Some Quantitative Tests for Stock Price Generating Models and Trading Folklore

Five stock price sequences are examined quantitatively for structure as predicated by: 1) a random walk model; 2) a continuously differentiable price process; 3) a dynamic model consisting of transients of 8. discrete process. The first and third models also make predictions in agreement with trading lore. The date are examined by the method of […]

Five stock price sequences are examined quantitatively for structure as predicated by:

1) a random walk model; 2) a continuously differentiable price process; 3) a dynamic model consisting of transients of 8. discrete process.

The first and third models also make predictions in agreement with trading lore. The date are examined by the method of coincident events. Positive evidence is found for both the random Walk and discrete transient model, and slightly against the continuous price process. The theoretical predictions seems better confirmed by data at price minima than price maxima . The data are in partial disagreement with the predictions of both the random Walk and discrete transient model that large Volume and large second differences of price should tend to occur at the same time. Some confirmation is found for items of trading lore not predicted by theory. The non-random properties of stock prices are primarily found in short interval (daily and weekly) and in individual stock prices as opposed to an average.

برچسبها :

مقالات مرتبط

Jamie Rogers – Strategy, Value And Risk-The Real Options Approach

The surge of innovation in information technology at the end of the twentieth century reduced the cost of communications, which facilitated the globalisation of the production and capital markets. Globalisation has in turn spurred competition and consequently innovation. Sustainable competitive advantage is an increasingly difficult proposition in this environment, which raises a number of issues […]

Gann Wheel

Gann Wheel History usually repeats itself, the relationship between your previous as well as the future hasn’t been revealed before W. D. Gann. Gann stipulated which in financial market market covers and bottoms are associated by amounts and angles. \Gann wheel is definitely an esoteric market evaluation method, that W.D Gann sometimes known because it […]

gimmibar

gimmibar The \Gimmee bar comes from one of the oldest formations known to traders, the reversal bar at the end of ris ing or fall ing prices when a market is seen overall to be going sideways. Although there cognition of reversal bars is ancient, using them in combination with Bollinger Bands is not ancient. […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

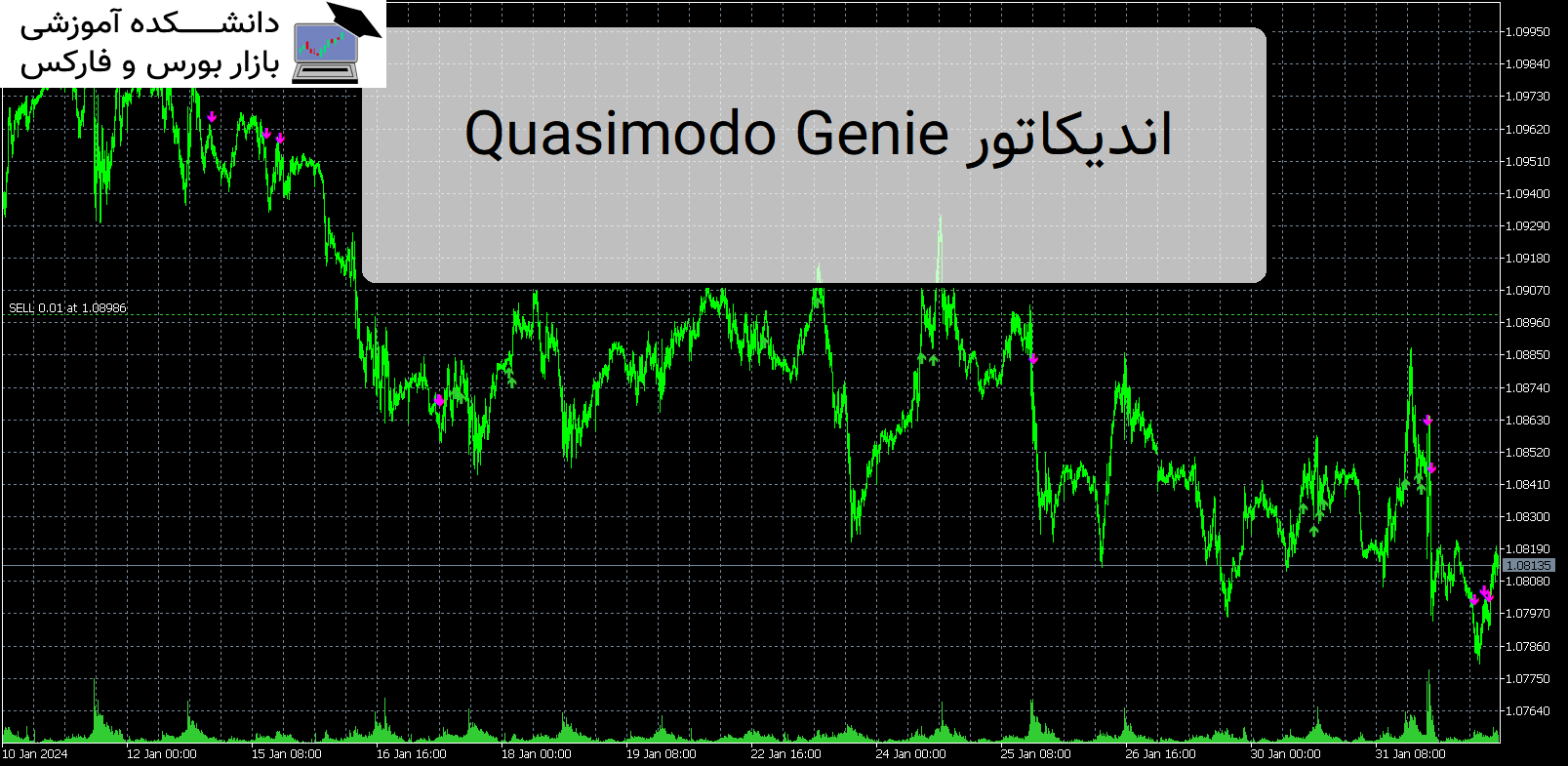

Quasimodo Genie اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی Quasimodo Genie معرفی اندیکاتور Quasimodo Genie ، یک نشانگر قدرتمند برای MetaTrader 5 که به طور خودکار الگوی Quasimodo یا Over and Under را شناسایی می کند. معرفی اندیکاتور کاربردی Quasimodo Genie این اندیکاتور برای معامله گرانی که می خواهند از این الگوی نمودار محبوب استفاده کنند و معاملات سودآوری […]

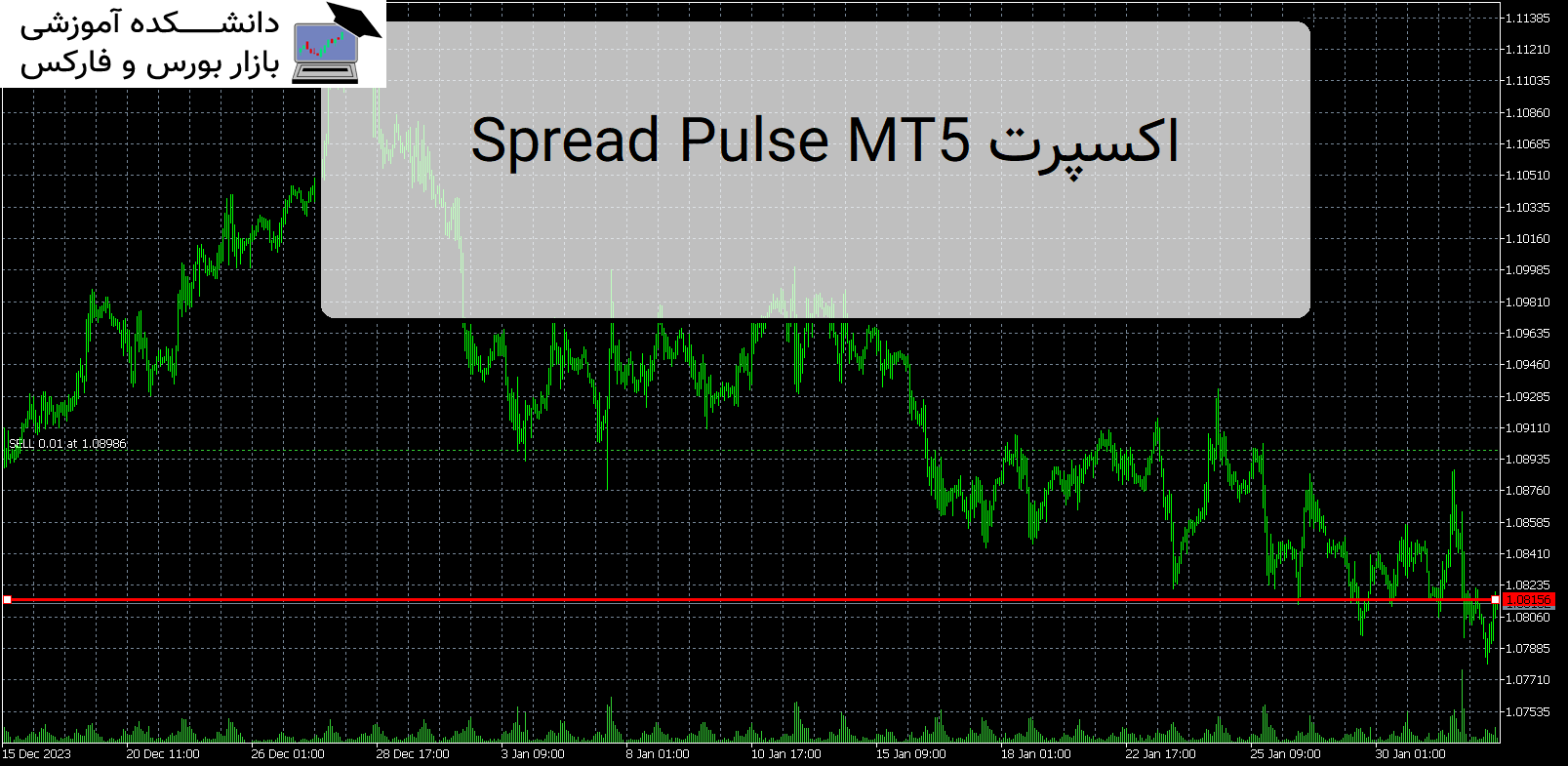

Spread Pulse MT5 اندیکاتور

معرفی و دانلود اندیکاتور کاربردی Spread Pulse MT5 Spread Pulse MT5 ابزار موثری است که اطلاعاتی را در مورد اسپرد فعلی در نمودار به معامله گران ارائه می دهد. اسپرد تفاوت بین قیمت خرید و قیمت فروش یک ابزار است. معرفی اندیکاتور کاربردی Spread Pulse MT5 نشانگر در قالب متنی که در نمودار نمایش داده […]

-

فایل های که پسوند آنها rar یا zip یا 7z هست را چگونه باز کنم؟

توسط نرم افزار Winrar فایل را از حالت فشرده خارج کنید و بعد برای اجرا و یا نصب اقدام کنید. دانلود WINRAR

فایل های با فرمت mq4 و mq5 را چگونه اجرا کنم ؟جهت اجرای این نوع فایل ها برای نسخه mq4 باید متاتریدر 4 را روی سیستم خود و برای نسخه mq5 متاتریدر 5 را روی سیستم عامل خود نصب داشته باشید . جهت راهنمایی کلیک کنید

-

رمز تمامی فایل ها :

- عنوان مقاله : ...Article - Finance - Some Quantitative Tests

- نوع فایل : PDF

- حجم فایل : 2.180 کیلوبایت