Griffiths, Turnbullb And White-Re-Examining The Small-Cap Myth Problems In Portfolio Formation An

This study investigates the realizable returns on portfolios at the turn-of-the-year. Using an intraday simulation that accounts for the volumes offered or wanted at market bid-ask prices, large-capitalization securities significantly outperform small-capitalization securities by 2.4% and 6.5%, depending on whether the portfolios were formed on the last day of the taxation year or were formed […]

This study investigates the realizable returns on portfolios at the turn-of-the-year. Using an intraday simulation that accounts for the volumes offered or wanted at market bid-ask prices, large-capitalization securities significantly outperform small-capitalization securities by 2.4% and 6.5%, depending on whether the portfolios were formed on the last day of the taxation year or were formed over the last month of the trading year. In no one year could the small-capitalization portfolio be completely divested by the end of the holding period,suggesting that investors are not remunerated for the illiquidity in this portfolio. Results based on returns calculated by using the mean of the bid-ask spread show that the results are not derived solely from transaction costs. Ó 2000 Elsevier Science Inc. All rights reserved.

برچسبها :

مقالات مرتبط

Investment Risk Management

Investment Risk Management Risk has two sides: underestimating it harms the investor, while overestimating it prevents the implementation of bold business projects.

Credit Risk Modelling and Credit Derivatives

Credit Risk The creditrisk market is the fastest growing financial market in the world, attracting everyone from hedge funds to banks and insurance companies. Increasingly, professionals in corporate finance need to understand the workings of thecredit risk market in order to successfully manage risk in their own organizations; in addition, some wish to move into […]

Fibonacci Trader Journal

Fibonacci Trader Journal Trading any market carries a high level of risk,and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest you should carefully consider your investment objectives,level of experience,and risk appetite. The possibility exists that you could sustain […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

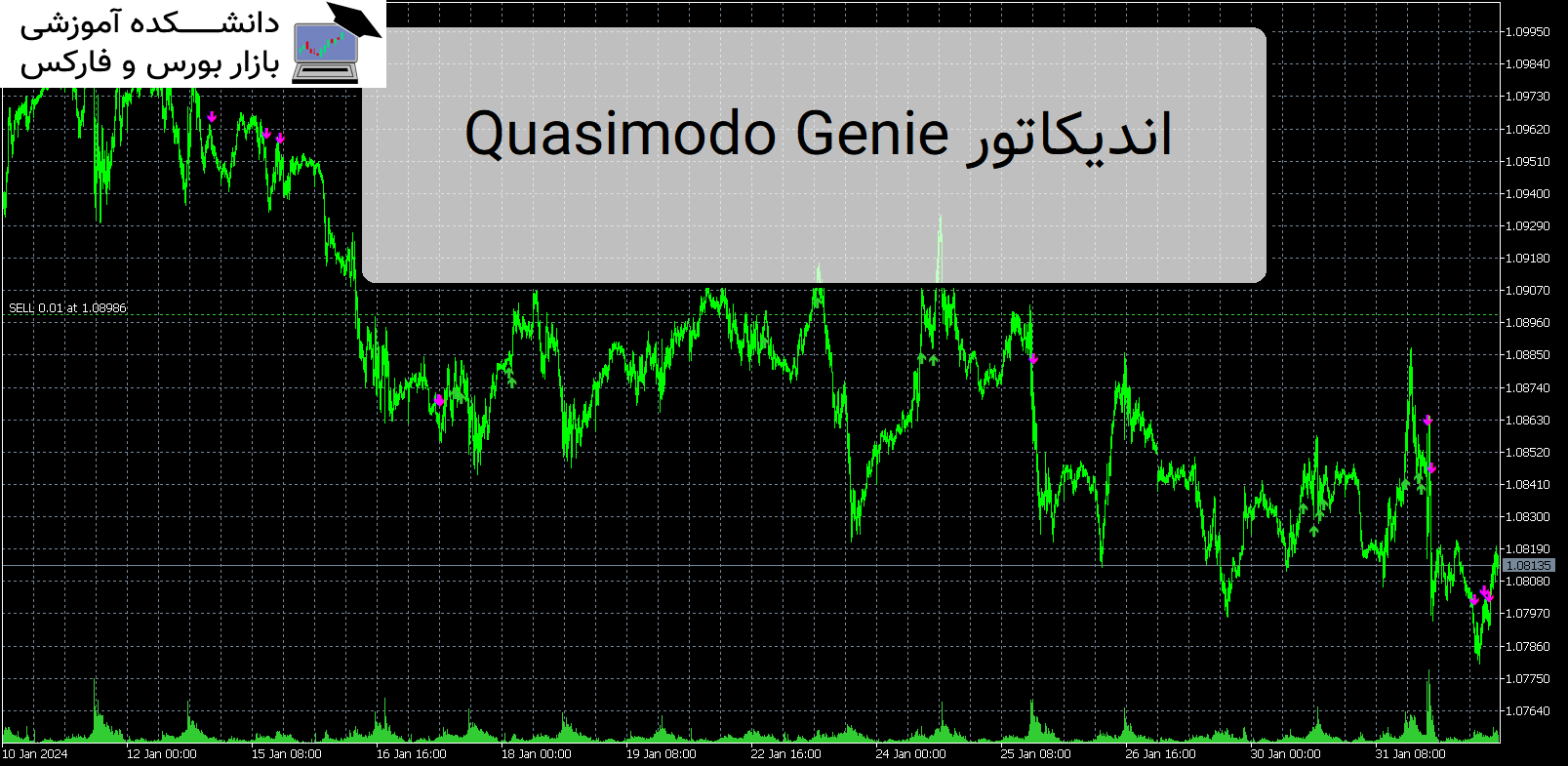

Quasimodo Genie اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی Quasimodo Genie معرفی اندیکاتور Quasimodo Genie ، یک نشانگر قدرتمند برای MetaTrader 5 که به طور خودکار الگوی Quasimodo یا Over and Under را شناسایی می کند. معرفی اندیکاتور کاربردی Quasimodo Genie این اندیکاتور برای معامله گرانی که می خواهند از این الگوی نمودار محبوب استفاده کنند و معاملات سودآوری […]

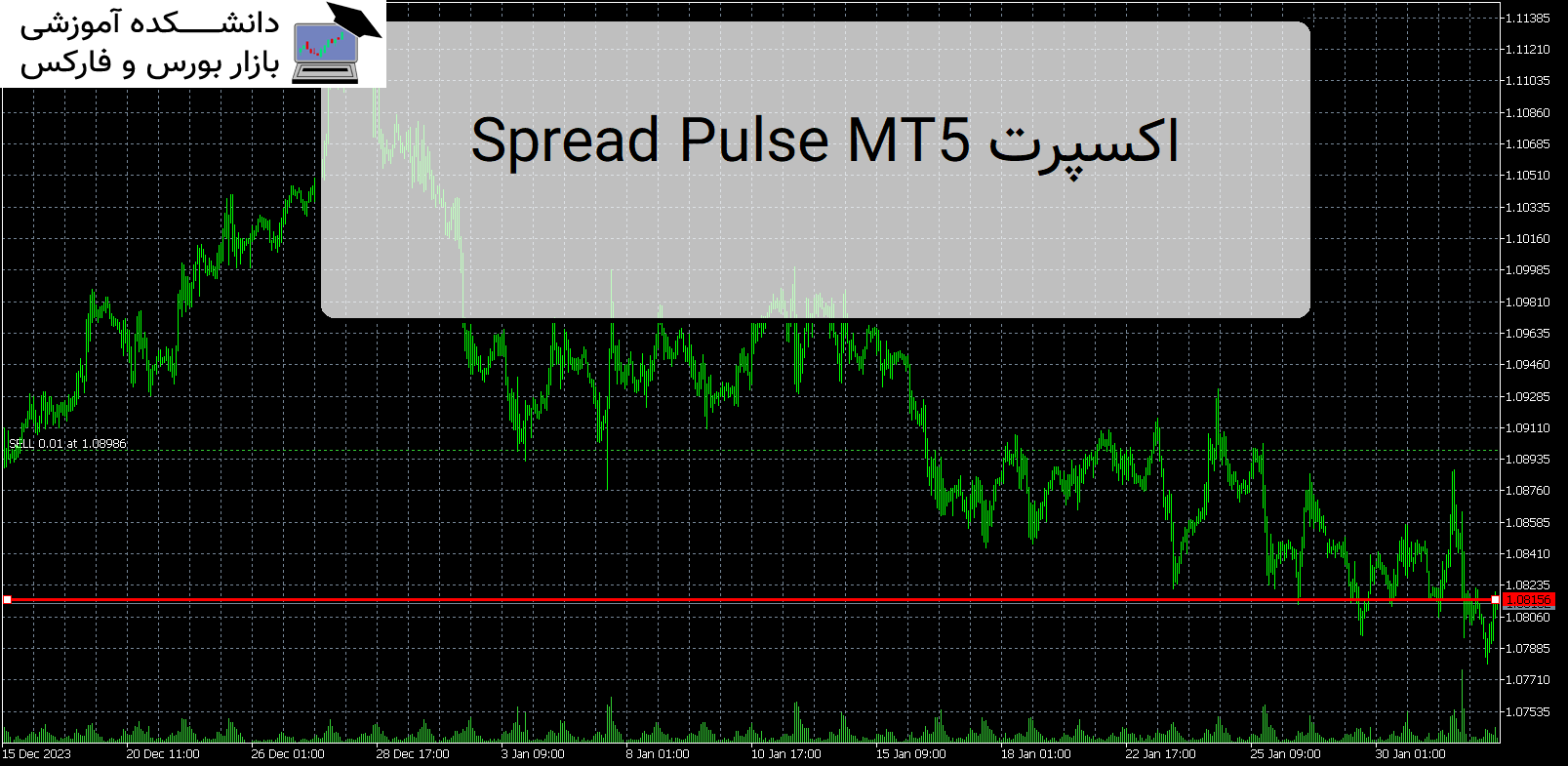

Spread Pulse MT5 اندیکاتور

معرفی و دانلود اندیکاتور کاربردی Spread Pulse MT5 Spread Pulse MT5 ابزار موثری است که اطلاعاتی را در مورد اسپرد فعلی در نمودار به معامله گران ارائه می دهد. اسپرد تفاوت بین قیمت خرید و قیمت فروش یک ابزار است. معرفی اندیکاتور کاربردی Spread Pulse MT5 نشانگر در قالب متنی که در نمودار نمایش داده […]

-

فایل های که پسوند آنها rar یا zip یا 7z هست را چگونه باز کنم؟

توسط نرم افزار Winrar فایل را از حالت فشرده خارج کنید و بعد برای اجرا و یا نصب اقدام کنید. دانلود WINRAR

فایل های با فرمت mq4 و mq5 را چگونه اجرا کنم ؟جهت اجرای این نوع فایل ها برای نسخه mq4 باید متاتریدر 4 را روی سیستم خود و برای نسخه mq5 متاتریدر 5 را روی سیستم عامل خود نصب داشته باشید . جهت راهنمایی کلیک کنید

-

رمز تمامی فایل ها :

- عنوان مقاله : ...Griffiths, Turnbullb And White-Re-Examining

- نوع فایل : PDF

- حجم فایل : 112 کیلوبایت