A Realistic And Effective Strategy For Using Candlestic

Tsutae Kamada Pick up any stock or futures chart book in Japan and more than 90% of the time you’ll find candlestick charts. It’s rare to see bar charts like those used in U.S. When I ask friends who work at stock brokerages in Japan why they use andlesticks rather than bars, interestingly, nobody says […]

Tsutae Kamada

Pick up any stock or futures chart book in Japan and more than 90% of the time you'll find candlestick charts. It's rare to see bar charts like those used in U.S. When I ask friends who work at stock brokerages in Japan why they use andlesticks rather than bars, interestingly, nobody says candlesticks are better just that they are clearer What they mean by clearer is that with candlestick charts, we can distinguish down-days from up-days quickly and easily.

On an up-day, we see a white real body candlestick. On a down-day, the real body of the candlestick is black. (See examples below.) On the other hand, with the bar chart, according my friends, it is not so easy to tell if the day is up or down by a quick glace.

As we know, this problem can be solved easily. We have many charting-software packages today which can give us different colors for up-days and down-days we simply make the down-day bar black and the up-day bar white

The mechanics of short selling are relatively simple, yet virtually no one, including most professionals, knows how to sell short correctly. In How to Make Money Selling Stocks Short, William J. O'Neil offers you the information needed to pursue an effective short selling strategy, and shows youith detailed, annotated chartsow to make the moves that will ultimately take you in the right direction.

From learning how to set price limits to timing your short sales, the simple and timeless advice found within these pages will keep you focused on the task at hand and let you trade with the utmost confidenc

برچسبها :

مقالات مرتبط

Jeff Cooper – The 5 Day Momentum Method

How Would You Like To: 1. Buy a stock today 2. Sell it for a solid profit in 5 days 3. Repeat this again and again for the rest of your life! Jeff Cooper’s 5 Day Momentum Method Can Help You Do This In his first book, Hit & Run Trading, Jeff Cooper taught traders […]

Lehman Currency Hedging in Fixed Income Portfolios

Portfolios Portfolio managers typically minimize currency exposure in bond portfolios with the useof foreign-exchange forward transactions (forwards). However, the use of forwardscannot entirely eliminate currency volatility, since fluctuations in underlying asset valueswill lead the portfolio to be either over- or under-hedged. In addition, the use of forwardschanges portfolio interest-rate exposures. In this article, we discuss […]

Tony Oz – How I Make A Living Trading Stocks

Put your money where your mouth is,” came the challenge. So he did. Best selling author, Tony Oz, was challenged by Tim Bourquin and Jim Sugarman, founders of the International Online Trading Expo, to prove that his stock trading strategies work, that he could consistently take higher-than-average returns out of the market. To meet the […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

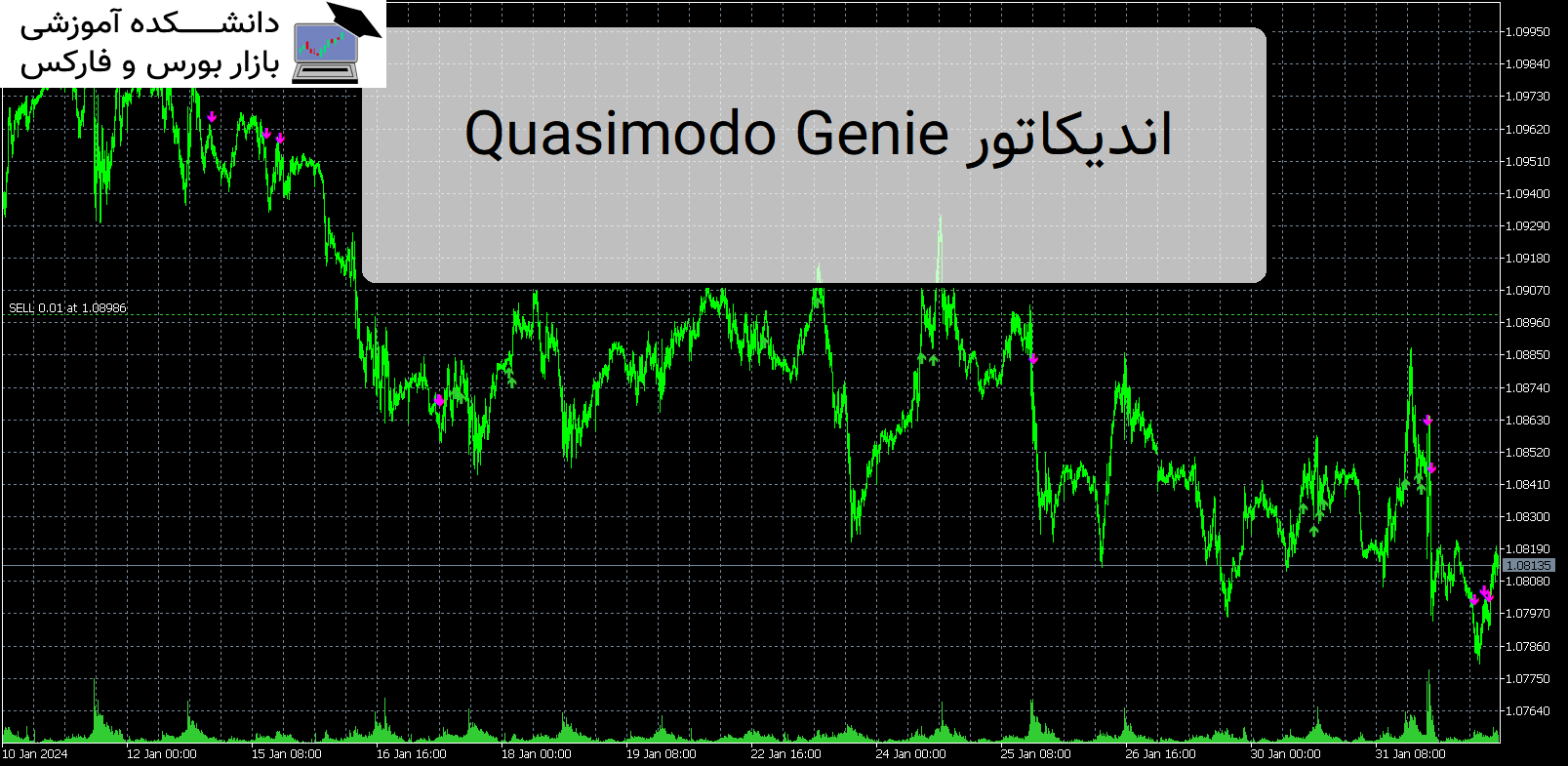

Quasimodo Genie اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی Quasimodo Genie معرفی اندیکاتور Quasimodo Genie ، یک نشانگر قدرتمند برای MetaTrader 5 که به طور خودکار الگوی Quasimodo یا Over and Under را شناسایی می کند. معرفی اندیکاتور کاربردی Quasimodo Genie این اندیکاتور برای معامله گرانی که می خواهند از این الگوی نمودار محبوب استفاده کنند و معاملات سودآوری […]

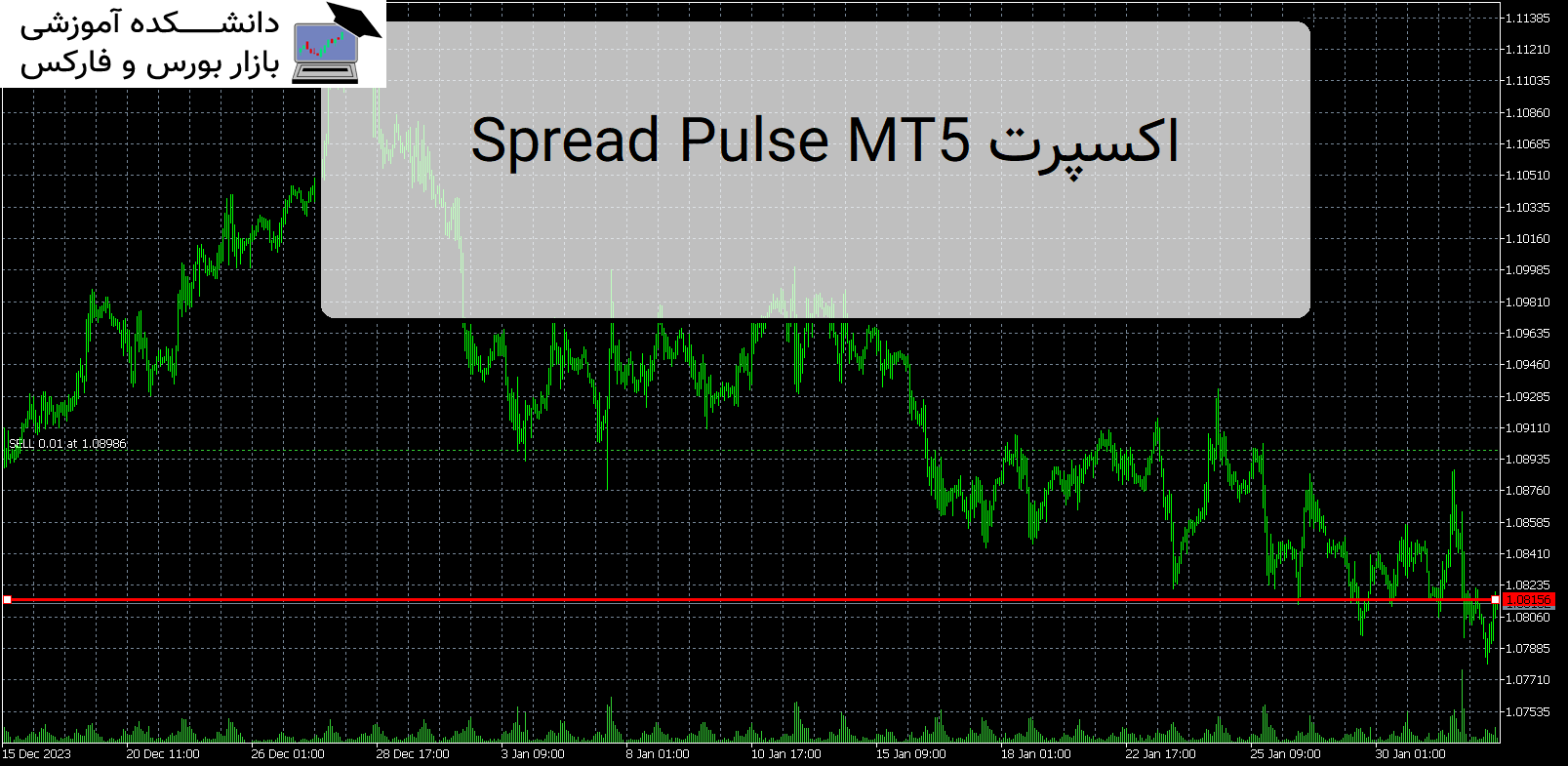

Spread Pulse MT5 اندیکاتور

معرفی و دانلود اندیکاتور کاربردی Spread Pulse MT5 Spread Pulse MT5 ابزار موثری است که اطلاعاتی را در مورد اسپرد فعلی در نمودار به معامله گران ارائه می دهد. اسپرد تفاوت بین قیمت خرید و قیمت فروش یک ابزار است. معرفی اندیکاتور کاربردی Spread Pulse MT5 نشانگر در قالب متنی که در نمودار نمایش داده […]

-

فایل های که پسوند آنها rar یا zip یا 7z هست را چگونه باز کنم؟

توسط نرم افزار Winrar فایل را از حالت فشرده خارج کنید و بعد برای اجرا و یا نصب اقدام کنید. دانلود WINRAR

فایل های با فرمت mq4 و mq5 را چگونه اجرا کنم ؟جهت اجرای این نوع فایل ها برای نسخه mq4 باید متاتریدر 4 را روی سیستم خود و برای نسخه mq5 متاتریدر 5 را روی سیستم عامل خود نصب داشته باشید . جهت راهنمایی کلیک کنید

-

رمز تمامی فایل ها :

- عنوان مقاله : ...A Realistic And Effective Strategy For

- نوع فایل : PDF

- حجم فایل : 130 کیلوبایت