Thomas And Patnaik-Serial Correlation In High-Frequency Data And The Link With Liquidity

This paper tests for market efficiency at high-frequencies of the Indian equity markets. Wedo this by testing the behaviour of serial correlation in firm stock prices using the Variance Ratio test on high frequency returns data. We find that at a frequency interval of five minutes,all the stocks show a pattern of mean-reversion. However, different […]

This paper tests for market efficiency at high-frequencies of the Indian equity markets. Wedo this by testing the behaviour of serial correlation in firm stock prices using the Variance Ratio test on high frequency returns data. We find that at a frequency interval of five minutes,all the stocks show a pattern of mean-reversion. However, different stocks revert at different rates. We find that there is a correlation between the time the stock takes to revert to the mean and the liquidity of the stock on the market. Here, liquidity is measured both in terms of impact cost as well as trading intensi

برچسبها :

مقالات مرتبط

F E James Jr – Monthly Moving Averages An Effective Investment Tool

James Jr – Monthly Moving Averages An Effective Investment Tool analysts and investment advisors have long searched for investment tools that would either furnish predictiv prabablities for future security price movment

FX Engines Predicting Price Action

Price Action The Forex Report is a periodic publication that investigates advanced strategies for superior trading performance in the foreign exchange markets. These reports utilize advanced statistical and econometric modeling techniques to create new insight into the trading strategy of the average trader. This Data Brief, Predicting Price Action, is intended for traders with moderate […]

Common Sense Commodities A Common Sense Approach To Trading Commodities

THE INFORMATION CONTAINED HEREIN IS BELIEVED TO BE RELIABLE BUT CANNOT BE GUARANTEED AS TO RELIABILITY, ACCURACY,OR COMPLETENESS.COMMON SENSE COMMODITIES,AND/OR DAVID G.DUTY,WILL NOT BE RESPONSIBLE FOR ANYTHING,WHICH MAY RESULT FROM ONE’S RELIANCE ON THIS MATERIAL,NOR THE OPINIONS EXPRESSEDHEREIN. DISCLOSURE OF RISK:THE RISK OF LOSS IN TRADING FUTURES AND OPTIONS CAN BE SUBSTANTIAL;THEREFORE,ONLY GENUINE RISK FUNDS […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

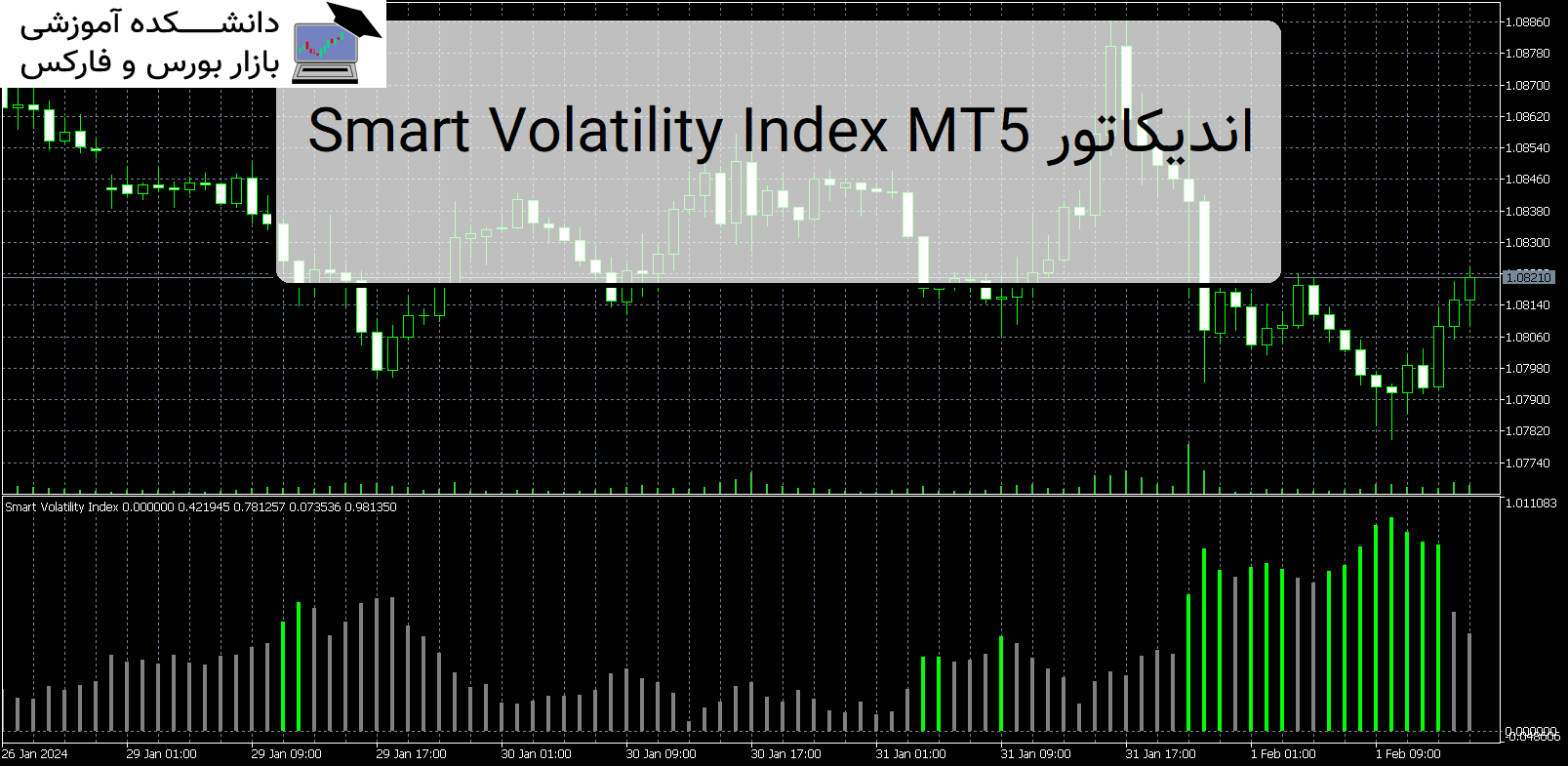

Smart Volatility Index MT5 اندیکاتور

معرفی و دانلود اندیکاتور کاربردی Smart Volatility Index MT5 Smart Volatility Index MT5 از محبوب ترین و با رتبه بندی بالای شاخص نوسانات (VIX) در بازار است. این خوانش همان چیزی است که VIX برای شاخص های سهام انجام می دهد. معرفی اندیکاتور کاربردی Smart Volatility Index MT5 با این حال، این شاخص در تمام […]

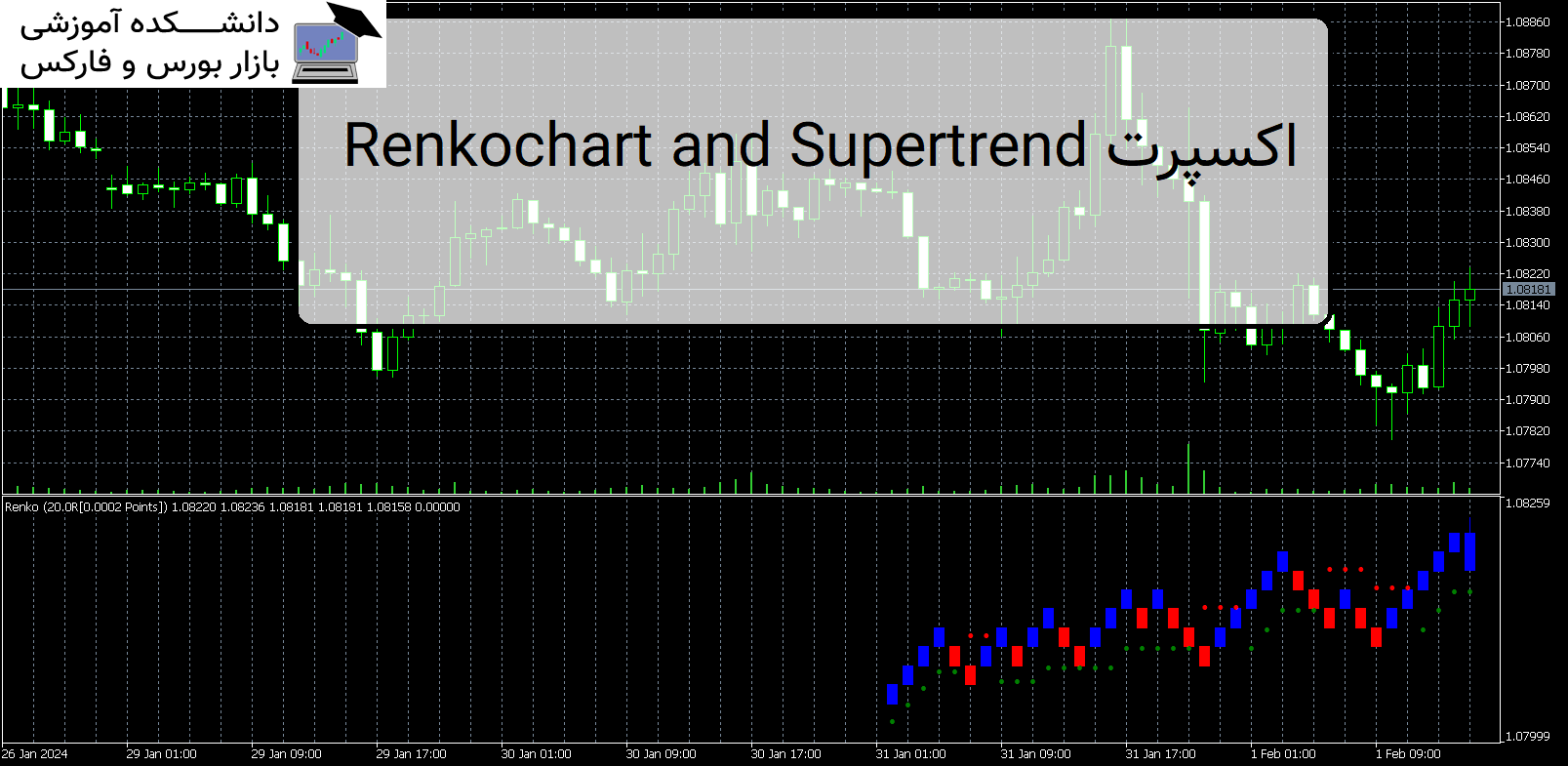

Renkochart and Supertrend اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی Renkochart and Supertrend Renkochart and Supertrend شاخص فوق روند را در زمان واقعی نمایش می دهد. پس از نصب اندیکاتور، پنجره نمودار Renko و نشانگر supertrend را در همان پنجره نمایش می دهد. معرفی اندیکاتور کاربردی Renkochart and Supertrend این به شما این امکان را میدهد که نقاط ورودی و […]

-

فایل های که پسوند آنها rar یا zip یا 7z هست را چگونه باز کنم؟

توسط نرم افزار Winrar فایل را از حالت فشرده خارج کنید و بعد برای اجرا و یا نصب اقدام کنید. دانلود WINRAR

فایل های با فرمت mq4 و mq5 را چگونه اجرا کنم ؟جهت اجرای این نوع فایل ها برای نسخه mq4 باید متاتریدر 4 را روی سیستم خود و برای نسخه mq5 متاتریدر 5 را روی سیستم عامل خود نصب داشته باشید . جهت راهنمایی کلیک کنید

-

رمز تمامی فایل ها :

- عنوان مقاله : ...Thomas And Patnaik-Serial Correlation

- نوع فایل : PDF

- حجم فایل : 300 کیلوبایت