فرهنگ لغات تخصصی بازار ارز حرف I

IBD/TIPP Economic Optimism Index:The IBD/TIPP Economic Optimism Index is the earliest and most authoritative take on consumer confidence each month and predicts with 90% reliability monthly changes in sentiment in well-known polls by The Conference Board and the University of Michigan. The IBD/TIPP Economic Optimism Index is based on a survey of 1,000-plus adults […]

IBD/TIPP Economic Optimism Index:

The IBD/TIPP Economic Optimism Index is the earliest and most authoritative take on consumer confidence each month and predicts with 90% reliability monthly changes in sentiment in well-known polls by The Conference Board and the University of Michigan. The IBD/TIPP Economic Optimism Index is based on a survey of 1,000-plus adults chosen at random nationwide. The poll is generally conducted in the first week of the month and has a margin of error of plus or minus 3.1 percentage points. The TIPP Economic Optimism Index is based upon responses to three questions: (1) In the next 6 months, do you think that economic conditions in the country will be better, worse or about the same as compared to now? (2) In the next 6 months, do you think that your personal financial situation will be better, worse or about the same as compared to now? (3) How satisfied are you with the current federal economic policies meant to keep the economy going in the right direction: Very satisfied, somewhat satisfied, not very satisfied or not at all satisfied?

ICCH=International Commodities Clearing House Limited:

A clearing house based in London operating world wide for many futures markets.

ICSC:

International Council of Shopping Centers

ICSC-UBS Store Sales:

This weekly measure of comparable store sales at major retail chains, published by the International Council of Shopping Centers, is related to the general merchandise portion of retail sales. It accounts for roughly 10 percent of total retail sales.

The ICSC-UBS index is one of the most timely indicators of consumer spending, since it is reported every week. It gets extra attention around the holiday season when retailers make most of their profits. It is also a useful indicator when special factors can cause economic activity to momentarily slide. For instance, it was widely watched in the aftermath of Hurricanes Katrina and Rita which hit New Orleans and the Gulf Coast in 2005.

IEA:

International Energy Agency

IFEMA:

International Foreign Exchange Master Agreement.

IFO:

Institut für Wirtschaftsforschung An der Universität München (German: Institute for Economic Research at the University of Munich)

ILO:

International Labor Organization

IMF:

International Monetary Fund, established in 1946 to provide international liquidity on a short and medium term and encourage liberalization of exchange rates. The IMF helps its members to tide over the balance of payments problems with supplying the necessary loans.

IMM=International Monetary Market:

The International Monetary Market (IMM), largely the creation of Leo Melamed, is part of the Chicago Mercantile Exchange (CME), the largest futures exchange in the United States and the second largest in the world after Eurex, for the trading of futures contracts and options on futures. The IMM was started on May 16, 1972. Two of the more prevalent contracts traded are currency futures and interest rate futures.

Implied Rates:

The interest rate determined by calculating the difference between spot and forward rates.

In-the-Money:

A call option is in-the-money if the price of the underlying instrument is higher than the exercise/strike price. A put option is in-the-money if the price of the underlying instrument is below the exercise/strike price.

Inconvertible Currency:

Currency which cannot be exchanged for other currencies either because it is forbidden by the foreign exchange regulations or the currency witnesses extreme volatility that it is not percieved to be a safe haven for parking the funds.

Index Linking:

The periodic adjustment of the money values of some regular scheduled payments based on the movement of the CPI or some other price index. The payments may be wages or salaries, social security or other pensions, other social security benefits, rents, interest payments, etc.

Index of Consumer Confidence:

The Index of Consumer Confidence (CCI) measures how people feel about the United States economy. It is issued monthly by The Conference Board, an independent economic research organization, and is based on 5,000 households. Such measurement is indicative of consumption component level of the gross domestic product. The Federal Reserve looks at the CCI when determining interest rate changes, and it also affects stock market prices.

Indicative Quote:

In forex trading, a currency quote that is provided by a market maker to a trading party but that is not firm. In other words, when a market maker provides an indicative quote to a trader, the market maker is not obligated to trade the given currency pair at the price or the quantity stated in the quote. Contrast this to a firm quote, in which a market maker guarantees a specified bid or ask price to a trader up to the maximum quantity specified in the quote.

Market makers will typically provide indicative quotes if a trader requests a quote for a currency pair but does not specify the quantity to be traded, or if there is some doubt as to the market maker's ability to transact the currency pair at the bid or ask quoted. The bottom line is that traders can rely on indicative quotes as a reasonable estimate of the exchange rate at which they can enter their currency trade, but there is no guarantee that this will be the rate they get.

Indirect quote:

See reciprocal currency.

Industrial New Orders:

The value of new contracts for goods produced by the manufacturing sector. A rising level of Industrial New Orders forecasts increased production and a rising GDP. There are two headline numbers released for this report, month to month and annualized change.

Industrial Production:

The index of industrial production measures the physical output of the nation's factories, mines and utilities

Industrial Production Index-IPI:

An indicator that shows the production output from industrial activities, such as mining, manufacturing and utilities. It is released by the Federal Reserve Board each month.

Inflation:

An economic condition whereby prices for consumer goods rise, eroding purchasing power.

Info Quote:

Rate given for information purposes only.

Initial Margin:

This is the deposit required by a broker in order for a trader to start a transaction.

Initial Margin Requirement:

The minimum portion of a new security purchase that an investor must pay for in cash.

Instruction:

The specification of the banks at which funds shall be paid upon settlement.

Inter-dealer Broker:

A specialist broker who acts as an intermediary between market-makers who wish to buy or sell securities to improve their book positions, without revealing their identities to other market-makers.

Interbank Rates:

The Foreign Exchange rates at which large international banks quote other large international banks.

Interest Rate Futures:

An Interest Rate Future is a futures contract with an interest-bearing instrument as the underlying asset. Examples include Treasury-bill futures, Treasury-bond futures and Eurodollar futures. The global market for exchange-traded interest rate futures is notionally valued by the Bank for International Settlements at $5,794,200 million in 2005.

Interest Rate Risk:

The potential for losses arising from changes in interest rates

Intermarket tahlil:

An tahlil of an underlying asset that incorporates examinations of various markets. Namely, four markets are examined: currencies, commodities, stocks, and bonds. Intermarket tahlil is centered on the idea that the four markets are correlated.

International Capital flows= TIC flows:

Summarizes the flow of stocks, bonds, and money market funds to and from the United States . The headline figure is the difference in value between American purchases of foreign securities and foreign purchases of American securities, expressed in millions of dollars. The Treasury International Capital or TIC statement is a major component of the American capital account and gives valuable insight into foreign demand for American investments and dollar.

A positive figure indicates that more capital is entering the US than leaving as sales of American securities to foreigners exceed American purchases of foreign securities. Such positive figures suggest that American security markets are competitive with those of other countries. Foreign security purchases are especially important in the case of a trade deficit, as a positive figure can offset the depreciating effect of a trade shortfall. On the contrary, a negative or declining TICS figure reflects a declining capital flow picture. Outflows are indicative of weaker demand for US assets which puts downward pressure on the value of the dollar.

A key feature of the TIC data is its measurement of the types of investors the dollar has; governments and private investors. Usually, a strong government holding of dollar denominated assets signals growing dollar optimism as it shows that governments are confident in the stability of the U.S. dollar. Most importantly seems to be the purchases of Asian central banks such as that of Japan and China. Waning demand by these two behemoth US Treasury holders could be bearish for the US dollar. As for absolute amount of foreign purchases, the market generally likes to see purchases be much stronger than the funding needs of that same month's trade deficit. If it is not, it signals that there is not enough dollars coming in to match dollar going out of the country. As a side note, purchases by Caribbean central banks are generally seen to be less consistent since most hedge funds are incorporated in the Caribbean. Hedge funds generally have a much shorter attention span than other investors.

International Merchandise Trade-Canada:

The difference between imports and exports of goods. Merchandise Trade differentiates itself from Trade Balance because it does not record intangibles like services, only reporting on physical goods. Because exports of tangibles like oil, gold and manufacturing contribute to a large part of Canada 's GDP, trade data can give critical insight into developments in the economy and into foreign exchange rates.

International Securities Dealers Association - ISDA:

Organization which foreign currency exchange banks have formed to regulate inter-bank markets and exchanges.

International Swaps and Derivatives Association- ISDA:

Organization defining the terms and conditions for derivative trades.

Intervention:

Action by a central bank to effect the value of its currency by entering the market.

Intra-Day limit:

Limit set by bank management on the size of each dealer's Intra Day Position.

Intra-Day Position:

Open positions run by a dealer within the day. Usually squared by the close.

Intraday:

During a single trading day.

Intrinsic Value:

The amount by which an option is in-the-money. The intrinsic value is the difference between the exercise/strike price and the price of the underlying security.

Inverted Market:

A futures market in which the nearer months are selling at premiums over the more distant months; characteristically, a market in which supplies are currently in shortage.

Investment Lending:

The value of loans provided to individuals and corporations. An increase in Investment Lending forecasts growth in the economy since greater capital investments typically finance expansions of output and productivity and usually occur in periods of high consumer and business confidence. During these periods borrowers are willing to make investments because they hold reasonable expectations that their investments will pay off in the future. By making these investments, borrowers both increase private expenditure and enhance the future productive capacity of the economy. Though, this figure typically does not have significant impact upon markets.

The figure is reported as a seasonally adjusted percentage change from the previous month.

Invisibles:

A term for exports and imports of services as distinct from merchandise

IOM:

Index and Options Market- part of the Chicago Mercantile Exchange.

IPI:

Industrial Production Index. A coincident indicator measuring physical output of manufacturing, mining and utilities.

IPO:

initial public offering: a company's first stock offering to the public.

ISDA - International Securities Dealers Association:

Organization which foreign currency exchange banks have formed to regulate inter-bank markets and exchanges.

ISM:

Institute for Supply Management

ISM Manufacturing:

ISM Manufacuring assesses the state of US industry by surveying executives on expectations for future production, new orders, inventories, employment and deliveries. Though manufacturing accounts for a relatively small portion of GDP, fluctuations in manufacturing tend to bear the most responsibility for changes in GDP. Consequently, developments in manufacturing often front run trends in the overall economy, making the ISM Manufacturing figure a leading indicator of economic turnarounds. A pickup in demand for manufactured products after a period of recession, reflected by a higher ISM figure, strongly suggests a reversal upward. Conversely a slowdown in manufacturing orders and production during a boom suggests a slowing of the economy. The ISM Manufacturing Survey is valued for its timeliness, and indeed, during waning boom cycles analyst point out that ISM tends to be one of the biggest market moving economic releases. The reasoning lies within the ISM's Prices Paid and Employment subcomponents. These components reflect sentiment towards inflation and labor conditions - two of the market's most significant health indicators. Given that the ISM's timeliness, the information gleaned from such components precedes other market data (like Non-Farm Payrolls or CPI), making the ISM a significant indicator.

The headline figure is expressed as a diffusion index based on survey responses. For each category (production, new orders etc.), the index is calculated by adding the percentage of executive responding "higher" with half the percentage of "no change" responses, and subtracting the percentage of "lower" responses. The ISM manufacturing indicator is the aggregate of the results for all categories.

Values over 50 generally indicate an expansion, while values below 50 indicate contraction.

Retail Sales can be volatile due to seasonal fluctuations in demand. Thus the headline figure is the seasonally adjusted percentage change in sales compared to the previous year.

ISM Non-Manufacturing - United States:

ISM Non-Manufacturing gauge of business conditions in non-manufacturing industries, based on measures of employment trends, prices and new orders. Though non-manufacturing sectors make up the majority of the economy, the ISM Non-Manufacturing has less market impact because non-manufacturing data tends to be more cyclical and predictable. However, these sectors do account for a considerable portion of CPI. As a result, the figure gives insight into conditions which can impact output growth and inflationary pressures.

ISO:

ISO is the short name (not acronym) for the International Organization for Standardization.

ISTAT:

Italian National Statistics Institute

Ivey Purchasing Managers Index (PMI) - Canada:

A monthly measure of the change in purchases by corporate executives. One hundred and seventy-five managers distributed among different regions and sectors are asked: "Are your purchases higher, the same, or lower than the previous month" A headline value above 50 indicates an increase in purchases from the previous month and a value below 50 indicates a decrease.

مقالات مرتبط

فرهنگ لغات تخصصی بازار ارز حرف S

S&P – Standard and Poors: A US firm engaged in assessing the financial health of borrowers. The firm also has generated certain stock indices i.e. S&&P 500. s.a: seasonally adjusted Same day transaction: A transaction that matures on the day the transaction takes place. same store sales: statistic used in retail industry tahlil. It […]

فرهنگ لغات تخصصی بازار ارز حرف Q

Quanto option: An option in which the foreign exchange risk in the underlying instrument has been removed. Quote: A simultaneous bid and offer in a currency pair. QV=Quotable Value New Zealand, Ltd: Quotable Value Limited (QV) is New Zealand’s largest valuation and property information company. QV operates from 22 offices throughout New Zealand and with […]

فرهنگ لغات تخصصی بازار ارز حرف M

M0: Cash in circulation . Only used by the UK. M1: Cash in circulation plus demand deposits at commercial banks. There are variations between the precise definitions used by national financial authorities. machin tool: A machine tool is a powered mechanical device, typically used to fabricate metal components of machines by machining, which […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

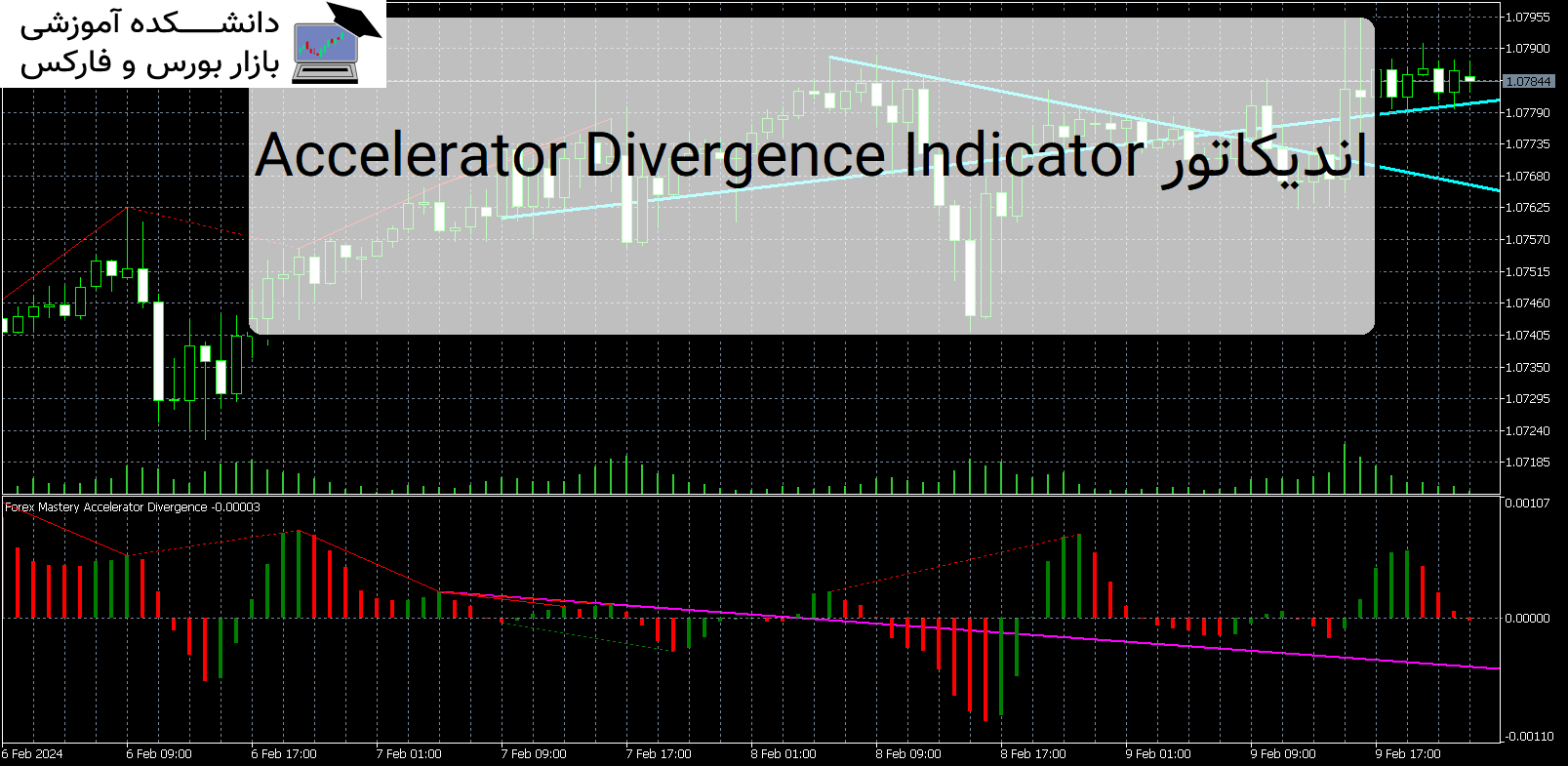

Accelerator Divergence Indicator اندیکاتور MT5

دانلود و معرفی اندیکاتور کاربردی Accelerator Divergence Indicator معرفی اندیکاتور کاربردی Accelerator Divergence Indicator ، ابزاری قدرتمند که برای ارتقای تجربه تجارت فارکس شما طراحی شده است. معرفی اندیکاتور Accelerator Divergence Indicator این شاخص نوآورانه به طور خاص برای شناسایی واگرایی بازار ساخته شده است و به معامله گران بینش ارزشمندی برای تصمیم گیری آگاهانه […]

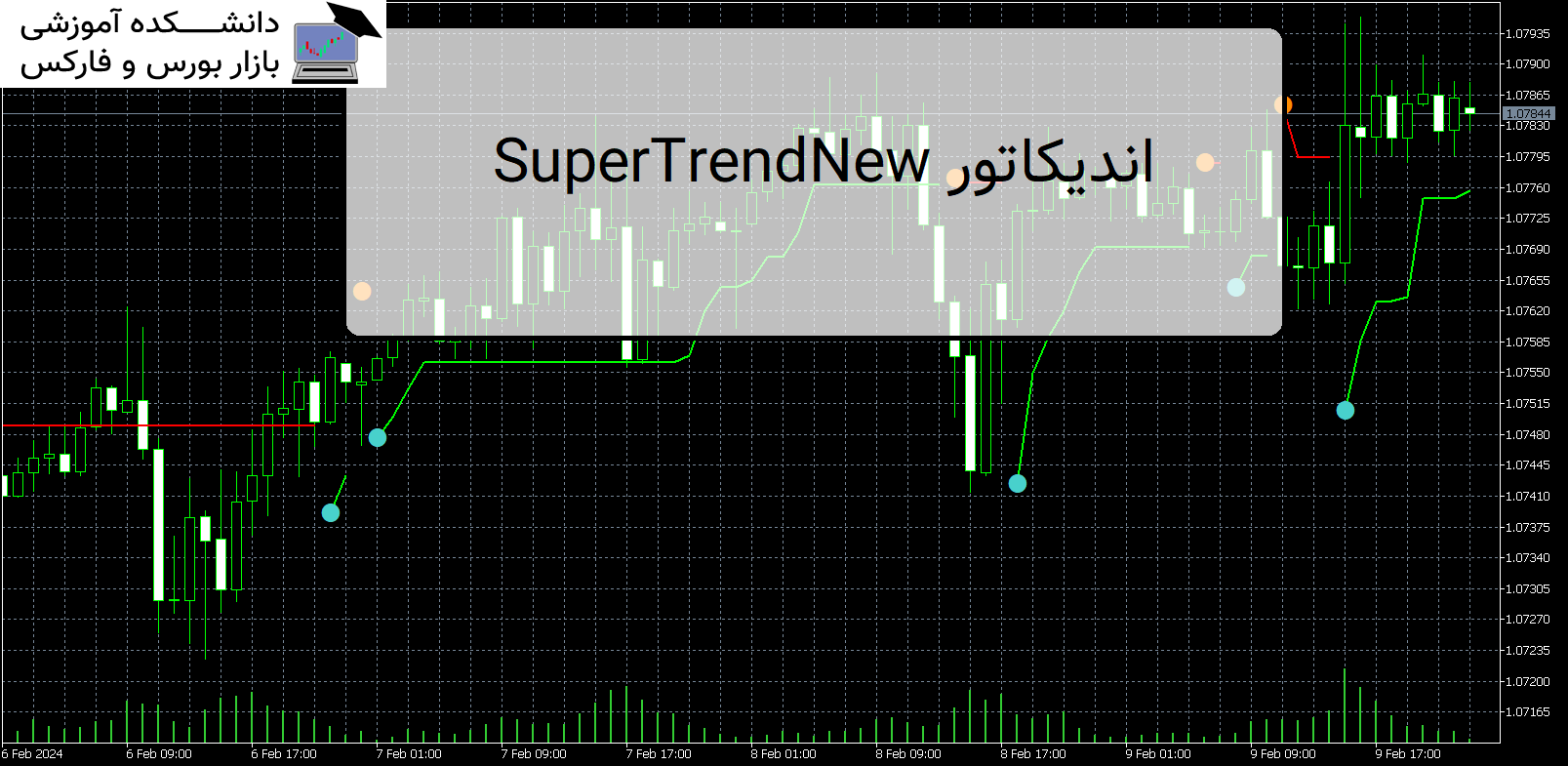

SuperTrendNew اندیکاتور MT5

معرفی و دانلود اندیکاتور SuperTrendNew SuperTrendNew به شما این امکان را می دهد که از تغییر روند سوپرترند، طولانی یا کوتاه را وارد کنید. هر دو دوره ATR و ضرب کننده ATR قابل تنظیم هستند. معرفی اندیکاتور SuperTrendNew اگر «تغییر روش محاسبه ATR» را علامت بزنید، محاسبه بر اساس SMA انجام میشود و نتایج کمی […]