Hill Arthur – Introduction to Candlesticks

The Japanese began using technical tahlil to trade rice in the 17th century. While this early version of technical tahlil may have been different from the US version initiated by Charles Dow around 1900, many of the guiding principles were very similar The “what” (price action) is more important than the why news, earnings, and […]

All known information is reflected in the price Buyers and sellers move markets based on expectations and emotions (fear and greed

Markets fluctuate The actual price may not reflect the underlying value According to Steve Nison, candlestick charting came later and probably began sometime after 1850. Much of the credit for candlestick development and charting goes to Homma, a legendary rice trader from Sakata. Even though it is not exactly clear "who" created candlesticks, Nison notes that they likely resulted from a collective effort developed over many years of trading

برچسبها :

مقالات مرتبط

E pocket book

pocket book Pocket Books produced the first mass-market, pocket-sized paperback books in America in early 1939 and revolutionized the publishing industry. The German Albatross Books had pioneered the idea of a line of color-coded paperback editions in 1931 under Kurt Enoch; Penguin Books in Britain had refined the idea in 1935 and had 1 million […]

Cut Losses

Cut Losses The DOW came down 791 points (6.45%) last week,Straits Times Index plunged 112.23(3.61%) on Friday, it was not a pretty sight.The question on everybody’s mind is how low can it go? The answer is much lower.The Dow closed at 11,450 points on Friday, but in March 2009,it was as low at 6,626 points, […]

The Midas Method Of Technical tahlil By Paul Levine

In this,the first of a series of columns,we will introduce to the community of technical analysts a new approach to charting the pricehistory of a stock or commodity.I call this technique the MIDAS method an acronym for Market Interpretation/Data tahlil System. It is designed to focus attention on the dynamic interplay of support/resistance and accumulation/distribution […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

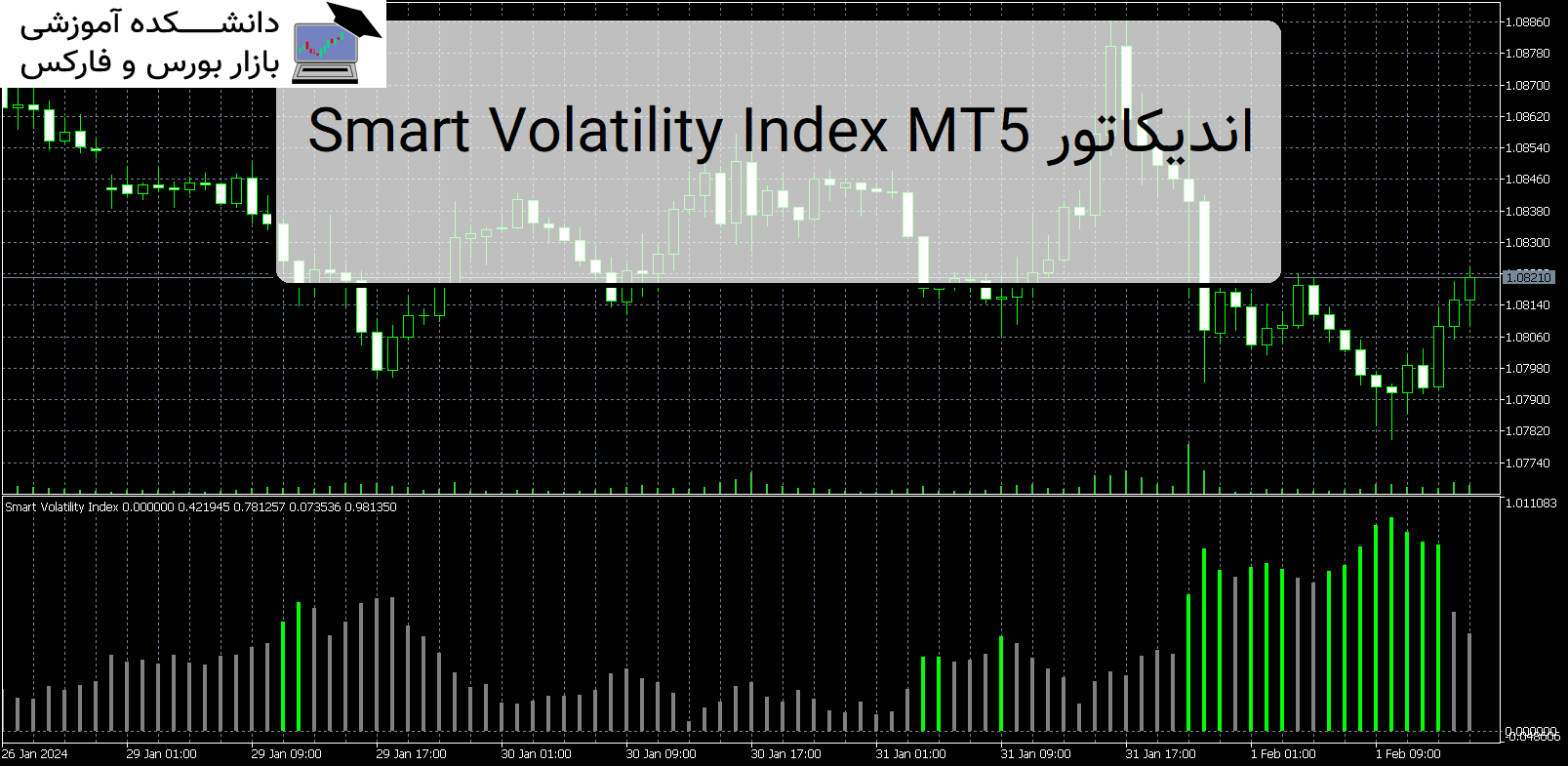

Smart Volatility Index MT5 اندیکاتور

معرفی و دانلود اندیکاتور کاربردی Smart Volatility Index MT5 Smart Volatility Index MT5 از محبوب ترین و با رتبه بندی بالای شاخص نوسانات (VIX) در بازار است. این خوانش همان چیزی است که VIX برای شاخص های سهام انجام می دهد. معرفی اندیکاتور کاربردی Smart Volatility Index MT5 با این حال، این شاخص در تمام […]

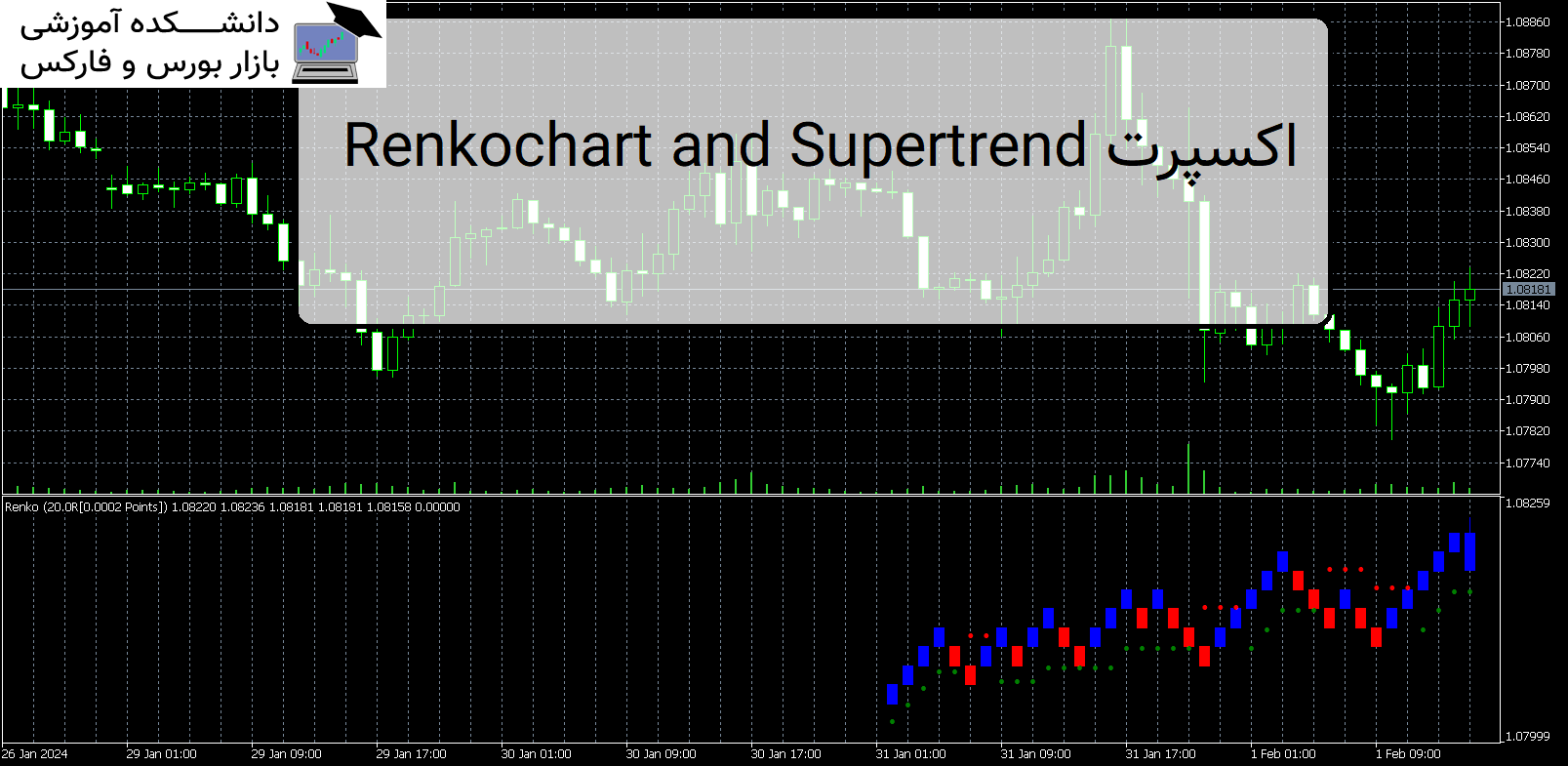

Renkochart and Supertrend اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی Renkochart and Supertrend Renkochart and Supertrend شاخص فوق روند را در زمان واقعی نمایش می دهد. پس از نصب اندیکاتور، پنجره نمودار Renko و نشانگر supertrend را در همان پنجره نمایش می دهد. معرفی اندیکاتور کاربردی Renkochart and Supertrend این به شما این امکان را میدهد که نقاط ورودی و […]

-

فایل های که پسوند آنها rar یا zip یا 7z هست را چگونه باز کنم؟

توسط نرم افزار Winrar فایل را از حالت فشرده خارج کنید و بعد برای اجرا و یا نصب اقدام کنید. دانلود WINRAR

فایل های با فرمت mq4 و mq5 را چگونه اجرا کنم ؟جهت اجرای این نوع فایل ها برای نسخه mq4 باید متاتریدر 4 را روی سیستم خود و برای نسخه mq5 متاتریدر 5 را روی سیستم عامل خود نصب داشته باشید . جهت راهنمایی کلیک کنید

-

رمز تمامی فایل ها :

- عنوان مقاله : Hill Arthur - Introduction to Candlesticks

- نوع فایل : PDF

- حجم فایل : 7 مگابایت