CAI discretionary risk matrix

CAI discretionary fund managers believe that the speed in which a loss (our accumulation of losses due to a drawdown) occur must be balanced with the absolute value or impact of that loss. Components speed and impact, when combined, share profoundly in the psychological effect that loss taking has on a trader. Generally speaking, the […]

CAI discretionary fund managers believe that the speed in which a loss (our accumulation of losses due to a drawdown) occur must be balanced with the absolute value or impact of that loss. Components speed and impact, when combined, share profoundly in the psychological effect that loss taking has on a trader. Generally speaking, the larger and a faster a loss is realized, the more destabilizing. Below is a high and low level “Speed vs. Impact Risk Matrix”. Each demonstrate how CAI fund managers approach stop-loss placement and size, in terms of its psychological state and the place of confidence we findourselves trading from.

برچسبها :

مقالات مرتبط

Huang And Stoll-The Components Of The Bid-Ask Spread – A General Approach

The difference between the ask and the bid quotes — the spread — has long been of interest to traders, reg-ulators, and researchers. While acknowledging that the bid-ask spread must cover the order processing costs incurred by the providers of market liquidity, researchers have focused on two additional costs of market making that must also […]

Candlesticks Fibonacci and Chart Pattern Trading Tools

An in-depth examination of a powerful new trading strategy “Fischer provides an intriguing and thorough look at blending the Fibonacci series, candlesticks, and 3-point chart patterns to trade securities. Backed by explicit trading rules and numerous examples and illustrations, this book is an invaluable tool for the serious investor. Read it.”–Thomas N. Bulkowski author of […]

An Empirical tahlil Of Stock And Bond Market Liquidity

This paper explores liquidity movements in stock and Treasury bond markets over a period of more than 1800 trading days. Cross-market dynamics in liquidity are documented by estimating a vector autoregressive model for liquidity (that is, bid-ask spreads and depth), returns, volatility, and order flow in the stock and bond markets. We find that a […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

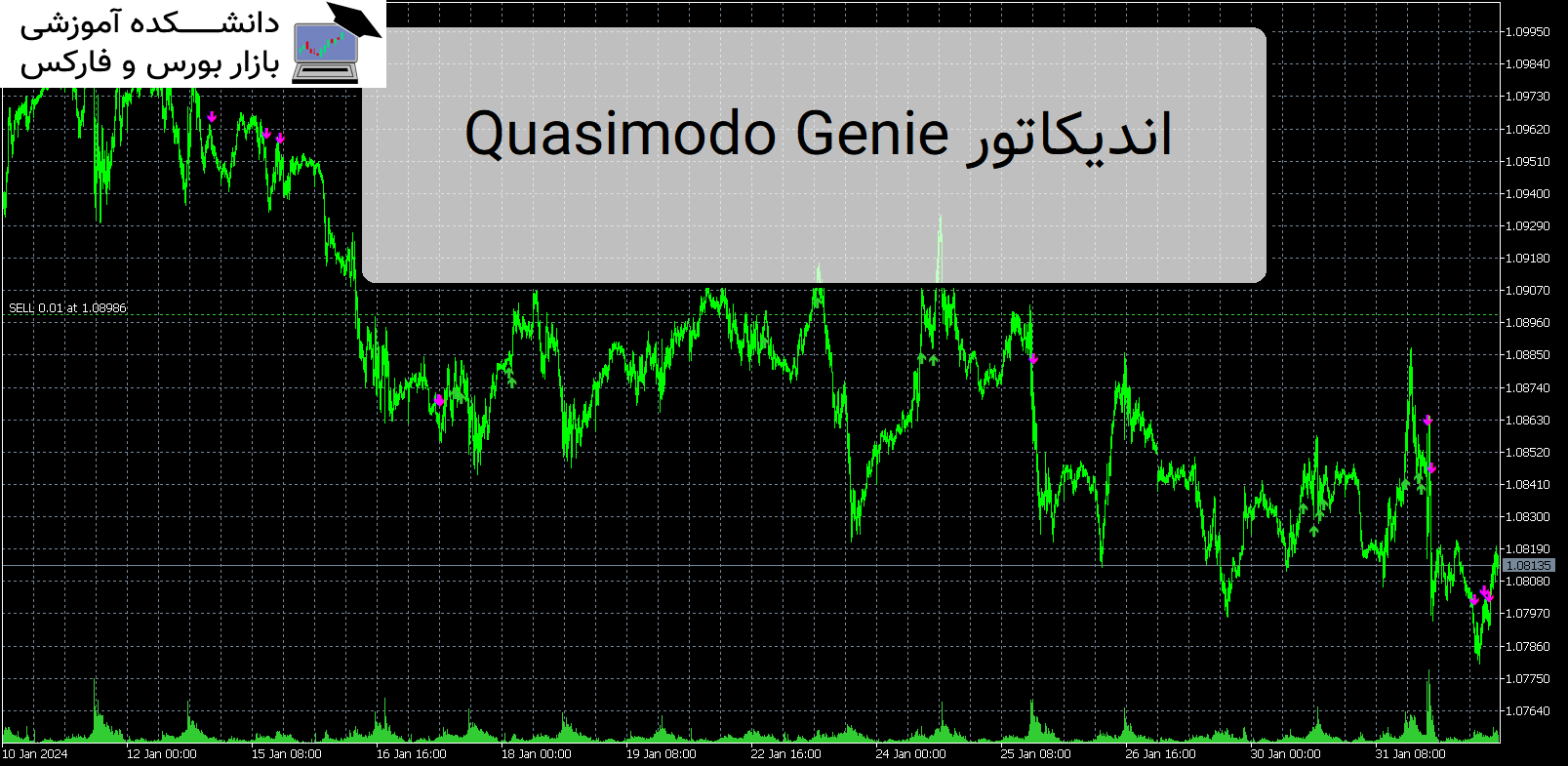

Quasimodo Genie اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی Quasimodo Genie معرفی اندیکاتور Quasimodo Genie ، یک نشانگر قدرتمند برای MetaTrader 5 که به طور خودکار الگوی Quasimodo یا Over and Under را شناسایی می کند. معرفی اندیکاتور کاربردی Quasimodo Genie این اندیکاتور برای معامله گرانی که می خواهند از این الگوی نمودار محبوب استفاده کنند و معاملات سودآوری […]

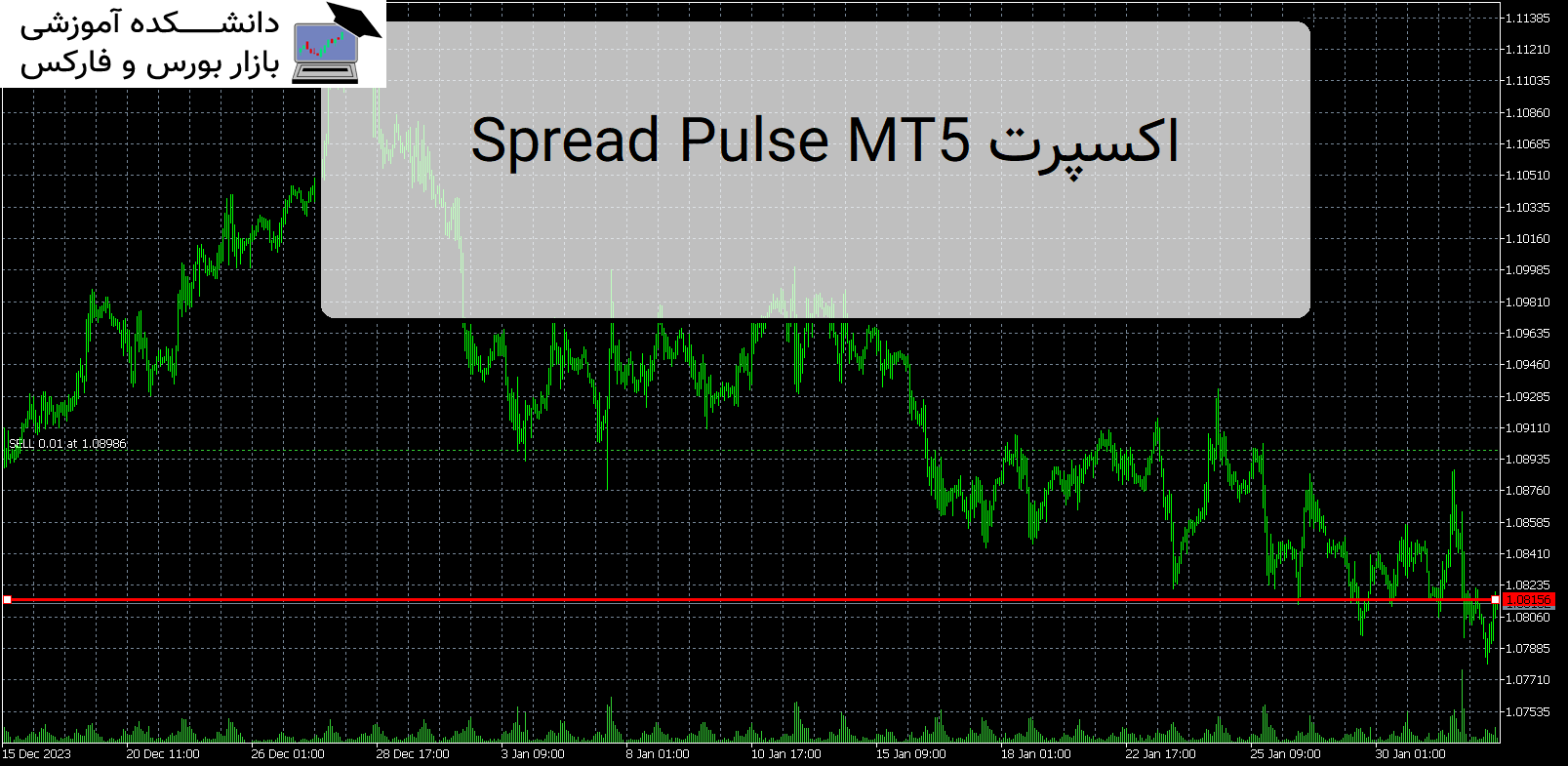

Spread Pulse MT5 اندیکاتور

معرفی و دانلود اندیکاتور کاربردی Spread Pulse MT5 Spread Pulse MT5 ابزار موثری است که اطلاعاتی را در مورد اسپرد فعلی در نمودار به معامله گران ارائه می دهد. اسپرد تفاوت بین قیمت خرید و قیمت فروش یک ابزار است. معرفی اندیکاتور کاربردی Spread Pulse MT5 نشانگر در قالب متنی که در نمودار نمایش داده […]

-

فایل های که پسوند آنها rar یا zip یا 7z هست را چگونه باز کنم؟

توسط نرم افزار Winrar فایل را از حالت فشرده خارج کنید و بعد برای اجرا و یا نصب اقدام کنید. دانلود WINRAR

فایل های با فرمت mq4 و mq5 را چگونه اجرا کنم ؟جهت اجرای این نوع فایل ها برای نسخه mq4 باید متاتریدر 4 را روی سیستم خود و برای نسخه mq5 متاتریدر 5 را روی سیستم عامل خود نصب داشته باشید . جهت راهنمایی کلیک کنید

-

رمز تمامی فایل ها :

- عنوان مقاله : CAI discretionary risk matrix

- نوع فایل : PDF

- حجم فایل : 28 کیلوبایت