فرهنگ لغات تخصصی بازار ارز حرف B

Back: Term referring to the amount that the spot price exceeds the forward price Back Office: The office location, or department, where the processing of financial transactions takes place. Back Testing: The process of designing a trading strategy based on historical data. It is then applied to fresh data to see if and how well […]

Back:

Back Office:

The office location, or department, where the processing of financial transactions takes place.

Back Testing:

The process of designing a trading strategy based on historical data. It is then applied to fresh data to see if and how well the strategy works. Most technical tahlil is tested with this approach.

Back to Back:

An arrangement in which two companies in different countries borrow each other's currency for a given period of time, in order reduce foreign exchange risk for both of them. also called parallel loans.

Backwardation:

Term referring to the amount that the spot price exceeds the forward price.

bail out:

1.To sell a security, generally at a loss, in anticipation of a further price decline.

2.Excessive selling of a firm's stock by its stockholders, perceived as a lack of their confidence in the profitability or viability of the firm.

3.To provide emergency financial help to keep a firm afloat

Balance:

Amount of money in a forex account.

Balance of Trade:

The value of a country's exports minus its imports.

Balance-of-Payments:

A systematic record of a nation's total payments to foreign countries, including the price of imports and the outflow of capital and gold, along with the total receipts from abroad, including the price of exports and the inflow of capital and gold.

Band:

The range in which a currency is permitted to move. A system used in the ERM.

BIS

Bank for International Settlements :

An international organization fostering the cooperation of central banks and international monetary policy makers. Established in 1930, it is the oldest international financial organization, and was created to administer the transaction of monies according to the Treaty of Versailles. Among others, its main goals are to promote information sharing and to be a key center for economic research.

Bank holiday:

A bank holiday is a public holiday in the United Kingdom and also in the Republic of Ireland. Although there is no legal right to time off on these days, the majority of the population not employed in essential services (e.g. utilities, fire, ambulance, police, health-workers) receive them as holidays; those employed in essential services usually receive extra pay for working on these days. Bank holidays are so called because they are days upon which banks are shut and therefore (traditionally) no other businesses could operate. Legislation allows certain payments to be deferred to the next working day

Bank Lending - Japan:

The value of all outstanding loans with Japanese banks. Bank lending is important because lending increases with increased business confidence and investment. It is particularly insightful for the Japanese economy because of the weakness that has plagued the Japanese banking sector. The headline number is for total loans and discounts and is a percentage change from the previous year.

Bank Line:

Line of credit granted by a bank to a customer, also known as a " line".

Bank Notes:

Paper issued by the central bank, redeemable as money and considered to be full legal tender.

Bank of England Meeting Minutes - United Kingdom:

The Bank of England Monetary Policy Committee keeps notes from its rate decision meetings. The detailed minutes from these meetings give some of the best insight into the monetary policy decision making process and what the BOE thinks about economic developments inside and outside of the UK.

Bank Rate:

The rate at which a central bank is prepared to lend money to its domestic banking system.

Bar Chart:

A type of chart which consists of four significant points: the high and the low prices, which form the vertical bar, the opening price, which is marked with a little horizontal line to the left of the bar, and the closing price, which is marked with a little horizontal line of the right of the bar.

Base Currency:

In terms of foreign exchange trading, currencies are quoted in terms of a currency pair. The first currency in the pair is the base currency. The base currency is the currency against which exchange rates are generally quoted in a given country. Examples: USD/JPY, the US Dollar is the base currency; EUR/USD, the EURO is the base currency.

Base Price:

the initial price of something (goods or services) without the additional charges that may be added, such as handling or shipping charges, sales tax, optional equipment charges, etc.

Base Rate:

The UK base rate is the equivalent to the prime rate in the United States, generally the average interest rate that British banks charge to their customers.

Basing:

A period in which a stock price has very little or no trend. The resulting price pattern is a flat line.

Basis:

1. The difference between the cash price and futures price

2.Purchase price, including commissions and other expenses, used to determine capital gains and capital losses for tax purposes. This can be determined by several methods. For a purchased investment, the basis is the amount paid. If inherited, the basis is the value of the stock on the date of the original owner's death. If received as a gift, the basis is the amount that was originally paid for the investment, unless the market value of the investment on the date the gift was given was lower. also called cost basis or tax basis.

Basis Convergence:

The process whereby the basis tends towards zero as the contract expiry approaches.

Basis Point:

1.A Basis Point is defined as 1/100 of 1%, and is used to note changes in the rates of financial instruments. Basis points, or bps for short, are most commonly used in quoting interest rate and yield changes. If the FOMC were to change interest rates from 1.00% to 1.25%, we would say the FOMC increased rates 25 basis points (bps). 2.A phrase used to describe differences in bond yields, with one basis point representing one-hundredth of a percentage point. Thus if Bond X yields 8.5 per cent and Bond Y 8.75 per cent, the difference is 25 basis points.

Basis Price:

The price expressed in terns of yield maturity or annual rate of return.

Basis Trading:

Taking opposite positions in the cash and futures market with the intention of profiting from favorable movements in the basis.

Basket:

A group of currencies normally used to manage the exchange rate of a currency. Sometimes referred to as a unit of account.

BBA:

British Bankers Association

BCI

Business Cycle Indicator:

Conference Board and used to forecast changes in the direction of the overall economy of a country. They can be used to confirm or predict the peaks and troughs of the business cycle and are published for the U.S., Mexico, France, the U.K., South Korea, Japan, Germany, Australia and Spain.

Interpretation of BCI involves much more than simply reading graphs - an economy is too complex to be summarized with just a few statistics. Although past business cycles have shown patterns that are likely to be repeated to some degree, business cycles can start and end quite quickly for reasons that an indicator may not account for. Thus, investors, traders and corporations must realize that it is unreasonable to believe that any single indicator, or even set of indicators, always gives true signals and never fails to foresee a turning point in an economy.

Bear:

A person who believes that prices will decline.

Bear Call Spread:

A spread designed to exploit falling exchange rates by purchasing a call option with a high exercise price and selling one with a low exercise price.

Bear Market:

An extended period of general price decline in an individual security, an asset, or a market.

Beige Book - United States:

1.Report on current economic conditions in each of the 12 Federal Reserve districts covering the entire US. Regional Banks in the Federal Reserve System gather anecdotal information based on surveys of executives, economist and market participants. The Beige Book summarizes this data into a relatively short document, giving a picture of economic trends and challenges faced by different parts of the nation.

2.This book is produced roughly two weeks before the monetary policy meetings of the Federal Open Market Committee. On each occasion, a different Fed district bank compiles anecdotal evidence on economic conditions from each of the 12 Federal Reserve districts.

This report on economic conditions is used at FOMC meetings, where the Fed sets interest rate policy. These meetings occur roughly every six weeks and are the single most influential event for the markets. Market participants speculate for weeks in advance about the possibility of an interest rate change that could be announced upon the end of these meetings. If the outcome is different from expectations, the impact on the markets can be dramatic and far-reaching.

If the Beige Book portrays an overheating economy or inflationary pressures, the Fed may be more inclined to raise interest rates in order to moderate the economic pace. Conversely, if the Beige Book portrays economic difficulties or recessionary conditions, the Fed may see the need to lower interest rates in order to stimulate activity.

Bid:

The price at which an investor can place an order to buy a currency pair; the quoted price where an investor can sell a currency pair. This is also known as the 'bid price' and 'bid rate'.

Bid Price:

The bid is the price at which the market is prepared to buy a specific Currency in a Foreign Exchange Contract or Cross Currency Contract. At this price, the trader can sell the base currency. It is shown on the left side of the quotation. For example, in the quote USD/CHF 1.4527/32, the bid price is 1.4527; meaning you can sell one US dollar for 1.4527 Swiss francs.

Bid-Offer Spread:

The difference between the buy (bid) and sell (offer) price of a currency or financial instrument.

Bid/Ask Spread:

The point difference between the bid and offer (ask) price.

Big Figure:

The stem, or whole dollar price, of a quote, often used in reference to foreign currencies or money markets. For example, if a foreign currency was trading at 108.3457 and a money market security was trading at 108.6666, both would have big figures of 108. Traders will often not mention the big figure when quoting a security, assuming that other traders know this number.

In the U.S., the big figure is often referred to as the handle.

Bilateral Clearing:

A system used where foreign currency is limited. Payments are usually routed through the central banks, and sometimes require that the trade balance is equaled every year.

BIS

Bank for International Settlements:

An international organization fostering the cooperation of central banks and international financial institutions. Essentially, the BIS, located in Basel, Switzerland, is a central bank for central banks. It monitors and collects data on international banking activity and promulgates rules concerning international bank regulation.

Black-Scholes Model:

An option pricing formula initially derived by Fisher Black and Myron Scholes for securities options and later refined by Black for options on futures. It is widely used in the currency markets.

Blocked Currency:

Any currency that is mainly used for domestic transactions and does not freely trade on a forex market (usually due to government restrictions). Also referred to as a "nonconvertible currency".

It is very difficult (if not impossible) to convert the blocked currency into a freely traded one such as the U.S. dollar.

Blotter:

A record of trades and the details of the trades made over a period of time (usually one trading day). The details of a trade will include such things as the time, price, order size and a specification of whether it was a buy or sell order. The blotter is usually created through a trading software program that records the trades made through a data feed.

The purpose of a trade blotter is to carefully document the trades so that they can be reviewed and confirmed by the trader or the brokerage firm. The blotter is used in the stock market, foreign exchange market, and the bond market and can be customized based on the needs of the user.

blue chips:

A blue chip stock is the stock of a well-established company having stable earnings and no extensive liabilities. Most blue chip stocks pay regular dividends, even when business is faring worse than usual. They are valued by investors seeking relative safety and stability, though prices per share are usually high. Typically, such stocks are perceived to offer reliable returns, low yield, and low risk. Many blue chips are components of popular indices, such as the Dow Jones Industrial Average and the S&P 500.

BoC

Bank of Canada:

The central bank of Canada, that came into existence after the passing of the Bank of Canada Act in 1935, influences the country's economy and money supply.

BoJ

Bank of Japan:

Headquartered in the business district of Nihonbashi in Tokyo, the Bank of Japan is the Japanese central bank. The bank is responsible for issuing and handling currency and treasury securities, implementing monetary policy, maintaining the stability of the Japanese financial system, and providing settling and clearing services.

Like most central banks, the Bank of Japan also compiles and aggregates economic data and produces economic research and tahlil.

Bollinger Bands:

The basic interpretation of Bollinger Bands is that prices tend to stay within the upper and lower bands. The distinctive characteristic of Bollinger Bands is that the spacing between the bands varies based on the volatility of the prices.

During periods of extreme price changes (i.e., high volatility), the bands widen to become more forgiving. During periods of low volatility, the bands narrow to contain foreign exchange prices. The bands are plotted two standard deviations above and below a simple moving average. They indicate a "sell" when above the moving average (or close to the upper band) and a "buy" when below it (or close to the lower band). The bands are used by some FX traders in conjunction with other analyses, including RSI, MACD, CCI, and Rate of Change.

Bond:

Bonds are issued by governments, companies and other entities and individuals in return for cash from lenders and investors. The borrower pays interest to the lender or investor through the life of the bond.

Book:

In a professional trading environment, a 'book' is the summary of a trader's or desk's total positions.

Booked:

The recording of a transaction outside the country where the transaction is itself negotiated.

BOP:

Balance of Payments

Boris:

Slang for Russian trading.

BRC:

British Retail Consortium

BRC Shop Price Index - UK:

A monthly indicator of price changes at the most popular retail outlets in the United Kingdom. The index takes into account five hundred of the most commonly purchased goods and gives insight into consumer-price inflation. Shop Prices differentiate themselves from British CPI by coming out days before the headline inflation figure. Increases in the BRC Shop Price Index are bullish for the Pound, given that the Bank of England usually raises interest rates to control inflation reflected in the BRC. Conversely, a falling BRC Shop Price Index suggests falling price pressures.

Break Out:

Technical tahlil term used to describe price action rising above resistance or dropping below support.

Break-Even Point:

1. In general, the point at which gains equal losses. 2. In options, the market price that a stock must reach for option buyers to avoid a loss if they exercise. For a call, it is the strike price plus the premium paid. For a put, it is the strike price minus the premium paid.

Bretton Woods:

The site of the conference which in 1944 led to the establishment of the post war foreign exchange system that remained intact until the early 1970s. The conference resulted in the formation of the IMF. The system fixed currencies in a fixed exchange rate system with 1% fluctuations of the currency to gold or the dollar.

Bretton Woods Accord of 1944:

An agreement that established fixed foreign exchange rates for major currencies, provided for central bank intervention in the forex market, and set the price of gold at US$35 per ounce. The agreement lasted until 1971.

Bretton Woods Agreement of 1944:

An agreement that established fixed foreign exchange rates for major currencies, provided for central bank intervention in the currency markets, and pegged the price of gold at US $35 per ounce. The agreement lasted until 1971, when President Nixon overturned the Bretton Woods agreement and established a floating exchange rate for the major currencies.

BRC

British Retail Consortium:

The British Retail Consortium (or BRC) is one of the leading trade associations in the United Kingdom. They represent all forms of retailers from small, independently owned stores, to big chain stores and department stores.

Broad Liquidity:

A category of the money supply which includes: all funds in M3, individual holdings in accounts, savings bonds, T-bills with maturity of less than one year, commercial papers, and banker's acceptances.

This is the widest measure of money supply. Broad liquidity can be generalized as the total amount of money issued by a central bank plus any new money created by commercial banks through lending. This is one of the economic measures that policy-makers and investors use to track and forecast inflation.

Broken Dates:

Deals that are undertaken for value dates that are not standard periods e.g. 1 month. The standard periods are 1 week, 2 weeks, 1,2,3,6, and 12 months.

Broker:

An individual or firm which acts as an intermediary between a buyer and seller, usually charging a commission. For securities and most other products, a license is required.

Brokerage:

Commission charged by a broker.

BSA:

Building Societies Association (UK)

BSI:

British Standards Institution

BUBA:

Bundesbank, the reserve bank of Germany.

Bull:

A person who believes that prices will rise.

Bull Market:

A market which is on a consistent upward trend.

Bulldogs:

Sterling bonds issued in the UK by foreign institutions.

Bundesbank:

Germany's Central Bank.

Business Climate:

Business climate indicates how states state, regional and local policies, relationships and local communities support business development. Ultimately, a good business climate allows businesses to conduct their affairs with minimal interference while accessing quality high inputs and customers at low costs. While no business climate is perfect for every kind of company, certain attributes of the regional or local economy allow investors to find fewer risks and higher returns when compared to other places.

Key factors used in the measure of business climate include:

Business and income tax levels Workforce availability Energy costs Market size Quality of services Cost of living Quality of life Environmental regulation Permitting, licensing, and various reporting regulations Real estate costs and availability Infrastructure Access to financing and capital Incentive

Business Conditions Survey:

The Business Conditions Survey is a quarterly survey that requests manufacturers' opinions on production impediments, finished product inventory levels, new and unfilled order levels and production and employment prospects in the coming three months.

The Business Conditions Survey is conducted in January, April, July and October; the majority of responses are recorded in the first two weeks of these months. Results are based on replies from over 3,000 manufacturers and are weighted by a manufacturer's shipments or employment. Consequently, larger manufacturers have a correspondingly larger impact on the results than smaller manufacturers.

BCI:

Business Cycle Indicator

Composite of leading, lagging and coincident indexes created by the Conference Board and used to forecast changes in the direction of the overall economy of a country. They can be used to confirm or predict the peaks and troughs of the business cycle and are published for the U.S., Mexico, France, the U.K., South Korea, Japan, Germany, Australia and Spain.

Interpretation of BCI involves much more than simply reading graphs - an economy is too complex to be summarized with just a few statistics. Although past business cycles have shown patterns that are likely to be repeated to some degree, business cycles can start and end quite quickly for reasons that an indicator may not account for. Thus, investors, traders and corporations must realize that it is unreasonable to believe that any single indicator, or even set of indicators, always gives true signals and never fails to foresee a turning point in an economy.

Business Inventories:

Business inventories are the dollar amount of inventories held by manufacturers, wholesalers, and retailers. The level of inventories in relation to sales is an important indicator of the near-term direction of production activity.

Rising inventories can be an indication of business optimism that sales will be growing in the coming months. By looking at the ratio of inventories to sales, investors can see whether production demands will expand or contract in the near future. For example, if inventory growth lags sales growth, then manufacturers will have to boost production lest commodity shortages occur. On the other hand, if unintended inventory accumulation occurs (that is, sales do not meet expectations), then production will probably have to slow while those inventories are worked down. In this manner, the business inventory data provide a valuable forward-looking tool for tracking the economy

Buy and Hold:

An investment strategy in which stocks are bought and then held for a long period, regardless of the market's fluctuations. The buy and hold approach to investing in stocks rests upon the assumption that in the very long term (over the course of, say, 10 or 20 years) stock prices will go up, but the average investor doesn't know what will happen tomorrow. Historical data from the past 50 years supports this claim. The logic behind the idea is that in a capitalist society the economy will keep expanding, so profits will keep growing and both stock prices and stock dividends will increase as a result.

There may be short term fluctuations, due to business cycles or rising inflation, but in the long term these will be smoothed out and the market as a whole will rise. Two additional benefits to the buy and hold strategy are that trading commissions can be reduced and taxes can be reduced or deferred by buying and selling less often and holding longer.

buy in:

Making purchase of a security to cover a previous sale of the same security. In case the seller is unable to deliver on the due date, the buyer can buy the security from some other seller and the original (defaulting) seller will have to make up the price difference. Also called buying-in.

Buy Limit Order:

An order to execute a transaction at a specified price (the limit) or lower.

Buy On Margin:

The process of buying a currency pair where a client pays cash for part of the overall value of the position. The word margin refers to the portion the investor puts up rather than the portion that is borrowed.

Buy stop:

A buy order which is to be held until the market price rises to a specified stop price, at which point it becomes a market order. This is not permitted for over-the-counter trading.

Buy Stop Order:

A Buy Stop is a Stop Order that is placed ABOVE the current dealing Ask price and is not activated until the market Ask price is at or above the Stop Price. The buy stop order, once triggered, becomes a market order to buy at the current market price.

Buyer's Market:

A condition of the market in which there is an abundance of goods available and hence buyers can afford to be selective and may be able to buy at less than the price that previously prevailed.

Buying Rate:

Rate at which the forex market and a market maker in particular is willing to buy the currency. Sometimes called bid rate.

Buying Selling FX:

Buying and selling in the foreign exchange market always happens in the currency which is quoted first. "Buy dollar/mark" means buy the dollar/sell the mark. Traders buy when they expect a currency's value to rise and sell when they expect a currency to fall.

برچسبها :

مقالات مرتبط

فرهنگ لغات تخصصی بازار ارز حرف M

M0: Cash in circulation . Only used by the UK. M1: Cash in circulation plus demand deposits at commercial banks. There are variations between the precise definitions used by national financial authorities. machin tool: A machine tool is a powered mechanical device, typically used to fabricate metal components of machines by machining, which […]

فرهنگ لغات تخصصی بازار ارز حرف D

Daily Trading Limit: The highest and lowest prices that a commodity or option is permitted to reach in a given trading session. Once reached, no trading occurs on that commodity or option until the following session. also called fluctuation limit or price limit. Day Order: A buy or sell order that will expire automatically […]

فرهنگ لغات تخصصی بازار ارز حرف U

U.S. Dollar Index =USDX: A measure of the value of the U.S. dollar relative to majority of its most significant trading partners. This index is similar to other trade-weighted indexes, which also use the exchange rates from the same major currencies. Currently, this index is calculated by factoring in the exchange rates of six […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

Renko Box اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی Renko Box Renko Box مبنای تشکیل نمودار رنکو محدوده قیمت است. اگر قیمت از حد خود فراتر رود، نمودار یک کادر بالاتر یا پایین تر از قبلی را نشان می دهد. اندیکاتور Renko Box در نتیجه، شاهد حرکت قیمت بدون «نویز» اضافی و سطوح حمایت و مقاومت مهم هستیم. امکانات. […]

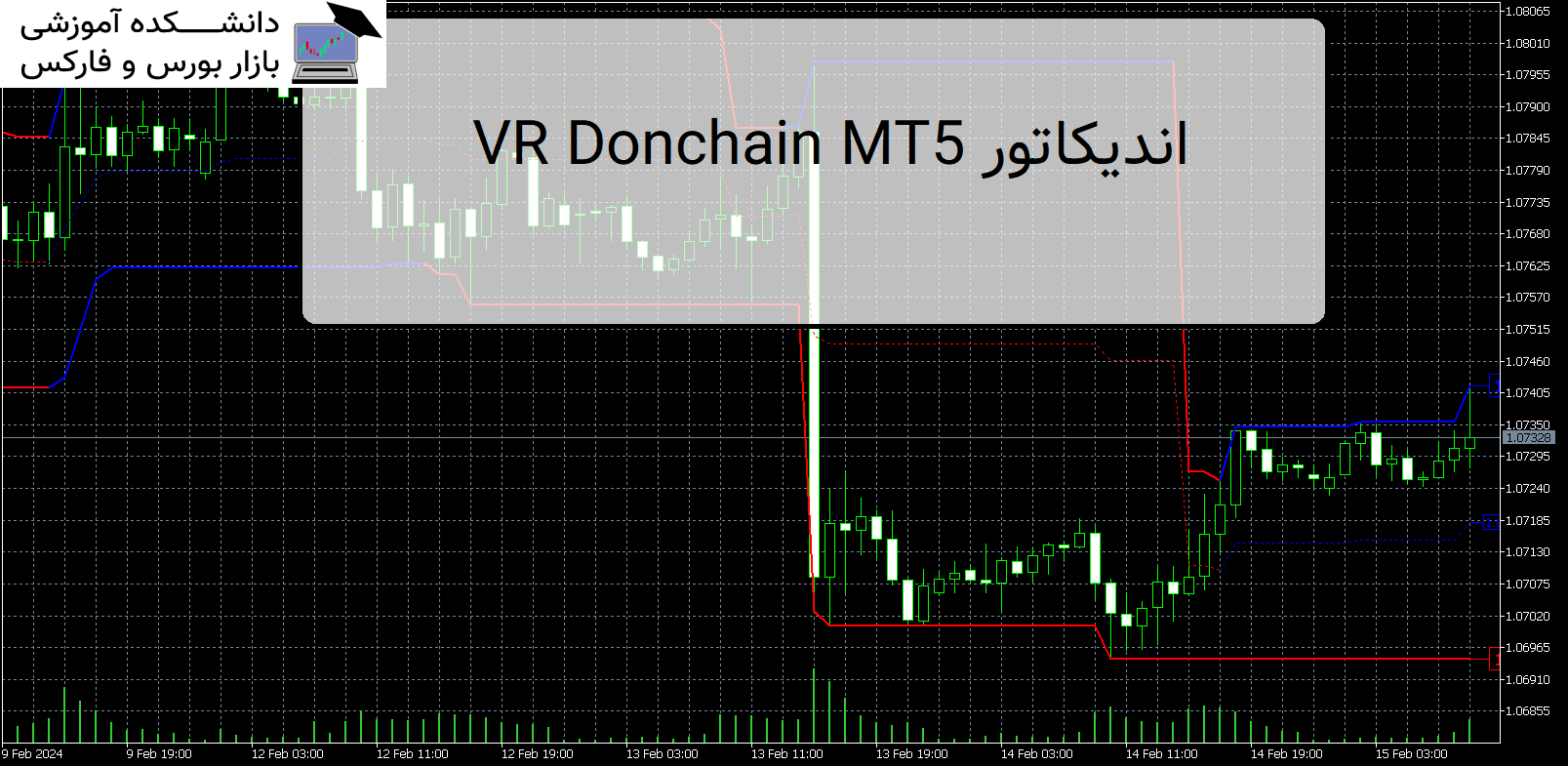

VR Donchian MT5 دانلود اندیکاتور

معرفی و دانلود اندیکاتور کاربردی VR Donchian MT5 نشانگر VR Donchian MT5 یک نسخه بهبود یافته از کانال Donchian است. تقریباً در تمام عملکردهای کانال بهبودهایی صورت گرفته است، اما الگوریتم اصلی و ساخت کانال حفظ شده است. اندیکاتور VR Donchain MT5 نشانگر اکنون رنگ سطوح را بسته به روند فعلی تغییر می دهد – […]