Managing Credit Risk With Credit And Macro Derivatives

We use the industrial organization approach to the microeconomics of banking, augmented by uncertainty and risk aversion, to examine credit derivatives and macro derivatives as instruments to hedge credit risk for a large commercial bank. In a partial-analytic framework we distinguish between the probability of default and the loss given default, model different forms of […]

We use the industrial organization approach to the microeconomics of banking, augmented by uncertainty and risk aversion, to examine credit derivatives and macro derivatives as instruments to hedge credit risk for a large commercial bank. In a partial-analytic framework we distinguish between the probability of default and the loss given default, model different forms of derivatives, and derive hedge rules and strong and weak separation properties between deposit and loan decisions on the one hand and hedging decisions on the other. We also suggest how bank specific macro derivatives could be designed from common macro indexes which serve as underlyings of recently introduced financial products.

برچسبها :

مقالات مرتبط

Mcgraw Hill – Understanding Stocks

Understanding Stocks While dozens of books purport to be for the beginning investor, most “beginner” books assume a level of knowledge that true novices just don’t have. \Understanding Stocks is targeted to the beginning investor, providing a concise yet comprehensive overview of the stock market without subjecting readers to terms and ideas they can’t understand […]

Thomas And Patnaik-Serial Correlation In High-Frequency Data And The Link With Liquidity

This paper tests for market efficiency at high-frequencies of the Indian equity markets. Wedo this by testing the behaviour of serial correlation in firm stock prices using the Variance Ratio test on high frequency returns data. We find that at a frequency interval of five minutes,all the stocks show a pattern of mean-reversion. However, different […]

oh crap free

crap free I’m here to help! This ebook can help explain what happened, and set you back on the track of success. Please don’t listen to your deepest fears, and don’t listen to your desire to give it all up. It’s bad, yes, but it’s not as bad as you think. Losing money is the […]

آخرین مقالات

FT ADX Color Candles اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی FT ADX Color Candles اندیکاتور کاربردی FT ADX Color Candles زمانی که نیاز دارید به طور همزمان به چندین مورد نگاه کنید، معامله می تواند بسیار خسته کننده باشد. اندیکاتور کاربردی FT ADX Color Candles قالب شمع ها، ساپورت ها، مقاومت ها، برنامه ها، اخبار و اندیکاتورها. هدف این ابزار […]

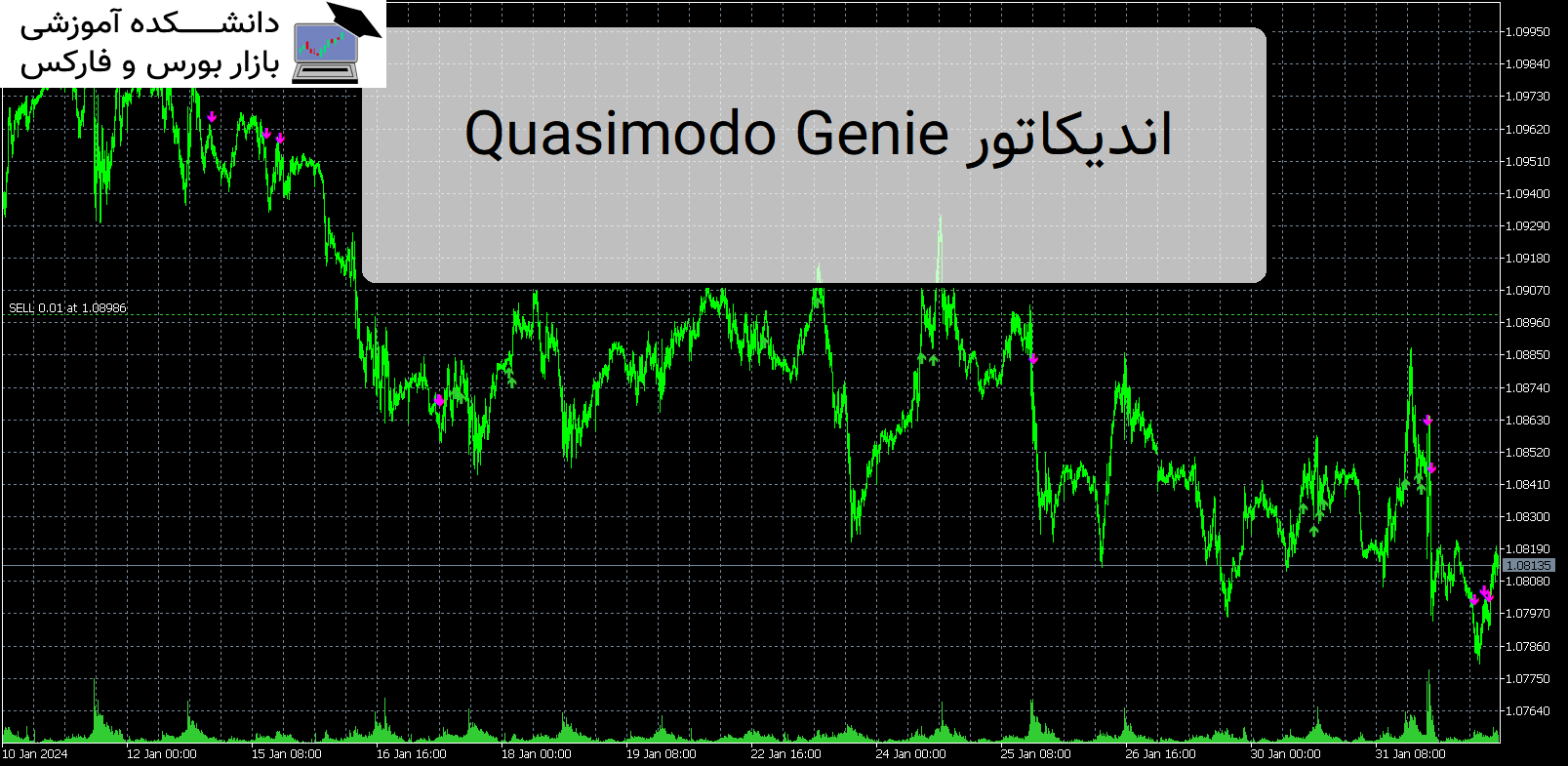

Quasimodo Genie اندیکاتور MT5

معرفی و دانلود اندیکاتور کاربردی Quasimodo Genie معرفی اندیکاتور Quasimodo Genie ، یک نشانگر قدرتمند برای MetaTrader 5 که به طور خودکار الگوی Quasimodo یا Over and Under را شناسایی می کند. معرفی اندیکاتور کاربردی Quasimodo Genie این اندیکاتور برای معامله گرانی که می خواهند از این الگوی نمودار محبوب استفاده کنند و معاملات سودآوری […]

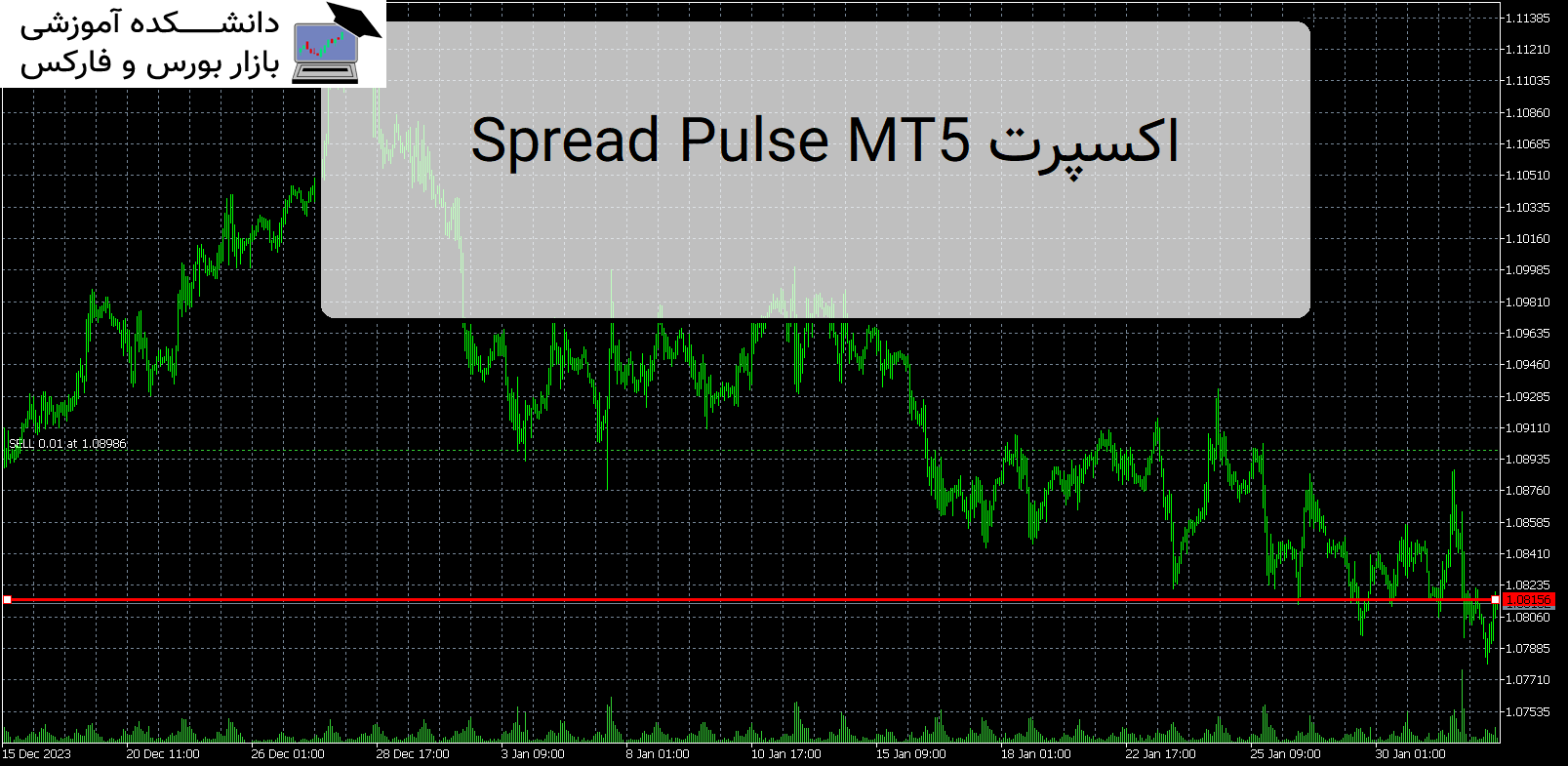

Spread Pulse MT5 اندیکاتور

معرفی و دانلود اندیکاتور کاربردی Spread Pulse MT5 Spread Pulse MT5 ابزار موثری است که اطلاعاتی را در مورد اسپرد فعلی در نمودار به معامله گران ارائه می دهد. اسپرد تفاوت بین قیمت خرید و قیمت فروش یک ابزار است. معرفی اندیکاتور کاربردی Spread Pulse MT5 نشانگر در قالب متنی که در نمودار نمایش داده […]

-

فایل های که پسوند آنها rar یا zip یا 7z هست را چگونه باز کنم؟

توسط نرم افزار Winrar فایل را از حالت فشرده خارج کنید و بعد برای اجرا و یا نصب اقدام کنید. دانلود WINRAR

فایل های با فرمت mq4 و mq5 را چگونه اجرا کنم ؟جهت اجرای این نوع فایل ها برای نسخه mq4 باید متاتریدر 4 را روی سیستم خود و برای نسخه mq5 متاتریدر 5 را روی سیستم عامل خود نصب داشته باشید . جهت راهنمایی کلیک کنید

-

رمز تمامی فایل ها :

- عنوان مقاله : ...Managing Credit Risk With Credit And Macro

- نوع فایل : PDF

- حجم فایل : 280 کیلوبایت