Mann, Venkataraman And Waisburd-Stock Liquidity And The Value Of A Designated Liquidity Provider Evidence From Paris Euronext

This paper studies the value of a designated liquidity provider (DLP) in an electronic limit order book. We conduct a natural controlled experiment by examining a sample of Euronext Paris securities that trades both with and without the assistance of a market maker.We find that less liquid stocks experience a statistically significant cumulative abnormal return […]

This paper studies the value of a designated liquidity provider (DLP) in an electronic limit order book. We conduct a natural controlled experiment by examining a sample of Euronext Paris securities that trades both with and without the assistance of a market maker.We find that less liquid stocks experience a statistically significant cumulative abnormal return of four percent around the introduction of the DLP. For this sample, the DLP enhances market quality by reducing the frequency of market failure, providing strong empirical support for Glosten (1989).Liquid stocks are generally unaffected. Overall, these findings support the joint hypothesis that liquidity is priced and that the services of the designated liquidity provider are an important factor in this premium. We thus present compelling evidence of a link between market microstructure and asset pricing.

برچسبها :

مقالات مرتبط

Brett Steenbarger – Psychology Of Trading

I’ve never seen a trader succeed whose explicit or implicit goal was to not lose. The trader who trades to not lose is like the person who lives to avoid death: both become spiritual hypochondriacs. No union was ever destroyed by a failure of romance. It is the loss of respect, not love, which ends […]

Tlatomi method

Download Tlatomi method Exit Exit when a new dot appears (red if you are long and blue if you are short). This method gives you mecanicals trades. Don’t hesitate to transform them into a discretionnay trade after because you can see things that the system can’t. Sometimes, it will be the difference between a […]

Trend Follower System

Download Trend Follower System I have been a forex trader since more years. From time to time I still trade, but my trading times have increasingly dropped since I feel its more and more boring waiting for the market to give you a proper signal all day. The main reason why I am writing […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

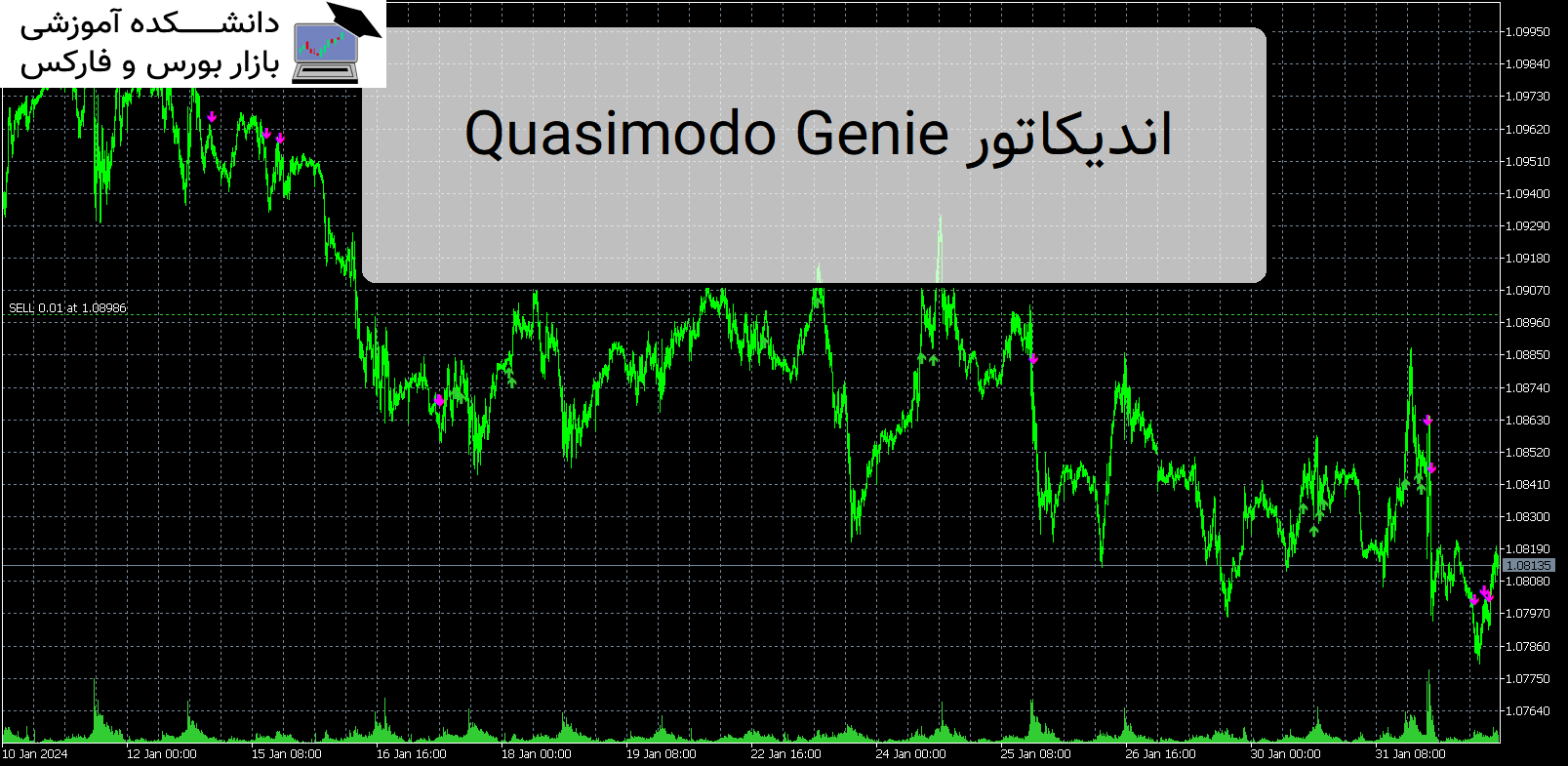

Quasimodo Genie اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی Quasimodo Genie معرفی اندیکاتور Quasimodo Genie ، یک نشانگر قدرتمند برای MetaTrader 5 که به طور خودکار الگوی Quasimodo یا Over and Under را شناسایی می کند. معرفی اندیکاتور کاربردی Quasimodo Genie این اندیکاتور برای معامله گرانی که می خواهند از این الگوی نمودار محبوب استفاده کنند و معاملات سودآوری […]

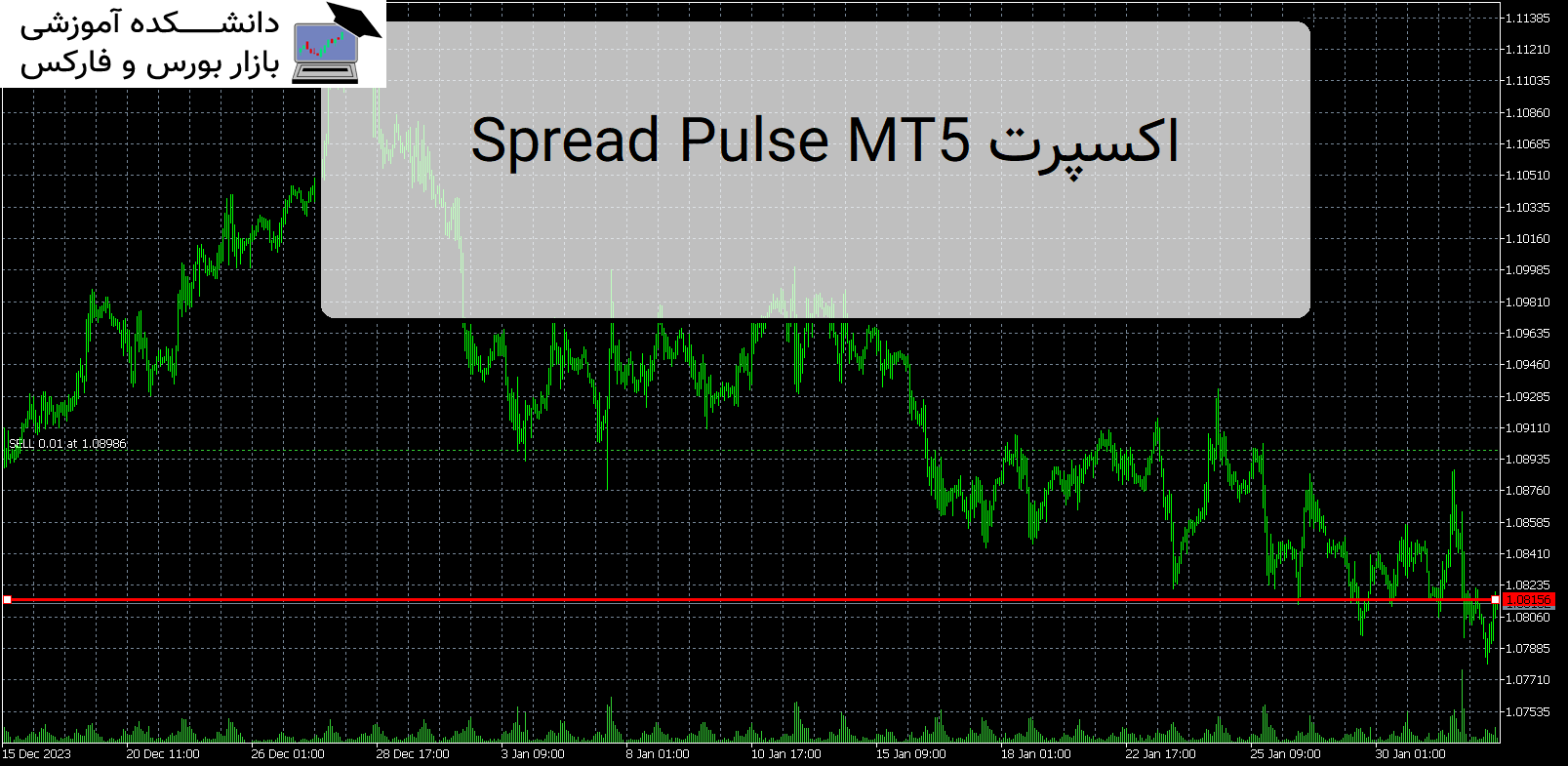

Spread Pulse MT5 اندیکاتور

معرفی و دانلود اندیکاتور کاربردی Spread Pulse MT5 Spread Pulse MT5 ابزار موثری است که اطلاعاتی را در مورد اسپرد فعلی در نمودار به معامله گران ارائه می دهد. اسپرد تفاوت بین قیمت خرید و قیمت فروش یک ابزار است. معرفی اندیکاتور کاربردی Spread Pulse MT5 نشانگر در قالب متنی که در نمودار نمایش داده […]

-

فایل های که پسوند آنها rar یا zip یا 7z هست را چگونه باز کنم؟

توسط نرم افزار Winrar فایل را از حالت فشرده خارج کنید و بعد برای اجرا و یا نصب اقدام کنید. دانلود WINRAR

فایل های با فرمت mq4 و mq5 را چگونه اجرا کنم ؟جهت اجرای این نوع فایل ها برای نسخه mq4 باید متاتریدر 4 را روی سیستم خود و برای نسخه mq5 متاتریدر 5 را روی سیستم عامل خود نصب داشته باشید . جهت راهنمایی کلیک کنید

-

رمز تمامی فایل ها :

- عنوان مقاله : ...Mann, Venkataraman And Waisburd-Stock Liquidity

- نوع فایل : PDF

- حجم فایل : 270 کیلوبایت