Lee, Mucklow And Ready-Spreads, Depths, And The Impact Of Earnings Information – An Intraday Anal

For a sample of NYSE firms, we show that wide spreads are accompanied by low depths, and that spreads widen and depths fall in response to higher volume. Spreads widen and depths fall in anticipation of earnings announcements; these effects are more pronounced for announcements with larger subsequent price changes. Spreads are also wider following […]

For a sample of NYSE firms, we show that wide spreads are accompanied by low depths, and that spreads widen and depths fall in response to higher volume. Spreads widen and depths fall in anticipation of earnings announcements; these effects are more pronounced for announcements with larger subsequent price changes. Spreads are also wider following earnings announcements, but this effect dissipates quickly after controlling for volume. Collectively, our results suggest liquidity providers are sensitive to changes in information asymmetry risk and use both spreads and depths to actively manage this risk. Article published by Oxford University Press on behalf of the Society for Financial Studies in its journal, The Review of Financial Studies...

برچسبها :

مقالات مرتبط

george angell sniper trading workbook

mportant lessons and key investment strategies for trading stocks, options, and futures Sniper Trading helps readers fine-tune their trading to the point where they know exactly where the market will go and when it will get there. With thirty years of experience, George Angell shows readers how to trade successfully on a consistent and informed […]

Martin J Pring – Investment Psychology – Part 1

x”or most of us, the task of beating the market is not difficult, it is the job of beating ourselves that proves to be overwhelming. In this sense, “beating our- selves” means mastering our emotions and attempting to think independently, as well as not being swayed by those around us. Decisions based on our natural […]

Sundial System

Welcome to the Sundial Systems section of James16’s teaching forum!Hi everyone!My name is Charles, and though I prefer to be called “Dial” or “Diallist”, please feel free to call me whatever you like.James16 has said that the system I’ll be teaching here, while publicly available, is hard to get information on, and some assistance is […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

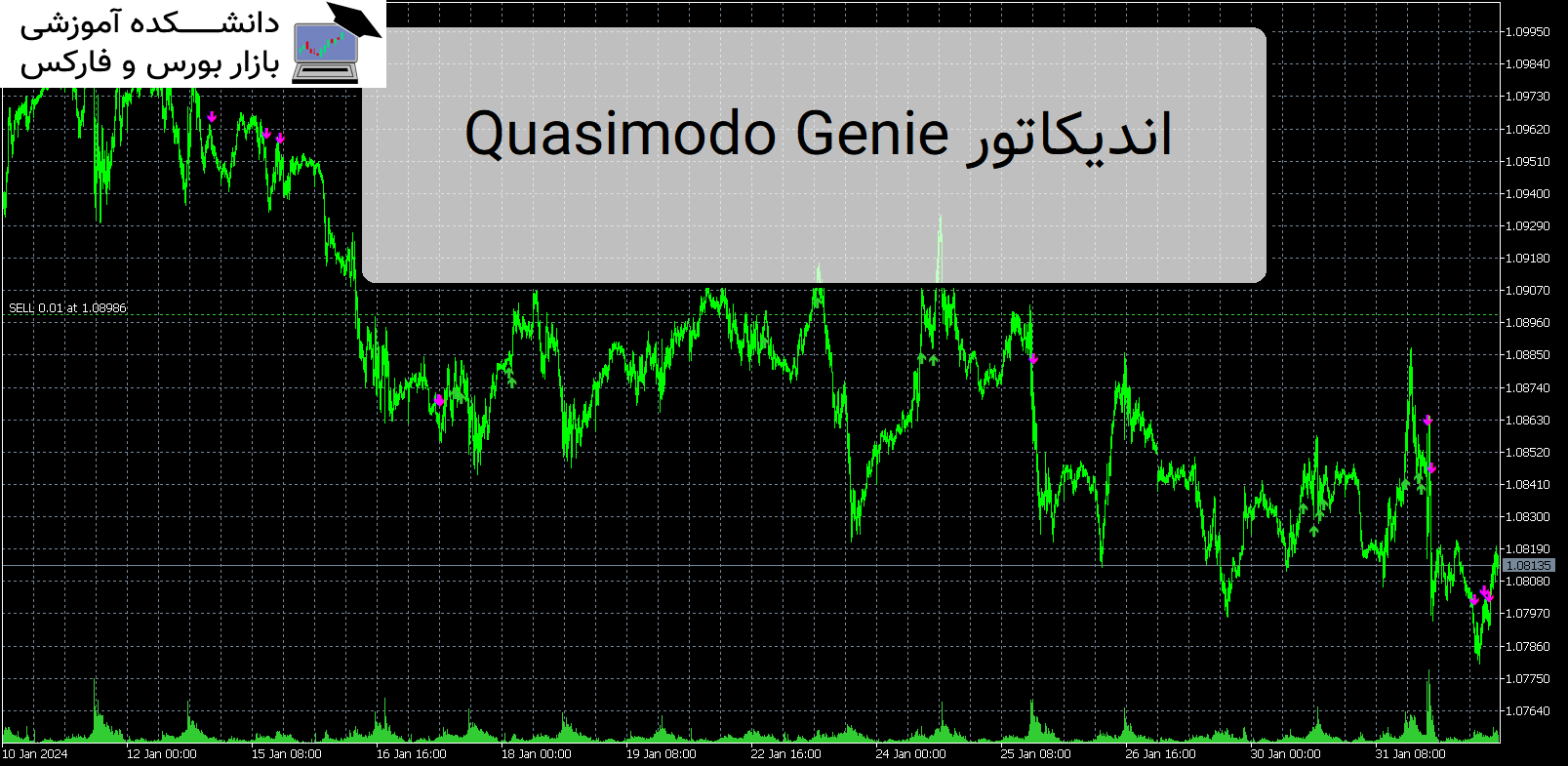

Quasimodo Genie اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی Quasimodo Genie معرفی اندیکاتور Quasimodo Genie ، یک نشانگر قدرتمند برای MetaTrader 5 که به طور خودکار الگوی Quasimodo یا Over and Under را شناسایی می کند. معرفی اندیکاتور کاربردی Quasimodo Genie این اندیکاتور برای معامله گرانی که می خواهند از این الگوی نمودار محبوب استفاده کنند و معاملات سودآوری […]

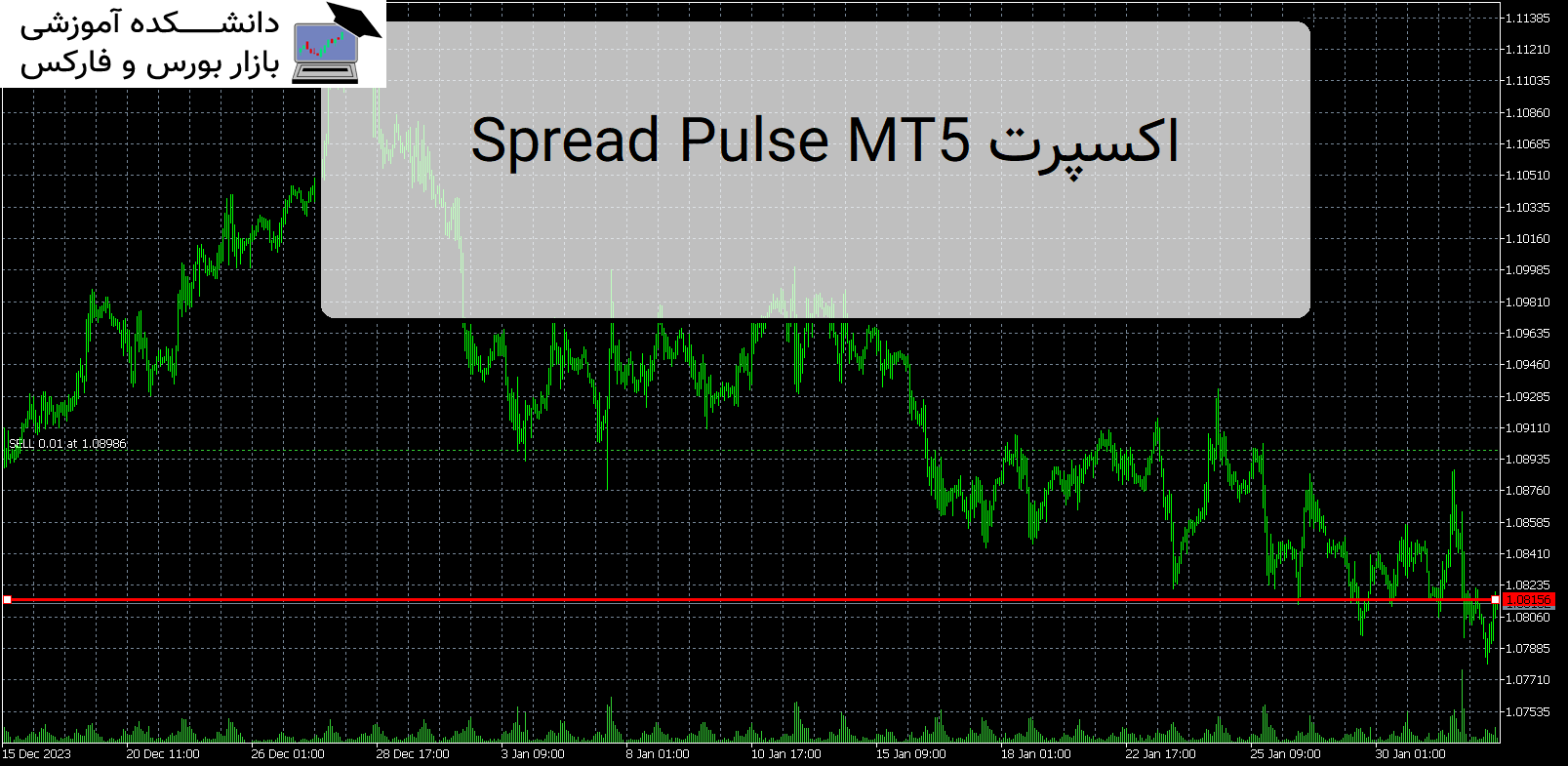

Spread Pulse MT5 اندیکاتور

معرفی و دانلود اندیکاتور کاربردی Spread Pulse MT5 Spread Pulse MT5 ابزار موثری است که اطلاعاتی را در مورد اسپرد فعلی در نمودار به معامله گران ارائه می دهد. اسپرد تفاوت بین قیمت خرید و قیمت فروش یک ابزار است. معرفی اندیکاتور کاربردی Spread Pulse MT5 نشانگر در قالب متنی که در نمودار نمایش داده […]

-

فایل های که پسوند آنها rar یا zip یا 7z هست را چگونه باز کنم؟

توسط نرم افزار Winrar فایل را از حالت فشرده خارج کنید و بعد برای اجرا و یا نصب اقدام کنید. دانلود WINRAR

فایل های با فرمت mq4 و mq5 را چگونه اجرا کنم ؟جهت اجرای این نوع فایل ها برای نسخه mq4 باید متاتریدر 4 را روی سیستم خود و برای نسخه mq5 متاتریدر 5 را روی سیستم عامل خود نصب داشته باشید . جهت راهنمایی کلیک کنید

-

رمز تمامی فایل ها :

- عنوان مقاله : Lee, Mucklow And Ready-Spreads, Depths, And

- نوع فایل : PDF

- حجم فایل : 170 کیلوبایت