:

Trader's long or short position in a currency at the end of a trading day.

Overnight trading:

The buying or selling of currencies between 9pm and 8am local time. This type of transaction occurs when an investor takes a position at the end of the trading day in a foreign market that will be open while the local market is closed. The trade will be executed sometime that evening or early morning.

Oversold:

The opposite of overbought; exists when the price of a currency decelerates at an abnormally fast rate, and hence is due for an upwards reversal.

A situation arising in the market after prompt and significant downturn of the price (Forex rate).

برچسبها :

مقالات مرتبط

فرهنگ لغات تخصصی بازار ارز حرف L

Labor Cash Earnings – Japan: The average amount of pre-tax earnings per regular employee, including overtime pay and bonuses. Though the report does not take into account all sources of household income (accumulated wealth and capital gains from financial assets are omitted), Labor Cash Earnings accurately reflects the spending ability of domestic consumers, one […]

فرهنگ لغات تخصصی بازار ارز حرف Y

Yard: A slang word used in the currency industry meaning ‘billion’. Year To Date – YTD: The period beginning January 1st of the current year up until today’s date. Yield: Annual income earned from an investment, expressed usually as a percentage of the money invested. Yield Curve: In finance, the yield curve is the […]

فرهنگ لغات تخصصی بازار ارز حرف I

IBD/TIPP Economic Optimism Index:The IBD/TIPP Economic Optimism Index is the earliest and most authoritative take on consumer confidence each month and predicts with 90% reliability monthly changes in sentiment in well-known polls by The Conference Board and the University of Michigan. The IBD/TIPP Economic Optimism Index is based on a survey of 1,000-plus adults […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

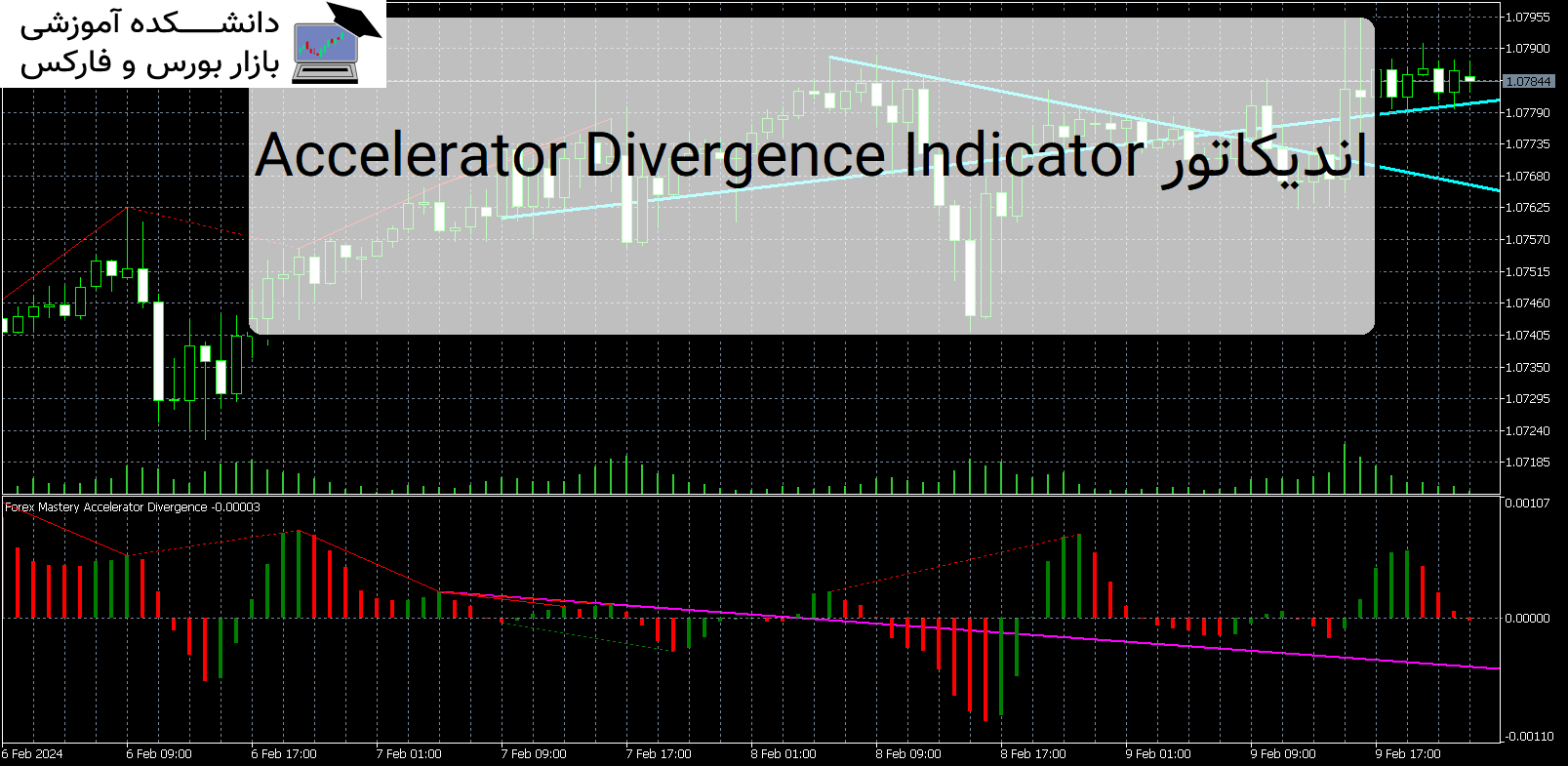

Accelerator Divergence Indicator اندیکاتور MT5

دانلود و معرفی اندیکاتور کاربردی Accelerator Divergence Indicator معرفی اندیکاتور کاربردی Accelerator Divergence Indicator ، ابزاری قدرتمند که برای ارتقای تجربه تجارت فارکس شما طراحی شده است. معرفی اندیکاتور Accelerator Divergence Indicator این شاخص نوآورانه به طور خاص برای شناسایی واگرایی بازار ساخته شده است و به معامله گران بینش ارزشمندی برای تصمیم گیری آگاهانه […]

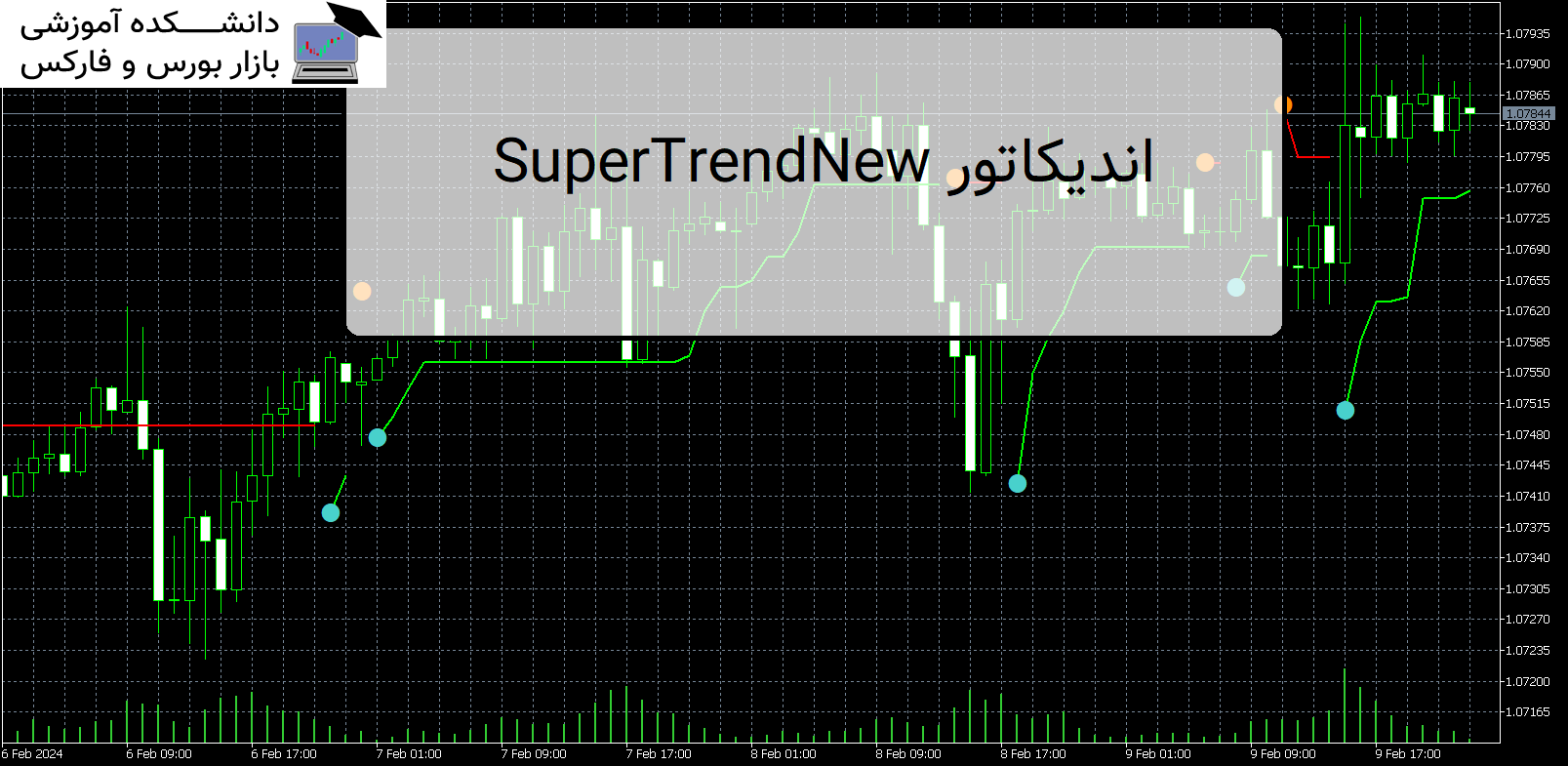

SuperTrendNew اندیکاتور MT5

معرفی و دانلود اندیکاتور SuperTrendNew SuperTrendNew به شما این امکان را می دهد که از تغییر روند سوپرترند، طولانی یا کوتاه را وارد کنید. هر دو دوره ATR و ضرب کننده ATR قابل تنظیم هستند. معرفی اندیکاتور SuperTrendNew اگر «تغییر روش محاسبه ATR» را علامت بزنید، محاسبه بر اساس SMA انجام میشود و نتایج کمی […]