Ahn And Cheung-The Intraday Patterns Of The Spread And Depth In A Market Without Market Makers – The Stock Exchange Of Hong Kong

Hong Kong We examine the temporal behavior of the spread and depth for common stocks listed on the Stock Exchange of Hong Kong (SEHK), which operates as a purely order-driven mechanism. We find U-shaped intraday and intraweek patterns in the spread and reverse U-shaped patterns in the depth. Our finding is consistent with that of […]

Hong Kong

We examine the temporal behavior of the spread and depth for

common stocks listed on the Stock Exchange of Hong Kong (SEHK),

which operates as a purely order-driven mechanism. We find

U-shaped intraday and intraweek patterns in the spread and reverse

U-shaped patterns in the depth. Our finding is consistent with

that of the study of Lee et al. (1993) [Lee, C.M.C., Mucklow,

B., and Ready, M.J., 1993, Spreads, depths, and the impact of

earnings information: an intraday tahlil, Review of Financial Studies

6, 345–374] of New York Stock Exchange (NYSE) stocks that wide spreads

are associated with small depths and narrow spreads are associated

with large depths. The negative association between spread and depth

on the SEHK implies that limit order traders actively manage both price and quantity dimensions

of liquidity by adjusting the spread and depth. Further, larger spreads and narrower depths around

the market open and close indicate a trading strategy by limit order traders to avoid possible

losses from trading with informed traders when the adverse selection problem is severe.

The paper provides further evidence that U-shaped spread and reverse U-shaped depth

patterns should not be solely attributed to specialist market making activities.

Hong Kong

.

برچسبها :

مقالات مرتبط

Daniel A Strachman Essential Stock Picking Strategies

Stock Picking Beating the market is every investor’s dream. Super Stockpicking Strategiesallows investors on Main Street to gain the consistent success(&profits)of the pros on Wall Street.This complete investment resource identifies successful stock-picking strategies and shares insights that help professional money managers make investment decisions. Stock Picking

DeMarkTom – DeMark on day-trading options

The option day trading blueprint you’ve been waiting for! Options day trading is no walk in the park. But it is your most potentially profitable way to take advantage of the day-trading phenomenon. Put the odds in your favor with Demark on Day DeMark and Thomas DeMark, Jr. Forget complicated formulas! Instead, this nuts-and-bolts guide […]

Walker, Myles Wilson – How To Indentify High-Profit Elliott Wave Trades in Real Time

This book finally transforms the Elliott Wave Theory into a practical, usable trade selection system. Mr. Walker calls his dynamic new trading approach the C Wave method. As a novice student, you would not expect to grasp the difficult concepts of Elliott’s Wave Principle instantly. Understanding and successfully using this methodology for analyzing market price […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

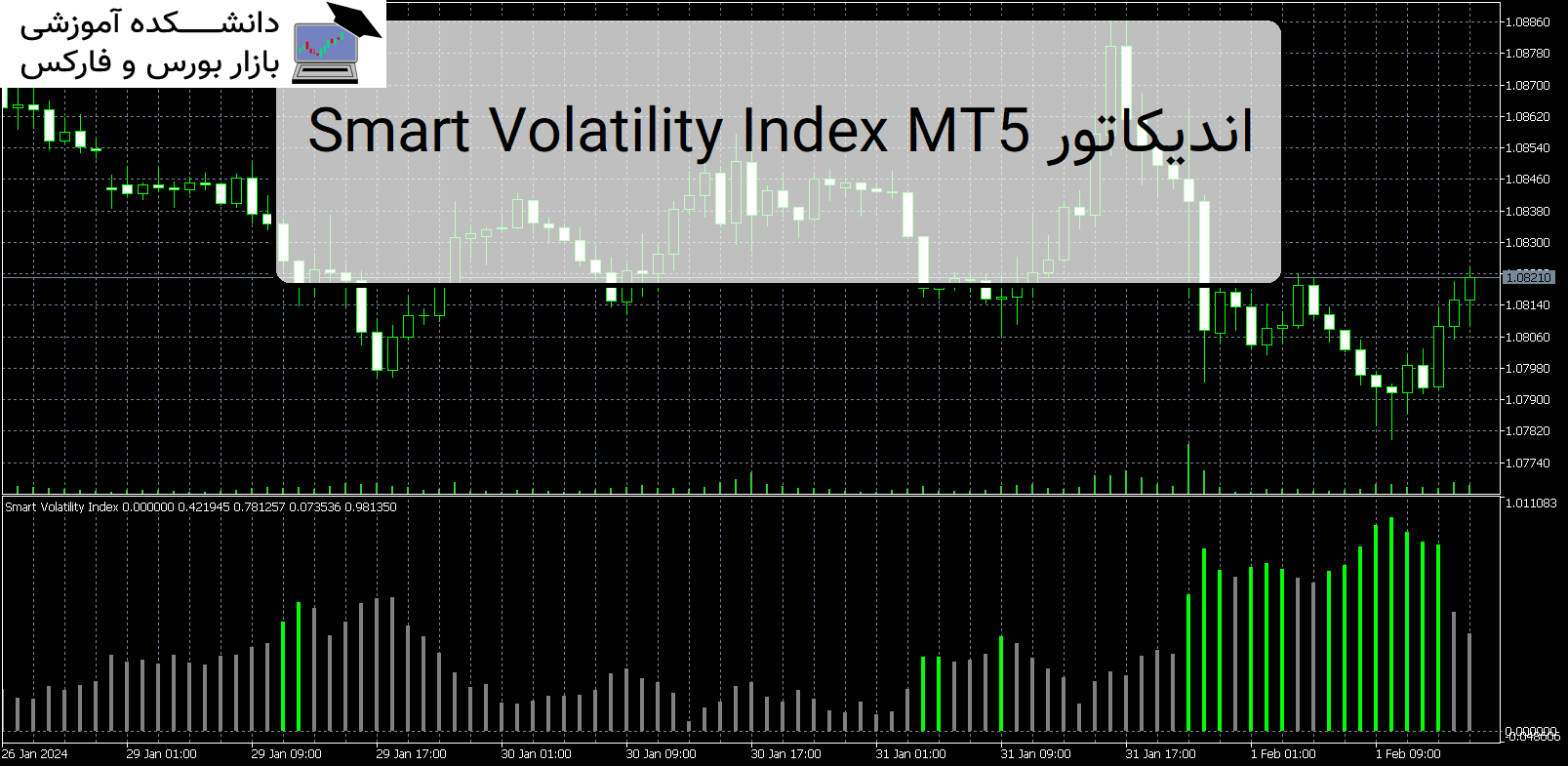

Smart Volatility Index MT5 اندیکاتور

معرفی و دانلود اندیکاتور کاربردی Smart Volatility Index MT5 Smart Volatility Index MT5 از محبوب ترین و با رتبه بندی بالای شاخص نوسانات (VIX) در بازار است. این خوانش همان چیزی است که VIX برای شاخص های سهام انجام می دهد. معرفی اندیکاتور کاربردی Smart Volatility Index MT5 با این حال، این شاخص در تمام […]

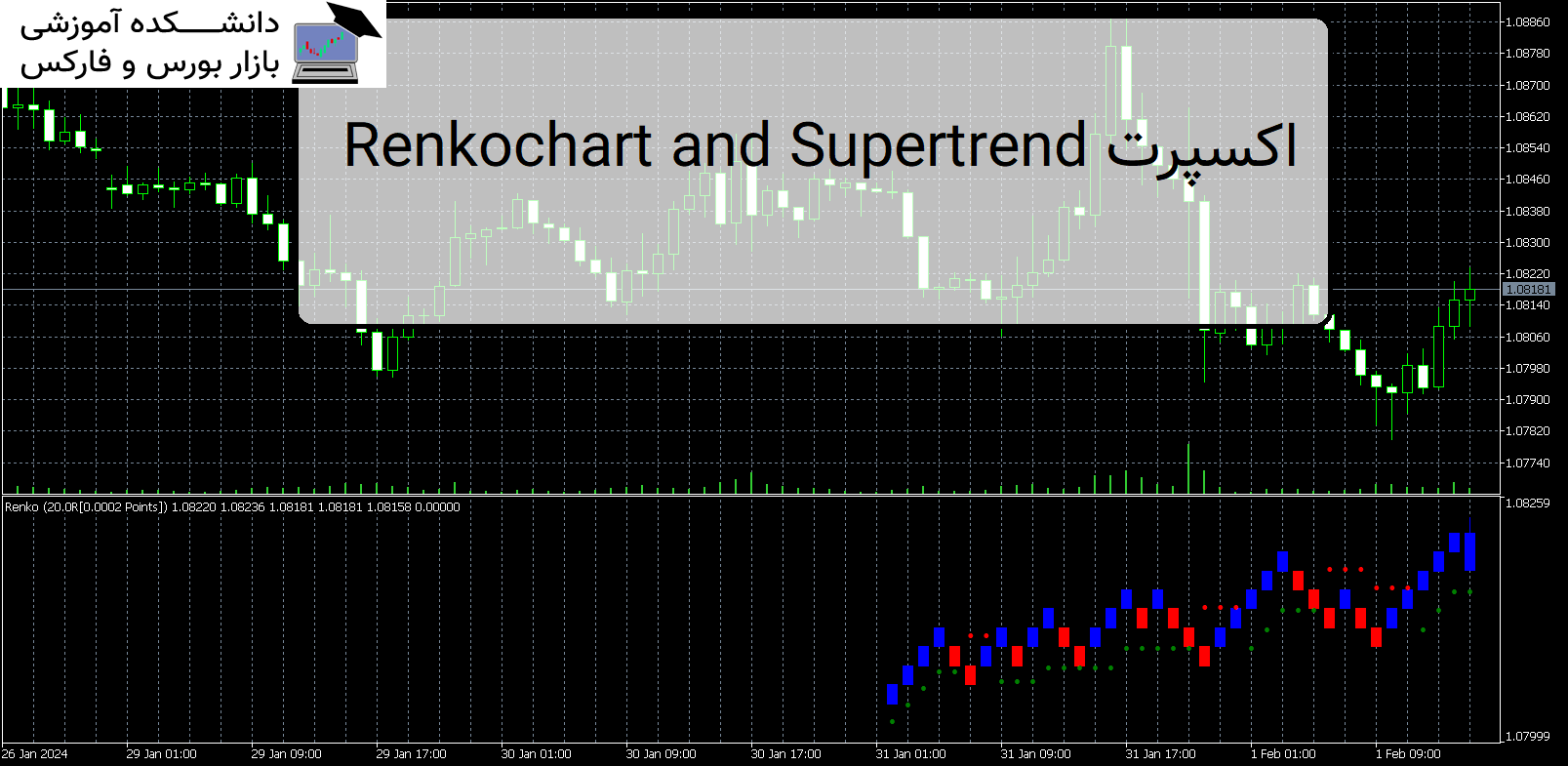

Renkochart and Supertrend اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی Renkochart and Supertrend Renkochart and Supertrend شاخص فوق روند را در زمان واقعی نمایش می دهد. پس از نصب اندیکاتور، پنجره نمودار Renko و نشانگر supertrend را در همان پنجره نمایش می دهد. معرفی اندیکاتور کاربردی Renkochart and Supertrend این به شما این امکان را میدهد که نقاط ورودی و […]

-

فایل های که پسوند آنها rar یا zip یا 7z هست را چگونه باز کنم؟

توسط نرم افزار Winrar فایل را از حالت فشرده خارج کنید و بعد برای اجرا و یا نصب اقدام کنید. دانلود WINRAR

فایل های با فرمت mq4 و mq5 را چگونه اجرا کنم ؟جهت اجرای این نوع فایل ها برای نسخه mq4 باید متاتریدر 4 را روی سیستم خود و برای نسخه mq5 متاتریدر 5 را روی سیستم عامل خود نصب داشته باشید . جهت راهنمایی کلیک کنید

-

رمز تمامی فایل ها :

- عنوان مقاله : ...Ahn And Cheung-The Intraday Patterns Of

- نوع فایل : PDF

- حجم فایل : 160 کیلوبایت