COT

Corrective Wave Checklist (Bull Market Example) Between 2001 and 2004, volume in the foreign-exchange market increased more than 50%, illustrating the overall rise in popularity of currency trading. The advent of online trading following the technology boom has allowed many equity and futures traders to look beyond their more traditional trading instruments. Most short-term traders […]

Corrective Wave Checklist (Bull Market Example)

Between 2001 and 2004, volume in the foreign-exchange market increased more than 50%, illustrating the overall rise in popularity of currency trading. The advent of online trading following the technology boom has allowed many equity and futures traders to look beyond their more traditional trading instruments. Most short-term traders or speculators trade FX based on technical analysis, so equity and futures traders who use technical analysis have made the switch to FX fairly easily. However, one type of analysis that traders have not been able to transfer over to currencies is volume-based trading. Since the currency market is decentralized and there is no one exchange that tracks all trading activities, it is difficult to quantify volume traded at each price level. But in place of volume-based trading, many traders have turned to the Commodity Futures Trading Commission's Commitments of Traders (COT) report, which details positioning on the futures market, for more information on positioning and volume. Here we look at how historical trends of the COT report can help FX traders.

برچسبها :

مقالات مرتبط

Larry Williams – How To Trade Better

I’d like you to start the New Year off on the right foot, being the best, clearest trader you can be. I want to restate basic understanding of the Fear/Greed dilemma.

An tahlil Of Order Submissions On The Xetra Trading System

An tahlil Of Order Submissions On The Xetra Trading System Book Description Using an innovative empirical methodology we analyze trad ing activity and liquidity supply in an open limit order book market and test a variety of ypotheses put forth by market microstructure theory. We study how the state of the limit order book, i.e. liquidity supply, as […]

1fta Forex Trading Course

Trading in the Forex market is a challenging opportunity where above average returns are available to educate and experienced investors who are willing to take above average risk. However, before deciding to participate in Forex trading, you should carefully consider your investment objectives, level of experience and risk appetite. Most importantly, do not invest money […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

Tillson TMA T3 اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی Tillson TMA T3 اندیکاتور کاربردی Tillson TMA T3 این یک میانگین متحرک است که از EMA و DEMA در فرمول خود استفاده می کند و با بسط Binomial درجه 3 محاسبه می شود. معرفی اندیکاتور کاربردی Tillson TMA T3 1- سیگنال های اشتباهی که در سایر میانگین های متحرک (زیگ […]

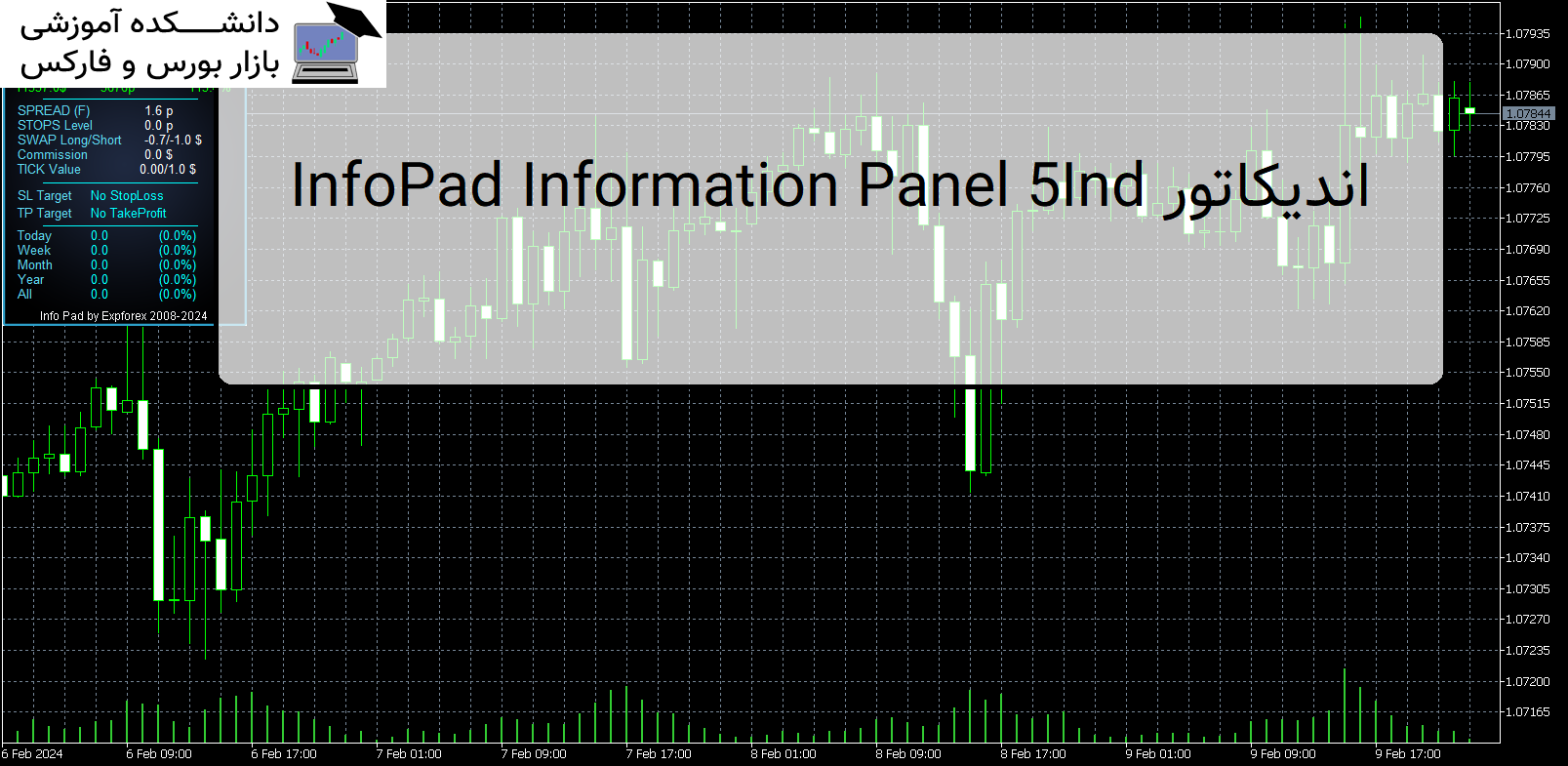

Ind5 InfoPad Information Panel اندیکاتور

معرفی و دانلود اندیکاتور Ind5 InfoPad Information Panel اندیکاتور Ind5 InfoPad Information Panel یک پنل اطلاعاتی است که اطلاعات مربوط به جفت ارز انتخاب شده را در ترمینال MetaTrader 5 ایجاد می کند. معرفی اندیکاتور Ind5 InfoPad Information Panel این نشانگر 5 عملکرد دارد: اطلاعات اصلی و اصلی را در نماد انتخاب شده نشان می […]

-

فایل های که پسوند آنها rar یا zip یا 7z هست را چگونه باز کنم؟

توسط نرم افزار Winrar فایل را از حالت فشرده خارج کنید و بعد برای اجرا و یا نصب اقدام کنید. دانلود WINRAR

فایل های با فرمت mq4 و mq5 را چگونه اجرا کنم ؟جهت اجرای این نوع فایل ها برای نسخه mq4 باید متاتریدر 4 را روی سیستم خود و برای نسخه mq5 متاتریدر 5 را روی سیستم عامل خود نصب داشته باشید . جهت راهنمایی کلیک کنید

-

رمز تمامی فایل ها :

- عنوان مقاله : COT

- نوع فایل : PDF

- حجم فایل : 160 کیلوبایت