فرهنگ لغات تخصصی بازار ارز حرف S

S&P – Standard and Poors: A US firm engaged in assessing the financial health of borrowers. The firm also has generated certain stock indices i.e. S&&P 500. s.a: seasonally adjusted Same day transaction: A transaction that matures on the day the transaction takes place. same store sales: statistic used in retail industry tahlil. It […]

S&P - Standard and Poors:

A US firm engaged in assessing the financial health of borrowers. The firm also has generated certain stock indices i.e. S&&P 500.

s.a:

seasonally adjusted

Same day transaction:

A transaction that matures on the day the transaction takes place.

same store sales:

statistic used in retail industry tahlil. It compares sales of stores that have been open for a year or more.

SDR:

International financing instrument created in 1970 by the International Monetary Fund (IMF) to coincide with the disfavor of the US dollar as the principal currency of the world trade. Also called paper gold, an SDR is neither paper nor gold but an accounting entry. It is not backed by any currency or precious metal, and is used only among governments and IMF for balance Of payments settlements. SDRs are a measure of a country's reserve assets with IMF and, whereas not 'money' in the strict sense, have several characteristics of money as interest bearing assets, store of value, and means of settling indebtedness. They are distributed among all member states of IMF in proportion to each member's quota of IMF dues based on the member's GNP. Used mainly to supplement gold and convertible (hard) currencies in maintaining stability of foreign exchange markets, SDRs are valued on the basis of the value of a basket of 16 major currencies with periodically adjusted weightage reflecting each currency's importance in global trade.

SEC:

Securities & Exchange Commission A federal agency that regulates the US financial markets. The SEC also oversees the securities industry and promotes full disclosure in order to protect the investing public against malpractice in the securities markets.

SECO:

the State Secretariat for Economic Affairs

Secured Loan:

A loan which is backed by assets belonging to the borrower in order to decrease the risk assumed by the lender. The assets may be forfeited to the lender if the borrower fails to make the necessary payments.

Securitization:

The process of creating a financial instrument by combining other financial assets and then marketing them to investors.

Sell Limit Order:

An order to execute a transaction only at a specified price (the limit) or higher.

Sell Stop Order:

A Sell Stop is a Stop Order that is placed BELOW the current dealing Bid price and is not activated until the market Bid price is is at or below the stop price. The sell stop order, once triggered, becomes a market order to sell at the current market price.

Selling Rate:

Rate at which a bank is willing to sell foreign currency.

Selling Short:

A situation where a currency has been sold with the intent of buying back the position at a lower price to make a profit.

Selloff:

A sudden drop in price as a result of widespread selling.

Series:

All options of the same class which share a common strike price and expiration date.

Session:

Period of trading activity from the time a market opens until it closes. also called trading session.

Settlement:

The actual delivery of currencies made on the maturity date of a trade.

Settlement Date:

It means the business day specified for delivery of the currencies bought and sold under a forex contract.

Settlement Risk:

The risk that one party will deliver and the counterparty will not be able to pay and vice versa.

Share:

Certificate representing one unit of ownership in a corporation, mutual fund, or limited partnership.

Shop Price Index:

A monthly indicator of price changes at the most popular retail outlets in the United Kingdom. The index takes into account five hundred of the most commonly purchased goods and gives insight into consumer-price inflation. Shop Prices differentiate themselves from British CPI by coming out days before the headline inflation figure. Increases in the BRC Shop Price Index are bullish for the Pound, given that the Bank of England usually raises interest rates to control inflation reflected in the BRC. Conversely, a falling BRC Shop Price Index suggests falling price pressures.

BRC appear in the headlines as the monthly percentage change for the BRC Shop Price Index.

Short:

In foreign exchange, when a currency pair is sold, the position is said to be short. It is understood that the primary currency in the pair is 'short', and the secondary currency is 'long'.

Short position:

In foreign exchange, when a currency pair is sold, the position is said to be short. It is understood that the primary currency in the pair is 'short', and the secondary currency is 'long'.

Short sale:

The sale of a specified amount of currency not owned by the seller at the time of the trade. Short sales are usually made in expectation of a decline in the price.

Short Squeeze:

The pressure on short sellers to cover their positions as a result of sharp price increases.

A situation in which the price of the stock rises and investors who sold short rush to buy it to cover their short position and cut their losses. As the price of the stock increases, more short sellers feel compelled to cover their positions. More common than the opposite, long squeeze.

Short-term interest rates:

Normally the 90 day rate.

Sidelined:

When there is above ordinary interest in a currency pair, other major currency pairs that are thinly traded as a result of this are considered "sidelined".

Sideways:

A price which is neither rising or falling; here also called flat.

SITC:

Standard International Trade Classification. A system for reporting trade statistics in a common manner.

SL:

Order to buy or sell when a given price is reached or passed to liquidate part or all of an existing position.

Slippage:

The difference between estimated and actual transaction costs.

SNB:

Swiss National Bank

SOFFEX:

Swiss Options and Financial Futures Exchange, a fully automated and integrated trading and clearing system.

Soft Market:

More potential sellers than buyers, which creates an environment where rapid price falls are likely.

speculation:

Speculation is the practice of selecting investments (exposing one's self to risk) with the intention of profiting from price fluctuations.

As opposed to hedging (where investors enter positions to reduce risk in another investment) or gambling (just risk), speculators make informed decisions before choosing to expose one's self to additional risk.

Spike:

A large, quick, temporary rise or fall in price.

Spot:

(1) Immediate delivery against cash payment, as opposed to future delivery against cash or credit payment

(2) Spot refers to the buying and selling of the currency where the settlement date is two business days forward.

Spot Market:

A market in which commodities, such as grain, gold, crude oil, or RAM chips, are bought and sold for cash and delivered immediately. also called cash market.

Spot Commodity:

Commodity bought or sold in a spot market, with the expectation that it will be actually delivered on the contracted date.

Spot Price:

The current market price of a currency that normally settles in 2 business days (1 day for Dollar/Canada).

Spot Price/Rate:

The price at which the currency is currently trading in the spot market.

Spread:

This point or pip difference between the bid and ask price of a currency pair.

Square/Flat:

Where a client has not traded in that currency or where an earlier deal is reversed thereby creating a neutral (flat) position. example: you bought $500,000 then sold $500,000 = FLAT

Squeeze:

Action by a central bank to reduce supply in order to increase the price of a currency.

Stable Market:

An active market which can absorb large sale or purchases of currency without having any major impact on the interest rates.

Stagflation:

Recession or low growth in conjunction with high inflation rates.

Stake:

In economics: a. A share or an interest in an enterprise, especially a financial share. b. Personal interest or involvement: a stake in her children's future.

Standard:

A term referring to certain normal amounts and maturities for dealing.

Standard and Poors - S&P:

A US firm engaged in assessing the financial health of borrowers. The firm also has generated certain stock indices i.e. S&&P 500.

Sterilization:

Central Bank activity in the domestic money market to reduce the impact on money supply of its intervention activities in the forex market.

Sterling:

Another term for the British currency, 'The Pound'.

Stock Index:

Statistical indicator used in measurement and reporting of changes in the market value of a group of stocks/shares. Different stock indices (such as Dow Jones Industrial Average, Russell 1000, Standard And Poor’s 500) track the market differently depending on (1) which averaging method is used to establish the index, (2) whether the index is broad based or narrow based, and (3) whether the averaging method assigns weights on the basis of market price or market capitalization. Also called Share Index

Stocky:

Market slang for Swedish Krona.

Stop (loss) Order:

Order to buy or sell when a given price is reached or passed to liquidate part or all of an existing position.

Stop Loss Order:

Order type whereby an open position is automatically liquidated at a specific price. Often used to minimize exposure to losses if the market moves against an investor's position. As an example, if an investor is long USD at 156.27, they might wish to put in a stop loss order for 155.49, which would limit losses should the dollar depreciate, possibly below 155.49.

Stop Order or Stop:

An order to buy or to sell a currency when the currency's price reaches or passes a specified level.

Stop Out Price:

US term for the lowest accepted price for Treasury Bills at auction.

Stop-Loss order:

A Stop Loss is an order to close a trade when the market moves a specified amount.

Straddle:

The simultaneous purchase/sale of both call and put options for the same share, exercise/strike price and expiry date.

Strike Price:

Also called exercise price. The price at which an option holder can buy or sell the underlying instrument.

Strike Price- Exercise Price:

The price at which an option can be exercised. The purchase or sale price of underlying stock that an option holder sees upon the exercising an option contract.

Strip:

1.A combination of two puts and one call.

2. bond that is issued by the U.S. Treasury for which interest and repayment of principal are separated and sold individually as zero-coupon bonds. The letters STRIP compose an Acronym for Separate Trading of Registered Interest and Principal of Securities.

Structural Unemployment:

Unemployment resulting from changes in the basic composition of the economy. These changes simultaneously open new positions for trained workers.

An example of structural unemployment is the technological revolution. Computers may have eliminated jobs, but they also opened up new positions for those who have the skills to operate the computers.

Support Levels:

A price at which a currency or the currency market will receive considerable buying pressure.

SVME:

Society for Veterinary Medical Ethics

The Society for Veterinary Medical Ethics was founded in 1994 by a group of veterinarians, biomedical researchers, and academics to promote discussion and debate about ethical issues arising in and relevant to veterinary practice. The Society presently has approximately 160 members, including veterinary school deans, officers of the AVMA and state veterinary medical associations, board-certified laboratory animal medicine specialists, biomedical scientists, officers of humane societies, clinical veterinary practitioners, members of veterinary school and university faculties, and veterinary-oriented students. The SVME publishes a newsletter, holds a plenary meeting with lectures and discussions at the AVMA annual convention, distributes information regarding recent publications relevant to veterinary ethics, and actively seeks to increase and elevate the level of discussion of issues in veterinary ethics. Although most members of the SVME are veterinarians, membership is not limited to veterinarians.

Swap:

A transaction which moves the maturity date of an open position to a future date.

Swap price:

A price as a differential between two dates of the swap.

Swissy:

Market slang for Swiss Franc.

برچسبها :

مقالات مرتبط

فرهنگ لغات تخصصی بازار ارز حرف B

Back: Term referring to the amount that the spot price exceeds the forward price Back Office: The office location, or department, where the processing of financial transactions takes place. Back Testing: The process of designing a trading strategy based on historical data. It is then applied to fresh data to see if and how well […]

فرهنگ لغات تخصصی بازار ارز حرف W

Wage drift: The difference between the basic wage and actual earnings including overtime and bonuses. Warrant: 1. A warrants is a form of traded option. It is a right but not obligation to buy shares in a company at a future date and at a prearranged price. 2.a type of security issued by a […]

فرهنگ لغات تخصصی بازار ارز حرف I

IBD/TIPP Economic Optimism Index:The IBD/TIPP Economic Optimism Index is the earliest and most authoritative take on consumer confidence each month and predicts with 90% reliability monthly changes in sentiment in well-known polls by The Conference Board and the University of Michigan. The IBD/TIPP Economic Optimism Index is based on a survey of 1,000-plus adults […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

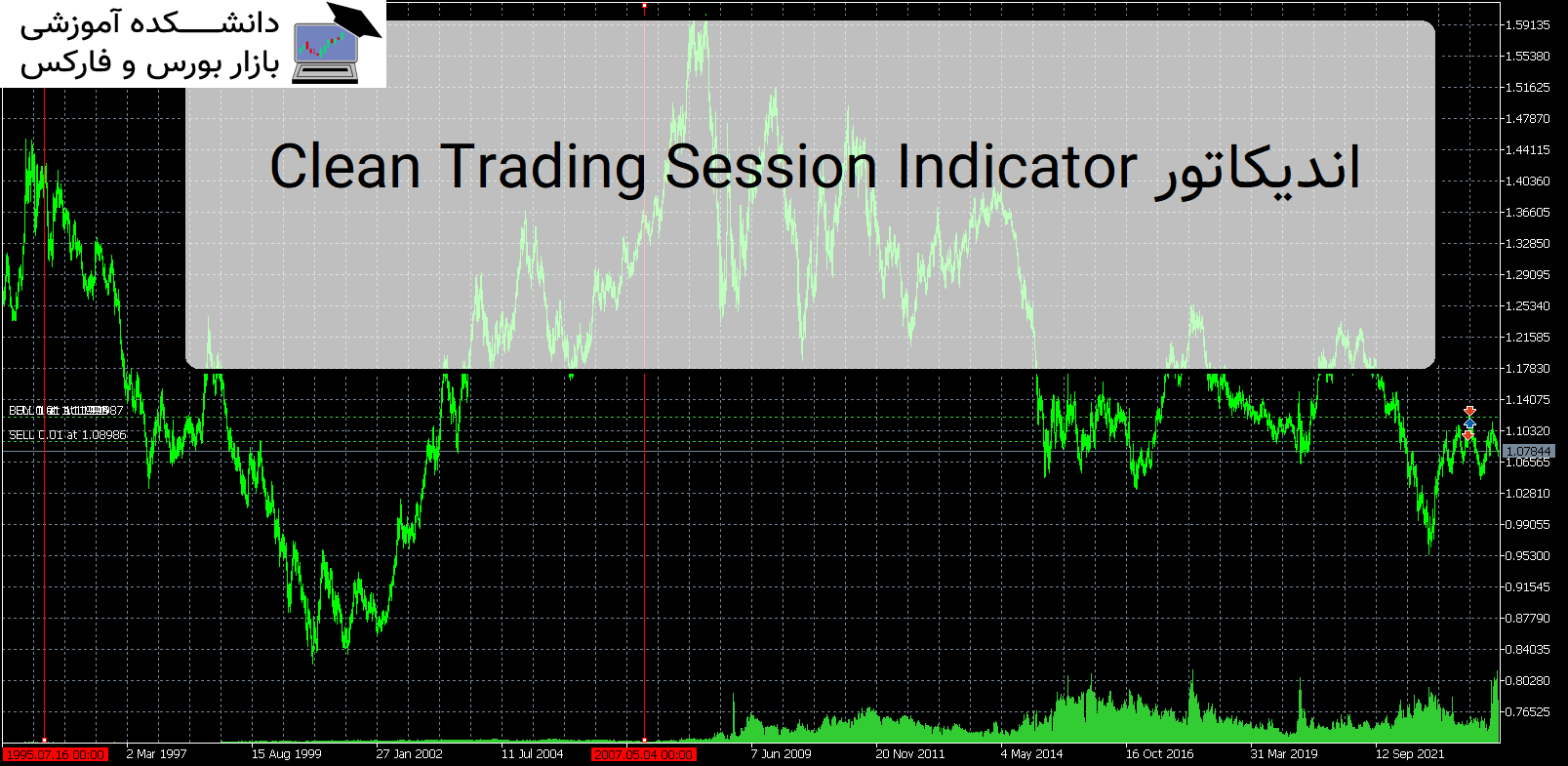

Clean Trading Session Indicator اندیکاتور MT5

معرفیو و دانلود اندیکاتور کاربردی Clean Trading Session Indicator اندیکاتور کاربردی Clean Trading Session Indicator مهم ترین جلسات معاملاتی را برای بازار فارکس مانند لندن، نیویورک، توکیو نشان می دهد. معرفی اندیکاتور کاربردی Clean Trading Session Indicator اندیکاتور Clean Trading Sessions یک شاخص ساده و در عین حال کاملاً کاربردی جلسات فارکس است که برای […]

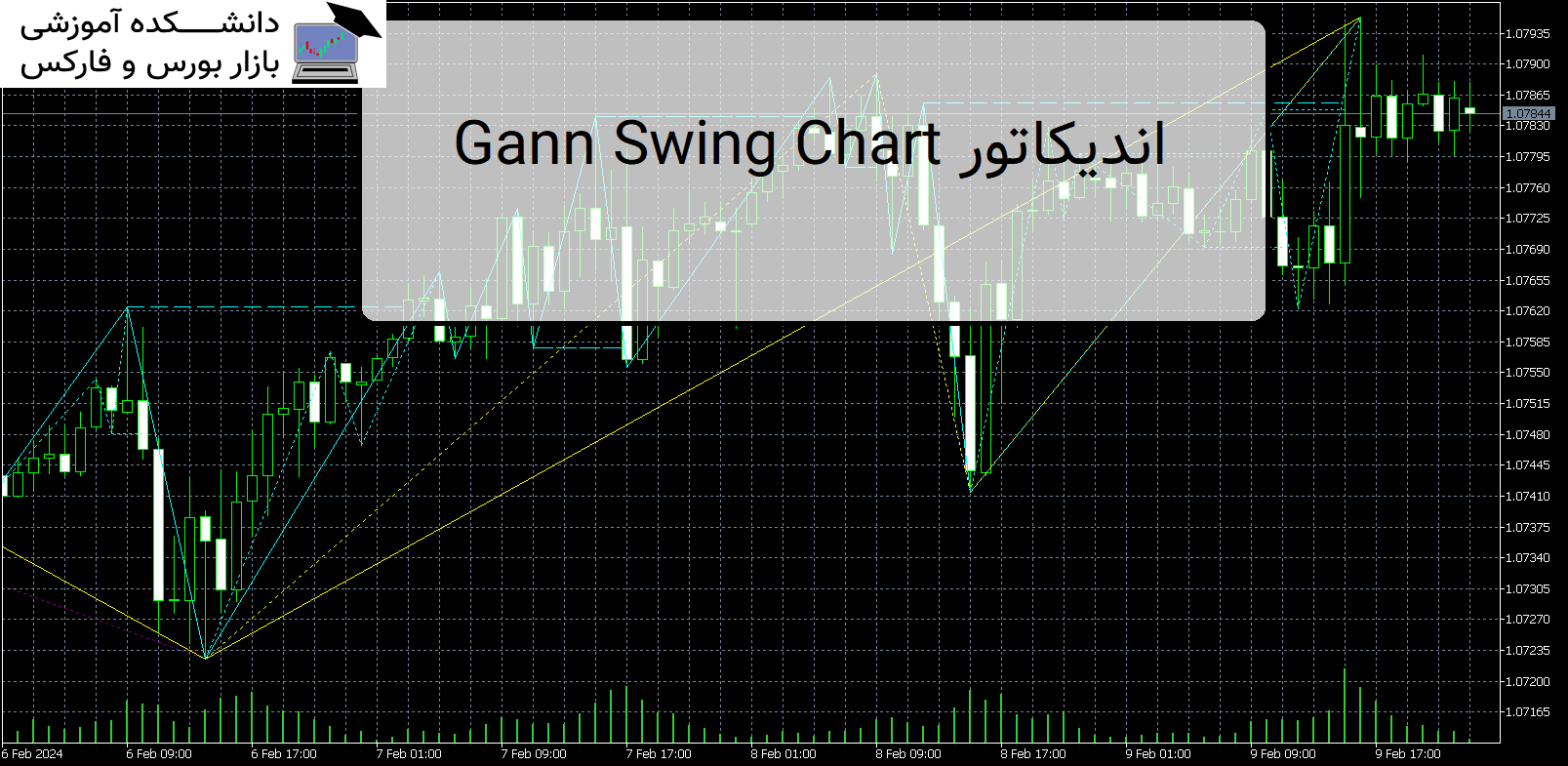

Gann Swing Chart اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی Gann Swing Chart اندیکاتور کاربردی Gann Swing Chart این اندیکاتور محبوب و کاربردی نمودار Swing گان (یک نوار) را با امواج چند لایه به معامله گران نشان می دهد. معرفی اندیکاتور کاربردی Gann Swing Chart 1. لایه موج F1: امواج گان بر اساس شمع ها ترسیم می شوند. موج SGann […]