volatility depth

volatility We investigate the role of limit orders in the liquidity provision in the Hong Kong stock market, which is based on a computerized limit-order trading system. Consistent with Handa and Schwartz (1996), results show that market depth rises subsequent to an increase in transitory \volatility, and transitoryvolatility declines subsequent to an increase in market […]

volatility

We investigate the role of limit orders in the liquidity provision in the Hong Kong stock market,

which is based on a computerized limit-order trading system. Consistent with Handa and Schwartz (1996),

results show that market depth rises subsequent to an increase in transitory \volatility,

and transitoryvolatility declines subsequent to an increase in market depth. We also examine how transitory \volatility affects the mix between limit orders and market orders. When transitory \volatility arises from the ask (bid) side,

investors will submit more limit sell (buy) orders than market sell (buy) orders. This result is consistent with the existence of limit-order traders who enter the market and place orders when liquidity is needed.

برچسبها :

مقالات مرتبط

Griffiths, Turnbullb And White-Re-Examining The Small-Cap Myth Problems In Portfolio Formation An

This study investigates the realizable returns on portfolios at the turn-of-the-year. Using an intraday simulation that accounts for the volumes offered or wanted at market bid-ask prices, large-capitalization securities significantly outperform small-capitalization securities by 2.4% and 6.5%, depending on whether the portfolios were formed on the last day of the taxation year or were formed […]

4H Simple System-D

Download 4H Simple System-D : indicators & PDF by the link below . . . Setup: 100 Simple Moving Average Damiani Volatmeter MACD – 15,26,9 4 hour chart – EURCHF The 100 Simple Moving Average serves as a support/resistance line as it is known to be used by major banks and financial institutions, a […]

Curtis Faith – Way of the Turtle

Curtis Faith I recent wrote a foreword for a book that I think is one of the top five trading books ever written. It’s Curtis Faith’s new book, Way of the Turtle. Curtis was one of the more successful traders in Richard Dennis’ experiment to see if he could train good traders. And since I […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

Tillson TMA T3 اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی Tillson TMA T3 اندیکاتور کاربردی Tillson TMA T3 این یک میانگین متحرک است که از EMA و DEMA در فرمول خود استفاده می کند و با بسط Binomial درجه 3 محاسبه می شود. معرفی اندیکاتور کاربردی Tillson TMA T3 1- سیگنال های اشتباهی که در سایر میانگین های متحرک (زیگ […]

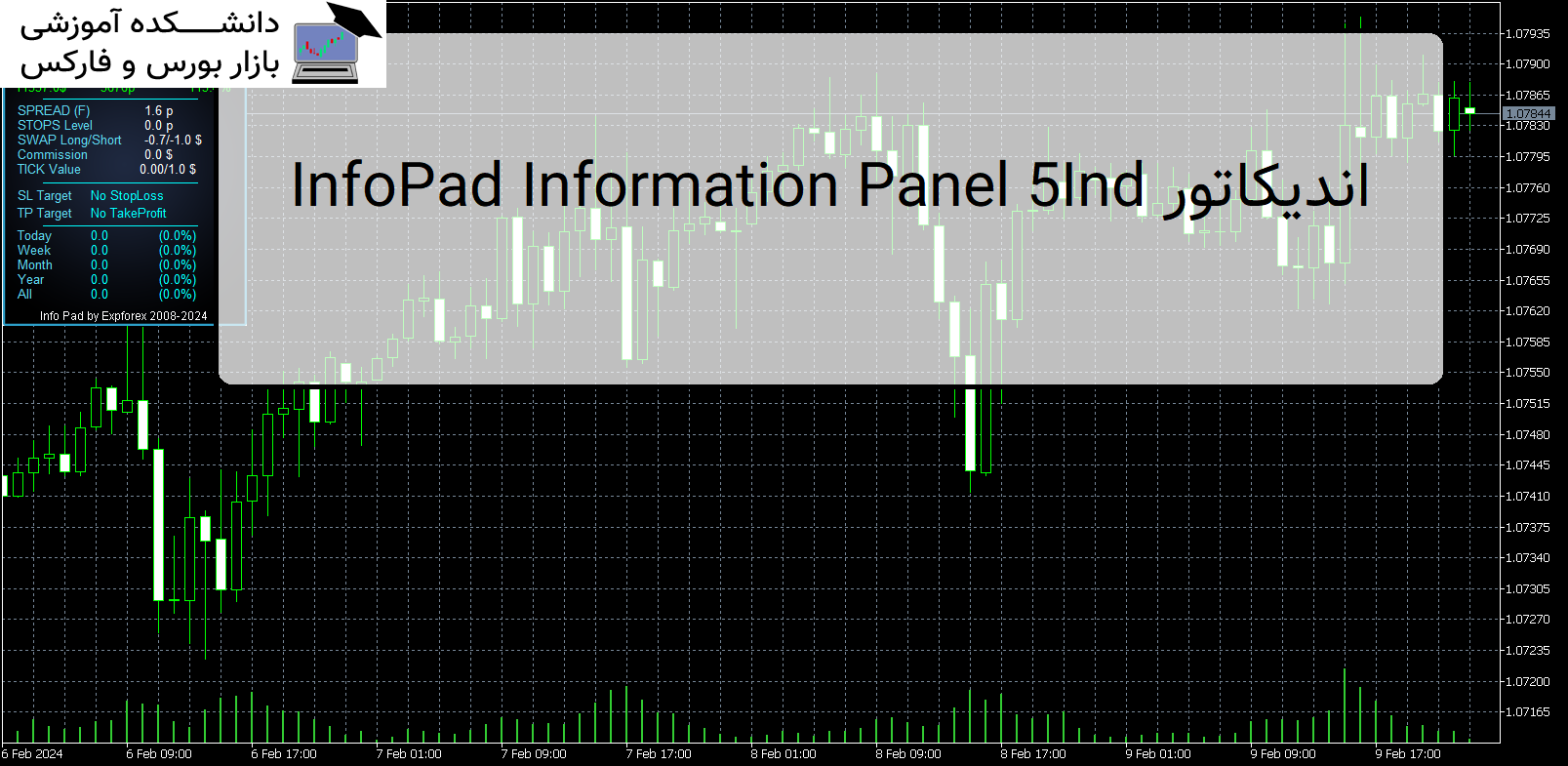

Ind5 InfoPad Information Panel اندیکاتور

معرفی و دانلود اندیکاتور Ind5 InfoPad Information Panel اندیکاتور Ind5 InfoPad Information Panel یک پنل اطلاعاتی است که اطلاعات مربوط به جفت ارز انتخاب شده را در ترمینال MetaTrader 5 ایجاد می کند. معرفی اندیکاتور Ind5 InfoPad Information Panel این نشانگر 5 عملکرد دارد: اطلاعات اصلی و اصلی را در نماد انتخاب شده نشان می […]

-

فایل های که پسوند آنها rar یا zip یا 7z هست را چگونه باز کنم؟

توسط نرم افزار Winrar فایل را از حالت فشرده خارج کنید و بعد برای اجرا و یا نصب اقدام کنید. دانلود WINRAR

فایل های با فرمت mq4 و mq5 را چگونه اجرا کنم ؟جهت اجرای این نوع فایل ها برای نسخه mq4 باید متاتریدر 4 را روی سیستم خود و برای نسخه mq5 متاتریدر 5 را روی سیستم عامل خود نصب داشته باشید . جهت راهنمایی کلیک کنید

-

رمز تمامی فایل ها :

- عنوان مقاله : depth volatility

- نوع فایل : PDF

- حجم فایل : 120 کیلوبایت