فرهنگ لغات تخصصی بازار ارز حرف P

Package Deal: An order that contains a number of exchange or deposit items that must be completed simultaneously, or not at all. Package deals allow traders to ensure specific prices or times to maturity for multiple assets. A trader may want to participate in a package deal to properly execute an investment strategy. […]

Package Deal:

An order that contains a number of exchange or deposit items that must be completed simultaneously, or not at all. Package deals allow traders to ensure specific prices or times to maturity for multiple assets.

A trader may want to participate in a package deal to properly execute an investment strategy. For example, let's say an investor wants to enter into a long-short strategy, where he or she purchases one stock and short sells another. Making this order a package deal will protect the investor in case either stock is not immediately available for purchase or sale. The investor may not want the exposure of being only long or short for the period of time required to complete the second transaction.

Par:

(1) The nominal value of a security or instrument. (2) The official value of a currency.

Parities:

The value of one currency in terms of another.

Parity:

Official rates in terms of SDR or other pegging currency.

Participation Rate:

A measure of the participating portion of an economy's labor force.

The participation rate is important in determining the number of individuals who are willing to work, are working, or are actively looking for work. Those who have no interest in working are not included in the participation rate.

payroll:

1 Total amount a business pays periodically for its workers.

2 List of employees, including information on salaries, wages, bonuses, and net pay after deductions.

Pegging:

A form of price stabilization; typically used to stabilize a country’s currency by making it fixed to the exchange rate with another country. A method of stabilizing a country's currency by fixing its exchange rate to that of another country.

Pending Home Sales Index:

The National Association of Realtors developed the pending home sales index as a leading indicator of housing activity. As such, it is a leading indicator of existing home sales, not new home sales. A pending sale is one in which a contract was signed, but not yet closed. It usually takes four to six weeks to close a contracted sale.

Pending Order:

Pending order is an instruction to open a position when the current price reaches the order level.

There are four types of pending orders:

Buy Stop - an order to open a Buy position at a price higher than the price at the moment of placing the order Sell Stop - an order to open a Sell position at a price lower than the price at the moment of placing the order Buy Limit - an order to open a Buy position at a lower price than the price at the moment of placing the order Sell Limit - an order to open a Sell position at a price higher than the price at the moment of placing the order

Performance:

The results of activities of an organization or investment over a given period of time.

Permitted Currency:

It means a foreign currency which is freely convertible i.e a currency which is permitted by the rules and regulations of the country concerned to be converted into major reserve currencies and for which a fairly active and liquid market exists for dealing against the major currencies.

Personal Consumption Expenditure:

A measure of price changes in consumer goods and services. It consists of the actual and imputed expenditures of households and includes data pertaining to durables, non-durables, and services. It is essentially a measure of goods and services targeted towards individuals and consumed by individuals

Personal Consumption Expenditure (PCE) - United States:

Comprehensive measure of how much consumers spend each month, counting expenditures on durable goods, consumer products, and services. Personal Consumption is a comprehensive measure of GDP; consequently the figure is watched as an indicator for economic trends. Spending also has direct affect on inflationary pressures.

Pip:

The smallest increment of change in a foreign currency price, either up or down.

Pips:

The smallest unit of price for any foreign currency. Digits added to or subtracted from the fourth decimal place, i.e. 0.0001. Also called Points.

Platform:

The word platform is used in several different contexts, usually referring to some kind of standing surface used to support things, give them stability, or visibility

PMI:

purchasing managers' index

PMI-New Zealand:

"PMI" usually stands for Purchasing Managers' Index. United States and Euro-Zone PMI is different from the New Zealand PMI, which stands for Performance of Manufacturing Index.

Point:

(1) 100th part of a per cent, normally 10,000 of any spot rate. Movement of exchange rates are usually in terms of points. (2) One percent on an interest rate e.g. from 8-9%. (3) Minimum fluctuation or smallest increment of price movement.

Political Risk:

Exposure to changes in governmental policy which will have an adverse effect on an investor's position.

Position:

To buy or sell securities in order to establish a net long or a net short position.

Position - Long:

A position that was obtained by buying in anticipation of an increase in price.

PPI:

Producer Price Indices. See wholesale price indices.

Premium:

1.The amount by which a bond or stock sells above its par value.

2.The amount that the buyer of an option pays to the seller.

Price:

The price at which the underlying currency can be bought or sold.

Price Transparency:

The ability of all market participants to "see" or deal at the same price.

Primary market:

Where a newly issuedsecurity is first offered. All subsequent trading of this security occurs is done in the secondary market.

Prime Rate:

The interest rate that commercial banks charge their most creditworthy borrowers, such as large corporations. The prime rate is a lagging indicator. also called prime.

Prime Rate -US:

The interest rate that commercial banks charge their most reliable borrowers (i.e. large corporations). The prime rate is a lagging indicator. Also known as prime.

Principal:

A dealer who buys or sells stock for his/her own account.

Principal Value:

The original amount invested by the client.

Private Capital Expenditure:

The value of actual and expected purchases of new capital. Capital purchases are investments in productive capacity like new machinery, plants, or improvements & additions to existing assets. Such purchases are made by companies optimistic that costs will be surmounted by future demand. For instance, Gold mines may purchase new Gold mining equipment to increase productivity in order to meet rising demand for Gold. Private Capital Expenditures generally indicate higher business confidence and reflect a healthy economy

Private Consumption - Germany - Euro-zone:

Represents household spending on all goods and services. Fluctuations in Private Consumption reflect the country's spending mood. As this figure trends positive it indicates that consumers are stimulating the economy by spending more. However, one cannot size up economic growth solely based on this report. Individuals can increase consumption unsustainably if not matched by income growth.

Producer & Import Prices-switzerland:

Tracks inflation in producer and import prices in Switzerland . The headline figure is the percentage change in the index from the previous period. Changes in this index will generally precede changes in the consumer price index, as higher import costs and producer prices tend to eventually be passed to consumers. As with any indicator of inflation, increases in producer and import prices tend to act as an appreciating weight for the Swiss franc because inflationary pressures are almost always met with interest rate increases from the Swiss central bank.

Producer Price Index (Input) - UK:

A monthly survey that measures change in input prices as incurred by UK manufacturers. Input prices include the cost of materials used plus operation costs of running the business. The index can be used as a measure of inflation, given that higher input costs will likely be passed on from producers to consumers in the form of higher retail prices. Th e figure is also calculated as Core Input PPI, which excludes volatile inputs such as food and energy that may distort the data. As such, the core figure is a more appropriate measure of inflation.

Producer Price Index (Output) - UK:

A monthly survey that measures the price changes of goods produced by UK manufacturers. The figure is also known as "Factory Gate Price" because it usually matches the price of goods when they first leave the factory. Increased prices in manufacturing typically lead to higher retail prices for consumers. However, it is also likely that higher output prices are caused by manufacturers charging a higher premium due to higher demand for their goods. Consequently, market trends in consumption should be considered with Output PPI to avoid data misinterpretation.

productivity:

A measure of how much an employee produces for each hour of work

Profit Taking:

The action of selling stock to cash in on a sharp rise. This action pushes prices down temporarily. When traders are profit taking, the implication is that there is an upward trend in the security.

PSNCR:

Public Sector Net Cash Requirements

public finances-UK:

The amount of money financed to the UK government. A higher value indicates a worsening fiscal condition for the British Government as the public sector is unable to maintain its spending patterns without further financing. As with any economy, budget deficits are unfavorable and viewed as bearish for the Pound.

Public Sector Net Borrowing - UK:

The amount of new debt held by the UK governments. In the long run, the public sector account must be in balance in order for the economy to be sustainable. If the UK spends more than what it earns, it must finance this budget deficit with an increase in Net Borrowing. Because budget deficits are generally unfavorable for the economy, growth in Net Borrowing is considered bearish for the Pound. Likewise, if Net Borrowing is negative, it means the UK is running a budget surplus and, rather than borrowing money, is a net lender. The headline number is the net borrowing for the previous month in billions of Pounds.

Purchasing Power Parity:

The theory that, in the long run, identical products and services in different countries should cost the same in different countries. This is based on the belief that exchange rates will adjust to eliminate the arbitrage opportunity of buying a product or service in one country and selling it in another. For example, consider a laptop computer that costs 1,500 Euros in Germany and an exchange rate of 2 Euros to 1 U.S. Dollar. If the same laptop cost 1,000 dollars in the United States, U.S. consumers would buy the laptop in Germany. If done on a large scale, the influx of U.S. dollars would drive up the price of the Euro, until it equalized at 1.5 Euros to 1 U.S. Dollar - the same ratio of the price of the laptop in Germany to the price of the laptop in the U.S. The theory only applies to tradable goods, not to immobile goods or local services. The theory also discounts several real world factors, such as transportation costs, tarrifs and transaction costs. It also assumes there are competitive markets for the goods and services in both countries.

Put Call Parity:

The equilibrium relationship between premiums of call and put options of the same strike and expiry.

Put Option:

A put option confers the right but not the obligation to sell currencies, instruments or futures at the option exercise price within a predetermined time period.

برچسبها :

مقالات مرتبط

فرهنگ لغات تخصصی بازار ارز حرف X

XAG: Silver Exchange Rate (ISO) XAU: Gold Exchange Rate (ISO)

فرهنگ لغات تخصصی بازار ارز حرف L

Labor Cash Earnings – Japan: The average amount of pre-tax earnings per regular employee, including overtime pay and bonuses. Though the report does not take into account all sources of household income (accumulated wealth and capital gains from financial assets are omitted), Labor Cash Earnings accurately reflects the spending ability of domestic consumers, one […]

فرهنگ لغات تخصصی بازار ارز حرف U

U.S. Dollar Index =USDX: A measure of the value of the U.S. dollar relative to majority of its most significant trading partners. This index is similar to other trade-weighted indexes, which also use the exchange rates from the same major currencies. Currently, this index is calculated by factoring in the exchange rates of six […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

Tillson TMA T3 اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی Tillson TMA T3 اندیکاتور کاربردی Tillson TMA T3 این یک میانگین متحرک است که از EMA و DEMA در فرمول خود استفاده می کند و با بسط Binomial درجه 3 محاسبه می شود. معرفی اندیکاتور کاربردی Tillson TMA T3 1- سیگنال های اشتباهی که در سایر میانگین های متحرک (زیگ […]

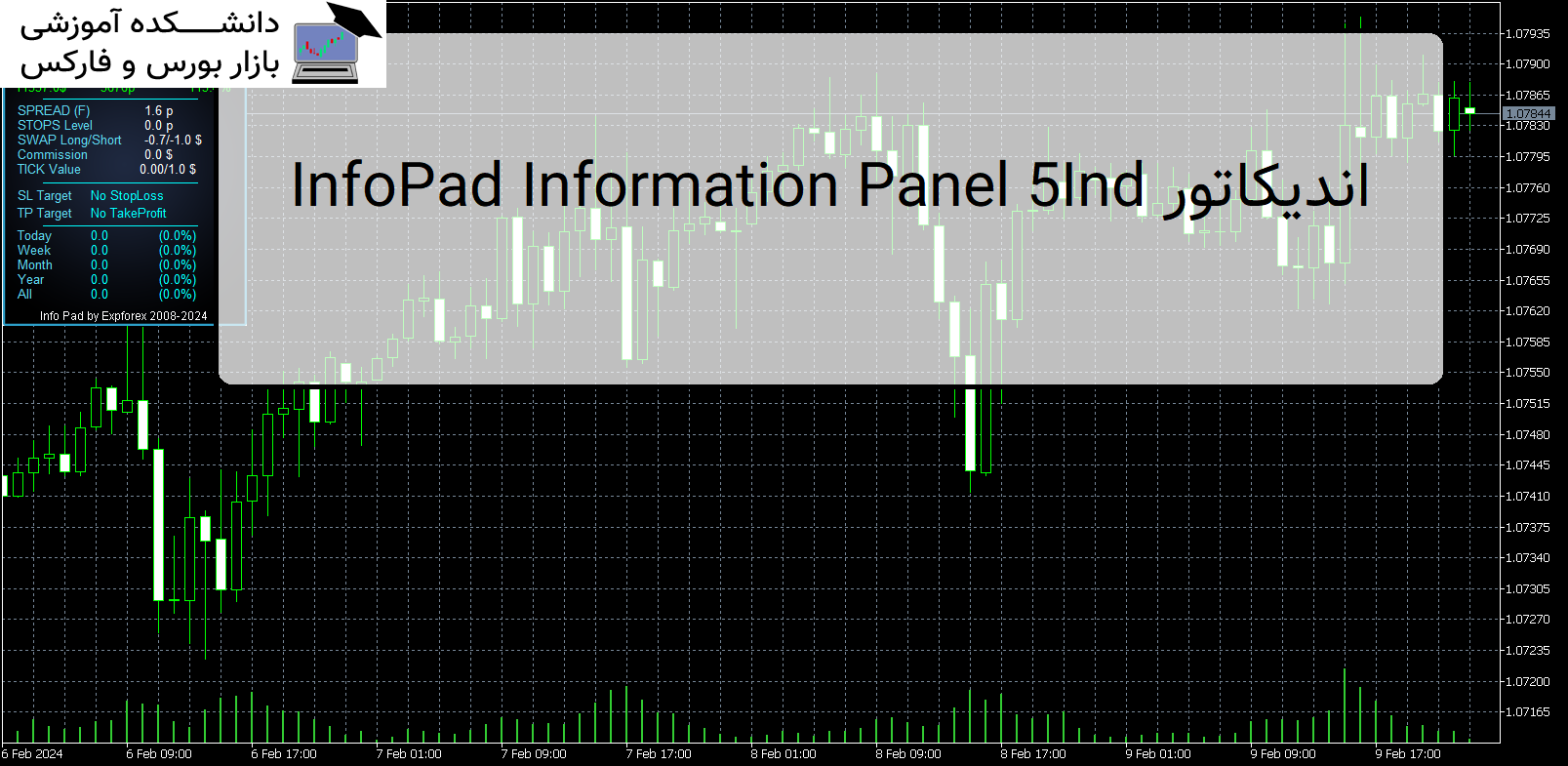

Ind5 InfoPad Information Panel اندیکاتور

معرفی و دانلود اندیکاتور Ind5 InfoPad Information Panel اندیکاتور Ind5 InfoPad Information Panel یک پنل اطلاعاتی است که اطلاعات مربوط به جفت ارز انتخاب شده را در ترمینال MetaTrader 5 ایجاد می کند. معرفی اندیکاتور Ind5 InfoPad Information Panel این نشانگر 5 عملکرد دارد: اطلاعات اصلی و اصلی را در نماد انتخاب شده نشان می […]