Foucault, Kadan And Kandel-Limit Order Book As A Market For Liquidity

We develop a dynamic model of an order-driven market populated by discretionary liquidity traders. These traders differ by their impatience and seek to minimize their trading costs by optimally choosing between market and limit orders. We characterize the equilibrium order placement strategies and the waiting times for limit orders. In equilibrium less patient traders are […]

We develop a dynamic model of an order-driven market populated by discretionary liquidity traders. These traders differ by their impatience and seek to minimize their trading costs by optimally choosing between market and limit orders. We characterize the equilibrium order placement strategies and the waiting times for limit orders. In equilibrium less patient traders are likely to demand liquidity, more patient traders are more likely to provide it. We find that the resiliency of the limit order book increases with the proportion of patient traders and decreases with the order arrival rate. Furthermore, the spread is negatively related to the proportion of patient traders and the order arrival rate. We show that these findings yield testable predictions on the relation between the trading intensity and the spread. Moreover, the model generates predictions for time-series and cross-sectional var iation in the optimal order-submission strategies. Finally, we find that imposing a minimum price variationimproves the resiliency of a limit order market. For this reason, reducing the minimum price variation does not necessarily reduce the average spread in limit order markets.

برچسبها :

مقالات مرتبط

Intraday Trading Techniques

Download Intraday Trading Techniques: Four Styles of Trading Day Trading Defined Psychological Requirements It should not be assumed that the methods, techniques, or indicators presented in this book and seminar will be profitable or that they will not result in losses. Past results are not necessarily indicative of future results. Examples in this book […]

The Secret To Selecting Automated Trading Software

Automated Trading Software When you invested your money in the foreign currency exchange market, you will need to perform thorough research and understanding of the market. If you are not careful, you can lose a large amount of money quickly when trading manually especially if you have not done your homework. Those who are […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

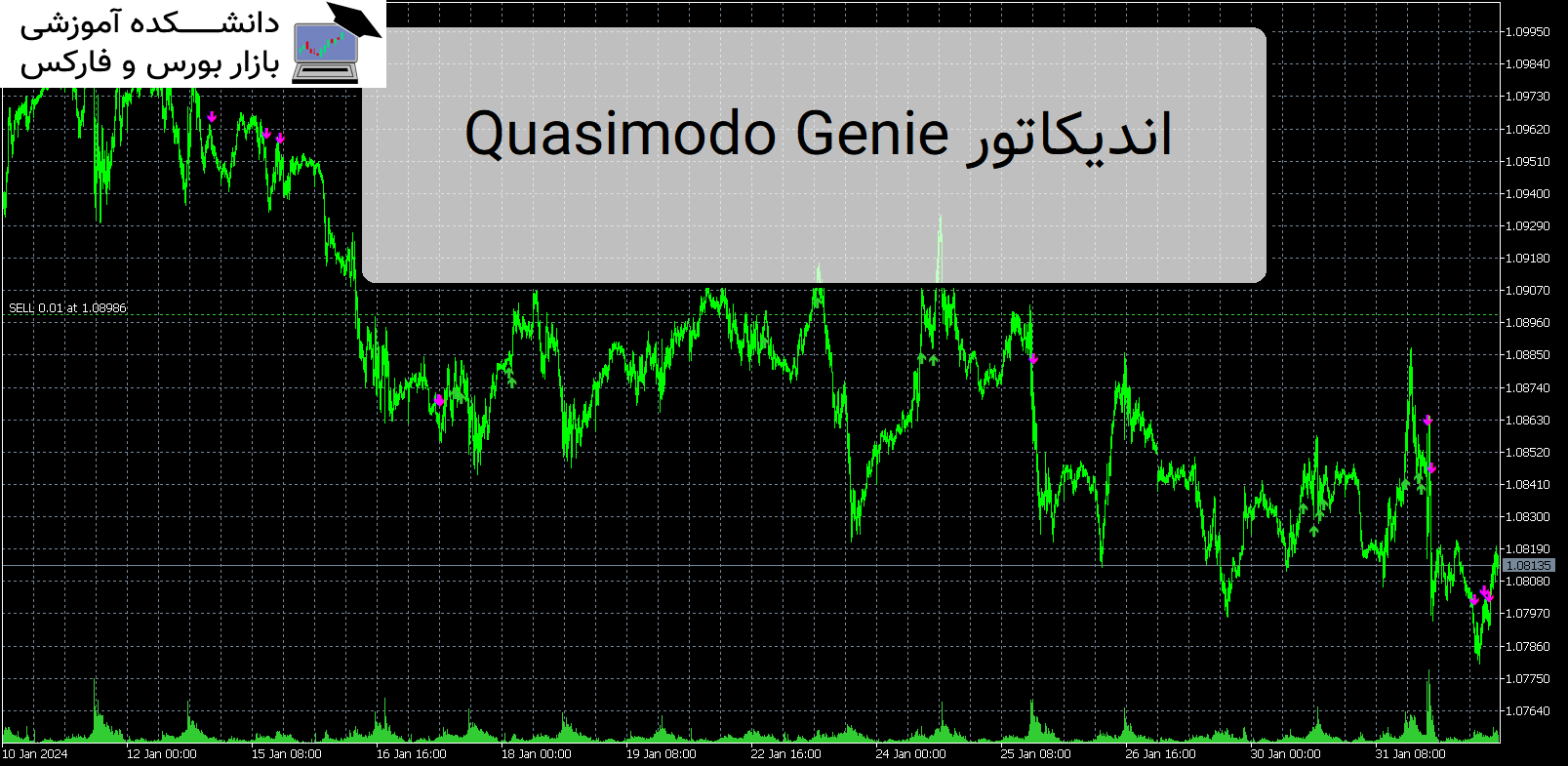

Quasimodo Genie اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی Quasimodo Genie معرفی اندیکاتور Quasimodo Genie ، یک نشانگر قدرتمند برای MetaTrader 5 که به طور خودکار الگوی Quasimodo یا Over and Under را شناسایی می کند. معرفی اندیکاتور کاربردی Quasimodo Genie این اندیکاتور برای معامله گرانی که می خواهند از این الگوی نمودار محبوب استفاده کنند و معاملات سودآوری […]

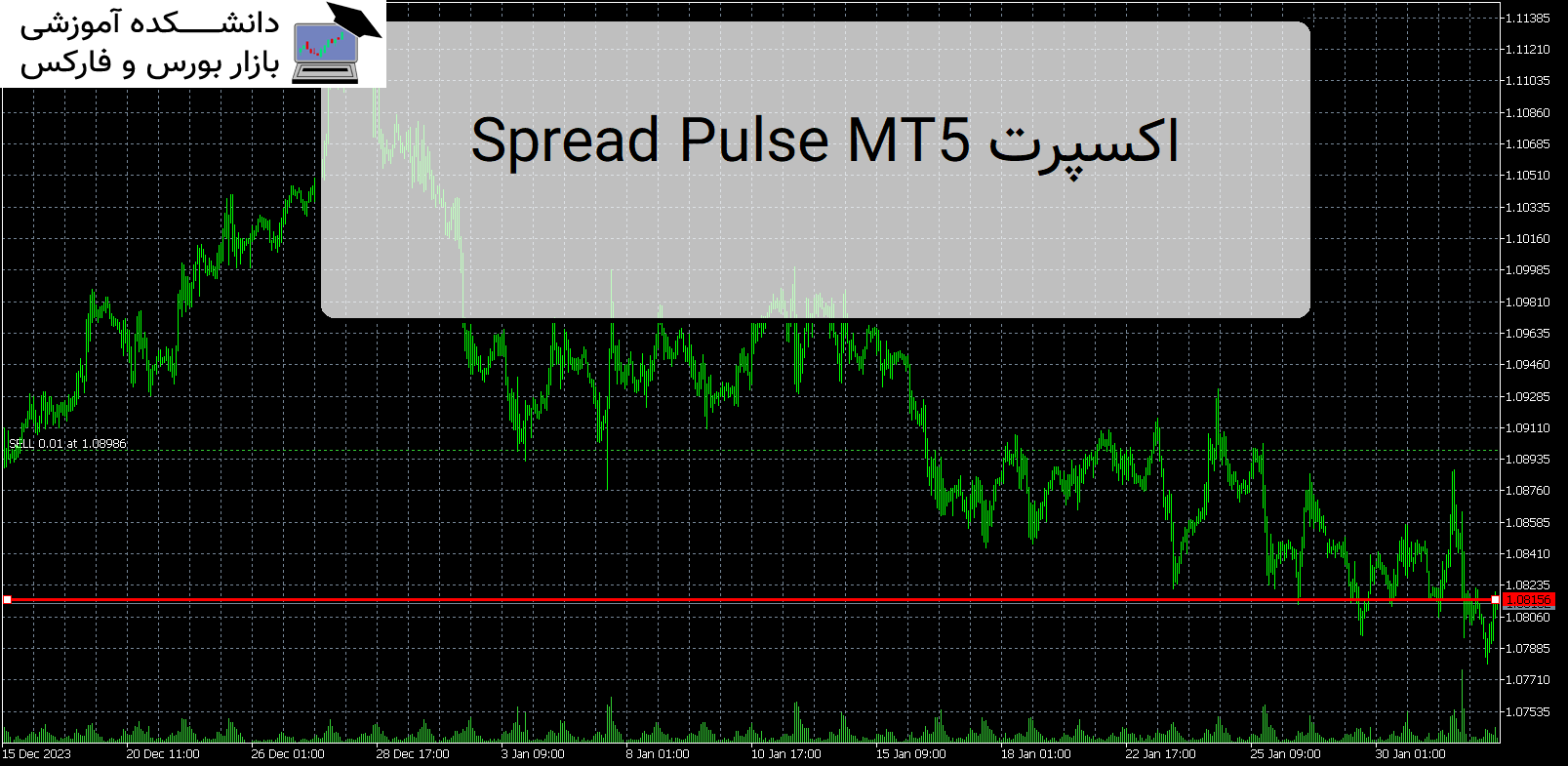

Spread Pulse MT5 اندیکاتور

معرفی و دانلود اندیکاتور کاربردی Spread Pulse MT5 Spread Pulse MT5 ابزار موثری است که اطلاعاتی را در مورد اسپرد فعلی در نمودار به معامله گران ارائه می دهد. اسپرد تفاوت بین قیمت خرید و قیمت فروش یک ابزار است. معرفی اندیکاتور کاربردی Spread Pulse MT5 نشانگر در قالب متنی که در نمودار نمایش داده […]

-

فایل های که پسوند آنها rar یا zip یا 7z هست را چگونه باز کنم؟

توسط نرم افزار Winrar فایل را از حالت فشرده خارج کنید و بعد برای اجرا و یا نصب اقدام کنید. دانلود WINRAR

فایل های با فرمت mq4 و mq5 را چگونه اجرا کنم ؟جهت اجرای این نوع فایل ها برای نسخه mq4 باید متاتریدر 4 را روی سیستم خود و برای نسخه mq5 متاتریدر 5 را روی سیستم عامل خود نصب داشته باشید . جهت راهنمایی کلیک کنید

-

رمز تمامی فایل ها :

- عنوان مقاله : ...Foucault, Kadan And Kandel-Limit Order Book As A

- نوع فایل : PDF

- حجم فایل : 560 کیلوبایت